The financial advisor industry is evolving rapidly, presenting both challenges and opportunities for professionals in the field. At Davies Wealth Management, we’ve observed significant shifts in the job market, including the growing importance of specialized skills and the impact of technology on traditional roles.

As the demand for financial expertise continues to rise, so does the potential for lucrative careers, with asset management company salaries reflecting the value placed on top talent. This blog post explores the current landscape and future prospects for financial advisors, providing insights for those considering or advancing in this dynamic profession.

What’s Driving Financial Advisor Job Growth?

Demographic Shifts Fuel Demand

The financial advisor job market experiences a significant upswing, driven by demographic shifts, economic factors, and changing consumer needs. The U.S. Bureau of Labor Statistics projects employment in business and financial occupations to grow faster than the average for all occupations from 2023 to 2033.

The aging population, particularly the baby boomer generation entering retirement, propels this growth. As traditional pension plans become less common, individuals need expert guidance to navigate complex retirement savings and investment strategies. This demographic trend will create job openings for personal financial advisors over the next decade.

Economic Factors and Industry Evolution

Broader economic trends shape the financial advisory landscape. The median pay for personal financial advisors stood at $99,580 per year in May 2023, reflecting the high value placed on financial expertise. However, the industry undergoes a significant transition, with a substantial portion of financial advisors expected to retire within the next decade. This creates opportunities for new entrants to the field.

Changing Consumer Expectations

Consumer expectations shift towards more comprehensive financial planning services. This trend pushes advisors to expand their skill sets and offer more diverse services, from investment management to tax planning and estate strategies.

Technology’s Impact on the Profession

Technology plays an increasingly important role in the financial advisory field. The rise of robo-advisors and digital financial planning tools reshapes how advisors interact with clients. According to Forbes, 95% of consumers say customer service impacts their brand loyalty, naming easy access, self-service, and professional agents as important factors.

Specialization and Niche Markets

The industry sees a rise in specialization, with niche areas such as ESG (Environmental, Social, and Governance) investing gaining popularity among investors. Financial advisors who develop expertise in specific areas (e.g., retirement planning for professional athletes or wealth management for tech entrepreneurs) can differentiate themselves in a competitive market.

As the financial advisor profession evolves, it requires professionals to adapt to new technologies, regulatory changes, and client needs. The next section will explore the skills and qualifications in high demand for those looking to thrive in this dynamic field.

What Skills Do Top Financial Advisors Need?

Essential Certifications and Education

Top financial advisors possess a combination of formal education and industry-recognized certifications. A bachelor’s degree in finance, economics, or a related field serves as the foundation. However, advanced certifications elevate an advisor’s credibility and expertise. The Certified Financial Planner (CFP) designation stands out as the industry benchmark. As of 2024, more than 100,000 people in the United States hold CFP® certification, underscoring its significance.

Other valuable certifications include the Chartered Financial Analyst (CFA) for investment management specialists and the Certified Public Accountant (CPA) for tax strategy experts. The Chartered Financial Consultant (ChFC) designation proves particularly beneficial for advisors who work with high-net-worth clients or specialize in comprehensive wealth management.

Soft Skills That Make a Difference

Technical knowledge alone does not guarantee success as a financial advisor. Interpersonal skills play a vital role in building and maintaining client relationships. Empathy and active listening enable advisors to truly understand their clients’ financial goals and concerns.

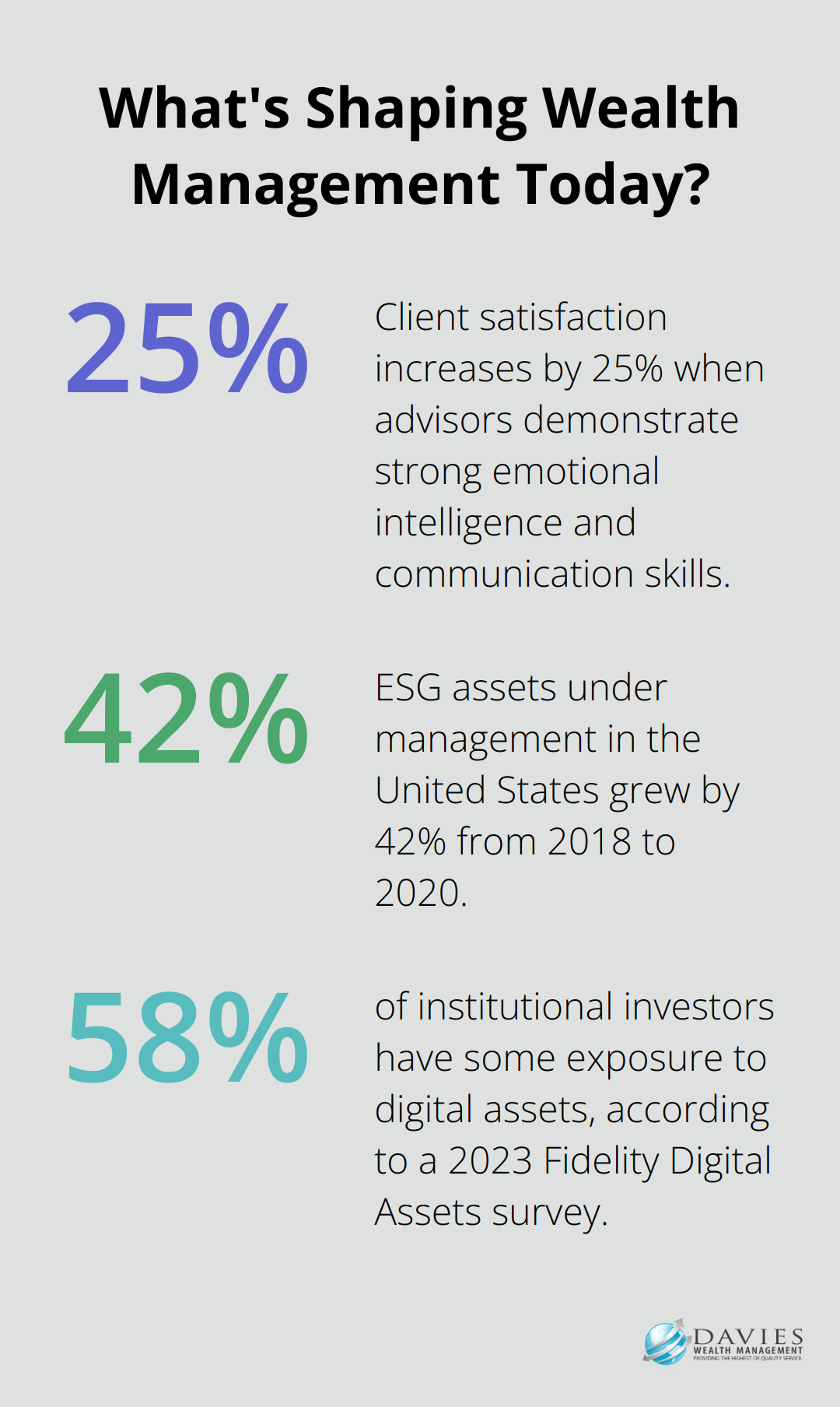

A 2023 J.D. Power study revealed that client satisfaction increases by 25% when advisors demonstrate strong emotional intelligence and communication skills. This finding highlights the importance of explaining complex financial concepts in simple, relatable terms.

Emerging Areas of Expertise

Specialization can set financial advisors apart in an increasingly complex financial world. Sustainable investing (also known as ESG investing) has gained significant traction. ESG assets under management in the United States grew to $17.1 trillion in 2020, a 42% increase from 2018.

Digital assets and cryptocurrency have emerged as important areas of knowledge. A 2023 Fidelity Digital Assets survey found that 58% of institutional investors have some exposure to digital assets, indicating a growing need for advisors well-versed in this space.

Expertise in niche areas (such as retirement planning for professional athletes or wealth management for tech entrepreneurs) can prove highly valuable. Specialized knowledge leads to more tailored and effective wealth management strategies.

Technological Proficiency

Modern financial advisors must master various technological tools. This proficiency includes customer relationship management (CRM) software, financial planning platforms, and data analytics tools. According to Cerulli Associates, as of year-end 2022, approximately 291,000 financial advisers managed $26.8 trillion in total retail wealth assets.

Understanding the basics of artificial intelligence and machine learning can give advisors an edge in portfolio management and risk assessment. However, these tools should enhance, not replace, the human touch that clients value in their financial advisors.

As the financial advisory landscape continues to evolve, professionals must adapt to new technologies, regulatory changes, and client needs. The next section will explore future trends shaping the financial advisor profession and how these changes will impact job prospects in the coming years.

How Technology Will Reshape Financial Advising

AI-Powered Tools Transform the Industry

Artificial Intelligence (AI) revolutionizes financial advising. AI is transforming the financial advisory sector, enhancing client service without replacing the human touch that clients value. These AI-powered tools enhance risk assessment, portfolio management, and client communication.

AI algorithms analyze vast amounts of market data in real-time, helping advisors make more informed investment decisions. This technology complements human expertise, allowing for more accurate and timely advice to clients (including professional athletes who require swift decision-making in their financial planning).

Holistic Financial Planning Becomes Essential

The financial services industry moves away from siloed offerings. Clients now expect comprehensive financial planning that addresses all aspects of their financial lives.

This shift requires advisors to expand their expertise beyond investment management. Tax planning, estate planning, and behavioral finance become essential skills. For professional athletes, this holistic approach proves particularly crucial. Their unique financial situations demand strategies that account for short career spans, fluctuating incomes, and post-career transitions.

Specialization Creates Competitive Advantage

As the financial advisory field grows more crowded, specialization emerges as a key differentiator. Niche expertise allows advisors to provide tailored services to specific client groups.

A Cerulli report provides a broad and deep perspective on financial advisors, highlighting their most critical needs, risks, opportunities, and challenges. This trend underscores the value of developing deep expertise in specific areas, such as sustainable investing, tech industry wealth management, or sports finance.

Digital Platforms Enhance Client Experience

Technology platforms transform how financial advisors interact with clients. User-friendly apps and secure online portals provide clients with real-time access to their financial information. These digital tools improve transparency and facilitate more frequent communication between advisors and clients.

This hybrid approach (combining technology with personal touch) becomes increasingly important in meeting client expectations.

Data Analytics Drive Personalized Strategies

Advanced data analytics tools enable financial advisors to create highly personalized investment strategies. These tools analyze a client’s financial history, risk tolerance, and long-term goals to recommend tailored solutions.

This data-driven approach allows advisors to make more informed decisions and adjust strategies in real-time based on changing market conditions or client circumstances.

Final Thoughts

The financial advisor profession offers promising opportunities and transformative challenges. Industry growth outpaces many other professions, indicating a robust job market for years to come. Aspiring advisors must blend traditional financial acumen with adaptability to emerging trends, while current professionals should focus on continuous learning and specialization.

Technology will reshape the financial advisory landscape without replacing human advisors. Instead, it will enhance their capabilities, allowing for more data-driven decisions and personalized client experiences. Embracing these technological advancements while maintaining a human touch will prove essential for success in this evolving field.

The potential for a rewarding career remains significant, with asset management company salaries reflecting the value placed on top talent. Financial advisors who stay ahead of industry trends and focus on client-centric approaches can look forward to a future filled with opportunity. At Davies Wealth Management, we understand the importance of specialized knowledge in areas like professional athlete financial planning to provide effective wealth management strategies.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply