Doctors face unique financial challenges that require specialized guidance. At Davies Wealth Management, we understand the complexities of managing finances in the medical profession.

Finding the right financial advisor for doctors can make a significant difference in achieving long-term financial success. This post will explore what to look for when selecting a financial advisor who can address the specific needs of physicians.

Why Do Doctors Need Specialized Financial Advice?

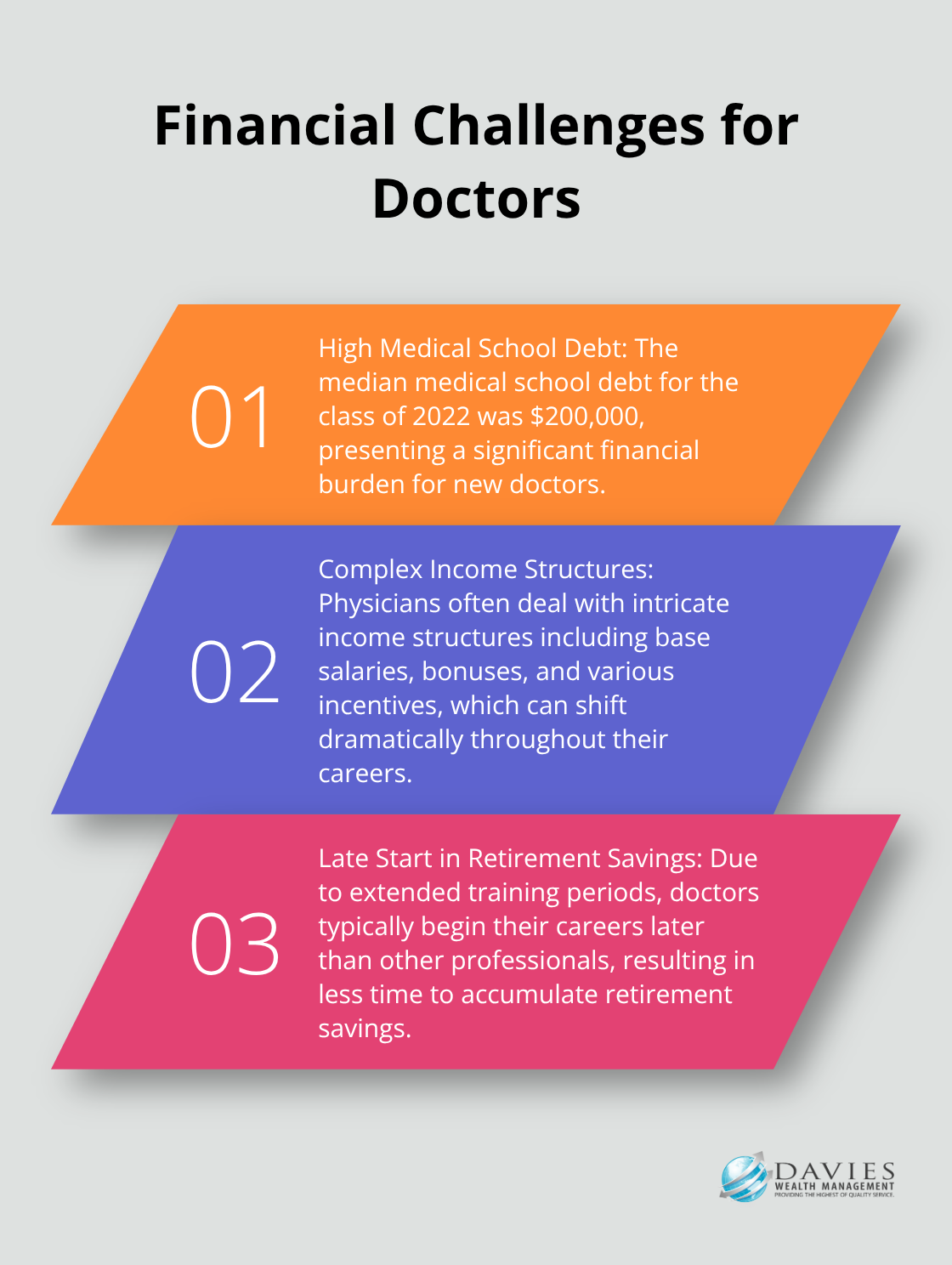

The Student Debt Burden

Medical school debt presents a significant challenge for many doctors. The median medical school debt for the class of 2022 was $200,000. This substantial amount can postpone other financial goals and requires strategic planning to manage effectively.

Complex Income Structures

Physicians often encounter intricate income structures that include base salaries, bonuses, and various incentives. These structures can shift dramatically throughout a doctor’s career, from residency to private practice or hospital employment. The optimization of these income streams for tax efficiency and long-term wealth building becomes essential.

Late Start in Retirement Savings

Due to extended training periods, doctors typically begin their careers later than other professionals. This delay in earning potential results in less time to accumulate retirement savings. A study by Fidelity Investments revealed that physicians often need to save for retirement, with some doctors saving up to 13.1% of their income.

The Malpractice Insurance Challenge

Malpractice insurance represents a necessary expense for doctors, but it can become a significant financial burden. Premiums can range from $40,000 to $60,000 annually for emergency medicine doctors. The balance of this expense with other financial priorities requires expert guidance.

The Need for Specialized Financial Advice

These unique financial challenges underscore the importance of specialized financial advice for doctors. A financial advisor who understands the intricacies of the medical profession can provide tailored strategies to address these specific issues.

At Davies Wealth Management, we recognize the complex financial landscape that physicians navigate. Our approach aims to help doctors focus on their practice while building a secure financial future. The next section will explore the key qualities to look for in a financial advisor who specializes in serving medical professionals.

What Makes a Great Financial Advisor for Doctors?

When selecting a financial advisor as a medical professional, it’s essential to find someone who truly understands the unique financial landscape of the healthcare industry. Several key qualities set apart exceptional financial advisors for doctors.

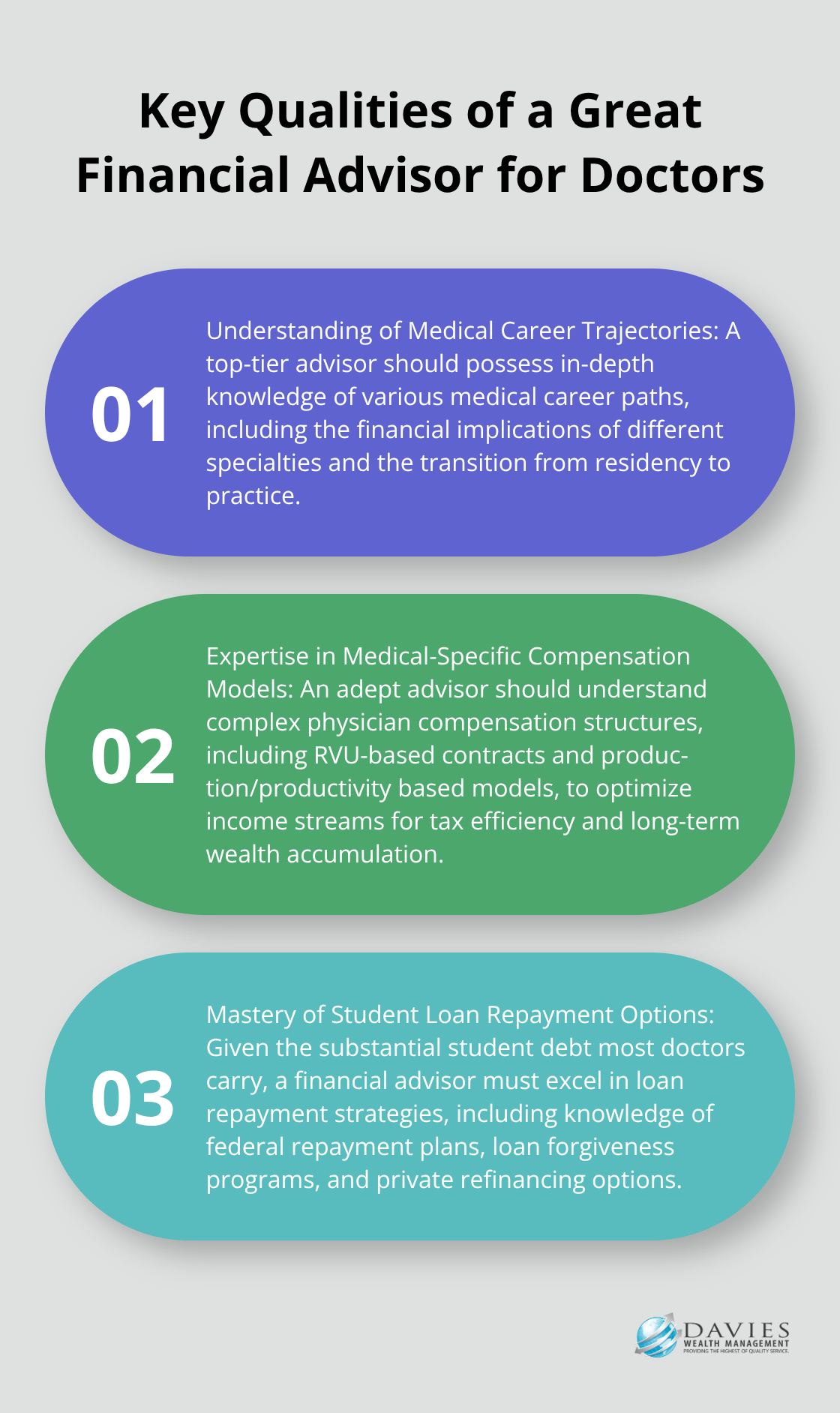

Understanding of Medical Career Trajectories

A top-tier financial advisor for physicians should possess in-depth knowledge of the various career paths within medicine. This includes understanding the financial implications of different specialties, the transition from residency to practice, and the potential for private practice ownership. Recent trends show an improvement in gender-based pay disparity among doctors in primary care. A skilled advisor can help doctors navigate these income trends and plan accordingly.

Expertise in Medical-Specific Compensation Models

Physician compensation often includes complex structures beyond a basic salary. An adept financial advisor should understand RVU-based contracts, which are often considered for salary plus performance and production/productivity based compensation models. They should optimize these various income streams for tax efficiency and long-term wealth accumulation. For example, they might suggest strategies to maximize contributions to tax-advantaged retirement accounts during high-income years.

Mastery of Student Loan Repayment Options

Given the substantial student debt most doctors carry, a financial advisor must excel in loan repayment strategies. This includes thorough knowledge of federal repayment plans, loan forgiveness programs (like Public Service Loan Forgiveness), and private refinancing options. A competent advisor can help a physician save tens of thousands of dollars over the life of their loans by choosing the optimal repayment strategy.

Proficiency in Risk Management for Healthcare Professionals

Doctors face unique risks that require specialized protection strategies. A qualified financial advisor should guide physicians through the intricacies of disability insurance, life insurance, and malpractice insurance. They should understand the nuances of own-occupation disability insurance versus any-occupation disability insurance and recommend appropriate coverage levels based on a doctor’s specialty and career stage.

Tailored Investment Strategies

A great financial advisor for doctors will create investment strategies that align with the unique career trajectory of physicians. This includes accounting for the late start in savings due to extended education and training periods, as well as planning for potentially higher peak earning years. The advisor should also consider the impact of student loan debt on investment capacity and recommend appropriate asset allocation strategies.

The next section will explore the essential services that a financial advisor should offer to doctors, building on these key qualities to provide comprehensive financial guidance.

What Services Should Your Doctor’s Financial Advisor Provide?

A comprehensive financial advisor for doctors should offer a range of specialized services tailored to the unique needs of medical professionals. Here are the essential services your financial advisor should provide:

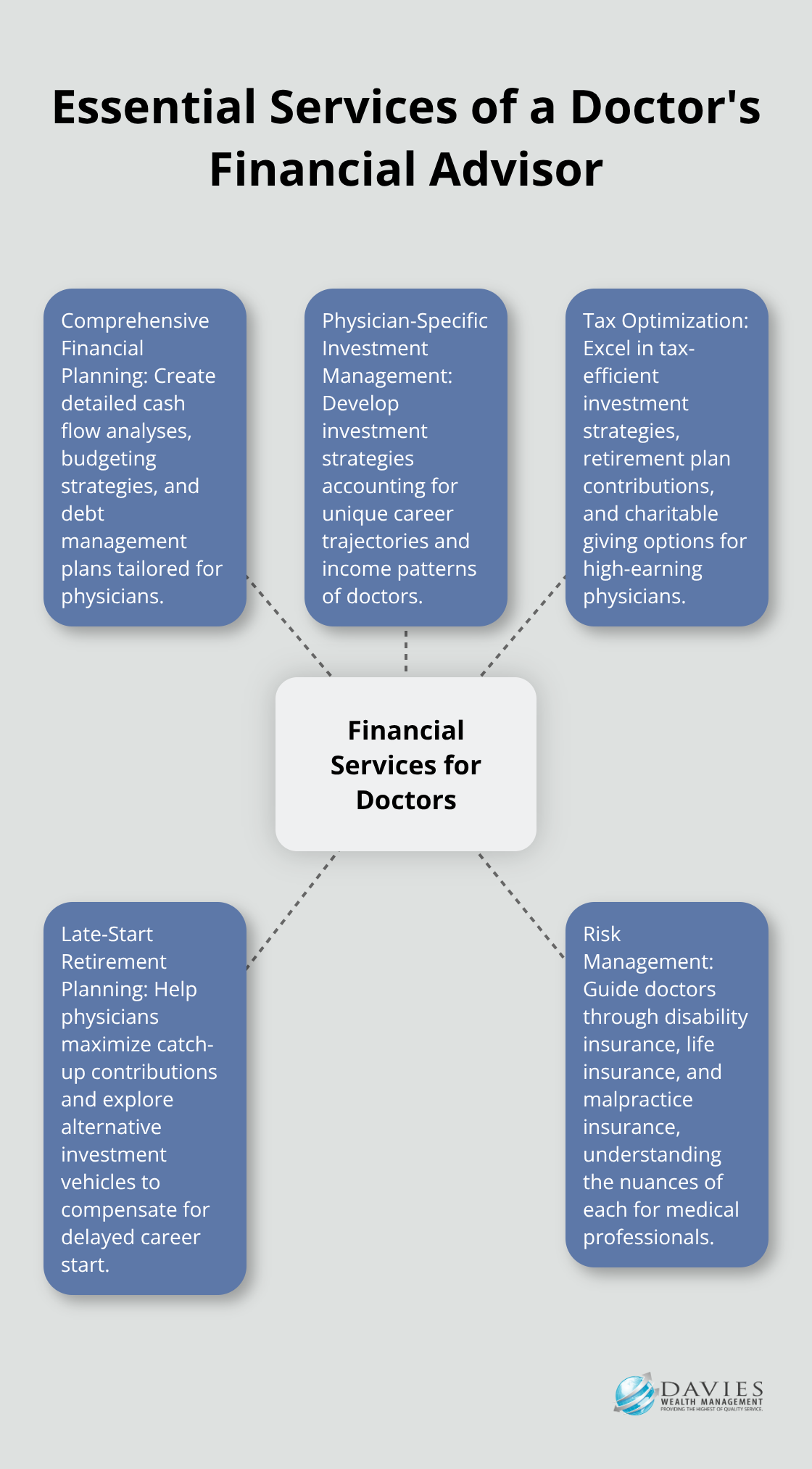

Comprehensive Financial Planning for Physicians

A financial advisor for doctors must offer holistic financial planning that addresses all aspects of a physician’s financial life. This includes the creation of detailed cash flow analyses, budgeting strategies, and debt management plans. A&I Wealth Management offers expert financial planning for physicians, providing tailored wealth strategies to help secure their future. A skilled advisor will create a plan to tackle debt while simultaneously building wealth.

Physician-Specific Investment Management

Investment strategies for doctors need to account for their unique career trajectories and income patterns. This often requires the development of aggressive catch-up strategies to compensate for the late start in saving due to extended education. A good advisor will create investment portfolios that balance risk and growth, taking into account factors such as specialty, practice type, and career stage.

Tax Optimization for Medical Professionals

Tax planning is essential for high-earning physicians. A competent financial advisor should excel in tax-efficient investment strategies, retirement plan contributions, and charitable giving options. They might suggest the use of a Backdoor Roth IRA strategy for high-income earners who exceed traditional IRA income limits. They should also understand tax implications specific to different practice structures (such as S-corporations or partnerships).

Late-Start Retirement Planning

Retirement planning for doctors requires specialized strategies due to their delayed entry into the workforce. A financial advisor should help physicians maximize catch-up contributions to retirement accounts and explore alternative investment vehicles. They should also excel at projecting future income needs, considering factors like lifestyle inflation and potential early retirement due to burnout.

Risk Management and Asset Protection

Doctors face unique risks that require specialized protection strategies. A qualified financial advisor should guide physicians through the intricacies of disability insurance, life insurance, and malpractice insurance. They should understand the nuances of own-occupation disability insurance versus any-occupation disability insurance, which only provides total disability benefits if the insured is unable to work in any occupation, and recommend appropriate coverage levels based on a doctor’s specialty and career stage.

Final Thoughts

Selecting the right financial advisor for doctors impacts your financial future significantly. Physicians face unique challenges, from student debt to complex income structures, which require specialized guidance. A financial advisor who understands the medical profession provides tailored strategies for your specific needs.

Prioritize professionals who demonstrate expertise in physician compensation models, student loan repayment options, and medical career trajectories. Seek advisors offering comprehensive services, including investment management, tax optimization, and retirement planning that accounts for doctors’ late start in savings (often due to extended training periods).

Your financial health deserves the same attention as your patients’ well-being. Davies Wealth Management specializes in personalized financial planning for high-income professionals, including physicians. Our team understands doctors’ unique financial challenges and helps build a secure financial foundation while you focus on your medical career.

Leave a Reply