Estate planning in Stuart, Florida is a critical process for safeguarding your assets and ensuring your wishes are honored after you’re gone. At Davies Wealth Management, we understand the unique considerations that Florida residents face when creating their estate plans.

Our comprehensive guide will walk you through the essential components of estate planning, from wills and trusts to healthcare directives. We’ll also explore how working with local professionals can provide invaluable expertise tailored to your specific needs.

Estate Planning in Stuart, Florida: Securing Your Legacy

Defining Estate Planning in the Sunshine State

Estate planning in Stuart, Florida extends beyond the creation of a will. It encompasses a comprehensive strategy to protect assets, provide for loved ones, and execute personal wishes after death. Florida’s unique laws and diverse population (including retirees and seasonal residents) shape the estate planning landscape in distinct ways.

Florida-Specific Estate Planning: Why It Matters

Florida’s estate laws differ markedly from other states. For example, Florida law states that if a spouse or minor child survives you, you cannot leave your homestead property to anyone else through your will. This protection allows the primary residence to pass to heirs without subjection to most creditors’ claims. Estate planning professionals in Stuart leverage these state-specific laws to maximize asset protection for their clients.

Essential Components of a Stuart, Florida Estate Plan

A robust estate plan in Stuart should include several key documents:

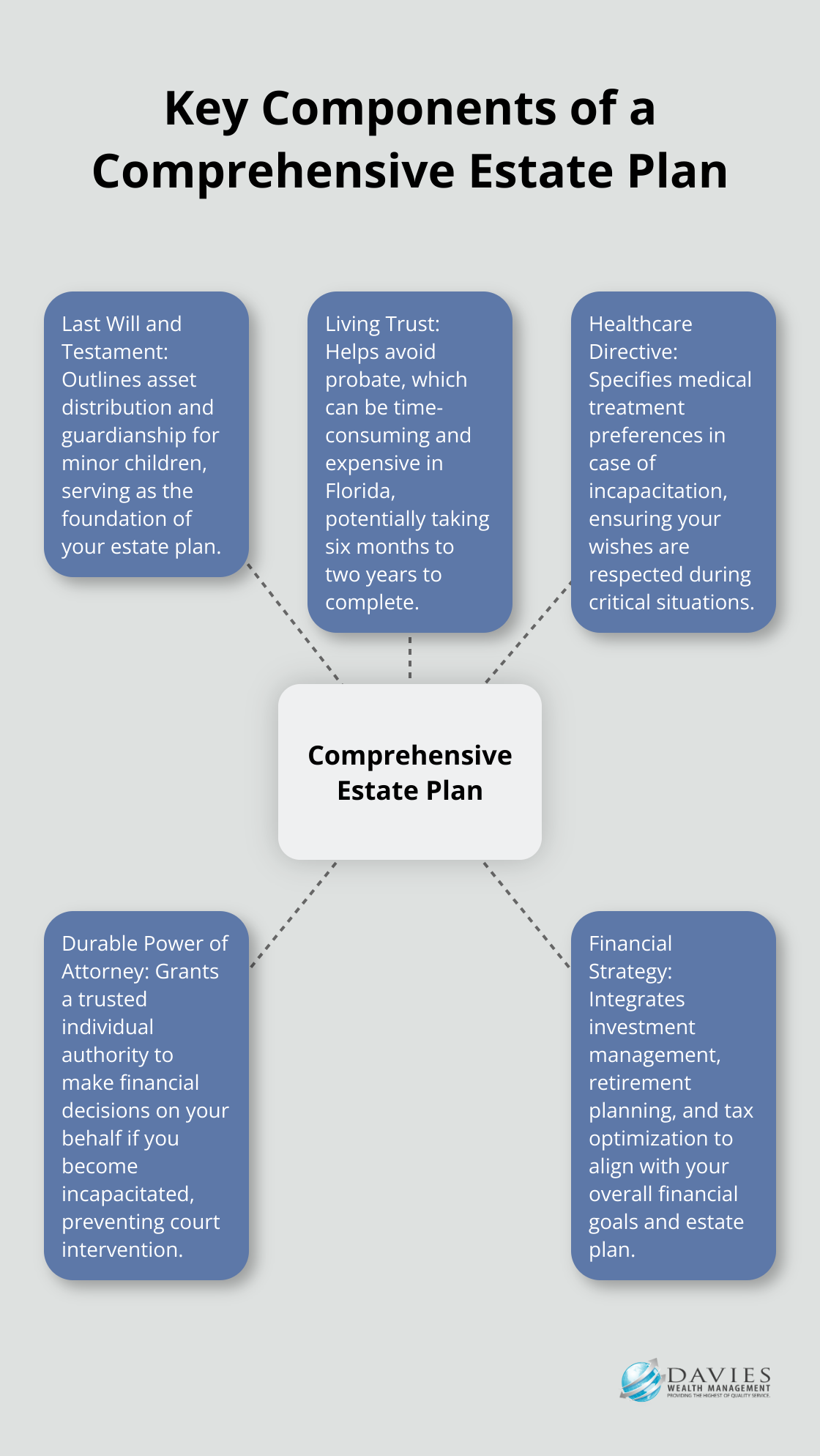

- Last Will and Testament: This fundamental document outlines asset distribution and guardianship for minor children.

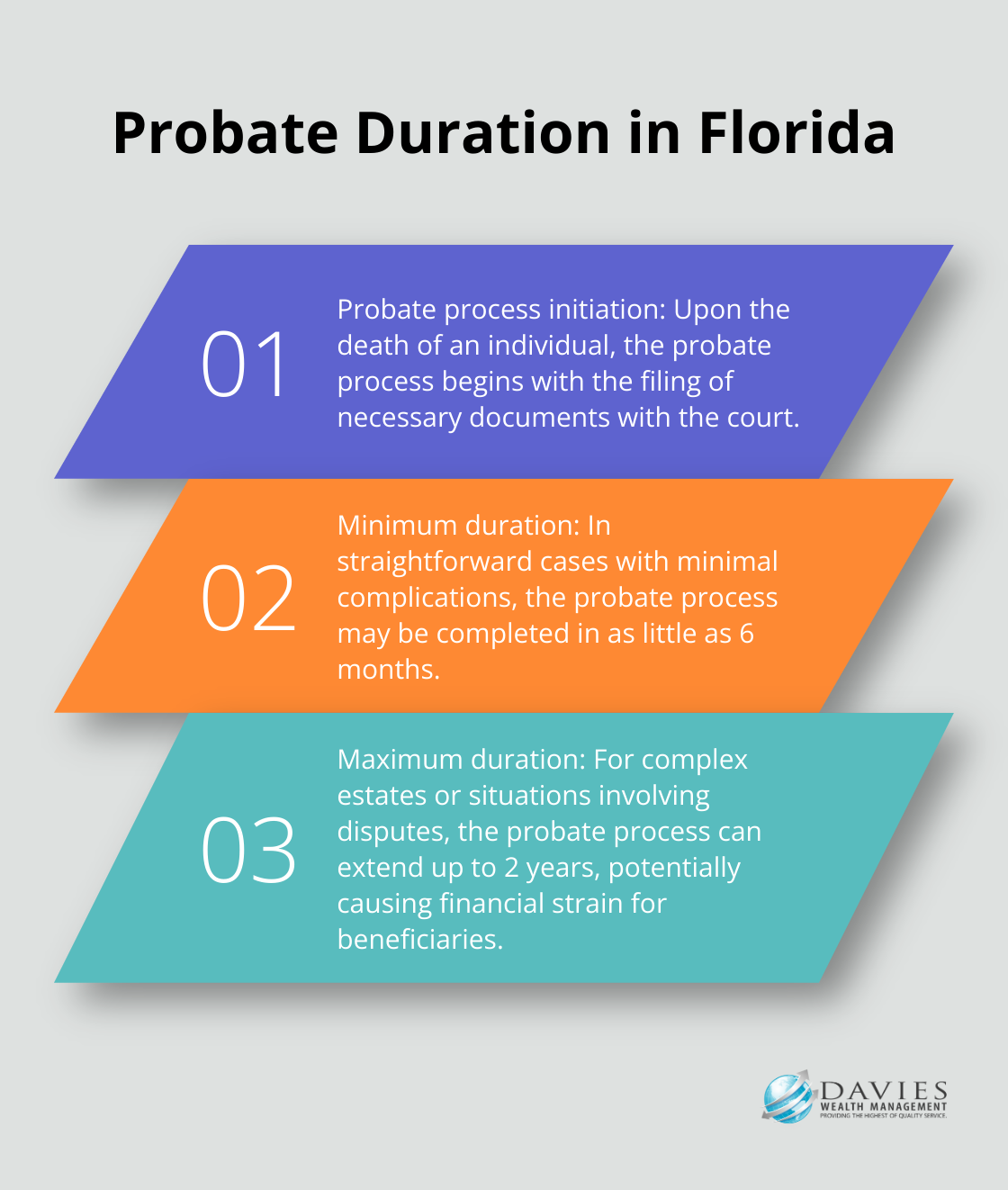

- Living Trust: Trusts help avoid probate, which can prove time-consuming and expensive in Florida. The Florida Bar reports that probate can take six months to two years to complete, potentially causing financial strain for beneficiaries.

- Healthcare Directive: This document specifies medical treatment preferences if incapacitation occurs.

- Durable Power of Attorney: This grants a trusted individual authority to make financial decisions on your behalf if you become incapacitated.

Unique Considerations for Florida Residents

Florida’s large retirement community necessitates estate plans that address long-term care needs. The proportion of older adults relative to younger populations is projected to increase through the year 2045 in Florida. This demographic shift underscores the importance of healthcare provisions in estate planning.

Additionally, Florida’s status as a popular vacation destination means many residents own multiple properties across different states (or even countries). This property diversity can complicate estate planning and requires careful consideration of multi-state probate issues.

Navigating Complex Estate Planning Scenarios

Professional athletes, business owners, and high-net-worth individuals often face unique estate planning challenges. These may include managing complex asset structures, addressing potential tax implications, and planning for generational wealth transfer. Specialized estate planning services (such as those offered by Davies Wealth Management) can provide tailored strategies to address these intricate scenarios.

As we move forward, let’s explore the essential estate planning documents in greater detail, understanding how each plays a vital role in securing your legacy in Stuart, Florida.

Essential Estate Planning Documents for Stuart, Florida Residents

Last Will and Testament: The Foundation of Your Estate Plan

A valid will in Florida is any written document stating your final wishes signed by yourself and two witnesses. This document outlines your wishes for asset distribution after death. Without a will, your estate falls under Florida’s intestacy laws, which may not align with your intentions.

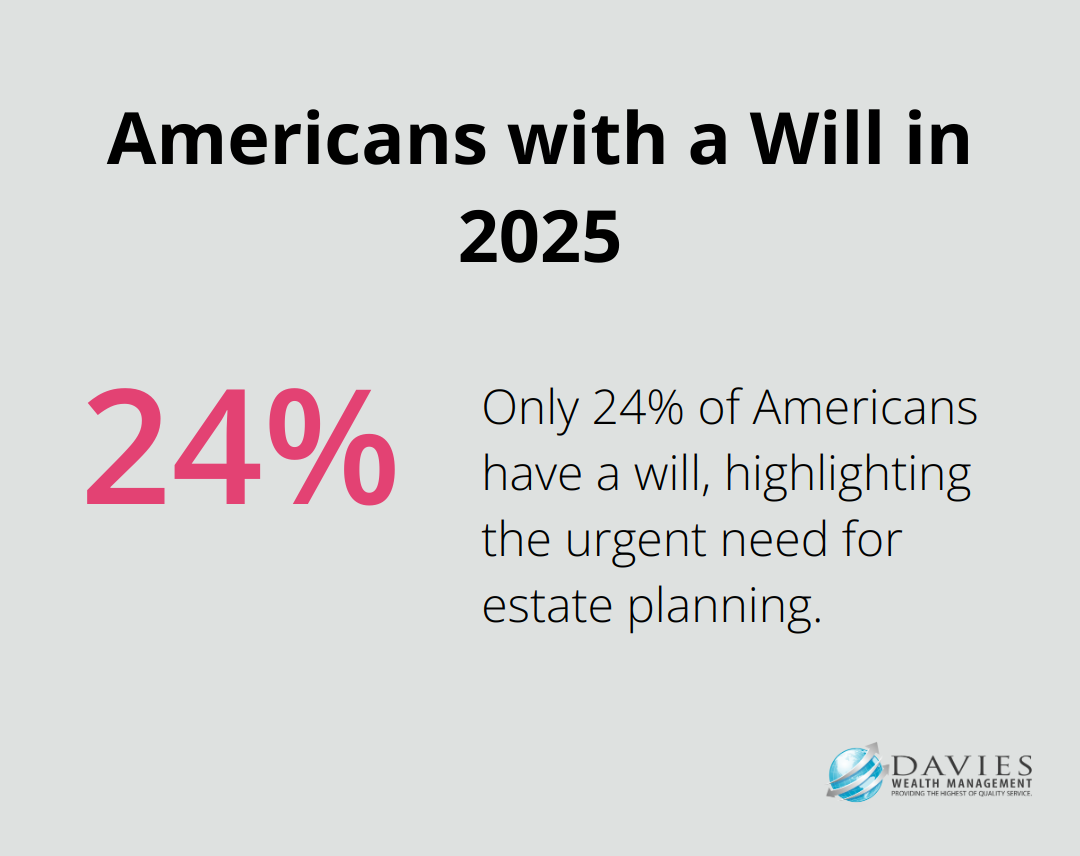

A 2025 Caring.com survey revealed that only 24% of Americans have a will. This statistic highlights the urgent need for proper estate planning. Professional guidance can help you create a clear, legally sound will that reflects your unique circumstances.

Living Trusts: Efficient Asset Transfer and Probate Avoidance

Living trusts serve as powerful tools for probate avoidance and privacy maintenance in Florida. The probate process in the state can take time to complete, potentially tying up assets for an extended period.

Two main types of living trusts exist:

- Revocable trusts: These offer flexibility, allowing modifications during your lifetime.

- Irrevocable trusts: While less flexible, they provide significant tax benefits and asset protection.

Your choice between these options depends on your specific financial situation and goals. A qualified estate planning professional can help you determine the most suitable trust structure for your needs.

Power of Attorney: Safeguarding Your Financial Affairs

A durable power of attorney grants authority to manage your financial affairs in case of incapacitation. This document prevents court intervention in your financial matters. In Florida, a valid power of attorney requires signatures from two witnesses and a notary public.

Selecting your agent demands careful consideration. This individual will wield significant control over your finances, making trust and competence paramount. Professional guidance can help you understand the implications of this decision and choose the right person for this critical role.

Healthcare Directive: Expressing Your Medical Preferences

A healthcare directive (also known as a living will or advance directive) outlines your preferences for medical treatment if you become unable to communicate them yourself. This document can prevent family disputes and ensure respect for your wishes during critical medical situations.

Florida law recognizes healthcare surrogates, who can make medical decisions on your behalf if you’re incapacitated. Designating a healthcare surrogate in addition to creating a living will provides comprehensive coverage for various medical scenarios.

Estate planning documents require customization to fit your unique circumstances, including family dynamics, asset composition, and personal goals. Professional guidance from experienced estate planning attorneys and financial advisors proves invaluable in creating a robust, tailored plan that secures your legacy in Stuart, Florida. As we move forward, let’s explore how working with local estate planning professionals can further enhance your estate planning strategy.

Navigating Estate Planning with Stuart Professionals

The Value of Local Expertise

Estate planning in Stuart, Florida requires a nuanced understanding of state-specific laws and regulations. A comprehensive Florida estate plan includes several key documents, each serving a distinct purpose in protecting your assets and ensuring your wishes are carried out. Local attorneys offer invaluable insights into Florida’s unique legal landscape, including homestead laws, asset protection strategies, and probate procedures.

Integrating Financial and Legal Strategies

Effective estate planning demands a holistic approach, combining legal expertise with financial acumen. In Stuart, estate planning attorneys, financial advisors, and tax professionals often collaborate. This integrated approach ensures that your estate plan aligns with your overall financial goals while maximizing tax efficiency.

Tailored Solutions for Complex Situations

Stuart’s diverse population, including retirees, business owners, and seasonal residents, often presents complex estate planning scenarios. Local professionals excel at crafting tailored solutions for these unique situations. For example, snowbirds with properties in multiple states require careful consideration of multi-state probate issues and tax implications.

Staying Current with Changing Laws

Florida’s estate planning laws change frequently. Local professionals keep up with these changes, ensuring your estate plan remains current and effective.

The Role of Financial Advisors in Estate Planning

Financial advisors play a critical role in the estate planning process. They provide valuable insights into investment strategies, tax implications, and long-term financial projections that complement the legal aspects of estate planning. This collaboration between financial advisors and legal professionals results in a more comprehensive and effective estate plan.

For instance, Davies Wealth Management works closely with Stuart’s legal and tax professionals to provide comprehensive estate planning services. These services include investment management, retirement planning, tax optimization, and estate planning. Our team’s expertise in financial planning enhances the legal aspects of estate planning, offering clients a robust, well-rounded approach to securing their legacy.

Final Thoughts

Estate planning in Stuart, Florida protects your financial legacy and ensures your wishes are honored. The unique legal landscape and diverse population make professional guidance essential for a comprehensive estate plan. Local experts bring invaluable knowledge about Florida-specific laws, tax implications, and probate procedures to create tailored strategies for complex scenarios.

Financial advisors complement legal expertise in the estate planning process. They offer insights that integrate financial and legal strategies, creating a robust plan that distributes assets according to your wishes and maximizes tax efficiency. This holistic approach aligns with your overall financial goals and secures your future.

Davies Wealth Management offers comprehensive financial advisory services, including estate planning support in Stuart, Florida. Their expertise in investment management, retirement planning, and tax-efficient strategies can help you create a holistic approach to secure your financial future. Take the first step towards comprehensive estate planning in Stuart today and gain peace of mind knowing your assets and loved ones will be protected.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply