At Davies Wealth Management, we understand the importance of having the right tools for effective financial planning. In today’s digital age, individuals have access to a wide array of financial planning tools that can significantly improve their financial health.

This blog post will explore essential financial planning tools for individuals, covering everything from budgeting apps to retirement calculators. We’ll guide you through the most useful resources to help you take control of your finances and work towards a secure financial future.

How Budgeting Tools Can Revolutionize Your Finances

At Davies Wealth Management, we’ve witnessed the transformative power of effective budgeting tools. Let’s explore some of the most impactful options available today and how they can enhance your financial planning.

Popular Budgeting Apps and Their Features

Mint stands out in the budgeting app arena with its many features including bill tracking, budgeting, a free credit score, alerts and advice, simple categorization, and investment tracking. YNAB (You Need A Budget) employs a zero-based budgeting approach, with users reporting average savings of $600 in their first two months and $6,000 in their first year.

Personal Capital combines budgeting with investment tracking, making it particularly useful for individuals with complex financial portfolios (such as professional athletes or business owners). It provides a holistic view of your finances, allowing for more informed decision-making.

Key Features in Expense Tracking Tools

When selecting an expense tracking tool, prioritize those that offer real-time synchronization with your bank accounts and credit cards. This feature ensures your budget always reflects your current financial status. Tools that provide customizable categories and tags allow you to organize your expenses in a way that aligns with your lifestyle.

The ability to set and track financial goals is another crucial feature. Setting specific financial goals can help you understand the real costs, timelines, and milestones needed to achieve your dreams.

The Advantages of Digital Budgeting Platforms

Digital budgeting platforms offer numerous benefits over traditional methods. They provide instant insights into your spending patterns, often through visually appealing charts and graphs. This immediate feedback can lead to more mindful spending habits.

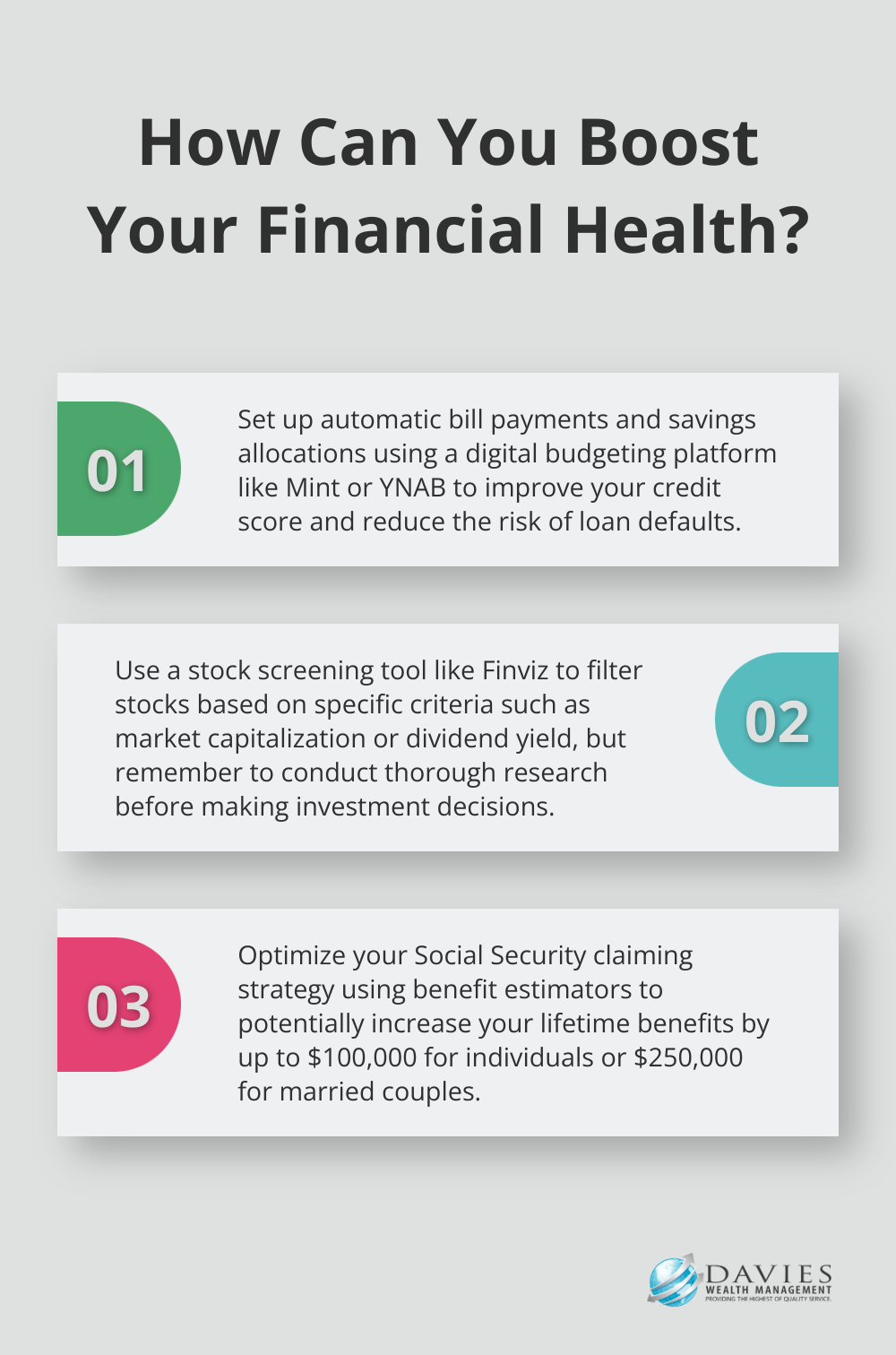

These platforms often include features like bill reminders and automatic savings allocations. A study found that automatic enrollment caused a modest increase in the average credit score and a decrease in loan defaults.

Clients who consistently use digital budgeting tools are better equipped to make informed financial decisions. They’re more likely to stick to their financial plans and achieve their long-term goals.

The best budgeting tool is the one you’ll use consistently. Whether you’re managing variable income or tracking complex expenses, there’s a tool out there that can streamline your budgeting process and set you on the path to financial success.

As we move forward, let’s explore how investment management and portfolio analysis tools can complement your budgeting efforts and further enhance your financial planning strategy.

Maximizing Your Investments with Digital Tools

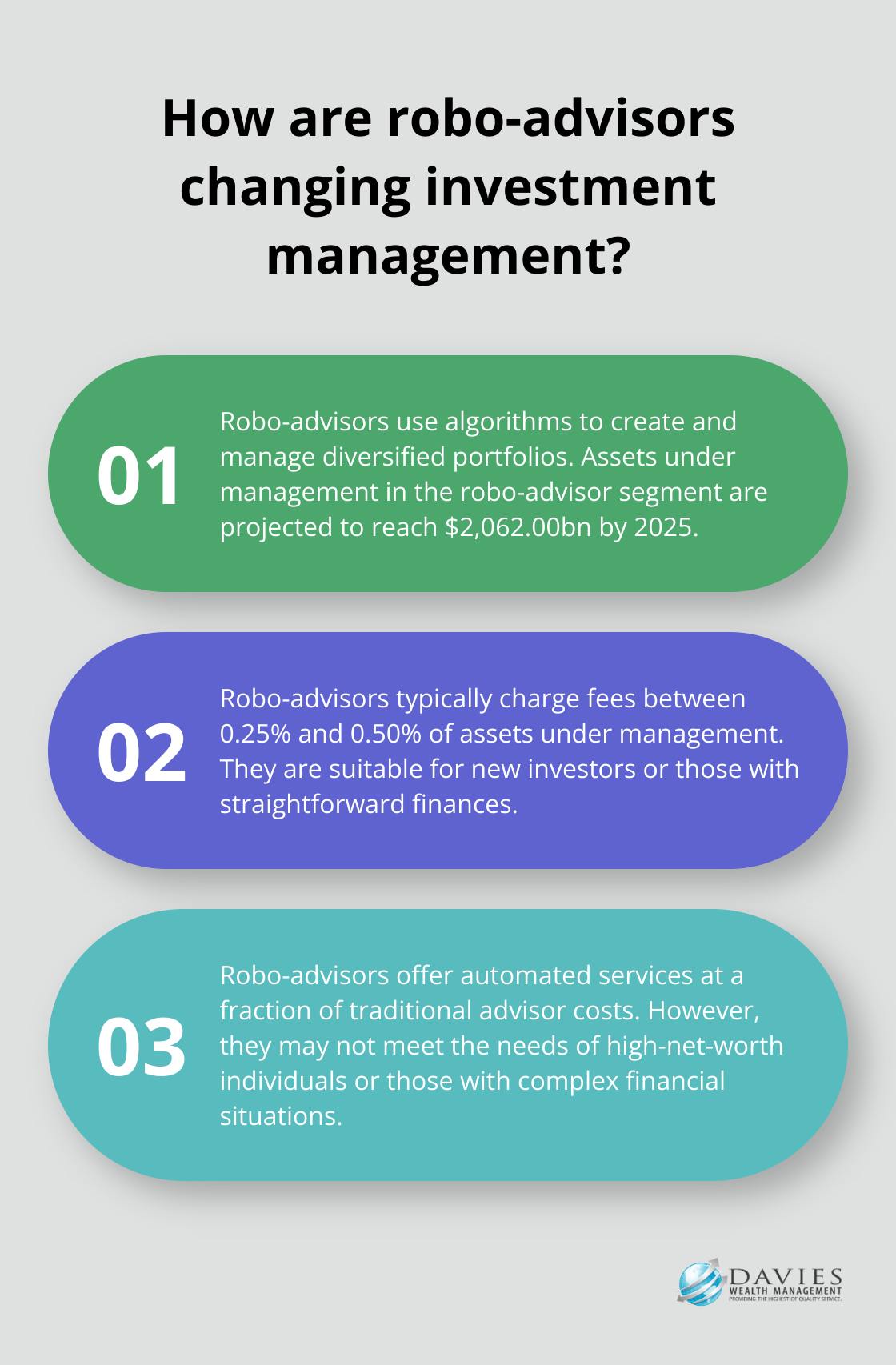

The Rise of Robo-Advisors

Robo-advisors have transformed investment management, offering automated services at a fraction of traditional advisor costs. These platforms use algorithms to create and manage diversified portfolios based on your risk tolerance and financial goals.

A Statista report projects assets under management in the robo-advisor segment to reach $2,062.00bn by 2025. This growth stems from their accessibility and low fees (typically 0.25% to 0.50% of assets under management).

While robo-advisors suit new investors or those with straightforward finances, they may not meet the needs of high-net-worth individuals or those with complex financial situations (such as professional athletes). These cases often require more personalized advice.

Leveraging Stock Screening Tools

Investors who prefer hands-on approaches benefit from stock screening tools. These platforms filter stocks based on specific criteria like market capitalization, dividend yield, or price-to-earnings ratio.

Finviz, a popular stock screening tool, offers both free and paid versions. It provides real-time quotes, interactive charts, and customizable screeners to identify potential investment opportunities aligned with your strategy.

Stock screening tools, however, represent just one part of the investment process. They help identify potential opportunities, but thorough research and analysis remain necessary before making investment decisions.

The Power of Portfolio Rebalancing Software

Portfolio rebalancing, a critical aspect of investment management, involves periodically buying or selling assets to maintain your desired asset allocation. Many individual investors overlook this process.

Automated rebalancing tools simplify this task. M1 Finance, for example, offers a free platform that automatically rebalances your portfolio based on your specified asset allocation. This ensures your portfolio aligns with your investment strategy, even as market conditions change.

A Vanguard study found that annually rebalanced portfolios can potentially provide an average of 0.35% higher returns compared to never-rebalanced portfolios. This seemingly small difference can substantially impact your overall returns over time.

As we move forward, we’ll explore how retirement planning tools and calculators complement these investment management tools, providing a comprehensive approach to your financial future.

Essential Retirement Planning Tools and Strategies

Retirement Savings Calculators: Your Financial Crystal Ball

Retirement calculators serve as powerful tools for projecting future financial needs. The U.S. Department of Labor provides a free retirement calculator that considers your current age, income, savings rate, and expected retirement age to estimate necessary savings for retirement.

Consider this example: A 35-year-old earning $75,000 annually who plans to retire at 65 might need to save approximately 15% of their income each year to maintain their current lifestyle in retirement. These figures can vary significantly based on individual circumstances, which underscores the importance of personalized financial advice.

Maximizing Social Security Benefits

Social Security benefit estimators play a vital role in retirement planning. The Social Security Administration’s Office of Retirement and Disability Policy has conducted a study on the accuracy of the current Statement estimation method.

Research from the National Bureau of Economic Research reveals that optimizing Social Security claiming strategies can increase lifetime benefits by up to $100,000 for an individual and $250,000 for a married couple. This finding highlights the importance of understanding and strategically planning Social Security benefits.

Projecting Future Expenses in Retirement

Accurate projection of future expenses forms a critical component of retirement planning. The Bureau of Labor Statistics Consumer Expenditure Survey offers valuable insights into spending patterns of different age groups, including retirees.

The survey indicates that housing typically accounts for about 35% of expenses for those aged 65 and older. Healthcare costs also tend to increase, with per-person healthcare spending estimated at $3,135 for the 65–74 age group and $3,568 for the 75-and-over age group.

Tools like ESPlanner and MaxiFi Planner employ dynamic programming techniques to help project future expenses and optimize retirement spending. NewRetirement has at least two major advantages over MaxiFi Planner: automated account linking with real-time updates and technical support availability.

Personalized Retirement Planning

While these tools provide valuable insights, they cannot replace personalized financial advice. Professional financial advisors can help navigate the complexities of retirement planning and create comprehensive strategies tailored to individual situations.

This personalized approach proves particularly beneficial for individuals with unique financial circumstances, such as professional athletes with short career spans or business owners planning for succession. A tailored retirement plan ensures a secure financial future that aligns with specific goals and lifestyle expectations.

Final Thoughts

Financial planning tools for individuals offer powerful support in the journey towards financial security. These resources provide real-time insights, sophisticated investment management, and retirement planning capabilities. The integration of budgeting tools, investment platforms, and retirement calculators creates a holistic view of your financial landscape, enabling more informed decision-making.

We at Davies Wealth Management encourage you to incorporate these tools into your financial planning process. They provide valuable insights and structure needed to make meaningful progress. However, these tools work best when combined with professional guidance.

Our team at Davies Wealth Management specializes in personalized financial advice that complements these digital tools. We tailor strategies to unique circumstances, particularly for professional athletes and high-net-worth individuals. Start exploring these financial planning tools today and take the first step towards a more secure financial future.

Leave a Reply