Most people struggle with money management because they lack a structured approach to their finances. Without proper planning, even high earners find themselves living paycheck to paycheck.

We at Davies Wealth Management see this pattern repeatedly. The difference between financial success and stress often comes down to having the right financial plan components in place from the start.

Setting Clear Financial Goals

The difference between wishful thinking and financial success lies in how you structure your objectives. Research from Dominican University shows people who write down specific goals achieve significantly more than those who simply think about their aspirations. This isn’t about creation of a generic list of dreams – it’s about construction of measurable targets with clear deadlines.

Start With Numbers That Matter

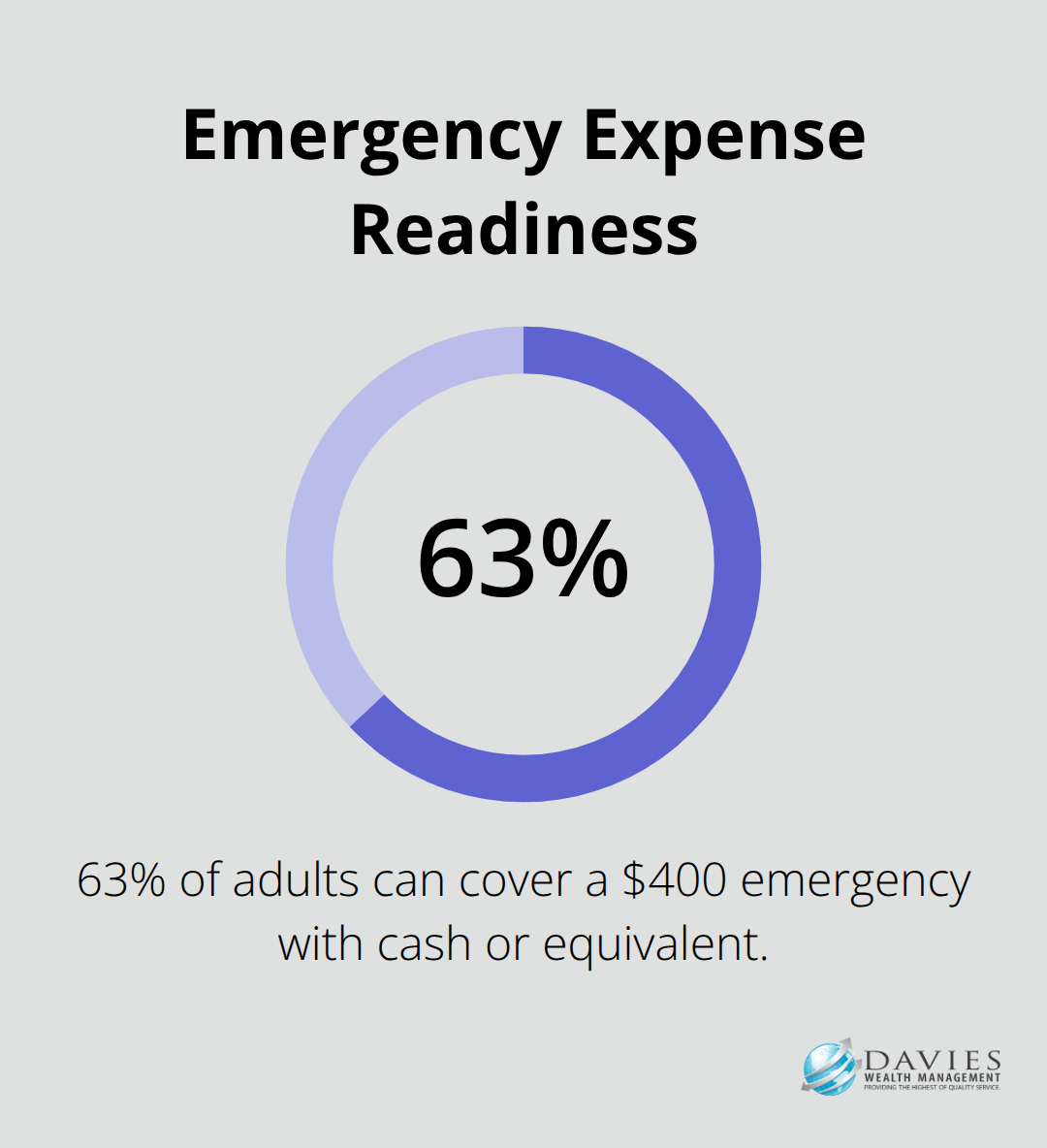

Financial goals without specific dollar amounts and timeframes are essentially worthless. Instead of saying you want to save more money, commit to save $500 monthly for the next 12 months to build a $6,000 emergency fund. The Federal Reserve reports that 63% of adults would cover a hypothetical $400 emergency expense exclusively using cash or its equivalent, which means concrete savings targets put you ahead of many Americans.

Short-term goals should span one to three years and include specific milestones like payment of a $5,000 credit card debt or savings for a $15,000 car down payment. Long-term objectives stretch beyond seven years and require more substantial plans – think accumulation of $1 million for retirement or construction of a real estate investment portfolio worth $500,000.

Match Your Timeline to Life Stages

Your financial priorities must shift as you age, and this reality costs money when ignored. People in their twenties should prioritize credit scores above 750 and establish emergency funds worth three months of expenses. Those in their thirties typically focus on maximization of retirement contributions to employer-sponsored 401k plans, especially if there’s company match available. Research shows median household income peaks between ages 45-54 at $84,464, which makes this the prime decade for aggressive wealth accumulation. After age 50, catch-up contributions allow an additional $7,500 annually in 401k accounts and $1,000 extra in IRAs (creation of opportunities to accelerate retirement savings when earnings are typically at their highest).

Track Progress With Regular Reviews

Most people set financial goals and then forget about them completely. This approach guarantees failure. Schedule quarterly reviews to assess your progress and make necessary adjustments. Market conditions change, income fluctuates, and life throws unexpected expenses your way. Regular review of your financial goals increases your likelihood of achieving them compared to those who set goals once and never revisit them.

Your budget and cash flow management system becomes the foundation that supports these carefully structured goals (and determines whether you’ll actually reach them).

Budgeting and Cash Flow Management

Most budgets fail within the first month because people create unrealistic plans that ignore their actual behavior patterns. The Bureau of Labor Statistics reports that the average American household spends $66,928 annually, but only 32% of families maintain a detailed monthly budget according to Gallup data. The problem isn’t willpower – it’s methodology.

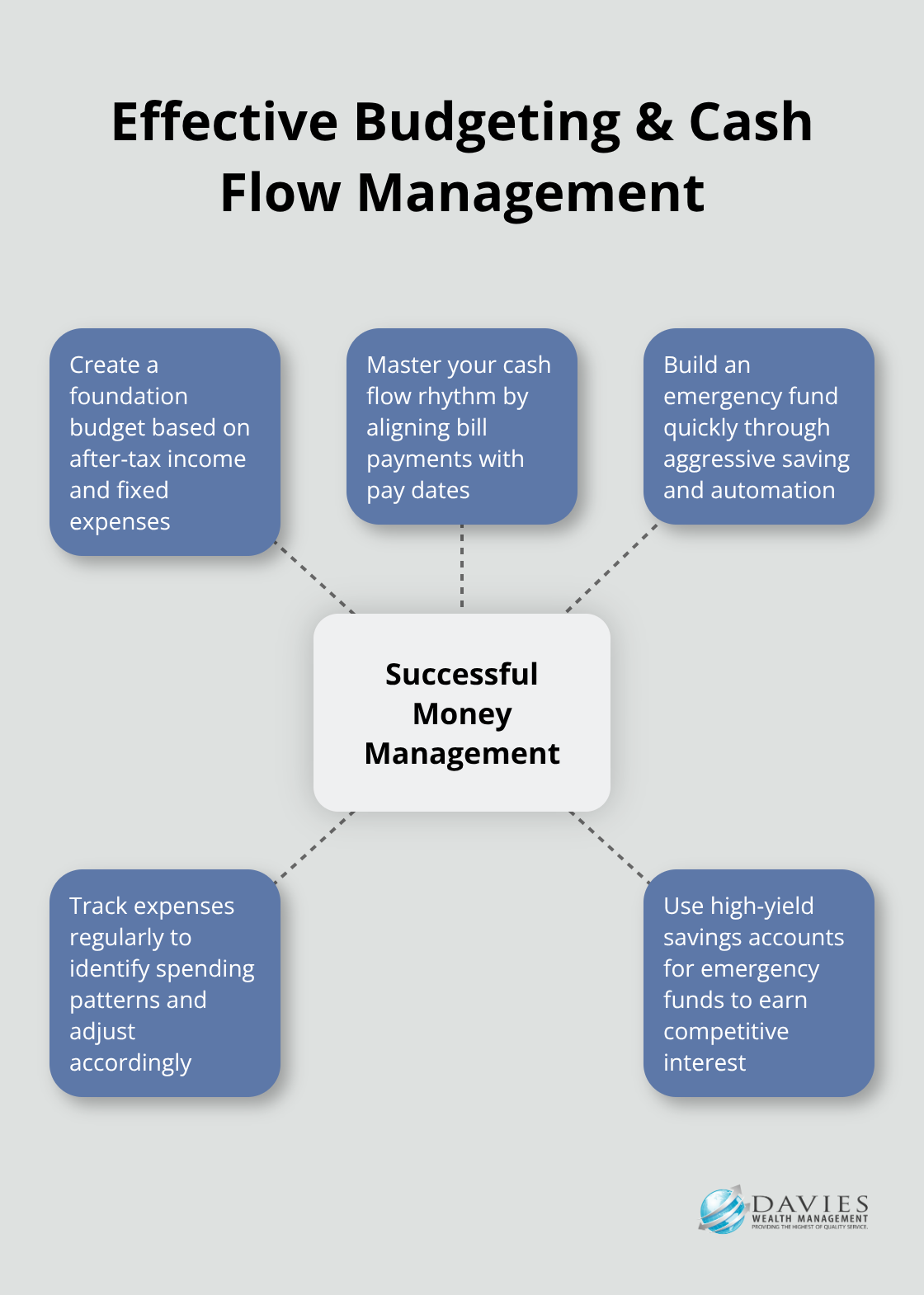

Create Your Foundation Budget

Start with your after-tax income and subtract fixed expenses like rent, insurance, and minimum debt payments. The amount that remains represents your discretionary power. Track every dollar for 30 days with apps like Mint or YNAB to identify patterns you didn’t know existed. Most people underestimate their monthly expenses by 20-30%, which explains why traditional budgets collapse quickly.

Master Your Cash Flow Rhythm

Cash flow management beats standard budgets when it comes to stress reduction. Your payday schedule determines everything about your monthly financial rhythm. If you receive biweekly paychecks, align major bill payments with your pay dates rather than spread them throughout the month.

10 percent of adults reported they struggled to pay their bills in the prior 12 months due to poor coordination between income and expenses (not insufficient income). Create a cash flow calendar that shows exactly when money arrives and when bills are due. Pay rent and utilities within three days of your largest paycheck each month.

Build Your Emergency Fund Fast

Emergency funds require aggressive action, not gradual accumulation over years. Financial planners typically recommend three to six months of expenses, but this generic advice ignores your specific situation. Single-income households need six months minimum, while dual-income families can start with three months.

Speed matters here – automate transfers of $200-500 immediately after each paycheck hits your account. High-yield accounts at online banks like Marcus or Ally currently offer competitive rates (which means a $10,000 emergency fund generates substantial annual interest). Skip the traditional advice about small $1,000 starts. Instead, redirect your tax refund, work bonuses, and any windfall money directly into emergency accounts until you reach your target.

This systematic approach to cash management creates the stable foundation you need for long-term wealth accumulation through strategic investment choices.

Investment and Retirement Planning

Your emergency fund sits in a high-yield savings account, but wealth creation requires you to move beyond cash into investments that outpace inflation. The S&P 500 has generated strong historical returns over the long term, while savings accounts currently offer 4-5%. This gap compounds dramatically over time – $10,000 invested in the S&P 500 in 1973 would be worth over $1.3 million today, while the same amount in savings would barely reach $150,000.

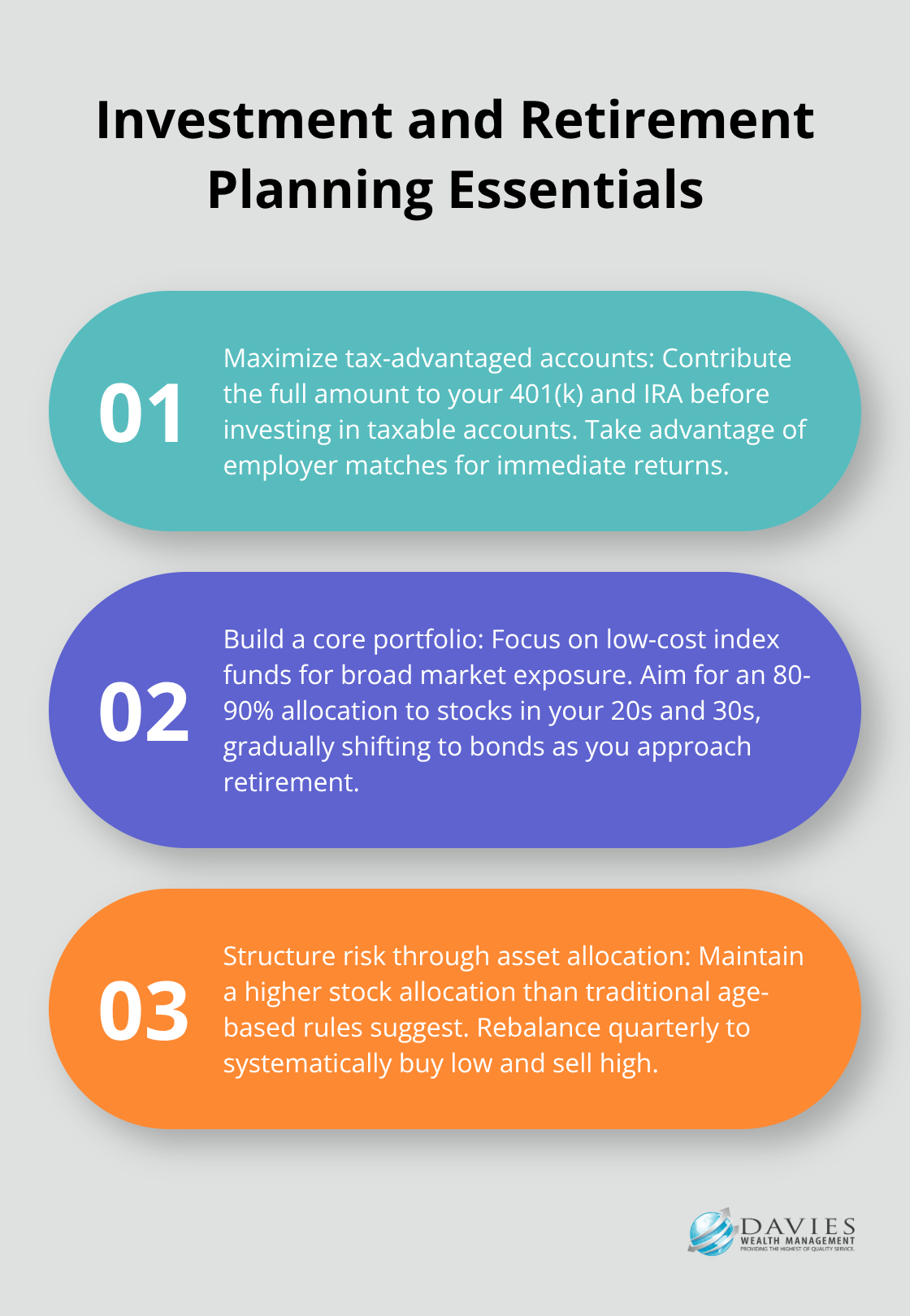

Maximize Tax-Advantaged Accounts First

You should max out your 401k contributions before you touch taxable investment accounts. For 2024, you can contribute $23,000 annually to employer-sponsored plans, plus an additional $7,500 if you’re over 50. Company matches represent free money – if your employer matches 50% of contributions up to 6% of salary, that’s an immediate 50% return on your investment. Roth IRAs offer tax-free growth with annual contribution limits of $7,000 for most people (the IRS allows backdoor Roth conversions for high earners who exceed income thresholds, which creates opportunities to build tax-free retirement wealth regardless of current earnings).

Build Your Core Portfolio

Target-date funds offer instant diversification but charge higher fees than index funds. Vanguard’s Total Stock Market Index Fund carries an expense ratio of just 0.03%, while actively managed funds average 0.67% according to Morningstar research. This difference costs you $64,000 over 30 years on a $100,000 investment. You should allocate 80-90% to stock index funds in your twenties and thirties, then gradually shift toward bonds as retirement approaches. International exposure through developed market funds should represent 20-30% of your equity allocation to reduce concentration risk in U.S. markets.

Structure Risk Through Asset Allocation

Age-based allocation rules like holding your age in bonds are outdated for modern lifespans. People who retire at 65 now face 20-30 years of potential inflation, which makes conservative portfolios dangerous for purchasing power preservation. A 40-year-old should maintain 70-80% stocks, not the traditional 60%. You should rebalance quarterly when allocations drift more than 5% from targets, which forces you to sell high-performing assets and buy underperforming ones systematically.

Final Thoughts

Successful financial plans share three fundamental characteristics: specific measurable goals, systematic execution, and regular adjustments. The most effective financial plan components work together like interconnected systems rather than isolated strategies. Your emergency fund supports your investment timeline, while your budget creates the cash flow needed to fund retirement accounts consistently.

The biggest mistakes stem from perfectionism and procrastination. People wait for perfect investment conditions or delay action because they can’t save the maximum amount immediately. Starting with $100 monthly beats waiting six months to contribute $500 (another common error involves chasing investment returns instead of focusing on consistent contributions and low fees).

Implementation beats analysis every time. Open your high-yield savings account this week, automate your 401k contributions, and schedule quarterly financial reviews. We at Davies Wealth Management specialize in creating comprehensive wealth management solutions that address your unique financial situation.

Leave a Reply