Building wealth requires more than just saving money in a bank account. The most successful investors understand that all parts of a financial plan must work together seamlessly.

We at Davies Wealth Management have seen how proper planning transforms financial futures. This guide breaks down the essential components every comprehensive financial plan needs to succeed.

What Financial Foundation Do You Need First?

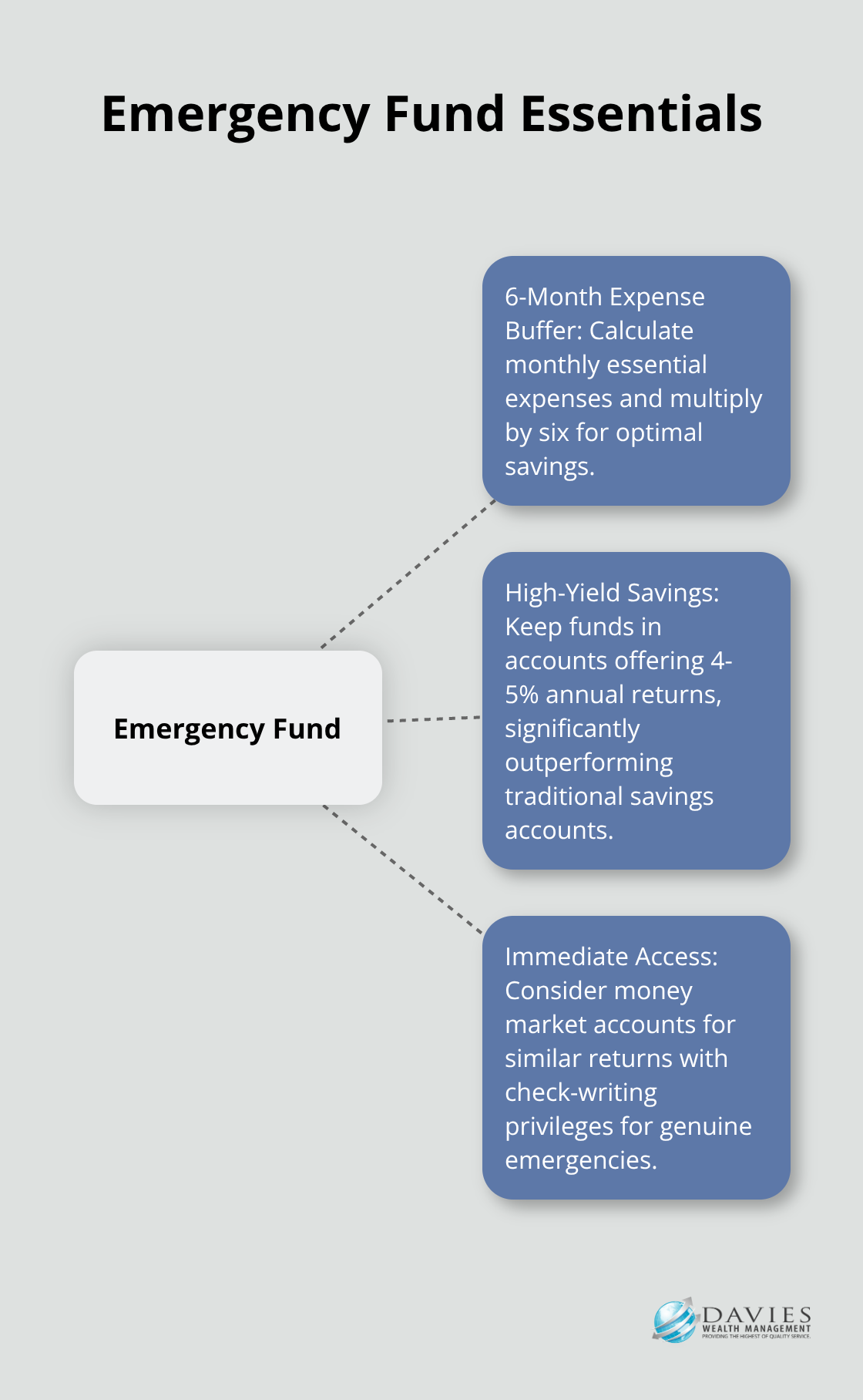

Emergency Fund Requirements

Your emergency fund represents the bedrock of financial security, yet most Americans maintain insufficient savings according to Federal Reserve data. This amount falls drastically short of the six-month expense buffer financial experts recommend. Calculate your monthly essential expenses (housing, utilities, food, and minimum debt payments), then multiply by six. A household that spends $4,000 monthly needs $24,000 in emergency savings. Keep these funds in high-yield savings accounts that offer 4-5% annual returns rather than traditional savings accounts that pay 0.01%. Money market accounts provide similar returns with check-writing privileges for immediate access during genuine emergencies.

Investment Strategy Framework

Portfolio diversification extends beyond the outdated 60/40 stock-bond split that dominated previous decades. Current market conditions demand more sophisticated approaches, with many successful investors who allocate 70-80% to stocks, 10-15% to bonds, and 5-10% to alternative investments that include real estate investment trusts. Index funds consistently outperform 85% of actively managed funds over 15-year periods while they charge expense ratios below 0.1% compared to 1.5% for active funds. Target-date funds automatically adjust allocations as retirement approaches and reduce risk exposure from 90% stocks at age 30 to 40% stocks at age 65.

Insurance Protection Strategy

Life insurance needs calculation follows the 10-times-income rule, which means someone who earns $75,000 annually requires $750,000 coverage. Term life insurance costs $30-50 monthly for healthy 35-year-olds who seek $500,000 coverage, while whole life insurance costs 10-15 times more with minimal investment returns. Disability insurance proves more valuable than life insurance for adults who work, as it replaces 60-70% of income when illness or injury prevents employment. One in four workers will face an accident or illness during their lifetime that keeps them out of work for at least one year, yet only 48% maintain coverage through employers. Supplement employer policies with individual coverage to maintain benefits between jobs.

These foundational elements create the stability you need before you tackle more complex wealth-building strategies. Once you establish these basics, you can focus on the sophisticated approaches that maximize your retirement savings and long-term financial growth.

How Should You Maximize Your Retirement Wealth?

Retirement Account Contribution Maximization

The 401k contribution limit for 2024 reaches $23,000, with catch-up contributions that add another $7,500 for workers over 50. Workers who max out both limits invest $30,500 annually, which grows to approximately $2.4 million over 30 years (assuming 7% returns). Roth 401k contributions offer superior tax advantages for younger workers in lower tax brackets, as withdrawals remain tax-free in retirement. Traditional 401k contributions reduce current taxes but face unknown future tax rates.

Company matches represent free money that 23% of eligible workers fail to claim fully according to Vanguard data. A 50% match on 6% of salary equals 3% additional compensation that compounds over decades. Professional athletes face unique challenges with variable income streams, making consistent retirement contributions particularly important during peak earning years.

Social Security Optimization Tactics

Workers who delay Social Security beyond full retirement age increase benefits by a certain percentage for each month until age 70. Someone entitled to $2,500 monthly at age 66 receives enhanced monthly payments at age 70, adding substantial income per month for life. Married couples can utilize file-and-suspend strategies where the higher earner delays benefits while the spouse claims spousal benefits.

Social Security Administration data shows the average monthly benefit reaches only $1,907 in 2024, making optimization strategies essential for comfortable retirement. High earners who contribute to Social Security for 35 years receive benefits based on their highest 35 earning years, making late-career salary increases particularly valuable for long-term wealth accumulation.

Estate Planning Implementation

The lifetime exemption is projected to be $7 million in 2026. Revocable trusts avoid probate costs that average 3-7% of estate value and maintain privacy that wills cannot provide. Irrevocable life insurance trusts remove policy death benefits from taxable estates while providing liquidity for estate taxes.

Generation-skipping trusts allow wealth transfer to grandchildren while avoiding estate taxes at the children’s level. Annual gift tax exclusion permits $18,000 per recipient in 2024, allowing married couples to gift $36,000 per child annually without tax consequences.

These retirement and estate strategies work best when they integrate with smart tax planning approaches that minimize your lifetime tax burden.

How Can Smart Tax Strategies Boost Your Wealth?

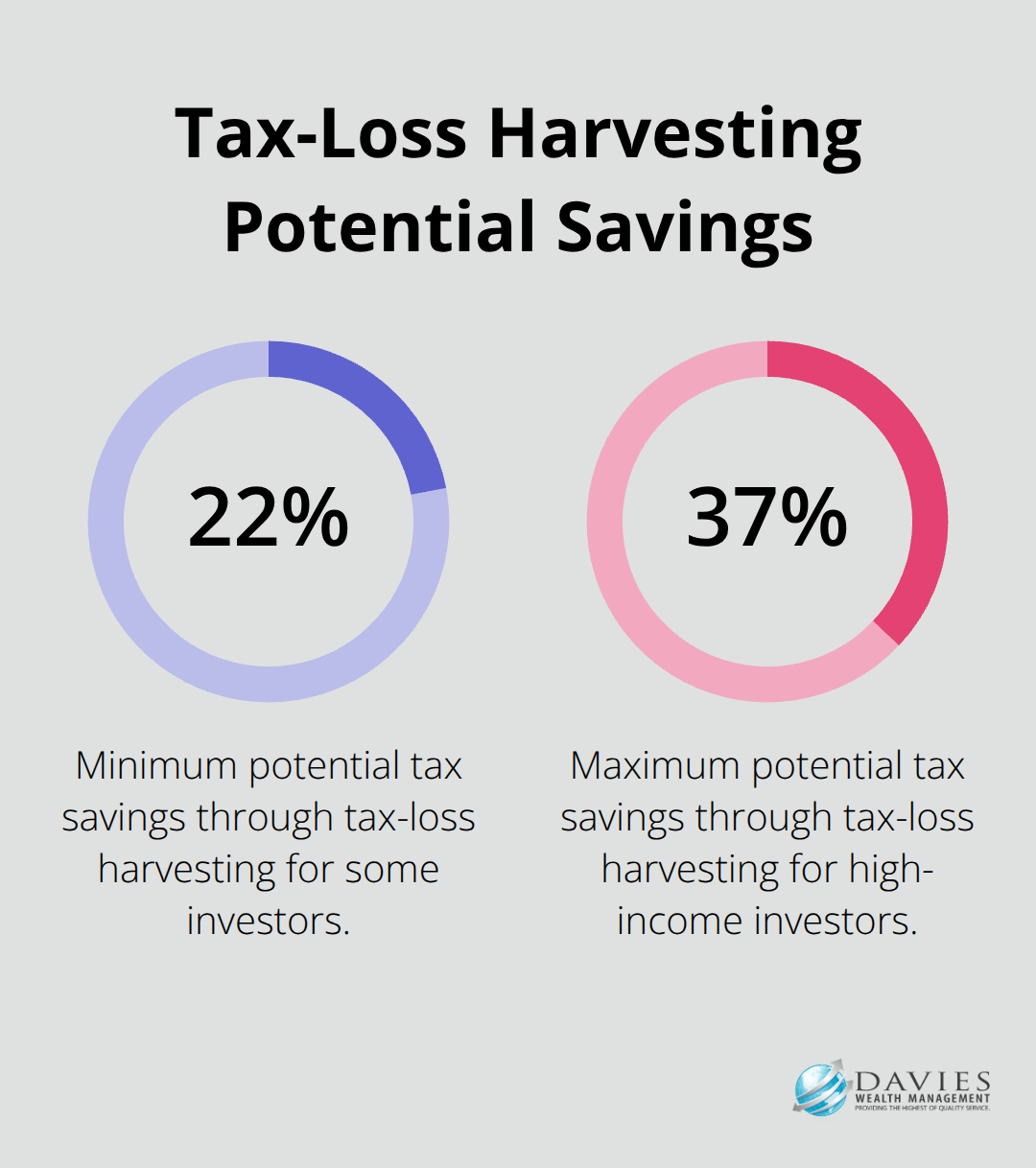

Tax-Loss Harvesting and Asset Location

Tax-loss harvesting generates immediate tax savings when you sell losing investments to offset capital gains. This strategy potentially saves investors 22-37% on taxes depending on their bracket. The IRS wash-sale rule prevents you from repurchasing identical or similar securities within 30 days, but you can buy different assets to maintain market exposure.

Asset location strategy places tax-inefficient investments like REITs and bonds in tax-deferred accounts while you hold tax-efficient index funds in taxable accounts. This approach can increase after-tax returns by 0.75% annually according to Vanguard research, which adds $150,000 over 30 years on a $500,000 portfolio.

Roth Conversion Ladder Strategy

Roth conversions during low-income years create tax-free retirement income while you manage tax brackets strategically. Convert traditional IRA funds to Roth IRAs when your income drops below $191,950 (2024 limit for 24% bracket). You pay taxes at lower rates than retirement withdrawals would require.

Professional athletes benefit significantly from this strategy during off-seasons or career transitions when endorsement income decreases. The five-year rule requires converted funds to remain untouched for five years to avoid penalties, which makes early planning essential for success.

Business Tax Optimization Techniques

Self-employed individuals can deduct home office expenses, business equipment, and professional development costs that W-2 employees cannot claim. Solo 401k plans allow employee contributions up to $23,000 annually, which significantly exceeds standard contribution limits when combined with employer contributions.

Health Savings Accounts offer triple tax advantages for business owners: deductible contributions, tax-free growth, and tax-free medical withdrawals. HSA funds can be invested after you reach a $1,000 balance, which creates powerful retirement savings vehicles since medical expenses become tax-free income after age 65.

Quarterly Tax Payment Strategy

Quarterly estimated tax payments prevent underpayment penalties that reach 8% annually. Variable income earners must plan cash flow carefully to avoid these costly penalties. Calculate your expected annual tax liability and divide by four to determine quarterly payment amounts. Safe harbor rules protect you from penalties when you pay 100% of last year’s tax liability (110% if your prior year income exceeded $150,000).

Final Thoughts

Your financial plan needs regular maintenance to stay effective. Market conditions change, tax laws evolve, and personal circumstances shift throughout your lifetime. Review all parts of a financial plan annually or after major life events like marriage, divorce, job changes, or inheritance.

Professional financial advisors provide objective expertise that most individuals lack. We at Davies Wealth Management specialize in comprehensive wealth management solutions that include investment management, retirement planning, and tax-efficient strategies. Our team understands the unique challenges professional athletes face with fluctuating income and short career spans (delivering personalized financial planning that secures long-term wealth beyond playing years).

The most expensive mistake involves delaying action while you wait for perfect market timing or complete knowledge. Start implementation of these strategies today, even with modest amounts. A 25-year-old who invests $200 monthly will accumulate more wealth than someone who waits until 35 to invest $400 monthly, and Davies Wealth Management offers the expertise to help you navigate your financial journey with confidence.

Leave a Reply