Professional athletes face unique financial challenges that require careful planning and budgeting. At Davies Wealth Management, we understand the complexities of managing wealth in the world of sports.

Athlete budgeting is a critical skill that can make the difference between long-term financial success and post-career struggles. This guide offers essential tips to help athletes navigate their financial journey and secure their future.

Why Are Athletes’ Finances So Complex?

Professional athletes face a unique set of financial challenges that set them apart from the average person. These challenges can significantly impact an athlete’s long-term financial health if not properly addressed.

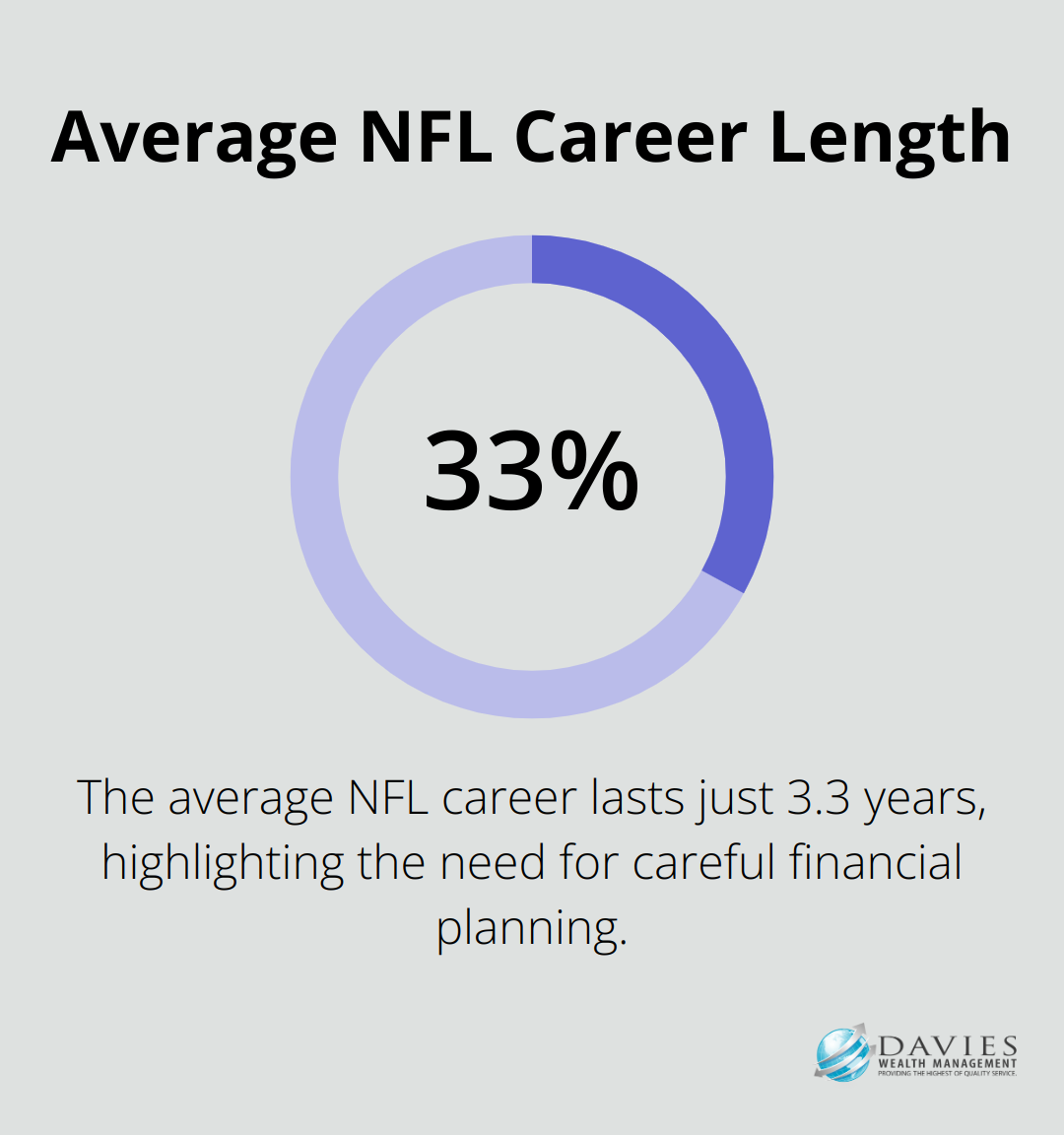

The Ticking Clock of Athletic Careers

Unlike traditional careers that span decades, professional athletes often have a limited window to earn their peak income. The average NFL career is only 3.3 years. This short career span forces athletes to compress a lifetime of earnings into a few years, making smart budgeting essential.

Riding the Income Rollercoaster

Athletes’ incomes are notoriously volatile. A player might sign a multi-million dollar contract one year, only to face a significant pay cut or early retirement the next due to injury or performance issues. This unpredictability complicates future planning and highlights the need for robust savings strategies.

Navigating the High-Stakes Lifestyle

The world of professional sports comes with intense pressure to maintain a certain lifestyle. From luxury cars to designer clothes, athletes often feel compelled to keep up appearances. This pressure can lead to overspending and financial strain. It’s important for athletes to align their spending with long-term financial goals.

The Looming Threat of Career-Ending Injuries

Injuries pose an ever-present risk in professional sports. A single injury can end a promising career in an instant. A study found that overall, 79 percent of the players studied returned to the field after injuries. This stark reality underscores the importance of a solid financial plan that accounts for potential early retirement.

Tackling Complex Tax Situations

Professional athletes often play in multiple states throughout a season, leading to complex tax situations. Each state has its own tax laws, and athletes may need to file returns in numerous jurisdictions. Many states and large cities levy a “jock tax” on professional athlete income, including taxing the value of championship rings and salaries. Without proper planning, athletes can face unexpected tax bills that eat into their earnings.

These unique financial challenges require specialized knowledge and strategies. Professional athletes should consider working with financial advisors who understand the intricacies of athlete finances and can provide tailored strategies to build and protect wealth, both during playing careers and beyond. The next chapter will explore how athletes can create a sustainable budget to navigate these financial complexities effectively.

How to Build a Sustainable Budget for Athletes

Professional athletes need a robust budget to navigate their unique financial landscape. At Davies Wealth Management, we’ve observed how effective budgeting can transform an athlete’s financial future. Let’s explore the key steps to create a budget that can withstand the pressures of a sports career.

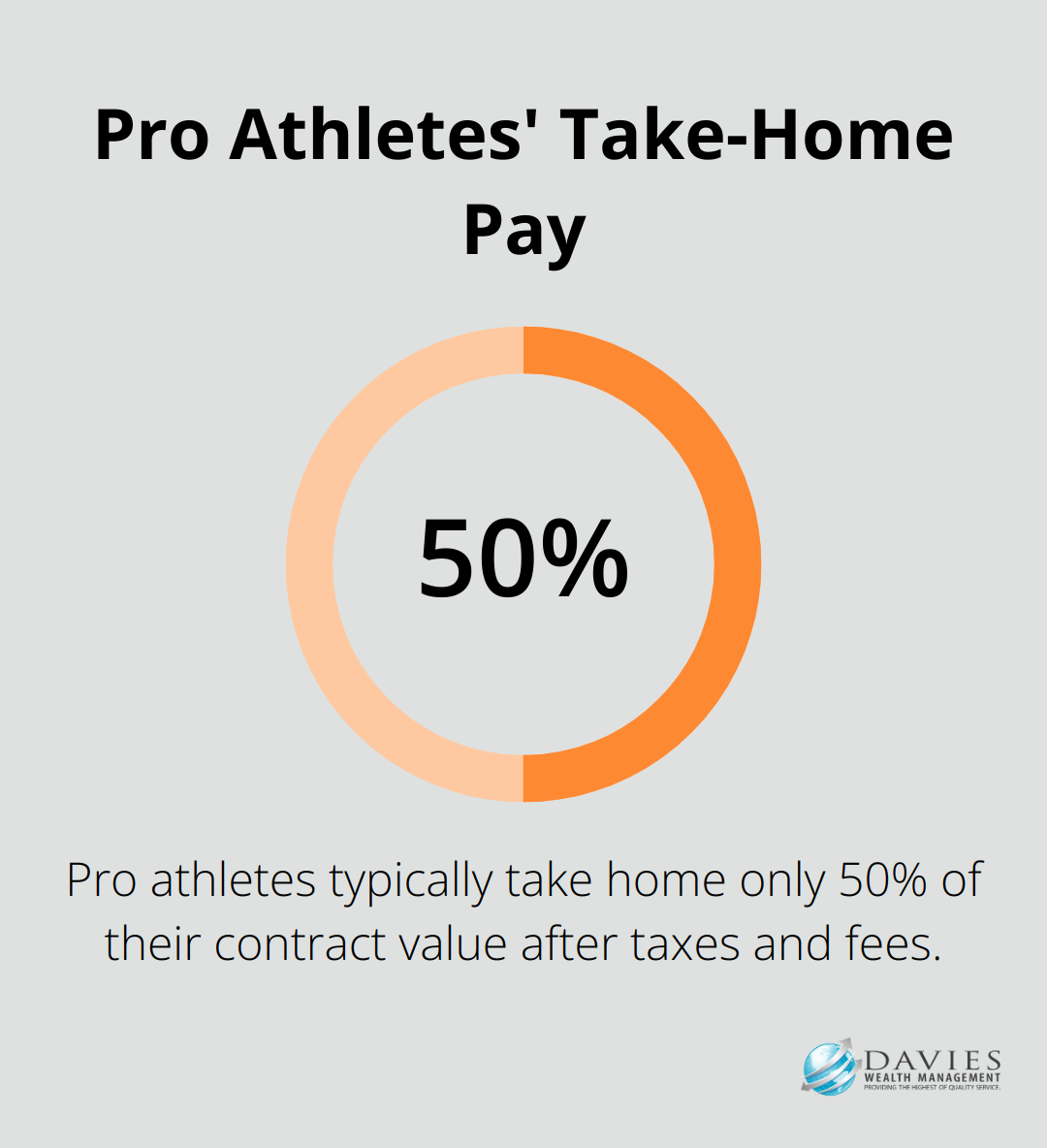

Calculate Your True Income

The first step in budget creation is to understand your actual take-home pay. For athletes, this isn’t as simple as looking at a contract value. You must account for taxes, agent fees, and other deductions. Pro athletes typically only take home around 50% of their contract value after taxes and fees. Additionally, most professional sports careers are relatively short-lived.

We suggest collaborating with a tax professional who specializes in athlete finances to get an accurate picture of your net income. This step forms the foundation of your entire budget.

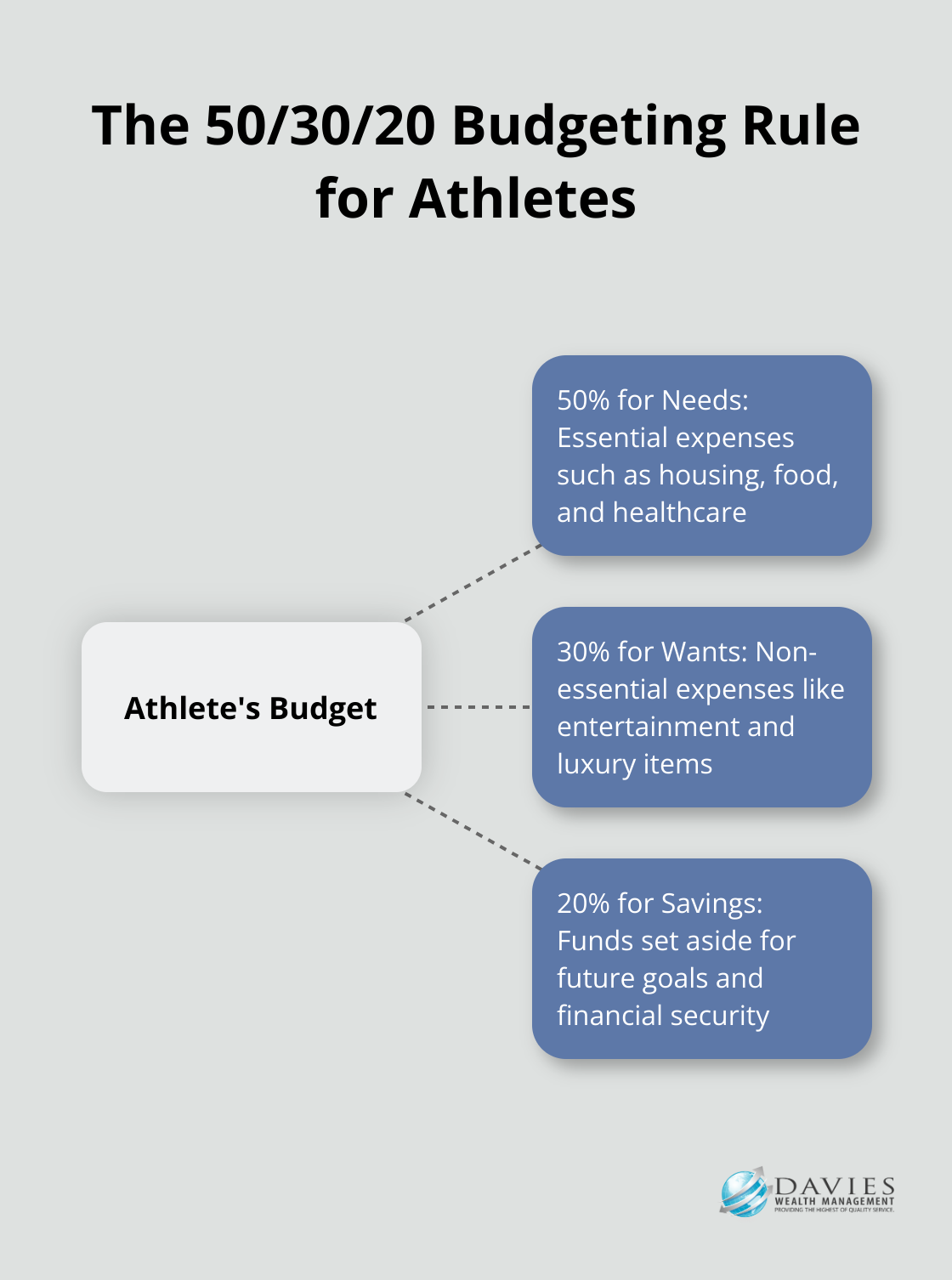

Apply the 50/30/20 Rule for Athletes

Once you’ve determined your true income, it’s time to allocate it. We often recommend a modified version of the 50/30/20 rule for our athlete clients. The 50-30-20 rule involves splitting your after-tax income into three categories of spending: 50% goes to needs, 30% goes to wants, and 20% goes to savings.

Plan for Post-Career Life

Many athletes overlook planning for life after sports. Your budget should include allocations for education, business ventures, or other career paths you might pursue after retirement from sports.

Set aside funds for continued education or business start-up costs. If real estate interests you, allocate a portion of your savings towards building a property portfolio.

Use Technology for Budget Tracking

In today’s digital age, tracking your spending is easier than ever. We recommend budgeting apps that sync with your bank accounts and credit cards to automatically categorize your expenses. Popular options include Mint, YNAB (You Need A Budget), and Personal Capital.

These tools provide real-time insights into your spending habits and alert you when you approach your limits in certain categories. They also help you visualize your progress towards savings goals.

Schedule Regular Financial Check-Ups

Your financial situation as an athlete can change rapidly. A new contract, an injury, or a change in endorsement deals can significantly impact your income. We recommend quarterly financial check-ups to review and adjust your budget as needed.

At Davies Wealth Management, we offer regular financial reviews for our athlete clients to ensure their budgets align with their current situation and long-term goals. This proactive approach helps identify potential issues before they become major problems. Careful planning and budgeting can help mitigate years where earnings are considerably lower.

Building a sustainable budget requires discipline and regular review. It often involves tough decisions. However, with the right approach and professional guidance, you can build a financial foundation that will support you throughout your career and into retirement. The next chapter will explore long-term financial planning strategies to complement your budgeting efforts and secure your financial future.

Building Wealth Beyond the Game

Diversify Your Income Streams

Professional athletes must think beyond their playing careers for financial planning. Relying solely on athletic salary is risky. Smart athletes expand their income sources. This might include endorsement deals, sponsorships, or strategic brand development. These ventures not only provide additional income but also set them up for a career after retirement.

Athletes should consider leveraging their expertise in their sport. They could start a training academy, launch a sports-related product, or become a sports commentator.

Invest in Your Personal Brand

Your name and image are valuable assets. Investing in your personal brand can lead to lucrative opportunities long after your playing days end. This might involve hiring a publicist, engaging with fans on social media, or participating in community events.

Brand partnerships can be powerful financial tools that, when done right, can provide security long after an athlete’s career ends. Building your brand isn’t just about fame-it’s about creating a sustainable income source for the future.

Start Retirement Planning Early

It’s never too early to start planning for retirement. As an athlete, your peak earning years are likely to be in your 20s and 30s. This means you need to save and invest aggressively during your playing career to support potentially decades of retirement.

Try to max out your contributions to retirement accounts like 401(k)s and IRAs. If you’re in a high tax bracket, which many professional athletes are, you might also benefit from tax-advantaged investment strategies. Davies Wealth Management specializes in creating comprehensive retirement plans tailored to the unique needs of athletes.

Explore Real Estate Investments

Real estate can provide a stable, long-term investment option for athletes. It offers potential for both passive income through rentals and capital appreciation over time. Many athletes have found success in real estate investments, using their earnings to build property portfolios that continue to generate income long after retirement.

Seek Professional Financial Advice

The financial landscape for professional athletes is complex and ever-changing. Working with experienced financial advisors who understand the unique challenges and opportunities in the sports industry is essential. Financial advisors for athletes specialize in addressing these needs, offering guidance on budgeting, investing, tax strategies and long-term wealth management. They can help create a personalized financial strategy that aligns with your goals and risk tolerance.

Final Thoughts

Athlete budgeting forms the cornerstone of financial security for sports professionals. Professional athletes must navigate unique financial challenges, including short career spans, unpredictable income, and complex tax situations. A sustainable budget helps athletes build a solid financial foundation, prioritize savings, and set realistic spending limits.

Long-term financial planning extends beyond budgeting to secure an athlete’s future after their playing years. Athletes should diversify income streams, invest in personal branding, and explore opportunities like real estate for lasting financial stability. Early retirement planning and consideration of post-career expenses will ensure a comfortable future for athletes.

The complexities of athlete finances highlight the need for professional financial advice. Davies Wealth Management specializes in addressing the unique financial needs of professional athletes. Our team provides tailored strategies to build and protect wealth throughout an athlete’s career and beyond (including investment management, retirement planning, and tax-efficient strategies).

Leave a Reply