EQUITY MARKETS RISE AGAIN THIS WEEK AS INFLATION WORRIES PERSIST AND AS Q1 EARNINGS SEASON KICKS OFF WITH THE BIG BANKSWeekly Market Update — April 15, 2023 |

|

Weekly Market Performance

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results. |

||||||||||||||||||||||||||||||||

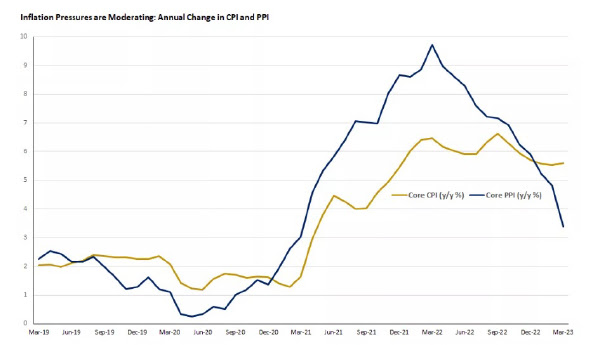

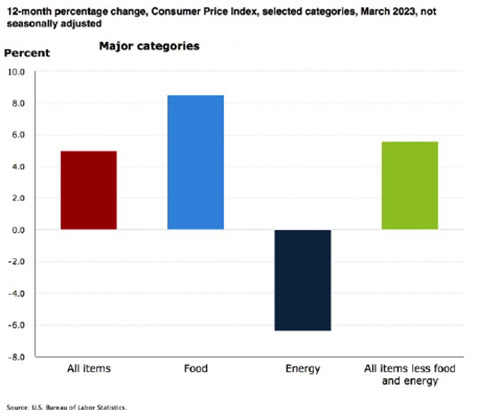

Stock Markets Advance This WeekThe major U.S. equity benchmarks ended another week higher, but inflation worries hung over investors all week, as CPI and PPI data was released. Total CPI and total PPI and core-PPI came in as expected, but the core-CPI data moved the wrong way. Trading was also very light all week, but picked up on Friday, which coincided with the start of Q1 earnings season that was kicked off by banking giants JPMorgan Chase, Wells Fargo, and Citigroup. All three big banks beat consensus estimates, which helped push the Financials sector to a gain of almost 3% on the week, topping the other 10 S&P 500 sectors. The most highly anticipated event of the week was the Labor Department’s Wednesday morning release of the Consumer Price Index for March. Investors rejoiced that the CPI rose only 0.1% and the year-over-year rate fell to 5.0%, the slowest pace since May 2021. But then investors parsed through the data and were less pleased with core-CPI numbers. Other economic data this week included:

Inflation Up 5.0% Over the Past YearOn Wednesday, April 12th, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers rose 0.1% in March, after increasing 0.4% in February, and that over the last 12 months, the All Items index increased 5.0%. Unpacking the CPI data shows that the index for shelter was by far the largest contributor to the increase, which more than offset a decline in the energy component, which decreased 3.5% over the month. Further, the food index was unchanged in March, but there were still some big price increases to food.

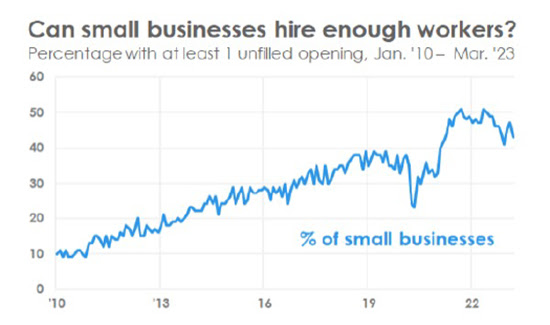

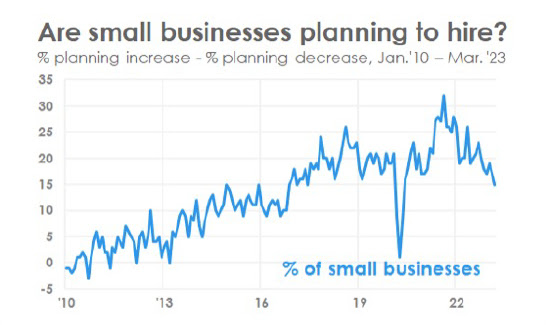

Small Businesses Struggling to Find WorkersA stunning 47% of small business owners reported job openings they could not fill in the current period, according to NFIB’s monthly jobs report. Further:

In addition, “Sixty percent of owners reported hiring or trying to hire in January, up three points from January. Of those hiring or trying to hire, 90% of owners reported few or no qualified applicants for the positions they were trying to fill. Thirty percent of owners reported few qualified applicants for their open positions. Seasonally adjusted, a net 46% of owners reported raising compensation, unchanged from last month. A net 23% plan to raise compensation in the next three months, up one point from January. Thirty-eight percent of owners have job openings for skilled workers and 19% have openings for unskilled labor.”

|

|

|

Sources bls.gov;nfib.com;mba.org;msci.

|

✅ BOOK AN APPOINTMENT TODAY: https://calendly.com/tdwealth

===========================================================

🔴 SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!💥

🎯🎯🎯Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

🔥🔥🔥 ====== ===Get Our FREE GUIDES ========== 🔥🔥🔥

🎯Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

🎯Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply