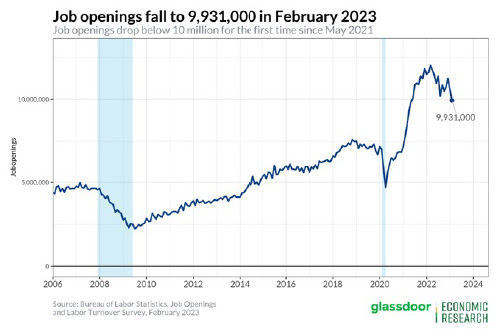

EQUITY MARKETS MOSTLY DOWN AS OIL JUMPS 6% AND NUMBER OF JOB OPENINGS FALLS BELOW 10 MILLION FOR THE FIRST TIME IN 2 YEARS

|

Weekly Market Update — April 8, 2023 |

|

Weekly Market Performance

| Close | Week | YTD | |

| DJIA | 33,485 | +0.6% | +1.0% |

| S&P 500 | 4,105 | -0.1% | +6.9% |

| NASDAQ | 12,088 | -1.1% | +15.5% |

| Russell 2000 | 1,755 | -1.6.% | +0.7% |

| MSCI EAFE | 2,101 | +0.4% | +8.1% |

| *Bond Index | 2,132.95 | +1.06% | +4.11% |

| 10–Year Treasury Yield | 3.41% | +0.11% | -0.5% |

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results.

Stock Markets Struggle This Week

It was only a 4-day trading week, as U.S. markets were closed on Friday in observance of the Good Friday holiday. Trading was mostly light during the 4 days, with many suggesting that traders needed a breather or were taking a pause to further digest last weeks big gains.

While there was a decent amount of economic data released, the one that seemed to generate the most negative reaction was the Institute for Supply Management’s gauge of March factory activity – which dropped to a three-year low. .

The ISM gauge seemed to grow recession concerns further when the Labor Department reported the next day that job openings declined much more than expected in February, falling below 10 million for the first time since May 2021.

There also seemed to be a bubbling worry when JPMorgan Chase CEO Jamie Dimon warned in a letter to shareholders that “the [banking] crisis is not yet over” and that “there will be repercussions from it for years to come.”

The economic data that Wall Street tried to digest, included:

- The March IHS Markit Manufacturing PMI fell to 49.2

- The March ISM Manufacturing Index decreased to 46.3%, which is the lowest reading since May 2020

- Total construction spending declined 0.1% month-over-month in February

- Total private construction was flat month-over-month

- Total public construction dropped 0.2% month-over-month

- On a year-over-year basis, total construction spending was up 5.2%

- Factory orders declined 0.7% month-over-month in February

- Job Openings totaled 9.931 million in February, the first reading below 10 million since May 2021

Finally, the weekly MBA Mortgage Applications Index fell 4.1% with purchase applications falling 4.0% and refinancing applications declining 5.0%

Around the World

- The pan-European STOXX Europe 600 Index finished with a 0.90% gain

- Japan’s Nikkei 225 Index fell 1.9% and the TOPIX Index dropped 2.1%

- China’s Shanghai Stock Exchange Index gained 1.22% and its blue chip CSI 300 rose 1.13%

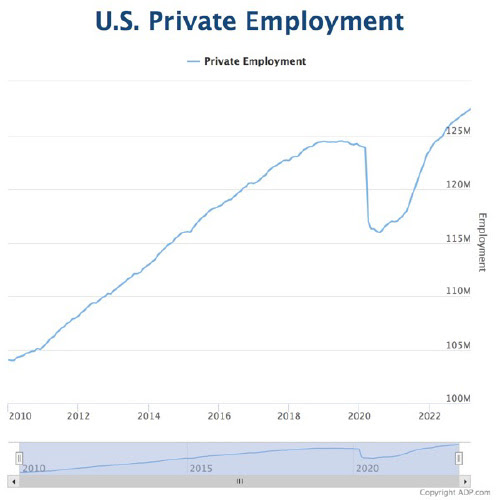

March Sees More Jobs and Higher Pay

Private sector employment increased by 145,000 jobs in March and annual pay was up 6.9% year-over-year, according to the March ADP National Employment Report.

“Our March payroll data is one of several signals that the economy is slowing. Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down.”

Further:

-

- Pay growth decelerated for both job stayers and job changers.

- For job stayers, year-over-year gains fell to 6.9% from 7.2% in February.

- Pay growth for job changers was 14.2%, down from 14.4%.

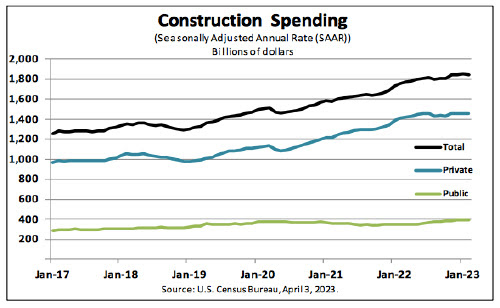

Construction Spending Down in February But Up Year-Over-Year

The U.S. Census Bureau reported that construction spending during February 2023 was at an annual rate of $1,844.1 billion, 0.1% below the revised January estimate of $1,845.4 billion.

- The February figure is 5.2% above the February 2022 estimate of $1,753.1 billion.

- During the first two months of this year, construction spending amounted to $260.8 billion, 5.9% above the $246.1 billion for the same period in 2022.

Private Construction

- Spending on private construction was at a seasonally adjusted annual rate of $1,453.2 billion, virtually unchanged from the revised January estimate of $1,453.6 billion.

- Residential construction was at a seasonally adjusted annual rate of $852.1 billion in February, 0.6% below the revised January estimate of $857.0 billion.

- Nonresidential construction was at a seasonally adjusted annual rate of $601.0 billion in February, 0.7% above the revised January estimate of $596.7 billion.

Public Construction

- In February, the estimated seasonally adjusted annual rate of public construction spending was $391.0 billion, 0.2% below the revised January estimate of $391.8 billion.

- Educational construction was at a seasonally adjusted annual rate of $84.6 billion, 0.9% below the revised January estimate of $85.4 billion.

- Highway construction was at a seasonally adjusted annual rate of $120.6 billion, 0.3% above the revised January estimate of $120.3 billion.

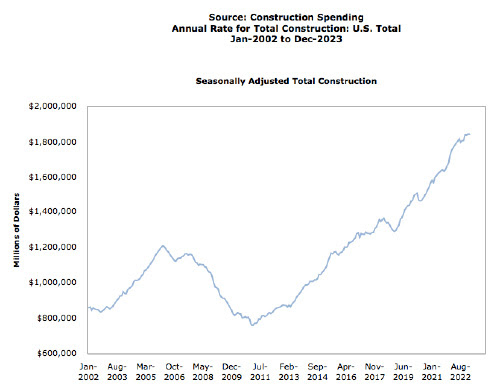

Construction Spending Over 20 Years Sources

census.gov;adpemploymentreport

.com;msci.com;fidelity.com;nas daq.com;wsj.com; morningstar.com;

✅ BOOK AN APPOINTMENT TODAY: https://calendly.com/tdwealth

===========================================================

🔴 SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!💥

🎯🎯🎯Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

🔥🔥🔥 ====== ===Get Our FREE GUIDES ========== 🔥🔥🔥

🎯Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

🎯Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply