EQUITIES RETREAT AS GEOPOLITICAL WORRIES INCREASE, DYSFUNCTION HITS CONGRESS AND LONG-TREASURIES HIT LEVELS NOT SEEN SINCE 2007Weekly Market Update — October 20, 2023 |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

Weekly Market Performance

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results. |

||||||||||||||||||||||||||||||||

Stocks & Equities Retreat on Israel-Hamas WarThe Israel-Hamas War, dysfunction in the House of Representatives, a still-hawkish Fed and rising yields weighed heavily on Wall Street and pushed the S&P 500 to its worst weekly decline in over a month. And although NASDAQ is still very positive for the YTD, shockingly it is very close to bear market territory, ending the week 19.91% below its early-2022 intraday highs. Not surprisingly, Value stocks outperformed Growth stocks and 9 of the 11 S&P 500 sectors dropped. And the tech names were hit hard as the yield on the 10-year U.S. Treasury breached 5%, its highest level since July 2007.

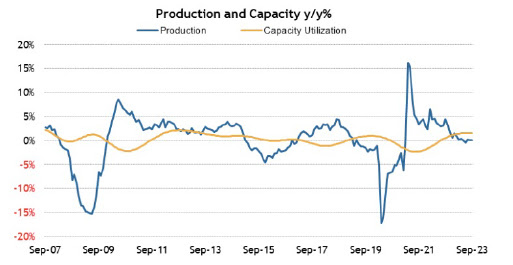

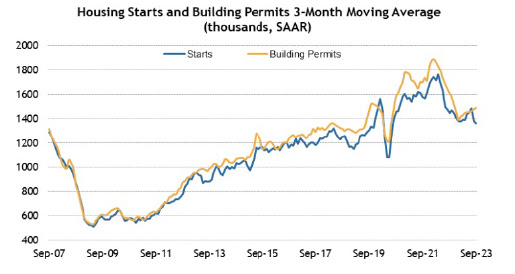

There was also a lot of economic data this week, most of it mixed, including that:

|

||||||||||||||||||||||||||||||||

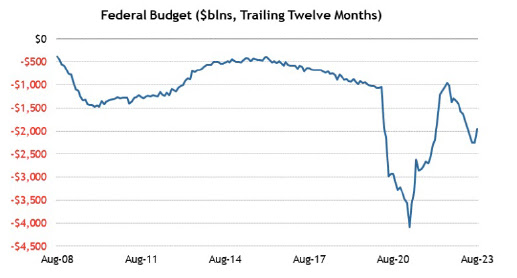

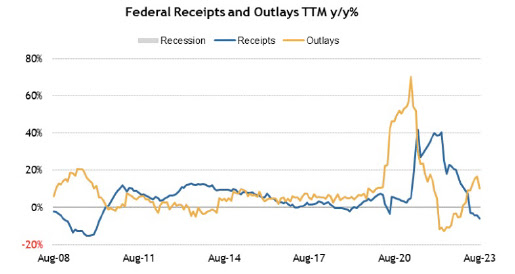

Treasury Budget Shows A Surplus in AugustThe August Treasury Budget showed a surprising surplus of $89.2 billion compared to a deficit of $219.6b in the same period a year ago. More specifically, the surplus in August resulted from receipts ($283.1 billion) exceeding outlays ($193.9 billion). August typically shows a budget deficit (68 times out of 69 fiscal years) since there are no major tax due dates. In addition:

|

||||||||||||||||||||||||||||||||

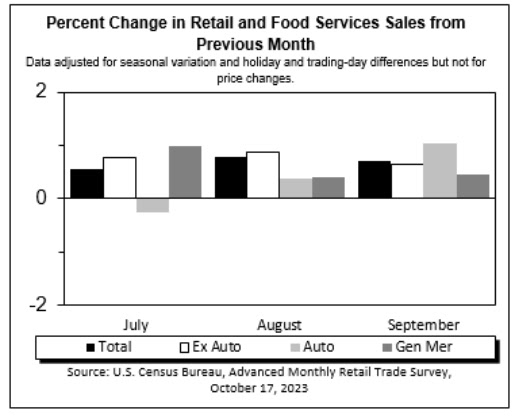

Retail Sales Up in September 2023On Tuesday, the U.S. Census Bureau announced the following advance estimates of U.S. retail and food services sales for September 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $704.9 billion, up 0.7% from the previous month, and up 3.8% above September 2022. Further:

|

||||||||||||||||||||||||||||||||

| Sources

census.gov ;msci.com;fidelity.com;nasdaq.com;wsj.com; morningstar.com; |

✅ BOOK AN APPOINTMENT TODAY: https://calendly.com/tdwealth

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply