EQUITIES GIVE BACK MOST OF LAST WEEK’S GAINS AS WALL STREET DIGESTS THE FED’S MINUTES AND SEE ANOTHER RATE HIKE COMINGWeekly Market Update — July 8, 2023 |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

Weekly Market Performance

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results. |

||||||||||||||||||||||||||||||||

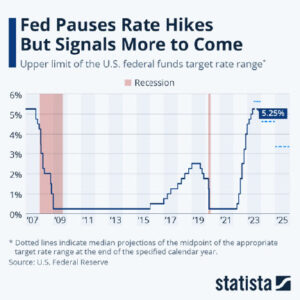

Stocks Close Out the Week Slightly LowerThe major U.S. benchmarks declined this week, as investors digested a slew of economic reports and parsed through every single word from the Fed’s meeting minutes thinking more rate hikes are on the near-term horizon. It was a very quiet trading week and generally speaking, Growth names outshined Value names, but not by much. Tech names outperformed modestly too, mostly driven by a few big tech names, especially Tesla. Markets were closed early Monday and all day Tuesday in observance of the Independence Day holiday. The main shadow overhanging Wall Street seemed to be the pending release of the minutes from the Federal Reserve’s last policy meeting. The minutes showed that the decision to keep rates static was not unanimous, as some members would have preferred another rate hike increase. After the minutes were released, markets priced in a roughly 44% chance of two 25 basis point rate hikes by year ‘s end. There was also a lot of economic data this week, including that:

|

||||||||||||||||||||||||||||||||

Fed Meeting Minutes ReleasedEarlier this week, the Fed’s meeting minutes were released and all indications are that most members think further hikes are on the way. Officials felt that “leaving the target range unchanged at this meeting would allow them more time to assess the economy’s progress toward the Committee’s goals of maximum employment and price stability.” In addition, the minutes stated that “The economy was facing headwinds from tighter credit conditions, including higher interest rates, for households and businesses, which would likely weigh on economic activity, hiring, and inflation, although the extent of these effect remained uncertain.” |

||||||||||||||||||||||||||||||||

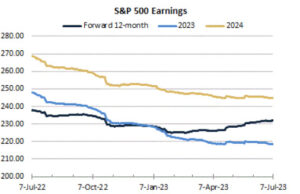

Estimated Earnings Declines Hits -7.2%On Friday, research firm FactSet reported that:

|

||||||||||||||||||||||||||||||||

Nonfarm Payrolls IncreaseThe Bureau of Labor Statistics announced on Friday that total nonfarm payroll employment increased by 209,000 in June, and the unemployment rate changed little at 3.6%. Employment continued to trend up in government, health care, social assistance, and construction. |

||||||||||||||||||||||||||||||||

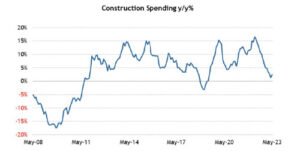

Total Construction Spending UpNew Orders

Private Construction

Public Construction

Manufacturing Contracts AgainThe latest Manufacturing ISM Report On Business reported that economic activity in the manufacturing sector contracted in June for the eighth consecutive month following a 28-month period of growth. “The June Manufacturing PMI registered 46 percent, 0.9 percentage point lower than the 46.9 percent recorded in May. Regarding the overall economy, this figure indicates a seventh month of contraction after a 30-month period of expansion. The New Orders Index remained in contraction territory at 45.6 percent, 3 percentage points higher than the figure of 42.6 percent recorded in May. The Production Index reading of 46.7 percent is a 4.4-percentage point decrease compared to May’s figure of 51.1 percent. The Prices Index registered 41.8 percent, down 2.4 percentage points compared to the May figure of 44.2 percent. The Backlog of Orders Index registered 38.7 percent, 1.2 percentage points higher than the May reading of 37.5 percent. The Employment Index dropped into contraction, registering 48.1 percent, down 3.3 percentage points from May’s reading of 51.4 percent.” |

||||||||||||||||||||||||||||||||

| Sources

census.gov; bls.gov; ismworld.org; factset.com; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com;

|

✅ BOOK AN APPOINTMENT TODAY: https://calendly.com/tdwealth

===========================================================

🔴 SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!💥

🎯🎯🎯Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

🔥🔥🔥 ====== ===Get Our FREE GUIDES ========== 🔥🔥🔥

🎯Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

🎯Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ LET’S GET SOCIAL

Facebook: https://www.facebook.com/DaviesWealthManagement

Twitter: https://twitter.com/TDWealthNet

Linkedin: https://www.linkedin.com/in/daviesrthomas

Youtube Channel: https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

DISCLAIMER

**Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply