At Davies Wealth Management, we’ve noticed a growing interest in using Bitcoin for early retirement financial planning. This unconventional approach has sparked curiosity among investors seeking alternative strategies to achieve their retirement goals.

In this post, we’ll explore the viability of incorporating Bitcoin into your retirement portfolio, examining both the potential benefits and risks associated with this digital asset.

What Is Bitcoin’s Role in Retirement Planning?

Understanding Bitcoin as a Digital Asset

Bitcoin, the world’s first decentralized cryptocurrency, has become a hot topic in financial circles. This digital asset operates on a blockchain, a distributed ledger technology that ensures transaction transparency and security without intermediaries.

Bitcoin’s Price History: A Wild Ride

Since its 2009 inception, Bitcoin’s price has fluctuated dramatically. The price graph since Bitcoin began in 2009 until today shows complete BTC all-time highs and historical events that have affected Bitcoin’s price.

This volatility creates both opportunities and challenges for retirement planning. While traditional retirement vehicles (like 401(k)s and IRAs) typically offer steady but slower growth, Bitcoin’s potential for explosive gains has attracted investors who want to accelerate their retirement timeline.

Bitcoin vs. Traditional Retirement Vehicles

Unlike traditional retirement accounts, Bitcoin doesn’t offer tax advantages or employer matching contributions. However, it provides unique benefits such as:

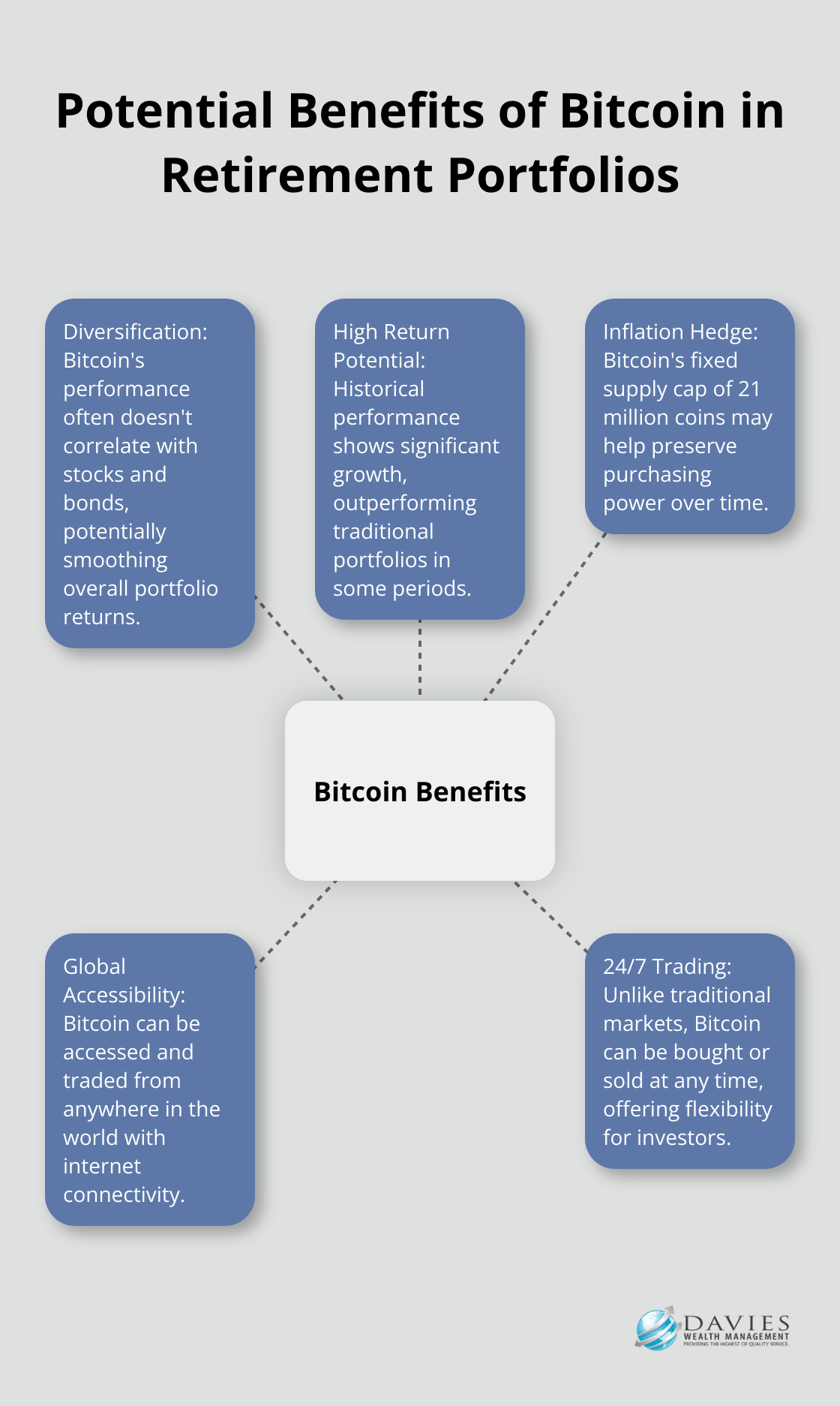

- 24/7 trading

- Global accessibility

- Potential protection against inflation (due to its limited supply of 21 million coins)

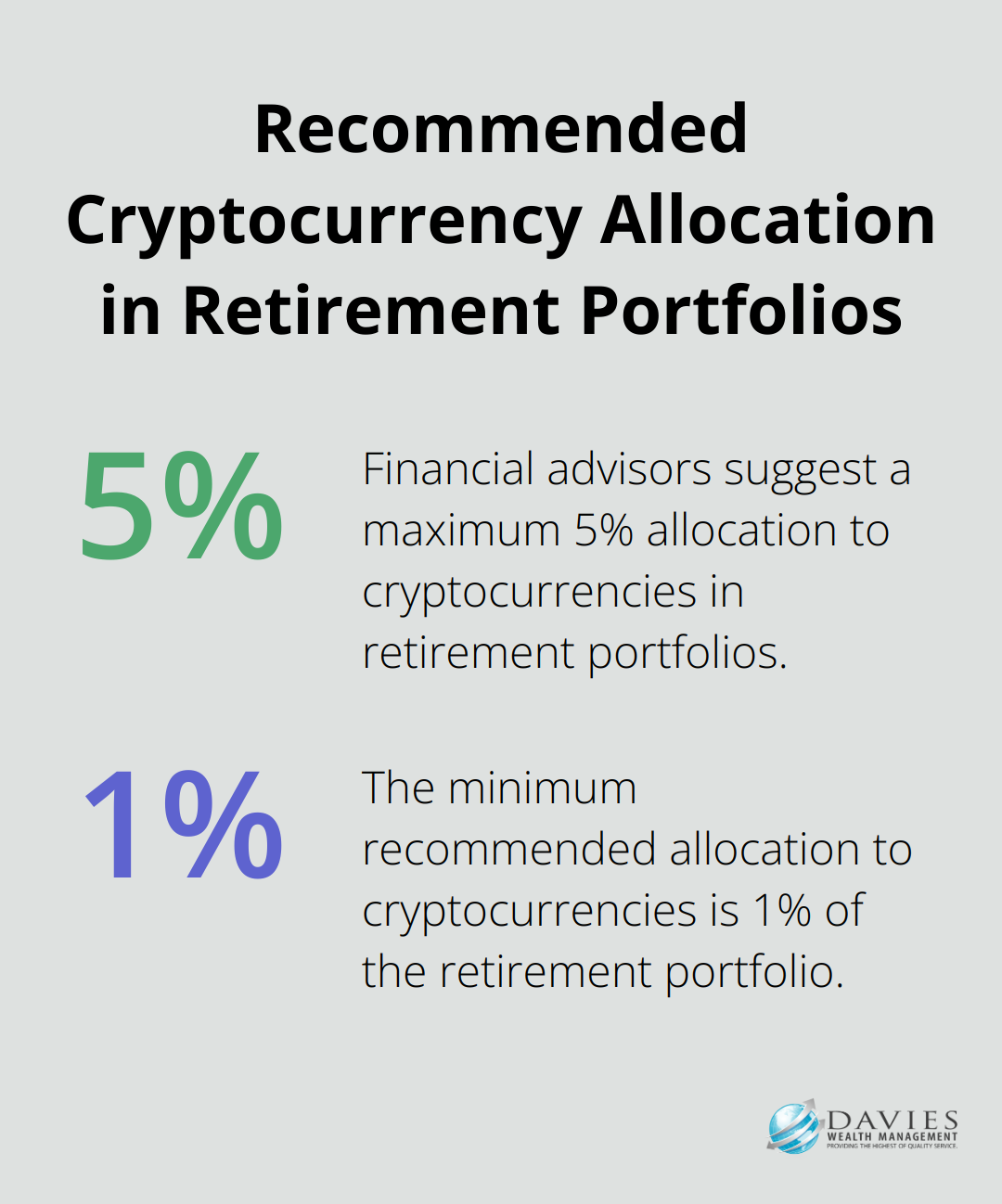

Financial advisors generally recommend allocating no more than 1-5% of a retirement portfolio to cryptocurrencies, depending on individual risk tolerance. This conservative approach aims to capture potential upside while limiting exposure to Bitcoin’s inherent volatility.

Navigating the Regulatory Landscape

The evolving regulatory environment surrounding cryptocurrencies is a crucial factor to consider. Available industry data and stakeholder interviews suggest crypto assets are a small part of the 401(k) market. However, recent news suggests that there might be changes in the future, with potential for opening 401(k)s to crypto, metals, and private assets, which could unlock significant retirement funds for Bitcoin, Ethereum, and other cryptocurrencies.

As regulations continue to evolve, investors must stay informed and work with knowledgeable financial advisors who can navigate these complexities.

The Future of Bitcoin in Retirement Planning

The role of Bitcoin in retirement planning remains a topic of debate. While its potential for high returns attracts many, its volatility and regulatory uncertainties pose significant challenges. As we move forward, it’s clear that Bitcoin will continue to shape discussions about alternative investment strategies for retirement. The next section will explore the potential benefits of including Bitcoin in your retirement portfolio, shedding light on why some investors find this digital asset so appealing.

Why Bitcoin Might Boost Your Retirement Portfolio

Diversification Beyond Traditional Assets

Bitcoin offers a unique opportunity to diversify retirement portfolios beyond traditional assets. Its performance often doesn’t correlate with stocks and bonds, which can help smooth out overall portfolio returns during market turbulence.

For instance, during the COVID-19 market crash in March 2020, the S&P 500 dropped by about 34%. Bitcoin, however, initially fell but quickly rebounded, ending the year up over 300%. This example illustrates how Bitcoin can potentially act as a counterbalance to traditional market movements.

Potential for Significant Returns

Bitcoin’s historical performance has been remarkable. A five-year study compared a traditional 60% stock/40% bond portfolio to the same portfolio plus 2.5% bitcoin, with stunning results. While past performance doesn’t guarantee future results, this growth potential is hard to ignore when planning for retirement.

Hedge Against Inflation and Economic Uncertainty

Bitcoin’s fixed supply cap of 21 million coins makes it an attractive option for those concerned about inflation eroding their retirement savings. Unlike fiat currencies that can be printed at will, Bitcoin’s scarcity could potentially preserve purchasing power over time.

During periods of economic uncertainty (such as the 2020 pandemic), Bitcoin has shown resilience. When the U.S. Federal Reserve increased its balance sheet by trillions of dollars in 2020, Bitcoin’s price surged, reflecting its appeal as a hedge against monetary policy actions.

Considerations for Retirement Planning

Incorporating Bitcoin into a retirement strategy requires careful consideration. While the potential benefits are significant, they must be weighed against the risks. Financial experts often recommend that clients interested in Bitcoin allocation start small and assess their risk tolerance.

A well-rounded retirement strategy should include a mix of assets. Bitcoin can be part of that mix, but it shouldn’t be the sole focus. Professional guidance can help navigate these decisions and create a retirement plan that aligns with unique financial situations and objectives.

As we explore the potential benefits of Bitcoin in retirement planning, it’s equally important to understand the risks and challenges associated with this digital asset. The next section will examine these factors in detail, providing a balanced view of Bitcoin’s role in retirement strategies.

What Are the Risks of Bitcoin in Retirement Planning?

At Davies Wealth Management, we provide a balanced view of investment options. Bitcoin offers potential benefits, but it also poses significant risks to retirement planning.

Extreme Price Volatility

Bitcoin’s price fluctuations surpass those in traditional markets. In 2022, Bitcoin’s value dropped by over 60%, wiping out years of gains for many investors. Such drastic changes can devastate retirement savings, especially for those close to retirement age who have less time to recover from losses.

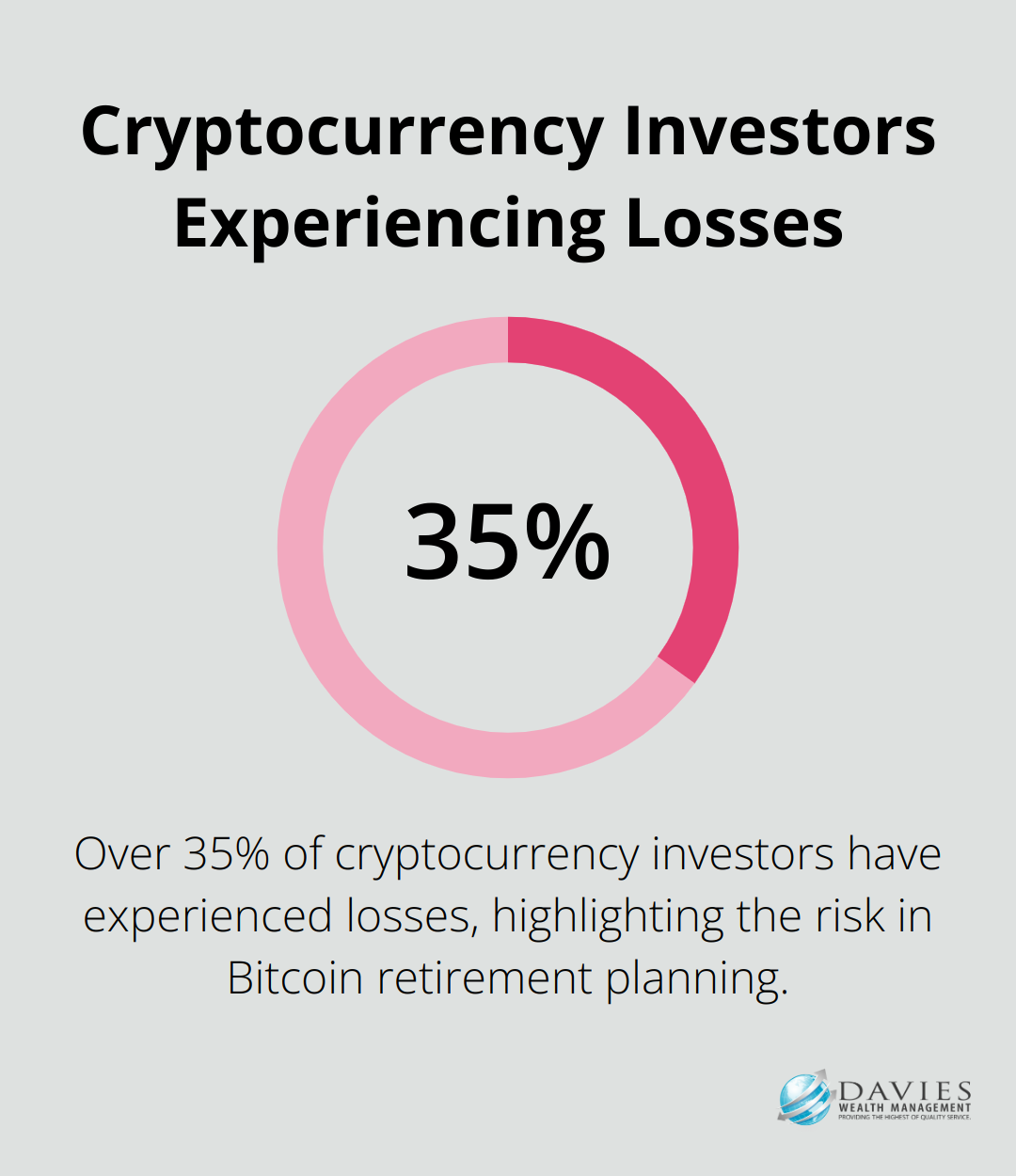

A study revealed that over 35% of cryptocurrency investors have experienced losses. This statistic highlights the real risk of substantial capital loss when using Bitcoin for retirement.

Regulatory Uncertainty

The cryptocurrency regulatory landscape constantly shifts. In 2022, the U.S. Department of Labor warned fiduciaries about offering cryptocurrencies in 401(k) plans, citing “significant risks of fraud, theft, and loss.” This uncertainty complicates the integration of Bitcoin into traditional retirement vehicles.

Future regulations could impact Bitcoin’s value and accessibility. If governments impose strict rules or bans on cryptocurrencies, it could severely affect Bitcoin’s price and liquidity.

Security Vulnerabilities

Bitcoin’s digital nature makes it susceptible to cyber threats. In 2024, crypto hacks resulted in losses of nearly $2.2 billion. For retirees who often lack technical expertise to secure digital assets properly, this presents a significant risk.

Secure storage solutions (like hardware wallets) can mitigate some risks, but they require technical knowledge that many retirees find challenging. Even a minor mistake in managing private keys could lead to permanent fund loss.

Limited Acceptance and Liquidity Challenges

Despite growing adoption, Bitcoin’s acceptance as payment remains limited. This lack of widespread use can create liquidity issues, especially for retirees who need to convert their Bitcoin holdings into fiat currency for daily expenses.

During market downturns, Bitcoin’s liquidity can quickly evaporate, making it difficult to sell without incurring significant losses. This liquidity problem could particularly affect retirees who rely on their investments for regular income.

Complexity and Learning Curve

Bitcoin and blockchain technology involve complex concepts that many individuals, especially those nearing retirement, find difficult to grasp. This complexity increases the risk of making uninformed investment decisions or falling victim to scams.

The learning curve associated with Bitcoin includes understanding wallet management, transaction processes, and security measures. For retirees accustomed to traditional financial systems, this learning curve can prove steep and potentially discouraging.

Final Thoughts

Bitcoin presents opportunities and challenges for early retirement financial planning. It offers potential high returns and diversification but comes with extreme volatility and regulatory uncertainties. Investors must carefully consider their risk tolerance and financial goals before incorporating Bitcoin into their retirement strategy.

A balanced approach remains essential when considering Bitcoin for retirement planning. Traditional assets should form the core of most portfolios, with Bitcoin representing only a small portion of investments. We recommend starting small and increasing exposure gradually as you become more comfortable with this asset class.

Professional guidance proves invaluable when navigating the complexities of Bitcoin and retirement planning. At Davies Wealth Management, we create personalized financial strategies aligned with our clients’ unique goals and risk profiles. Our team can help evaluate whether Bitcoin fits into your early retirement plan and how to integrate it responsibly.

Leave a Reply