Digital assets investing has transformed from a niche market into a $2.3 trillion global industry. Bitcoin alone gained over 160% in 2023, while institutional adoption continues accelerating.

We at Davies Wealth Management see clients increasingly asking about cryptocurrency portfolios and blockchain investments. This guide covers essential strategies, risk management, and practical steps for entering this evolving market.

Understanding Digital Assets

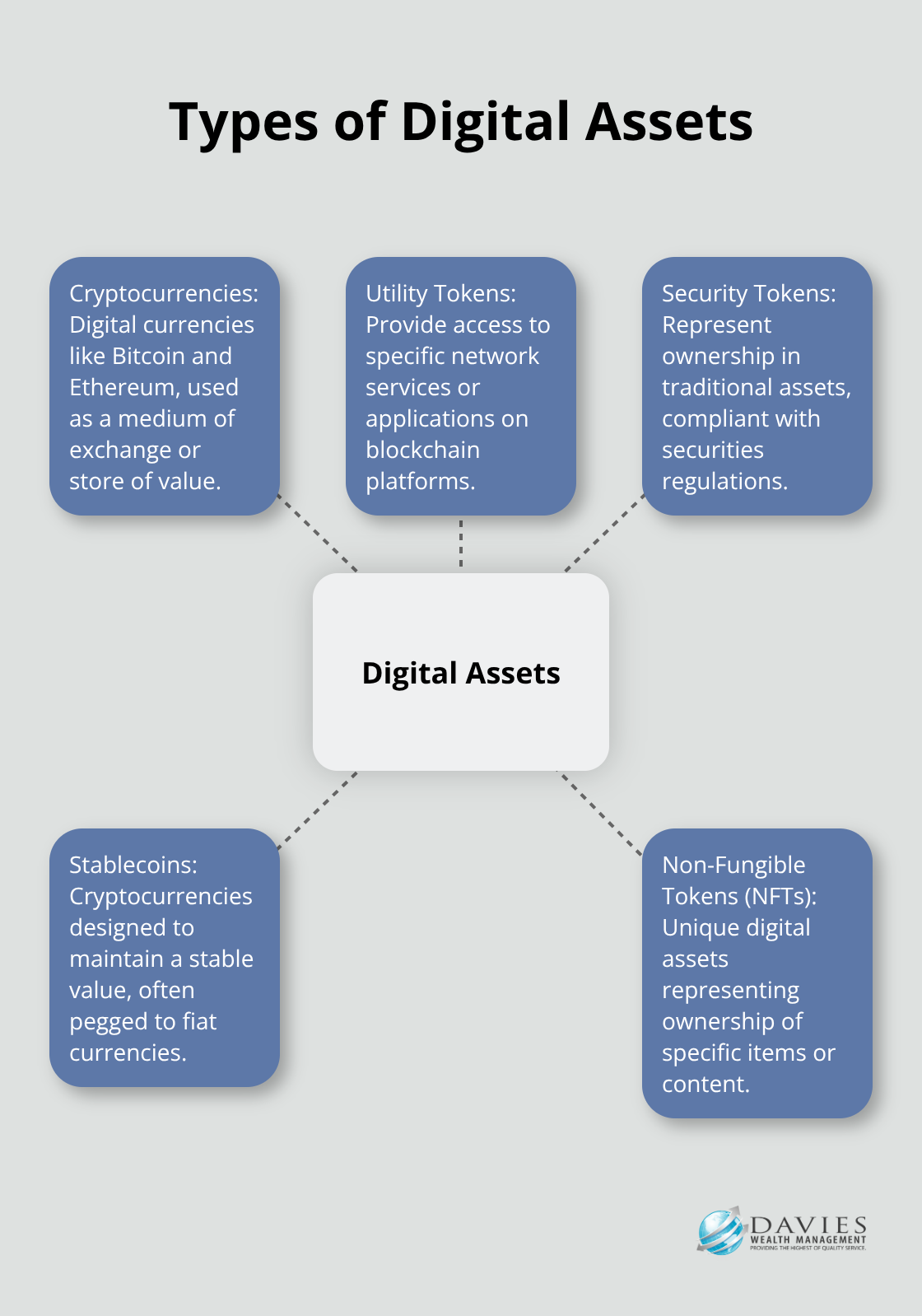

Digital assets represent ownership or access rights recorded on distributed ledger technology, primarily blockchain networks. The market encompasses over 17,000 different cryptocurrencies with Bitcoin and Ethereum commanding the largest market shares at $1.2 trillion and $400 billion respectively. Beyond cryptocurrencies, the space includes utility tokens that provide network access, security tokens that represent traditional asset ownership, stablecoins pegged to fiat currencies, and non-fungible tokens that represent unique digital ownership. The Invesco Galaxy Bitcoin ETF and Invesco Galaxy Ethereum ETF now provide institutional-grade access after SEC approval in 2024.

Traditional Investment Differences

Digital assets operate 24/7 without market closures, which creates constant price discovery unlike stock markets with defined hours. Ethereum’s transition to Proof of Stake validation in 2022 lowered energy use by 99.95% while it maintained network security through validator stakes. Smart contracts execute automatically without intermediaries, which removes traditional settlement periods and custodial requirements. Decentralized Finance protocols enable direct peer-to-peer transactions without banks, which fundamentally changes how financial services operate. Storage requires private cryptographic keys rather than traditional accounts (shifting security responsibility to individual investors).

Market Growth Reality

Digital asset investment products reached $40.4 billion in total assets under management in 2025. Bitcoin inflows alone totaled $977 million in the week that ended September 22, 2025, after Federal Reserve rate cuts. Institutional adoption accelerated with companies that hold crypto assets on balance sheets, while Nasdaq filed proposals for tokenized equity securities trades. Wyoming plans to launch the first state-issued stablecoin called Frontier Stable Token, and Illinois enacted comprehensive digital asset regulatory frameworks. The current growth trajectory suggests total assets under management may exceed 2024’s $48.6 billion peak before year-end.

Regulatory Landscape Evolution

The SEC and CFTC committed to a coordinated approach for digital assets to create clarity and foster innovation in crypto markets. The SEC announced potential rules under the Investment Advisers Act to update custody regulations that apply to crypto assets (with implementation expected in 2025). FINRA launched a comprehensive education program on crypto and blockchain for financial professionals to enhance their understanding of digital assets. These developments signal a maturing regulatory environment that addresses investor protection while it encourages market growth.

With this foundation established, investors need specific strategies to navigate digital asset allocation and risk management effectively.

How Should You Build Your Digital Asset Portfolio

Dollar-cost averaging beats lump sum investment for digital assets due to extreme volatility patterns. We recommend you invest the same dollar amount weekly or monthly regardless of price movements. This strategy captured Bitcoin’s 160% 2023 gains while it reduced emotional decisions that destroy returns. Professional athletes typically allocate $2,000-5,000 monthly rather than invest large contract bonuses at once, which smooths out market turbulence effectively.

Strategic Portfolio Allocation

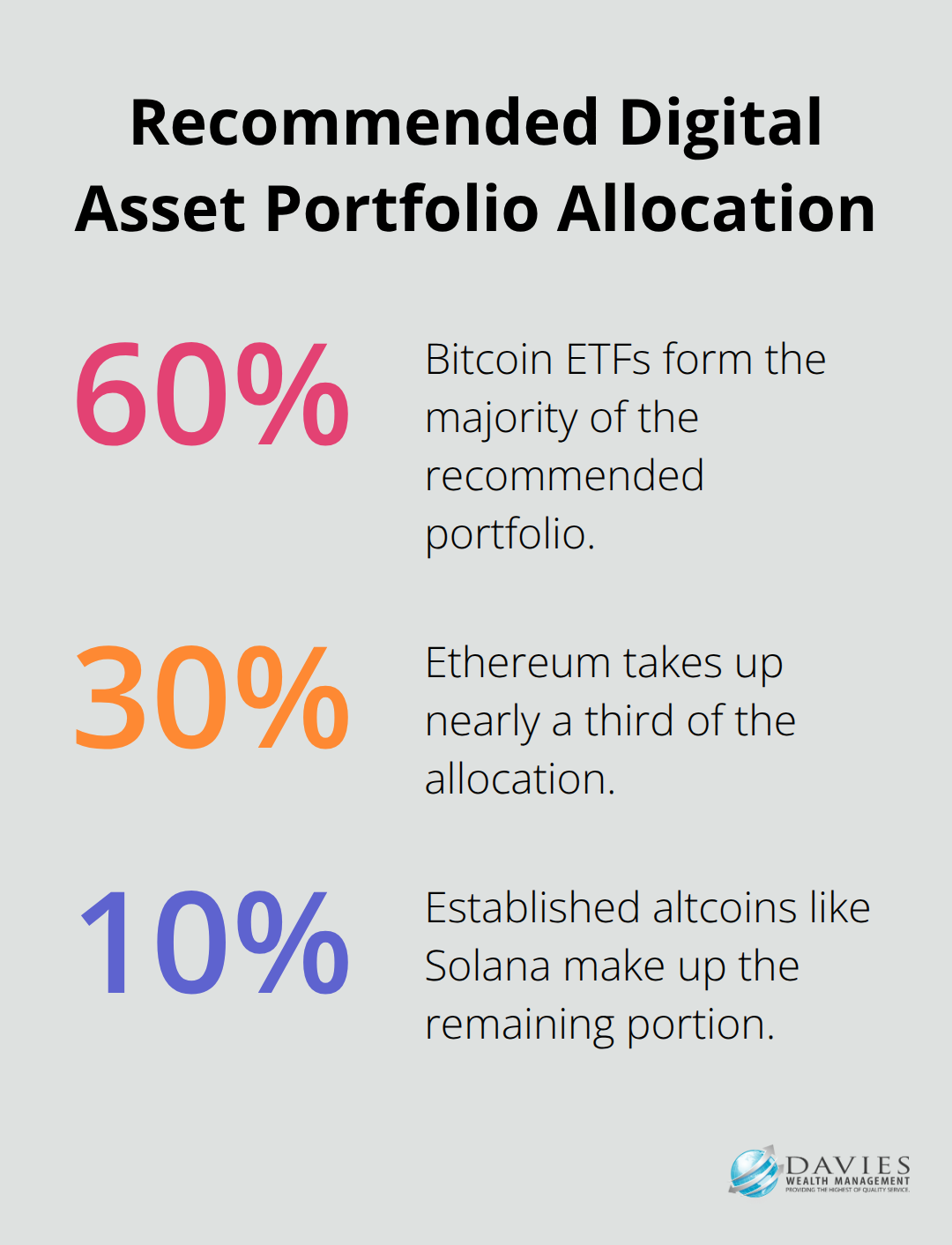

Never allocate more than 5% of your total portfolio to digital assets, despite recent institutional adoption. The $12.6 billion in year-to-date inflows shows growth acceptance, but volatility remains extreme. Split your digital asset allocation between Bitcoin ETFs (60%), Ethereum (30%), and established altcoins like Solana (10%) that received $127.3 million in recent inflows. Avoid new cryptocurrencies and meme coins entirely – stick to assets with proven track records and real-world utility.

Exit Strategy Implementation

Set predetermined profit-take levels at 25%, 50%, and 75% gains to lock in returns systematically. The Federal Reserve’s recent rate cuts triggered $1.9 billion in weekly inflows, which created optimal sale opportunities for disciplined investors. Use hardware wallets like Trezor or Ledger for storage security, as mismanagement of cryptographic keys causes permanent asset loss. Monitor regulatory developments closely – SEC and CFTC coordination signals potential policy changes that could impact valuations significantly.

Risk Management Framework

Establish clear stop-loss orders at 20% below your purchase price to limit downside exposure (particularly important given crypto’s 24/7 market operations). Track your total digital asset exposure monthly and rebalance when allocations drift beyond your target percentages. The recent $977 million Bitcoin inflows demonstrate how quickly market sentiment shifts, which makes disciplined position management essential for long-term success.

These portfolio construction principles provide the foundation for digital asset investment, but investors must also understand the significant risks that accompany this emerging asset class.

What Are the Real Risks of Digital Asset Investing

Extreme Price Volatility Threatens Capital

Digital asset volatility makes traditional market swings look mild. Bitcoin dropped 77% from its November 2021 peak to its June 2022 low, while Ethereum fell 83% during the same period. These extreme price movements happen without warning – Bitcoin took less than a month in 2021 to smash its 2020 price record, surpassing $40,000 by January 7, 2021. The 24/7 nature means prices can collapse while you sleep (unlike traditional markets with circuit breakers and halt mechanisms). Professional athletes who allocated large contract bonuses to crypto during peak periods lost millions within months, which demonstrates why strict portfolio allocation limits protect against catastrophic losses.

Regulatory Uncertainty Creates Investment Risk

The SEC’s enforcement actions against crypto exchanges and projects create sudden price drops and market uncertainty. Since at least 2019, Coinbase has made billions of dollars unlawfully facilitating the buying and selling of crypto assets according to the SEC’s complaint filed in June 2023. New regulations can eliminate entire investment categories overnight – China’s crypto ban in 2021 crashed Bitcoin 50% in weeks. The SEC custody rules for Investment Advisers Act could restrict how financial professionals handle client crypto assets, potentially limiting access to institutional services. Illinois enacted comprehensive digital asset frameworks while Wyoming launches state-issued stablecoins, which creates a patchwork of conflicting state regulations that complicate compliance and investment strategies. Understanding the evolving regulatory landscape remains crucial for investors.

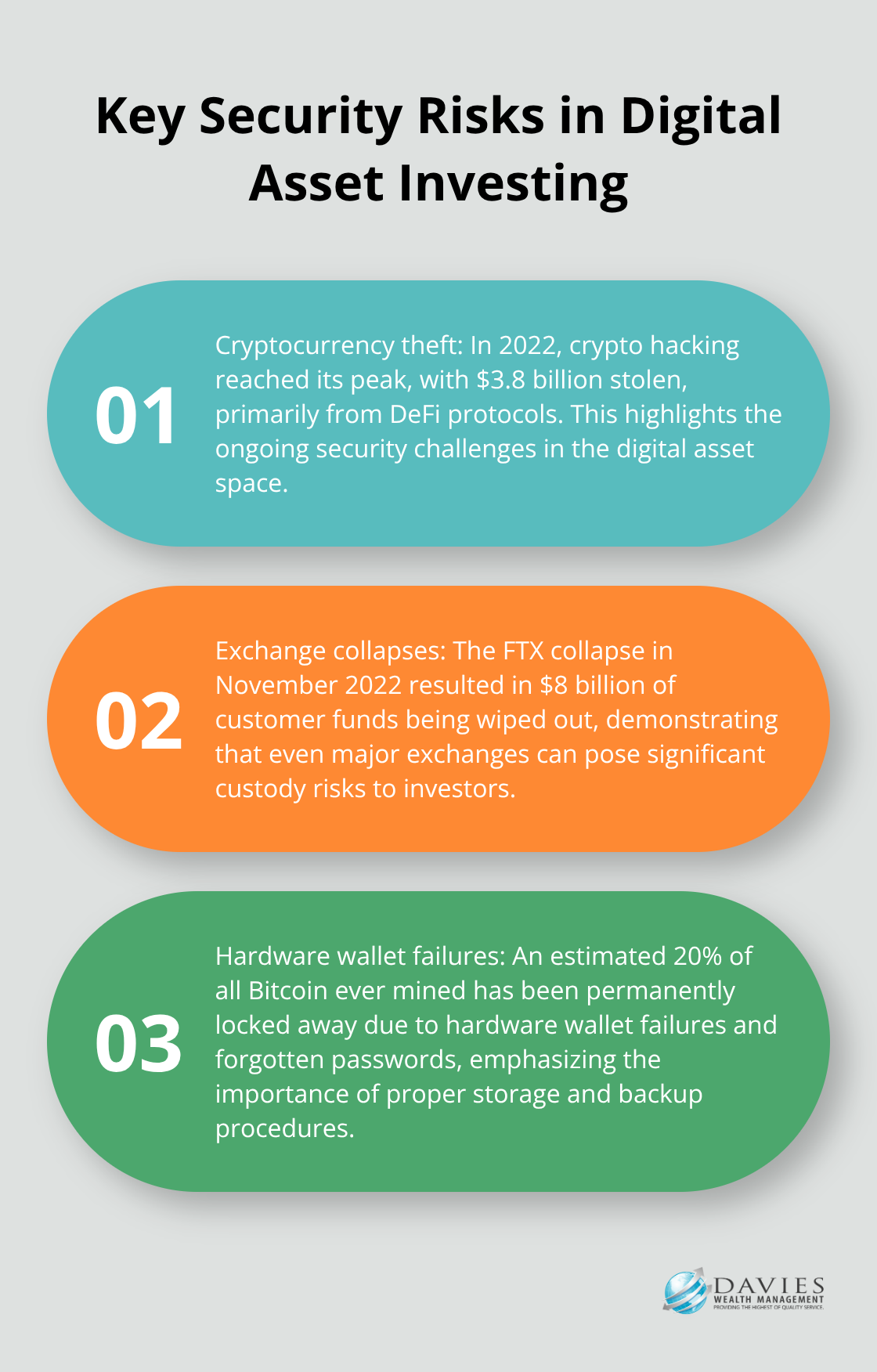

Security Threats Target Your Holdings

Cryptocurrency theft reached $3.8 billion in 2022 according to Chainalysis, with crypto hacking having its biggest year ever primarily from DeFi protocols. The collapse of FTX in November 2022 wiped out $8 billion in customer funds, which proved that even major exchanges pose custody risks. Hardware wallet failures and forgotten passwords have permanently locked away an estimated 20% of all Bitcoin ever mined. Social engineering attacks target crypto holders specifically – SIM swap attacks allow criminals to steal phone numbers and bypass two-factor authentication.

Storage and Technical Challenges

Store crypto assets in hardware wallets like Ledger or Trezor, never leave large amounts on exchanges, and use unique complex passwords with offline backup storage for recovery phrases. Mismanagement of cryptographic keys causes permanent asset loss with no recovery options available. Technical failures can occur at multiple points – wallet software bugs, blockchain network congestion, or exchange maintenance windows that prevent access to funds when you need them most.

Final Thoughts

Digital assets investing requires disciplined strategy and professional guidance to navigate successfully. The $40.4 billion in assets under management demonstrates institutional acceptance, but extreme volatility and regulatory uncertainty demand careful risk management. Never exceed 5% portfolio allocation, use dollar-cost averaging for entries, and maintain strict security protocols with hardware wallets.

Professional athletes face unique challenges with large contract payments and short career spans that make digital assets investing particularly complex. We at Davies Wealth Management help athletes and high-net-worth individuals develop comprehensive strategies that address these specific needs while they manage the inherent risks of cryptocurrency markets. Start with established assets like Bitcoin and Ethereum through regulated ETFs rather than direct ownership.

Set clear profit-take levels and stop-loss orders before you make any investments. The regulatory landscape continues to evolve with SEC and CFTC coordination (making professional oversight valuable for compliance and strategic positioning). Davies Wealth Management provides personalized financial planning that incorporates digital assets within broader wealth management frameworks.

Leave a Reply