Retirement is a pivotal life transition that deserves thoughtful planning and consideration. At Davies Wealth Management, we understand that crafting your ideal retirement lifestyle involves more than just financial preparation.

This blog post will guide you through the essential steps of designing a fulfilling retirement, from assessing your goals to creating a sustainable routine. We’ll explore how to align your finances with your dreams and make the most of your golden years.

What’s Your Retirement Dream?

Visualize Your Perfect Day

Designing your ideal retirement lifestyle starts with a clear vision of what you want your golden years to look like. This isn’t just about financial planning; it’s about crafting a life that brings you joy, purpose, and fulfillment.

Start by imagining your perfect day in retirement. What time do you wake up? Where do you live? How do you spend your mornings, afternoons, and evenings? This exercise helps you identify what truly matters to you and what you want to prioritize in retirement.

For example, you might envision waking up in a coastal town, spending your mornings walking on the beach, afternoons volunteering at a local animal shelter, and evenings enjoying dinner with friends. Or perhaps you see yourself in a bustling city, attending cultural events, taking classes at a local university, and exploring new restaurants.

Identify Your Core Values

Your retirement should align with your core values. Make a list of what’s most important to you. Is it family, health, learning, travel, or giving back to your community? Understanding your values will guide your decisions about where to live, how to spend your time, and how to allocate your resources.

A recent review aimed to determine the effects of retirement on quality of life and associated factors among older adults.

Consider Your Interests and Passions

Retirement offers an opportunity to explore interests you may not have had time for during your working years. Think about hobbies you’ve always wanted to pursue or skills you’d like to develop. Maybe you’ve always wanted to learn a new language, master the art of photography, or become an expert gardener.

Research suggests that having a purpose in life is associated with psychological well-being, better mental health, and good overall health status.

Embrace Flexibility

Your retirement vision may evolve over time (and that’s perfectly normal). The key is to start with a clear idea of what you want and remain open to adjustments as you go. Try to reassess your goals periodically and make changes as needed.

Plan for Purpose

Many retirees find fulfillment in giving back to their communities. Consider how you might want to contribute your time and skills. This could involve volunteering, mentoring, or even starting a small business that aligns with your passions.

As you move forward in designing your ideal retirement lifestyle, the next step involves translating your vision into a concrete financial plan. This will ensure that your dreams are not only inspiring but also achievable.

How Much Will Your Retirement Cost?

Calculating Your Retirement Expenses

The first step in financial planning for retirement requires an estimate of your expenses. Many financial experts suggest you’ll need about 70-80% of your pre-retirement income to maintain your standard of living. However, this can vary widely based on your specific retirement vision. For instance, households with a $30,000 income must replace 104% of their pre-retirement income.

Start by listing your expected fixed costs such as housing, utilities, and insurance. Then, factor in variable expenses like travel, hobbies, and entertainment. Don’t forget to account for potential lifestyle changes. For instance, if you plan to downsize your home, your housing costs might decrease, but your travel expenses might increase if you intend to explore the world.

Identifying Your Income Sources

Next, evaluate your potential income sources. These typically include:

- Social Security benefits

- Pension plans (if applicable)

- Retirement accounts (401(k)s, IRAs)

- Personal savings and investments

- Potential part-time work income

According to the Social Security Administration, the average monthly benefit for retired workers in 2023 is $1,827. However, this alone will likely not cover all your retirement expenses, highlighting the importance of additional income sources.

Developing a Sustainable Withdrawal Strategy

Once you’ve identified your income sources, you must develop a withdrawal strategy that ensures your money lasts throughout retirement. The traditional 4% rule suggests withdrawing 4% of your portfolio in the first year of retirement and adjusting for inflation in subsequent years. However, this rule may not suit everyone.

At Davies Wealth Management, we work with our clients to develop personalized withdrawal strategies based on their unique circumstances, risk tolerance, and market conditions. We consider factors such as asset allocation, tax efficiency, and required minimum distributions (RMDs) to optimize retirement income.

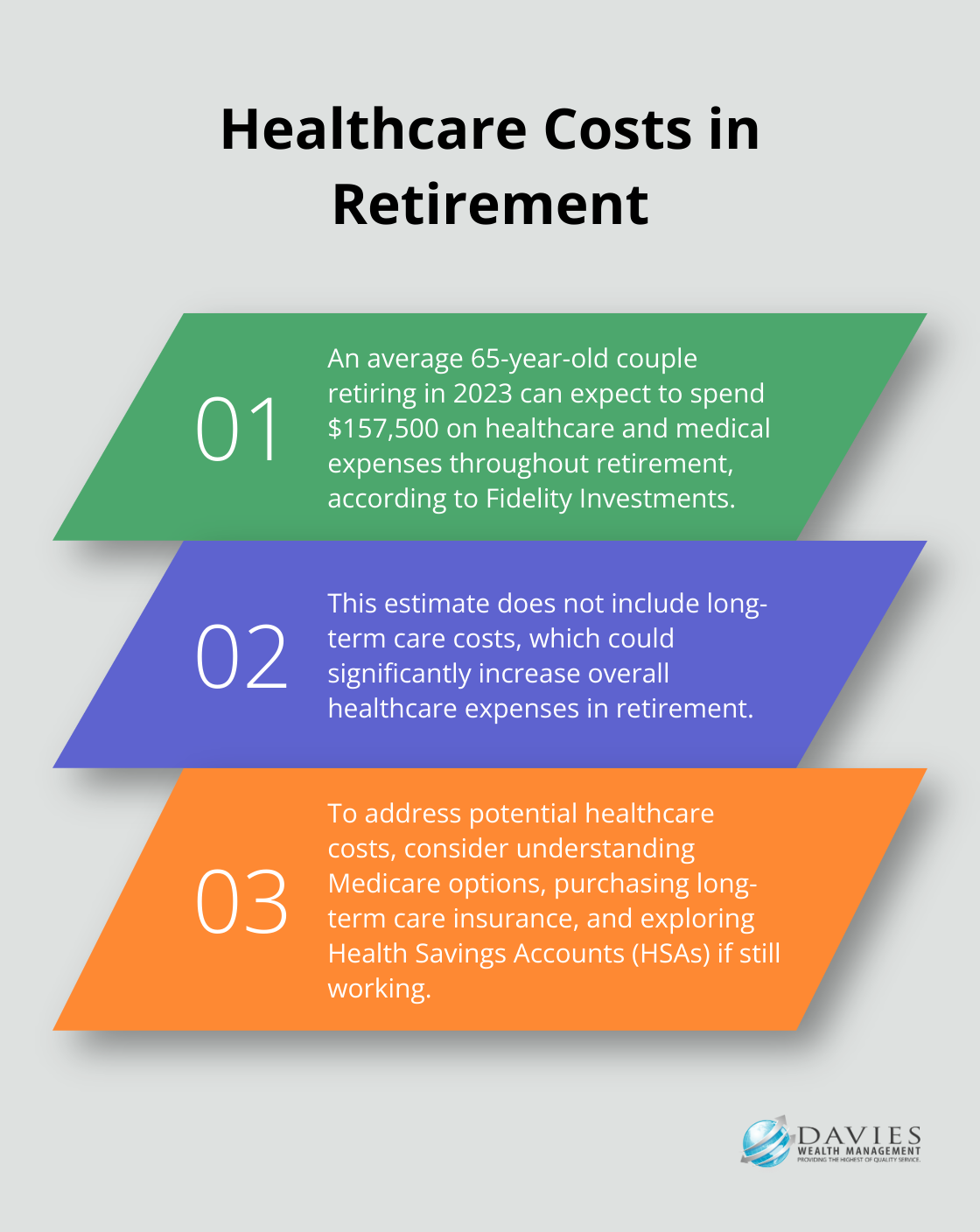

Planning for Healthcare Costs

Healthcare often represents one of the largest expenses in retirement. According to Fidelity Investments, an average 65-year-old couple retiring in 2023 can expect to spend an average of $157,500 on healthcare and medical expenses throughout retirement (not including long-term care costs).

To address these potential costs:

- Understand your Medicare options and enroll on time to avoid penalties.

- Consider purchasing long-term care insurance to protect against potentially catastrophic expenses.

- Explore Health Savings Accounts (HSAs) if you’re still working, as they offer triple tax advantages for healthcare savings.

Planning for healthcare costs proves particularly important for professional athletes. The physical demands of their careers can lead to higher healthcare needs in retirement, making it essential to factor these potential expenses into their financial plans.

As we move forward in our retirement planning journey, it’s important to consider how we’ll fill our days and maintain a sense of purpose. Let’s explore how to create a fulfilling retirement routine that aligns with your financial plan and personal goals.

How to Build a Rewarding Retirement Routine

Nurture Your Social Network

Social connections play a vital role in mental and emotional well-being during retirement. More socially active older adults experience less cognitive decline in old age. To keep your social life thriving:

- Join local clubs or groups aligned with your interests

- Attend community events and classes

- Use technology to connect with family and friends

- Consider a retirement community that offers social activities

Embrace Lifelong Learning

Continuing education in retirement keeps your mind sharp and opens new doors. 55% of Americans age 45 and older are actively learning new things, according to a recent AARP study on lifelong learning. Some ways to pursue learning include:

- Enroll in courses at local colleges or universities

- Attend workshops or seminars in areas of interest

- Learn a new language or musical instrument

- Explore online learning platforms (such as Coursera or edX)

Find Purpose Through Giving Back

Many retirees discover deep satisfaction in volunteering or mentoring. Volunteering is associated with reduced risk of functional decline and a range of chronic conditions. Consider these options:

- Volunteer at local non-profits or community organizations

- Mentor young professionals in your former field

- Participate in intergenerational programs at schools or community centers

- Offer pro bono consulting services to small businesses or startups

Stay Physically Active

Regular exercise maintains health and independence in retirement. The Centers for Disease Control and Prevention recommends at least 150 minutes of moderate-intensity aerobic activity per week for older adults. Some ways to stay active include:

- Join a gym or fitness class designed for seniors

- Take up low-impact activities like swimming or cycling

- Practice yoga or tai chi for balance and flexibility

- Garden or engage in other outdoor activities

Align Your Finances with Your Lifestyle

A fulfilling retirement extends beyond financial planning. Work with a trusted financial advisor (like Davies Wealth Management) to ensure your financial strategies support your desired lifestyle. This allows you to pursue enriching activities without financial stress. Whether you’re a professional athlete transitioning to retirement or an individual looking to make the most of your golden years, a comprehensive plan supports your ideal retirement routine.

Final Thoughts

Designing your ideal retirement lifestyle requires careful planning, self-reflection, and adaptability. Your vision of retirement dreams, values, and goals forms the foundation for financial planning. Financial preparation involves assessing expenses, income sources, and potential healthcare costs. We develop sustainable withdrawal strategies and address healthcare needs to secure your financial future.

A fulfilling retirement routine enhances your quality of life and promotes cognitive health. Social connections, lifelong learning, volunteering, and physical activity contribute to a rewarding retirement lifestyle. Your goals and circumstances may change, so we regularly reassess and adjust plans to navigate challenges and seize opportunities.

Early retirement planning allows more time to build financial resources and refine your vision. Davies Wealth Management helps individuals create comprehensive retirement plans tailored to their unique needs and goals. Our expertise in investment management, retirement planning, and tax-efficient strategies can help you build, protect, and transfer your wealth (with confidence).

Leave a Reply