At Davies Wealth Management, we believe retirement should be a time of fulfillment and enjoyment, not compromise. Many people dream of retirement luxury but worry about the financial implications.

Our guide will show you how to design your ideal retirement lifestyle while ensuring your financial security. We’ll explore strategies to align your retirement vision with smart financial planning, helping you create the retirement you’ve always imagined.

What’s Your Ideal Retirement?

Uncovering Your Retirement Priorities

The creation of your perfect retirement extends beyond financial planning-it involves a clear vision of your desired lifestyle. Start by asking yourself key questions: What brings you joy? How do you want to spend your days? What legacy do you want to leave behind? Your answers will form the foundation of your retirement plan. For example, if travel tops your list, you’ll need to account for higher expenses for trips and experiences. If family time takes precedence, consider how often you’ll visit or host loved ones.

Exploring Lifestyle Options

Retirement lifestyles vary as much as the individuals who plan them. Some retirees prefer a quiet life in a small town, while others seek the excitement of city living. A study by Age Wave and Merrill Lynch found that retirees are highly satisfied with their climate/weather in retirement. This statistic demonstrates that many successfully align their living situations with their retirement visions.

Location Matters

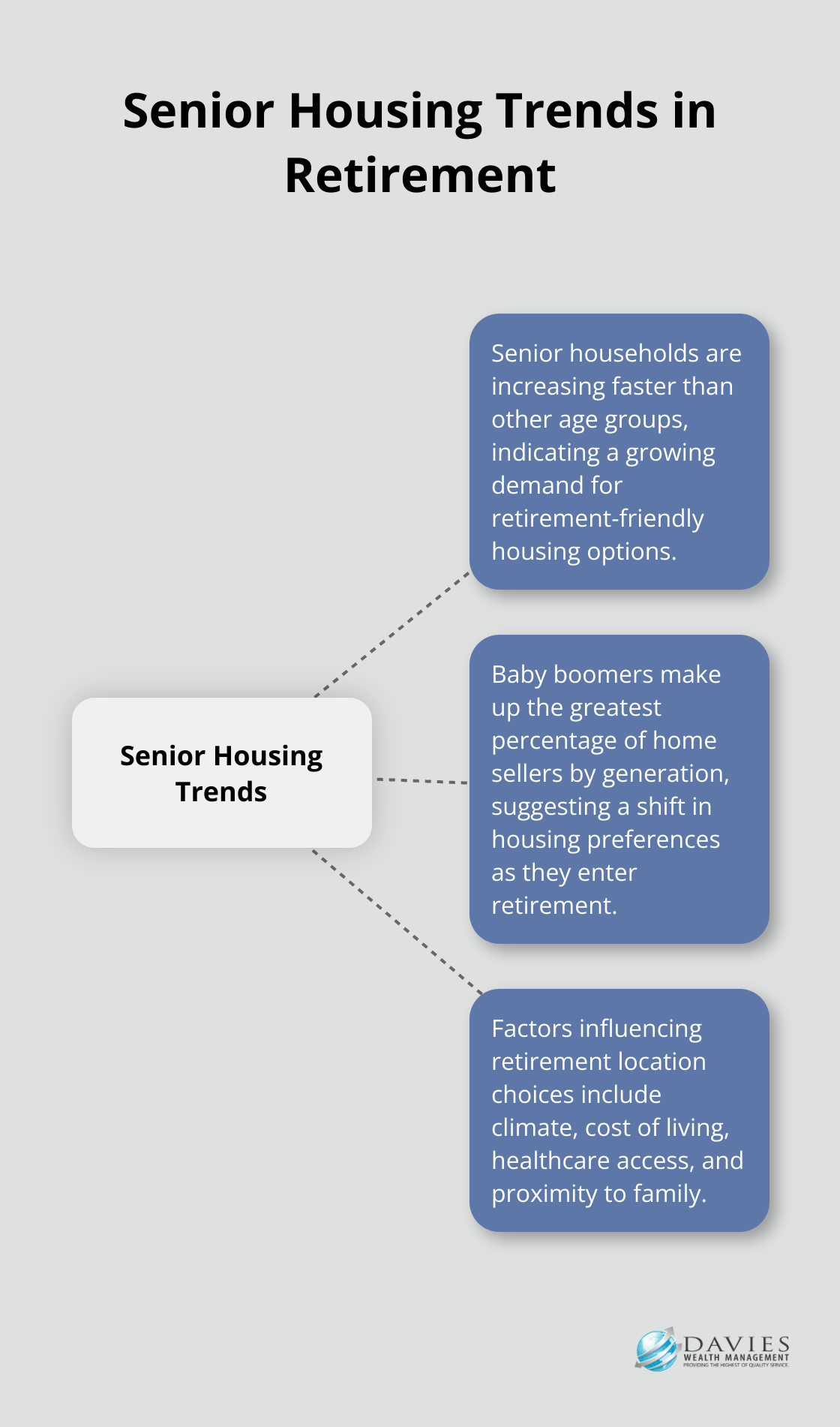

Your retirement location significantly impacts your lifestyle. Factor in climate, cost of living, healthcare access, and proximity to family when making your decision. The National Association of Realtors reports that senior households are increasing faster than other age groups and baby boomers make up the greatest percentage of sellers by generation.

Activities and Social Connections

Activities and social connections prove vital for a fulfilling retirement. Research has shown that engagement in activities such as music, theater, dance, and creative writing has shown promise for improving quality of life. Plan for regular engagement in hobbies, volunteering, or part-time work to keep your mind sharp and your days purposeful.

Tailoring Your Vision

No one-size-fits-all retirement plan exists. Each individual’s retirement vision should reflect their unique desires and circumstances. For professional athletes (who often face unique financial challenges), this might involve strategies to transition from a high-income, short-term career to a sustainable long-term lifestyle.

A clearly defined retirement vision serves as the first step towards achievement. This vision will guide your financial decisions and help ensure that your retirement years truly shine. As we move forward, we’ll explore how to align this vision with smart financial planning to turn your retirement dreams into reality.

How to Fund Your Dream Retirement

Determining Your Retirement Income Needs

The first step to fund your dream retirement requires a calculation of your income needs. The Employee Benefit Research Institute reports that the average retiree spends about $3,800 per month. Your specific needs may differ based on your desired lifestyle and location. We recommend the creation of a detailed budget that accounts for essential expenses, healthcare costs, and discretionary spending for activities you’ve envisioned in your retirement plan.

Building Your Retirement Nest Egg

After you determine your income needs, you must develop a robust savings and investment strategy. The U.S. Bureau of Labor Statistics reports that only 56% of American workers participate in a workplace retirement plan. If you’re part of this group, you should maximize your contributions, especially if your employer offers matching. For those without access to employer-sponsored plans, Individual Retirement Accounts (IRAs) offer tax-advantaged saving options.

Diversification proves key to building a resilient retirement portfolio. At its core, diversification is simple-it means making different kinds of investments so you’re not overly reliant on any single one. This might include a mix of stocks for growth, bonds for stability, and real estate for income. The specific allocation will depend on your risk tolerance and time horizon. As retirement approaches, it’s generally advisable to shift towards more conservative investments to protect your wealth.

Maximizing Tax Efficiency in Retirement

Tax planning forms a crucial aspect of retirement funding that’s often overlooked. The Tax Policy Center estimates that about half of all households headed by someone 65 or older pay no federal income tax. With strategic planning, you can potentially join this group.

Try Roth conversions in lower-income years to reduce future required minimum distributions (and associated taxes). For those over 70½, Qualified Charitable Distributions from IRAs can become tax-free as long as they’re paid directly from the IRA to an eligible charitable organization. If you’re a business owner, setting up a Solo 401(k) or SEP IRA can allow for higher contribution limits and potential tax deductions.

Tailored Strategies for Unique Situations

Different professions and life situations may require specialized retirement funding strategies. For instance, professional athletes face unique challenges in planning for retirement due to their typically short career spans and potentially high (but variable) incomes. These clients need to leverage their peak earning years to build a sustainable financial foundation for the long term.

Implementing Your Funding Plan

The implementation of your retirement funding plan requires discipline and regular review. You should automate your savings where possible and regularly reassess your investment strategy. As you near retirement, you’ll need to develop a withdrawal strategy that balances your income needs with the longevity of your nest egg. This might involve a combination of systematic withdrawals, annuities, and other income-generating investments.

The creation of a solid retirement funding strategy forms the foundation of your dream retirement. However, financial planning represents only one piece of the puzzle. In the next section, we’ll explore how to balance these financial realities with your retirement dreams, ensuring you can enjoy your golden years without compromise.

Striking the Balance: Dreams vs. Financial Reality

Prioritizing Retirement Goals

At Davies Wealth Management, we often meet clients who find it challenging to align their retirement aspirations with their financial situations. This challenge isn’t insurmountable, but it requires careful planning and strategic decision-making.

The first step to balance dreams and reality is to prioritize your retirement goals. Create a list of everything you want to achieve in retirement, then rank these goals in order of importance. This exercise helps you identify which aspects of your retirement vision are non-negotiable and which you might adjust if necessary.

For example, if world travel tops your list, you might compromise on the size of your retirement home. Or if staying close to family is paramount, you might choose to retire in a less expensive area to free up funds for frequent visits.

Flexible Retirement Approaches

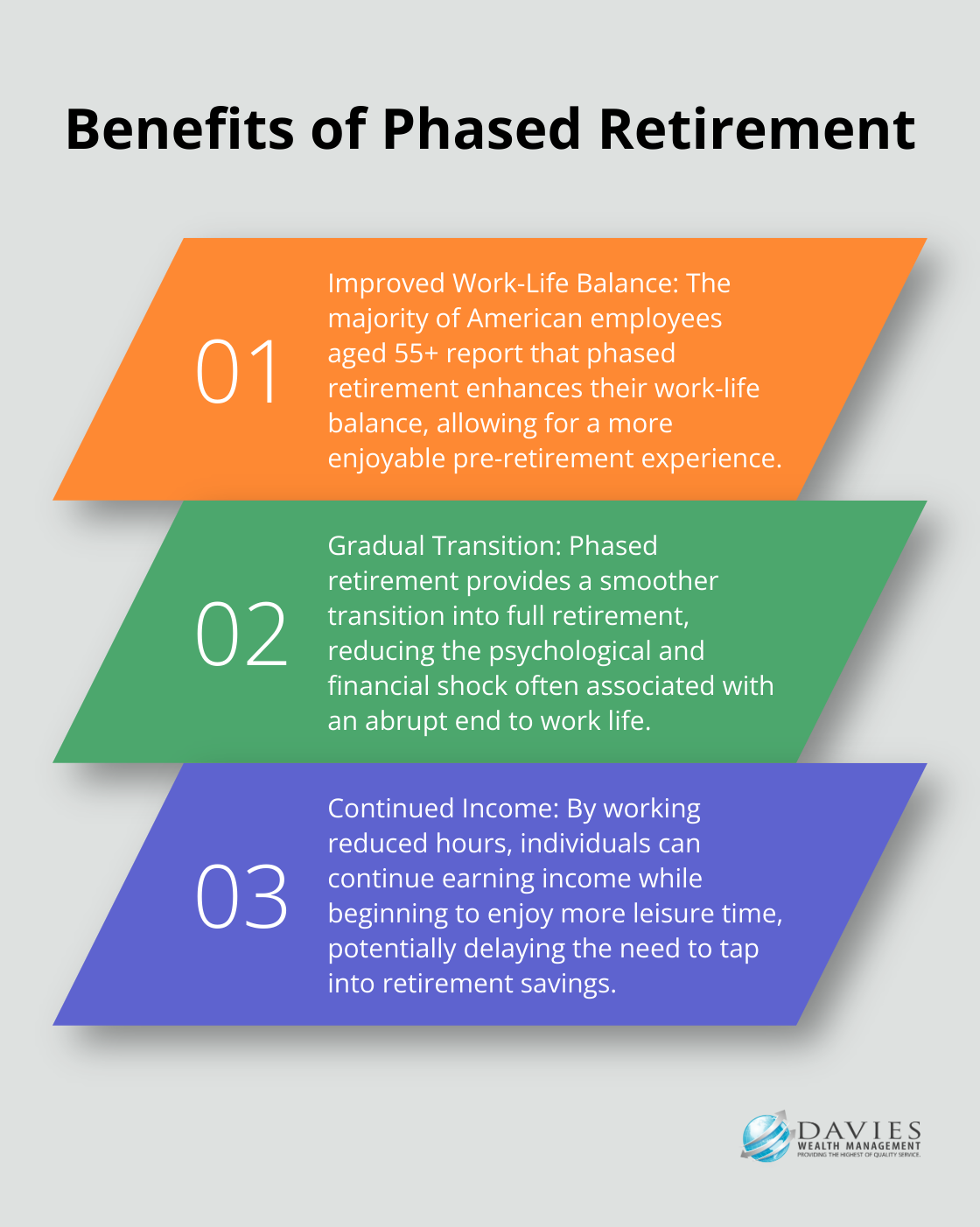

Flexibility is key in retirement planning. Consider phased retirement as an option. The majority of American employees aged 55+ say that phased retirement improves work-life balance. This approach allows you to reduce your work hours gradually while still earning income, easing the transition into full retirement.

Another strategy is to adjust your retirement timeline. Postponing retirement by even a few years can significantly boost your savings. The Social Security Administration states that for every year you delay claiming benefits past your full retirement age (up to age 70), your monthly benefit increases by about 8%.

Creative Solutions for Lifestyle Maximization

Think creatively to maximize your retirement lifestyle without overspending. For instance, house swapping or home sharing can provide cost-effective ways to travel. The National Association of Realtors reports that 13% of recent home buyers purchased a multi-generational home (which can reduce housing costs and strengthen family bonds).

Consider transforming hobbies into income streams. Recent studies have shown that entrepreneurs approaching the end of their careers are redefining what society considers as working life.

Tailored Strategies for Unique Situations

Different professions and life situations may require specialized retirement strategies. For instance, professional athletes face unique challenges in planning for retirement due to their typically short career spans and potentially high (but variable) incomes. These clients need to leverage their peak earning years to build a sustainable financial foundation for the long term.

At Davies Wealth Management, we specialize in creating personalized strategies that help our clients (including professional athletes) balance their retirement dreams with financial realities. We understand that each situation is unique and requires a tailored approach to achieve the best possible outcome.

Final Thoughts

Designing your dream retirement lifestyle without compromise requires a strategic alignment of aspirations with sound financial planning. At Davies Wealth Management, we understand the complexities of retirement planning and the unique challenges faced by individuals from various backgrounds, including professional athletes. Our expertise lies in creating personalized strategies that help you navigate the path to retirement luxury while ensuring financial security.

The journey to a luxurious retirement demands careful consideration, strategic planning, and often, professional guidance. We encourage you to take action today by assessing your current financial situation, outlining your retirement goals, and exploring strategies to bridge any gaps between your dreams and financial reality. Our team at Davies Wealth Management can provide tailored advice and comprehensive wealth management solutions to turn your retirement dreams into reality.

Don’t let the complexities of retirement planning deter you from pursuing your ideal lifestyle. With the right approach and expert support, you can design a retirement that’s not only financially secure but also rich in experiences, purpose, and fulfillment. Start planning your dream retirement today and take the first step towards a future without compromise.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

Tweets by TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply