At Davies Wealth Management, we believe that true financial success starts with the right mindset. A wealth mindset is more than just thinking about money; it’s a fundamental shift in how you approach your financial future.

Developing a wealth mindset can transform your financial decisions and outcomes, setting you on a path to long-term prosperity. In this post, we’ll explore the key principles of a wealth mindset and provide practical strategies to help you cultivate this powerful approach to your finances.

What Is a Wealth Mindset?

The Essence of a Wealth Mindset

A wealth mindset represents a powerful perspective that shapes our view of money, opportunities, and financial future. This mindset embodies a belief in abundance and possibility. It views money as a tool for growth and opportunity, rather than a scarce resource to be hoarded. Individuals with a wealth mindset focus on value creation, wise investments, and long-term financial stability.

This perspective contrasts sharply with a scarcity mindset, which perceives money as limited and often results in fear-based financial decisions. Those with a scarcity mindset might avoid calculated risks, overlook investment opportunities, or struggle to save effectively.

The Impact on Financial Decisions

Increased financial literacy generally comes with greater wealth. Those who adopt a wealth mindset are more likely to make informed financial decisions and develop long-term financial plans.

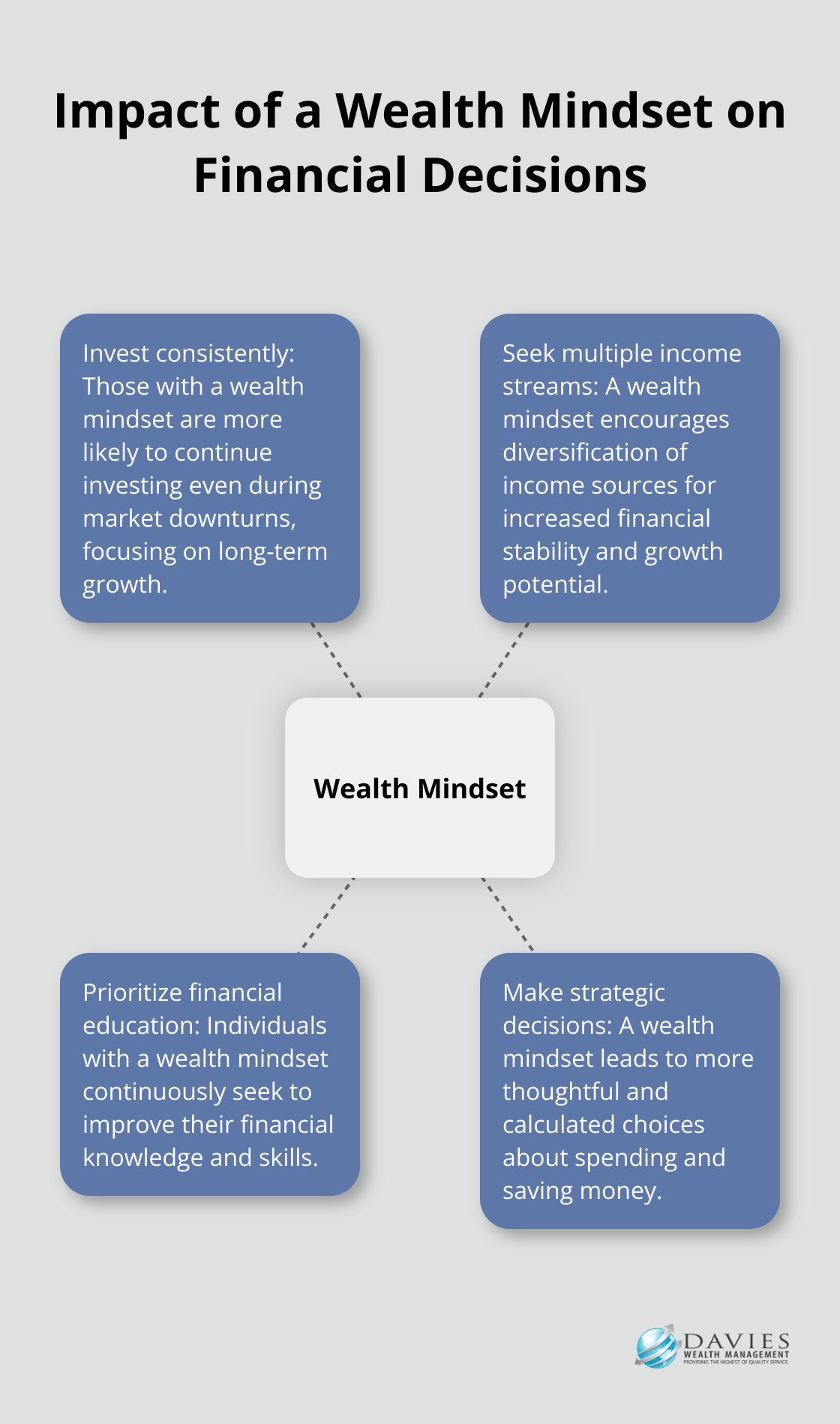

Clients who embrace a wealth mindset tend to:

- Invest consistently (even during market downturns)

- Seek multiple income streams

- Prioritize financial education and skill development

- Make strategic decisions about spending and saving

Practical Steps to Cultivate Your Wealth Mindset

The development of a wealth mindset requires concrete actions, not just positive thinking. Here are some practical steps:

- Set clear, measurable financial goals

- Educate yourself about personal finance and investing

- Surround yourself with financially savvy individuals

- Practice gratitude for your current financial situation

The Importance for Professional Athletes

For professional athletes (who often face unique financial challenges), the cultivation of a wealth mindset is particularly important. Their short career spans, fluctuating income, and potential earnings from endorsements and contracts require specialized financial planning strategies.

The Role of Financial Education

Financial education plays a key role in developing a wealth mindset. It empowers individuals to make informed decisions, understand complex financial concepts, and navigate the ever-changing economic landscape. Financial literacy is a key tool in breaking down barriers and achieving long-term success.

A wealth mindset isn’t about getting rich quick. It’s about making informed, strategic decisions that lead to long-term financial success. The shift in perspective and the implementation of actionable steps mark the beginning of one’s journey towards financial prosperity. As we move forward, let’s explore the key principles that underpin a wealth mindset and how they can be applied to achieve lasting financial success.

Mastering the Wealth Mindset Principles

Prioritizing Long-Term Growth

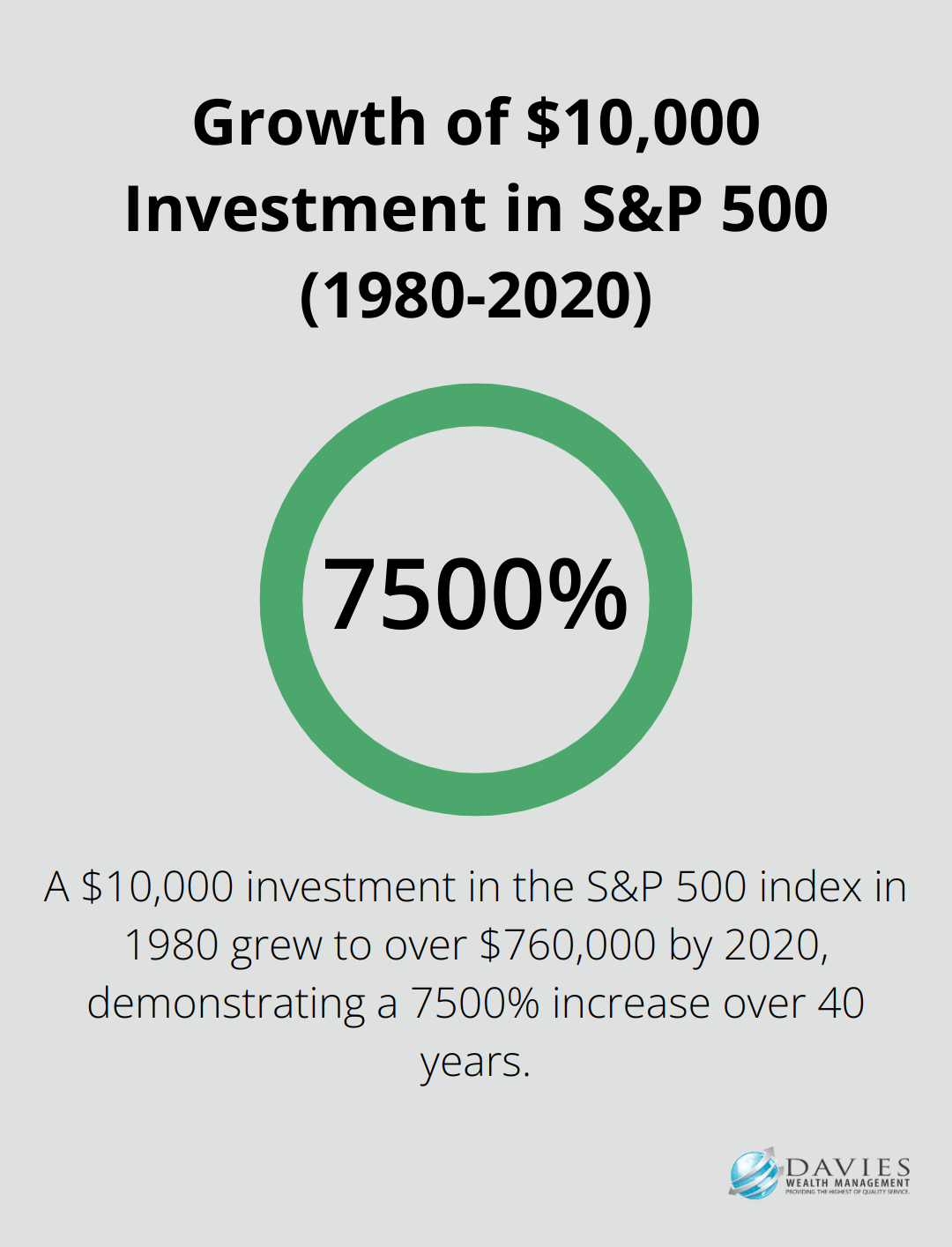

A cornerstone of the wealth mindset is the focus on long-term growth over short-term gains. This approach involves making strategic investment decisions that may not yield immediate results but have the potential for significant returns over time. For example, investing in low-cost index funds consistently over decades can lead to substantial wealth accumulation. A study by Vanguard showed that a $10,000 investment in the S&P 500 index in 1980 would have grown to over $760,000 by 2020 (showcasing the power of long-term investing).

Calculated Risk-Taking and Resilience

The wealth mindset embraces calculated risks and views failures as learning opportunities. This doesn’t mean reckless behavior, but rather a willingness to step out of comfort zones when the potential rewards justify the risks. Starting a side business or investing in real estate can be risky, but also potentially lucrative. Seventy-four percent of adults chose to pursue an opportunity as a basis for their entrepreneurial motivations, indicating a willingness to take calculated risks for potential gains.

Commitment to Continuous Learning

Financial landscapes constantly evolve, necessitating ongoing education and skill development. This might involve attending financial seminars, reading industry publications, or working with financial advisors to stay informed about new investment strategies or tax laws. A recent test found that test-takers from 15-18 years old scored an average of only 59.6% on financial literacy, highlighting the importance of continuous learning in finance.

Diversifying Income Streams

A key principle of the wealth mindset is the cultivation of multiple income sources. This approach not only increases overall income but also provides financial stability and resilience. According to a survey by Bankrate, 45% of Americans report having a side hustle in addition to their primary job. These additional income sources can range from rental properties and dividend-paying stocks to freelance work or online businesses.

Applying Wealth Mindset Principles

The adoption of these wealth mindset principles can significantly impact your financial trajectory. Whether you’re a professional athlete looking to secure your financial future beyond your playing career or an individual aiming to build long-term wealth, understanding and applying these wealth mindset principles can transform your financial outlook. The next section will explore practical strategies to develop and reinforce these principles in your daily life.

How to Develop a Wealth Mindset

Set SMART Financial Goals

The foundation of a wealth mindset starts with clear, actionable financial goals. Use the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. Replace vague goals like “save more money” with specific targets such as “save $10,000 for a house down payment within 18 months.” This approach provides clarity and motivation, making it easier to track progress and maintain commitment.

Practice Financial Mindfulness

Cultivate gratitude and abundance thinking to develop a wealth mindset. Start a financial gratitude journal. Budgeting and healthy spending are not only forms of financial responsibility but also teach your brain boundaries and compassion around money. This practice shifts your focus from what you lack to what you have, fostering a positive relationship with money.

Challenge negative money beliefs. When you think, “I’ll never be wealthy,” reframe it to “I learn and grow my wealth every day.” This cognitive restructuring can significantly impact your financial decisions and outcomes.

Curate Your Financial Circle

The people around you profoundly impact your financial mindset. Seek individuals who share your financial goals and values. Join investment clubs, attend financial seminars, or participate in online communities focused on wealth building. It was concluded in a study that by comparison of financial status, spending time with peers and discussing financial matters with them influence savings behavior.

For professional athletes, this is particularly important. Connect with financially savvy peers and mentors who understand the unique challenges of managing wealth in professional sports.

Invest in Financial Education

Continuous learning characterizes the wealth mindset. Allocate time and resources to enhance your financial knowledge. Read financial books, subscribe to reputable financial publications, or take courses on investing and money management.

Consider working with a financial advisor who can provide personalized guidance and education. Many firms (including Davies Wealth Management) offer comprehensive financial education tailored to each client’s needs, ensuring they understand the strategies implemented on their behalf.

Embrace Calculated Risks

A wealth mindset involves taking calculated risks. This doesn’t mean reckless behavior, but a willingness to step out of comfort zones when potential rewards justify the risks. Starting a side business or investing in real estate can be risky, but also potentially lucrative.

Final Thoughts

A wealth mindset transforms your financial future. This powerful perspective shifts your view of money from scarcity to abundance, encourages calculated risks, and promotes continuous learning. These principles set the stage for long-term financial success and open doors to new possibilities in personal finance.

Davies Wealth Management understands the importance of a wealth mindset in achieving financial goals. Our team of experts helps clients, including professional athletes with unique financial challenges, develop and maintain this mindset. We offer personalized financial planning strategies, investment management, and ongoing education to support your journey towards financial prosperity.

The path to financial success starts with the right mindset. Implement the strategies discussed in this post and seek professional guidance when needed. Davies Wealth Management provides comprehensive wealth management solutions designed to align with your individual goals and help you build, protect, and transfer your wealth with confidence.

Leave a Reply