At Davies Wealth Management, we’ve noticed a growing trend: the intersection of cryptocurrency and estate planning. As digital assets become more prevalent, it’s essential to consider how they fit into your legacy.

Incorporating cryptocurrencies into your estate plan presents unique challenges, from secure storage to tax implications. Understanding these complexities is crucial for effective probate planning to minimize estate costs.

This guide will explore key considerations and strategies for including cryptocurrency in your estate plan, ensuring your digital wealth is protected and transferred according to your wishes.

What Are Cryptocurrencies and Why Do They Matter for Estate Planning?

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin, since its creation in 2009, is the first-ever digital cryptocurrency; this led to the wave of the digital currency revolution. Since then, thousands of other cryptocurrencies have appeared, including Ethereum, Ripple, and Litecoin. These digital assets operate on decentralized networks based on blockchain technology (a distributed ledger enforced by a network of computers).

The popularity of cryptocurrencies as investment assets has grown significantly in recent years. This trend has introduced new complexities to estate planning that weren’t present with traditional assets.

The Unique Nature of Cryptocurrency Assets

Unlike traditional assets, cryptocurrencies exist only in digital form and are stored in digital wallets. Access to these wallets is controlled by private keys – long strings of numbers and letters. If these keys are lost, the cryptocurrency becomes inaccessible, potentially resulting in permanent loss of the asset.

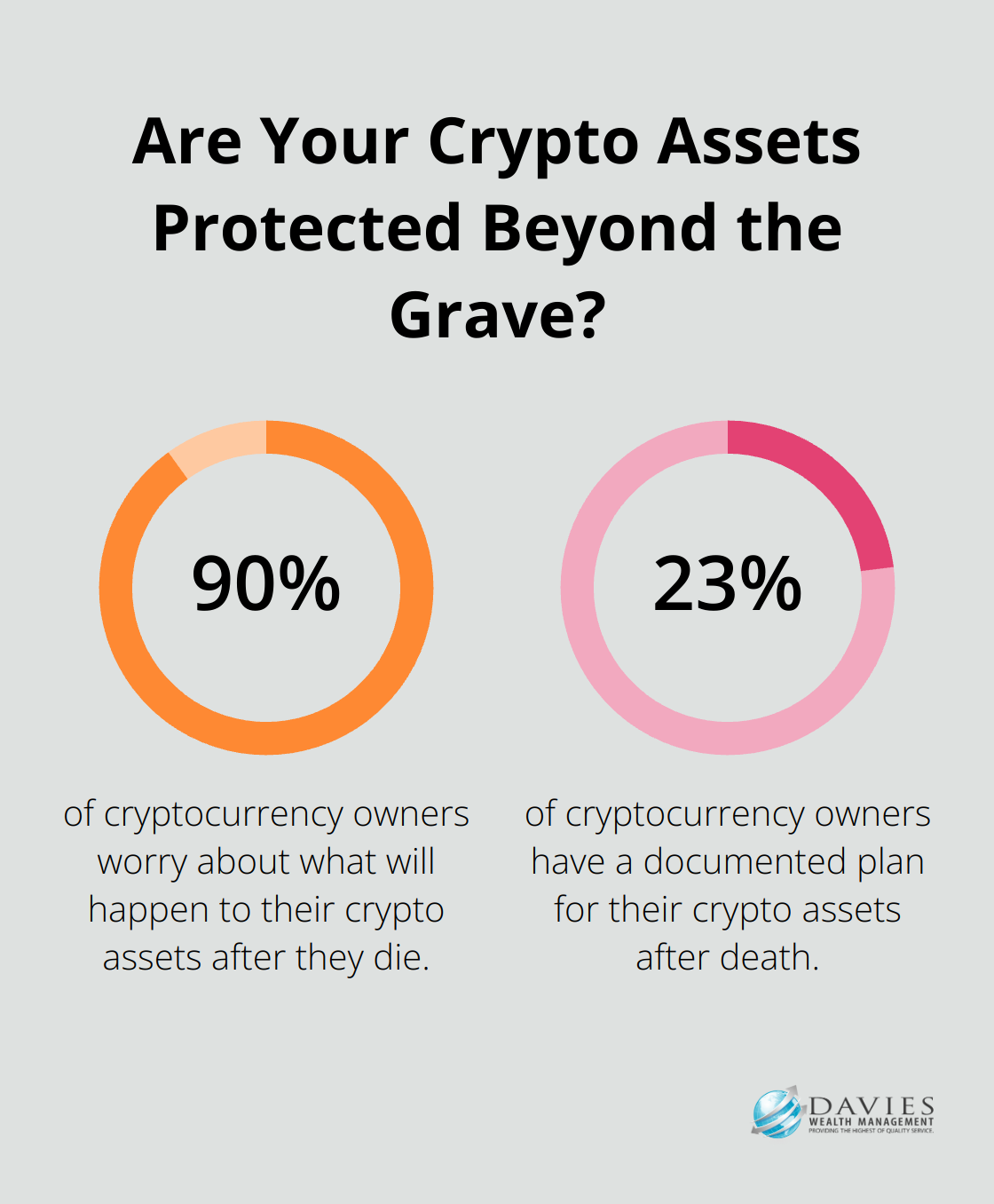

This unique characteristic presents a major challenge in estate planning. If a cryptocurrency owner dies without sharing access information, their digital assets could be lost forever. A 2020 study by the Cremation Institute revealed that nearly 90% of cryptocurrency owners worry about what will happen to their crypto assets after they die, yet only 23% have a documented plan.

Legal and Tax Implications

The legal status of cryptocurrencies varies by jurisdiction, adding another layer of complexity to estate planning. In the United States, the IRS treats cryptocurrency as property for tax purposes. This means that inheriting cryptocurrency can trigger capital gains tax for beneficiaries.

Moreover, the volatile nature of cryptocurrency values can complicate estate valuations. Such volatility can significantly impact estate taxes and distributions to beneficiaries.

Incorporating Cryptocurrencies into Your Estate Plan

Given these challenges, it’s essential to include specific provisions for cryptocurrency assets in your estate plan. This should include detailed instructions on how to access your digital wallets and private keys, as well as guidance on how to handle these assets.

Creating a separate digital asset trust for cryptocurrency holdings can provide better security and more flexibility in managing these unique assets. It’s also important to appoint a tech-savvy executor or trustee who understands how to handle cryptocurrencies.

The Importance of Professional Guidance

The rapidly evolving nature of cryptocurrencies and their regulatory environment makes professional guidance essential. Laws and best practices are still developing, and what works today may not be the best approach tomorrow.

For instance, the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA), adopted by most U.S. states, provides a legal framework for fiduciaries to access digital assets. However, its application to cryptocurrencies is still being tested in courts.

As we move forward, it’s clear that the intersection of cryptocurrency and estate planning will continue to evolve. In the next section, we’ll explore key considerations for incorporating cryptocurrency into your estate plan, ensuring your digital wealth is protected and transferred according to your wishes.

How to Safeguard Your Crypto Assets in Estate Planning

Create a Comprehensive Asset Inventory

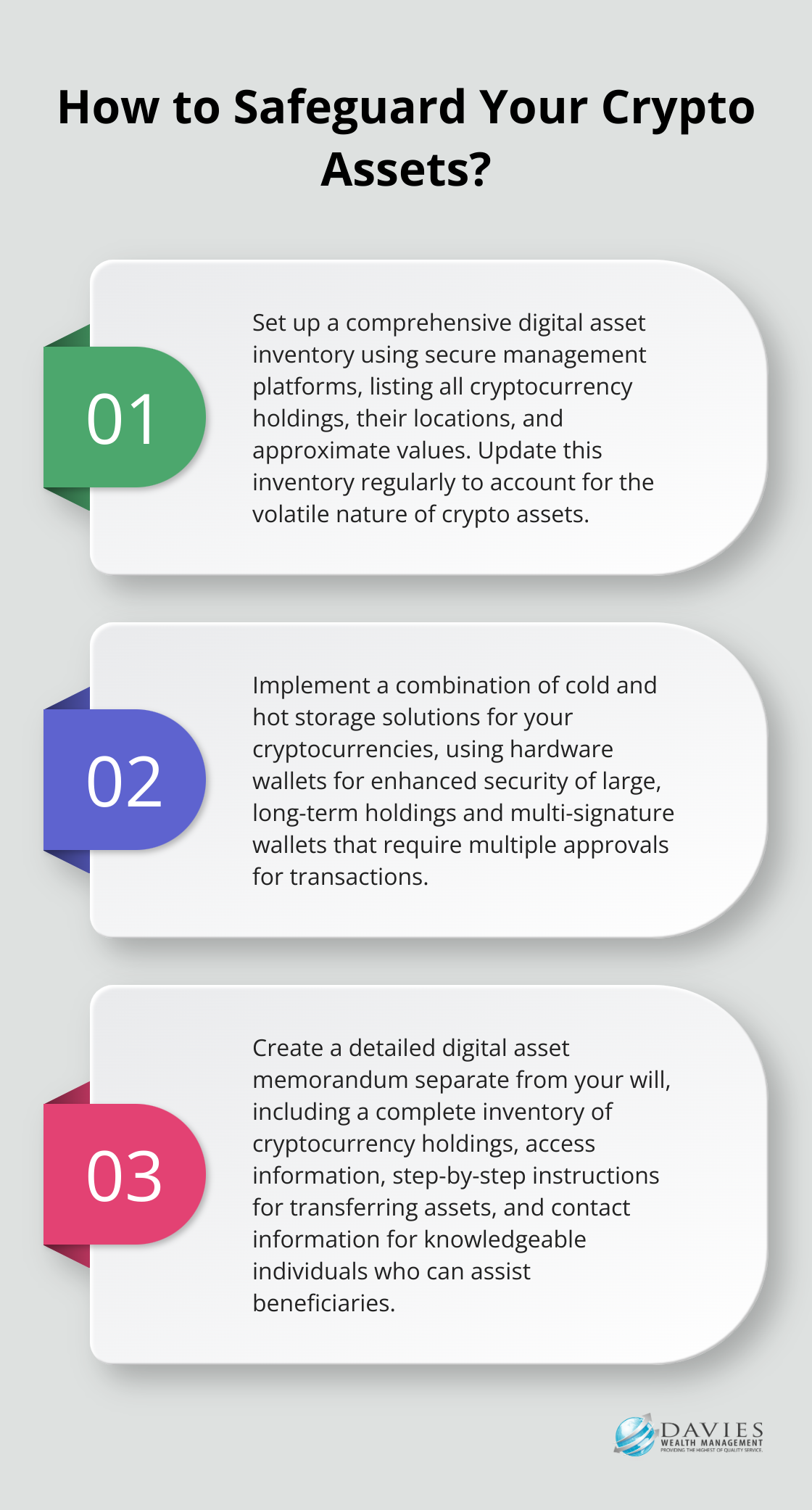

The foundation of protecting your crypto assets starts with a thorough inventory. List all your cryptocurrency holdings, their locations, and approximate values. Update this inventory regularly, as cryptocurrency values can change dramatically.

We recommend secure digital asset management platforms to track your holdings. These tools automatically update values and provide a clear overview of your crypto portfolio. However, exercise caution when storing sensitive information like private keys on these platforms.

Implement Secure Storage and Access Methods

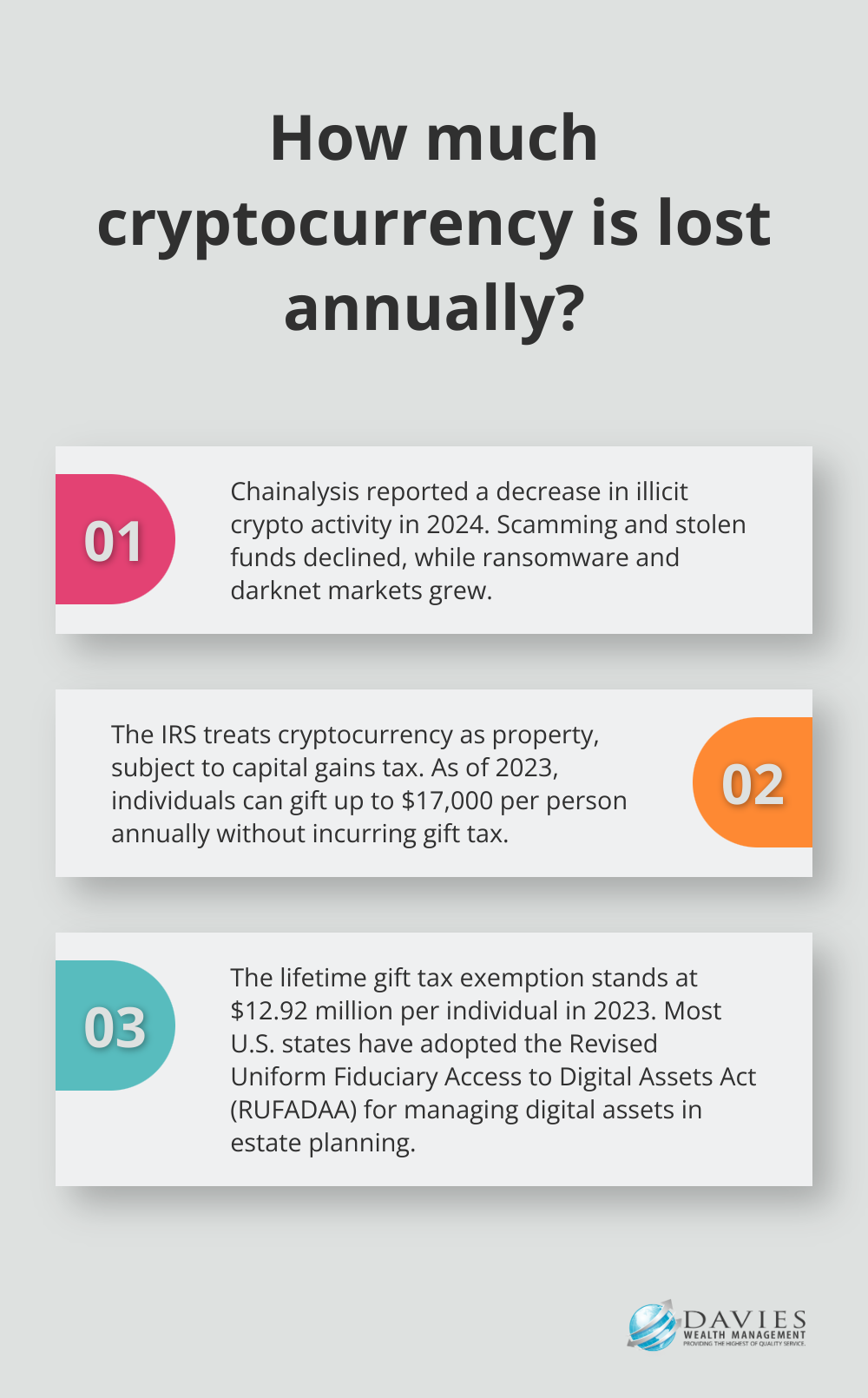

Protecting access to your digital wallets and private keys is essential. Cold storage methods, such as hardware wallets, offer enhanced security by keeping your assets offline. A 2024 Chainalysis report revealed that illicit activity in the crypto space has decreased, with scamming and stolen funds falling, although ransomware and darknet markets saw growth.

We advise our clients to use a combination of cold and hot storage solutions. The choice depends on the amount and frequency of use of their crypto assets. For large, long-term holdings, consider multi-signature wallets that require multiple approvals for transactions, adding an extra layer of security.

Understand and Plan for Tax Implications

The tax implications of cryptocurrency inheritance can be complex. The IRS treats cryptocurrency as property, subjecting it to capital gains tax when sold or transferred.

To reduce tax burdens, consider gifting cryptocurrency during your lifetime. As of 2023, you can gift up to $17,000 per person annually without incurring gift tax. For larger amounts, you might use your lifetime gift tax exemption (which stands at $12.92 million per individual as of 2023).

Update Estate Planning Documents

Revise your will or trust to explicitly include cryptocurrency assets. Specify how to distribute these assets and provide clear instructions for accessing them. Appoint a tech-savvy executor or trustee who understands cryptocurrency management.

We’ve observed an increasing number of clients incorporating crypto-specific clauses in their estate planning documents. These clauses often include detailed instructions on accessing and managing digital assets, ensuring a smooth transition to beneficiaries.

Seek Professional Guidance

The rapidly evolving nature of cryptocurrencies and their regulatory environment makes professional guidance invaluable. Laws and best practices continue to develop, and today’s optimal approach may not be the best tomorrow.

For example, the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA), adopted by most U.S. states, provides a legal framework for fiduciaries to access digital assets. It serves as the primary legal guideline for managing digital assets in estate planning.

As we move forward, the intersection of cryptocurrency and estate planning will continue to evolve. In the next section, we’ll explore specific strategies for incorporating cryptocurrency into your estate plan, ensuring your digital wealth transfers according to your wishes while minimizing potential legal and tax complications.

How to Effectively Integrate Crypto into Your Estate Plan

Leverage Trusts for Cryptocurrency

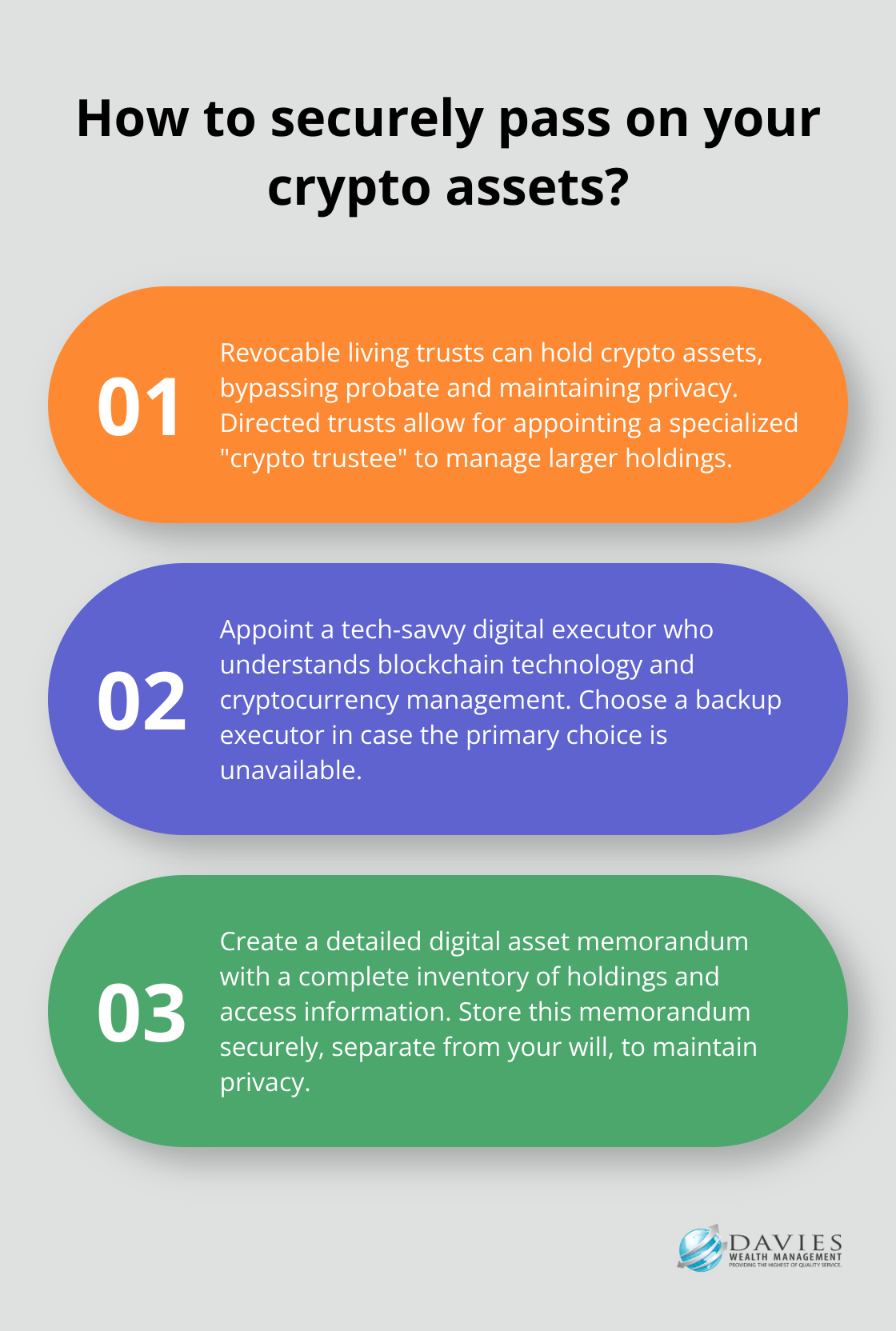

Trusts serve as powerful tools for managing cryptocurrency in estate planning. A revocable living trust can hold your crypto assets, making it less likely that your Bitcoin or cryptocurrency will go undiscovered upon your death. This approach bypasses probate, maintains privacy, and potentially reduces estate taxes.

For larger crypto holdings, consider a directed trust for cryptocurrency holdings. This structure allows you to appoint a “crypto trustee” with specialized knowledge to manage these assets. The crypto trustee works alongside the primary trustee, ensuring your digital assets receive expert attention.

Appoint a Tech-Savvy Digital Executor

Selecting the right executor for your crypto assets is important. This person should understand blockchain technology and cryptocurrency management. They’ll need to know how to access and transfer your digital assets securely.

When choosing a digital executor, consider their technical expertise, trustworthiness, and willingness to take on this responsibility. It’s also wise to name a backup in case your primary choice cannot serve.

Provide Detailed Instructions for Beneficiaries

Clear, comprehensive instructions are essential for ensuring your crypto assets reach your intended beneficiaries. Create a digital asset memorandum that includes:

- A complete inventory of your cryptocurrency holdings

- Detailed access information (wallet addresses, private keys, seed phrases)

- Step-by-step instructions for accessing and transferring the assets

- Contact information for knowledgeable individuals who can assist

Make sure to write a thorough cryptocurrency access guide with step-by-step instructions on accessing your digital assets. Test the step-by-step instructions to ensure they work.

Store this memorandum securely, separate from your will (which becomes public record upon probate). Try using a digital vault service or a secure physical location known to your executor.

Update Your Estate Plan Regularly

The cryptocurrency landscape evolves constantly. Regular updates to your estate plan are necessary to ensure it remains effective and compliant with current regulations. We recommend reviewing your crypto estate plan annually or whenever significant changes occur in your holdings or relevant laws.

Seek Professional Guidance

The complex nature of cryptocurrency and estate planning requires expert advice. Professional wealth management firms (like Davies Wealth Management) can provide valuable insights and strategies tailored to your specific situation. These firms stay up-to-date with the latest developments in crypto regulations and estate planning laws, ensuring your plan remains current and effective.

Final Thoughts

Integrating cryptocurrency into your estate plan requires careful consideration and expert guidance. We at Davies Wealth Management specialize in helping clients navigate this complex landscape, offering tailored strategies for managing digital assets within broader wealth management plans. Our expertise extends to probate planning to minimize estate costs, ensuring your legacy remains protected and efficiently transferred.

The intersection of cryptocurrency and estate planning will continue to evolve as regulations develop and new digital assets emerge. Staying informed and updating your estate plan regularly will prove essential in securing your digital legacy for future generations. Professional support can provide you with the confidence to incorporate your digital assets into your overall estate plan effectively.

Davies Wealth Management stands ready to assist you in creating a comprehensive strategy for your traditional and digital assets. We encourage you to reach out to our team for personalized advice on safeguarding your cryptocurrency holdings and ensuring their proper distribution according to your wishes. Our expertise can help you navigate the complexities of digital asset management within your estate plan.

Leave a Reply