At Davies Wealth Management, we understand that cryptocurrency has become a hot topic for investors in Stuart, Florida. The digital asset landscape is evolving rapidly, presenting both opportunities and challenges for local investors.

In this post, we’ll provide cryptocurrency advice for Stuart, Florida residents looking to navigate this complex market. We’ll cover the basics, potential benefits and risks, and investment strategies tailored to our local community.

What Is Cryptocurrency and How Does It Work?

The Basics of Cryptocurrency

Cryptocurrency has become a hot topic in Stuart, Florida, but many investors still struggle to understand its fundamentals. At its core, cryptocurrency uses cryptography for security. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology.

How Cryptocurrencies Function

When you invest in cryptocurrency, you buy a digital asset that can be used for transactions or held as an investment. These transactions are recorded on a public ledger called a blockchain, which ensures transparency and security. In Stuart, we’ve noticed a growing interest in cryptocurrencies, with some local businesses even starting to accept them as payment.

Popular Cryptocurrencies for Stuart Investors

Bitcoin remains the most well-known cryptocurrency, but it’s far from the only option. Ethereum, for example, offers smart contract functionality, which has led to its adoption in various industries. Ripple (XRP) focuses on facilitating international money transfers, which could be particularly interesting for Stuart residents with international business ties.

A recent survey found that roughly six-in-ten Americans (63%) say they have little to no confidence that current ways to invest in, trade or use cryptocurrencies are reliable and safe. This statistic underscores the need for caution and education when considering digital assets, even in more traditional investment hubs like Stuart.

Blockchain: The Backbone of Cryptocurrency

Blockchain technology forms the foundation upon which cryptocurrencies are built. It’s essentially a distributed database that records all transactions across a network of computers. This technology ensures that transactions are secure, transparent, and immutable.

For Stuart investors, understanding blockchain is important because it’s not just limited to cryptocurrencies. Many industries (from finance to supply chain management) are exploring blockchain applications. This broader adoption could potentially increase the value and utility of blockchain-based cryptocurrencies in the future.

Practical Considerations for Stuart Investors

If you’re considering investing in cryptocurrencies, it’s essential to understand the practical aspects. You’ll need a digital wallet to store your assets, and you’ll likely use a cryptocurrency exchange to buy and sell. Some popular exchanges include Coinbase and Gemini, but it’s important to research and choose a reputable platform.

The cryptocurrency market is highly volatile. While this can lead to significant gains, it also means you could face substantial losses. We always advise our clients to only invest what they can afford to lose and to diversify their portfolios to manage risk effectively.

Regulatory Landscape in Florida

Florida has taken steps to embrace cryptocurrency and blockchain technology. In 2019, the state established a Blockchain Task Force to explore the potential of these technologies. This proactive approach could lead to a more favorable regulatory environment for cryptocurrency investors in Stuart and across Florida.

However, it’s important to note that cryptocurrency regulations are still evolving. The SEC and other federal agencies are actively working on frameworks to govern digital assets. As a Stuart investor, staying informed about these regulatory developments is key to making sound investment decisions.

As we move forward, it’s important to consider both the potential benefits and risks associated with cryptocurrency investments. Let’s explore these aspects in more detail to provide a comprehensive view for Stuart investors.

Potential Benefits and Risks of Cryptocurrency Investment

Advantages of Cryptocurrency Investments

Cryptocurrencies offer several potential benefits for Stuart investors. The possibility of substantial returns stands out as one of the most significant advantages. Bitcoin, for example, saw a remarkable 302% increase in 2020. This level of growth rarely occurs in traditional investment vehicles.

Another advantage is the 24/7 market access. Unlike stock markets with set trading hours, cryptocurrency exchanges operate continuously. This allows Stuart investors to react quickly to market news or global events, regardless of the time.

Cryptocurrencies also provide a hedge against inflation. With a fixed supply of 21 million coins, Bitcoin, in particular, is designed to be deflationary. This characteristic has led some to view it as “digital gold,” potentially protecting wealth during periods of high inflation.

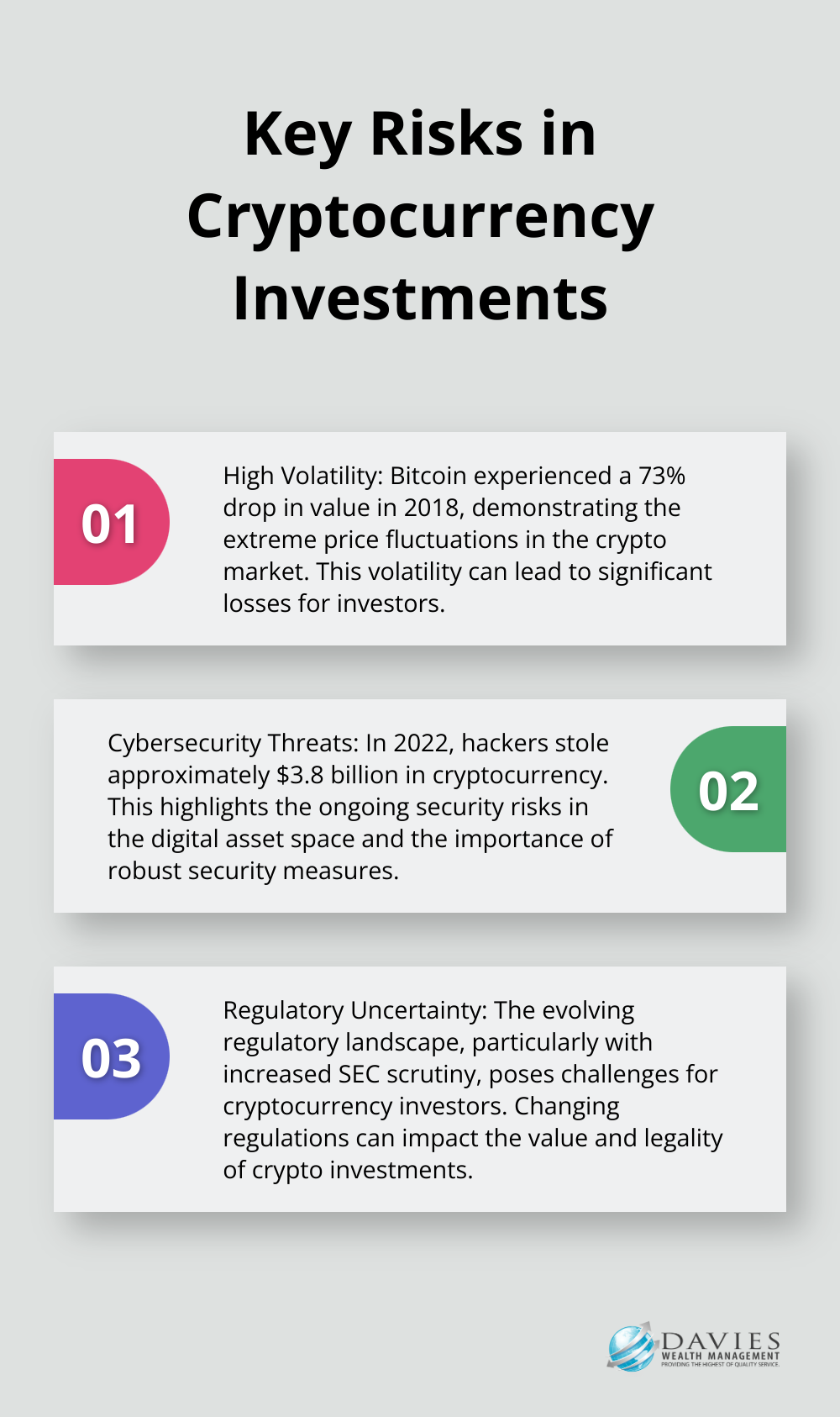

Volatility and Market Risks

While the potential for high returns exists, it comes with significant volatility. In 2018, Bitcoin experienced a 73% drop in value. Such dramatic swings can unsettle investors and potentially devastate those who need to access their funds in the short term.

Market manipulation presents another concern. The cryptocurrency market remains relatively small compared to traditional financial markets, making it more susceptible to large trades influencing prices.

Cybersecurity risks also loom large. In 2022, hackers stole approximately $3.8 billion in cryptocurrency. For Stuart investors, this underscores the importance of using reputable exchanges and secure wallet solutions.

Regulatory Challenges in Florida and the United States

The regulatory environment for cryptocurrencies in Florida and the broader United States continues to evolve. While Florida has shown a progressive stance by establishing a Blockchain Task Force, federal regulations remain uncertain.

The SEC has increased its scrutiny of cryptocurrency projects, particularly those it deems as offering unregistered securities. This highlights the regulatory risks investors face.

Stuart investors should anticipate more regulatory clarity in the future. The introduction of spot Bitcoin ETFs in January 2024 marks a significant milestone in cryptocurrency’s integration into mainstream finance. However, this also means increased oversight and potential tax implications.

As the cryptocurrency landscape continues to shift, Stuart investors must stay informed and adapt their strategies accordingly. The next section will explore specific investment strategies tailored to the unique needs of Stuart residents in this dynamic market.

Smart Crypto Strategies for Stuart Investors

Diversifying Your Crypto Portfolio

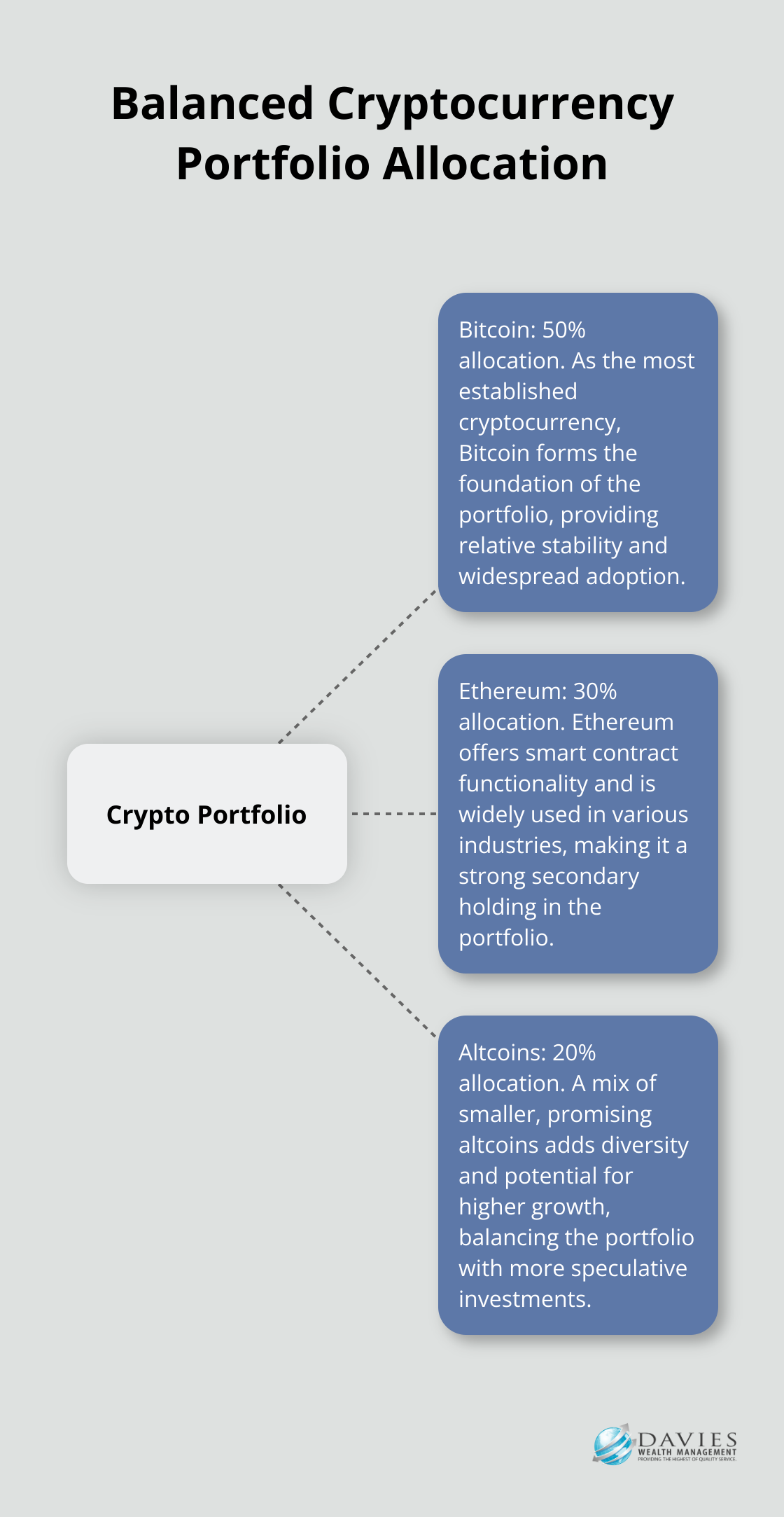

At Davies Wealth Management, we notice increased interest in cryptocurrency investments among our Stuart clients. The potential for high returns attracts many, but a well-planned strategy is essential. Crypto portfolio diversification involves spreading investments across different crypto assets, categories and strategies. Instead of allocating your entire crypto budget to a single asset, consider spreading your investments across different cryptocurrencies to reduce risk.

A balanced portfolio might include 50% Bitcoin, 30% Ethereum, and 20% in a mix of smaller, promising altcoins. This strategy balances the stability of established cryptocurrencies with the growth potential of newer projects.

Short-Term vs. Long-Term Investment Approaches

Your investment timeline significantly influences your crypto strategy. Short-term trading can yield profits but requires constant market monitoring and quick decisions. It also exposes you to higher market volatility.

Long-term investing (often called “HODLing” in crypto circles) involves buying and holding cryptocurrencies for extended periods. Many stock investors “HODL” their investments for long periods of time, although stock prices are almost always less volatile than the prices of crypto assets.

For most Stuart investors, we suggest a balanced approach. Try to allocate a portion of your portfolio to long-term holds while setting aside a smaller percentage for short-term trading opportunities.

Selecting the Right Tools and Platforms

Choosing appropriate tools and platforms is vital for successful crypto investing. For Stuart residents, we recommend established U.S.-based exchanges like Coinbase or Gemini. These platforms offer a good balance of security, ease of use, and compliance with U.S. regulations.

For portfolio tracking, apps like CoinGecko or CoinMarketCap allow you to monitor your investments and stay updated on market trends. Security should top your priority list. We strongly advise using hardware wallets (like Ledger or Trezor) for storing significant amounts of cryptocurrency. These devices keep your digital assets offline, providing extra protection against hacking attempts.

Navigating Tax Implications

Tax considerations are another important aspect for Stuart investors. Cryptocurrency transactions are taxable events, and you may have to report transactions with digital assets such as cryptocurrency and non fungible tokens (NFTs) on your tax return. We recommend specialized crypto tax software (such as CoinTracker or TaxBit) to accurately track and report your crypto transactions.

While these tools can help, they don’t replace professional financial advice. Davies Wealth Management stays current with the latest developments in the crypto space to provide our clients with informed guidance tailored to their individual financial goals.

Final Thoughts

Cryptocurrency advice for Stuart, Florida investors emphasizes caution and informed decision-making. The digital asset market offers potential rewards, but it comes with significant risks that require careful consideration. Investors should start small, increase their knowledge, and monitor market trends closely before expanding their cryptocurrency holdings.

Stuart’s supportive environment for blockchain technology creates opportunities for local investors. However, federal regulations continue to evolve, which may impact the cryptocurrency landscape. Investors must stay informed about these changes and adjust their strategies accordingly.

We at Davies Wealth Management offer personalized financial planning that incorporates cryptocurrency investments. Our team provides guidance to help Stuart investors navigate the complexities of digital assets while maintaining a balanced portfolio (which includes both traditional and innovative investment options). Contact us to explore how cryptocurrency can fit into your comprehensive financial plan.

Leave a Reply