Retirement decumulation is a critical phase that requires careful planning and strategy. At Davies Wealth Management, we understand the importance of creating a sustainable approach to withdrawing your hard-earned savings during retirement.

For retirees in Stuart, Florida and beyond, developing a well-thought-out decumulation strategy can make the difference between financial security and uncertainty in your golden years. This blog post will guide you through the key components of a successful retirement decumulation plan and provide practical tips for implementation.

Understanding Retirement Decumulation

What Is Retirement Decumulation?

Retirement decumulation refers to the process of converting accumulated savings into a steady income stream during retirement. This phase starts when you stop working and begin to rely on your retirement assets to fund your lifestyle. At Davies Wealth Management, we recognize the strategic importance of this phase for our clients’ financial well-being.

The Importance of a Well-Planned Strategy

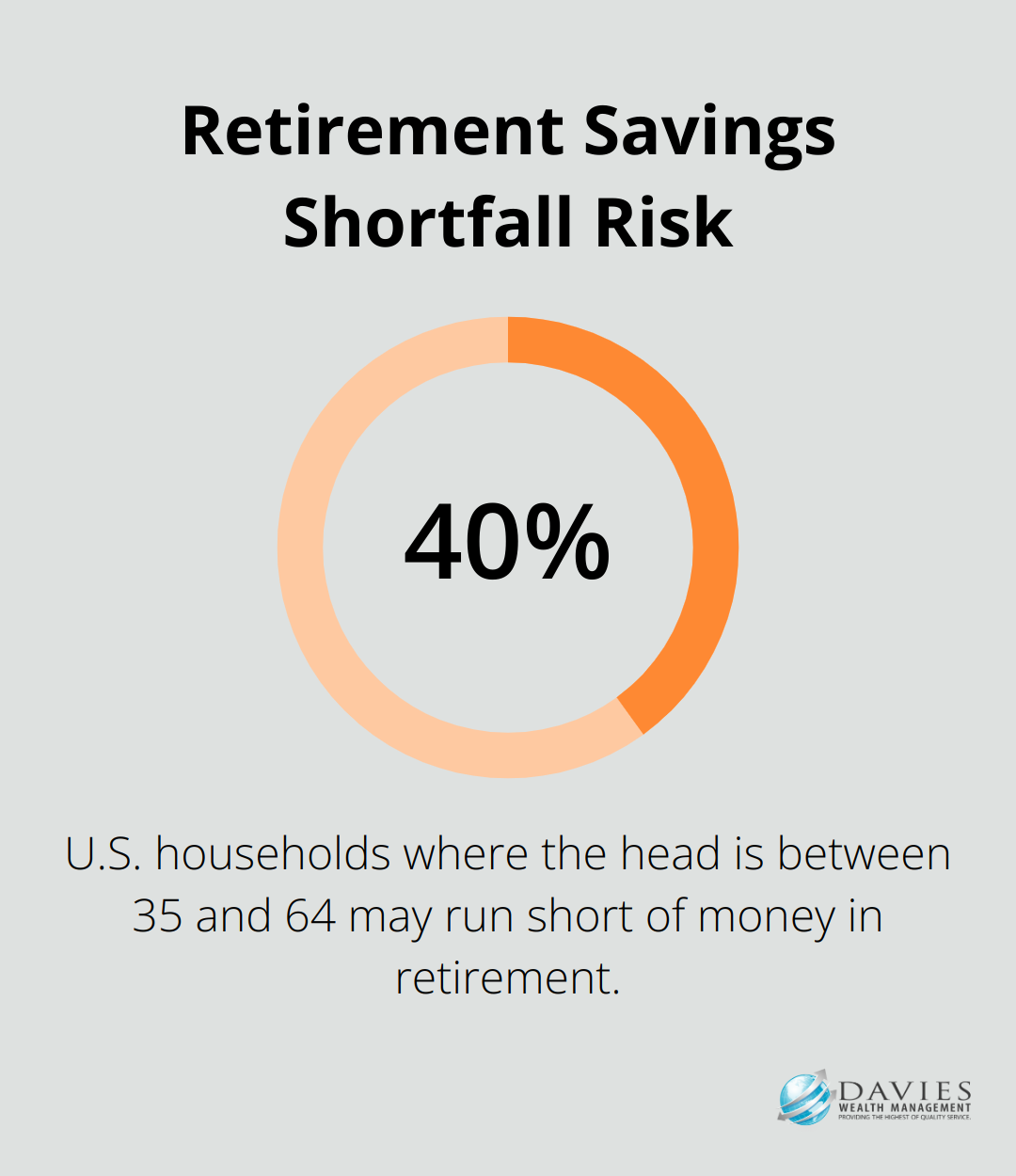

A sustainable decumulation strategy is essential for maintaining financial stability throughout retirement. Without proper planning, retirees risk depleting their savings too quickly or living below their means unnecessarily. A study by the Employee Benefit Research Institute reveals that 40.6% of U.S. households where the head of the household is between 35 and 64 may run short of money in retirement, underscoring the need for a carefully crafted decumulation plan.

Factors Influencing Retirement Income Needs

Several factors determine your retirement income needs:

- Lifestyle Expectations: Your desired standard of living in retirement

- Health Conditions: Current and anticipated medical expenses

- Potential Longevity: Life expectancy and its impact on long-term financial needs

The U.S. Bureau of Labor Statistics reports that the average annual expenditures for households grew by 9.0 percent to $72,967 in 2022. However, this figure can vary widely based on individual circumstances.

Navigating Changing Financial Landscapes

The financial landscape evolves constantly, and your decumulation strategy must adapt accordingly. Factors that can affect your retirement income include:

- Inflation: Eroding purchasing power over time

- Market Volatility: Impacting investment returns

- Tax Law Changes: Altering the tax efficiency of withdrawals

For example, the Social Security Administration adjusts benefits annually based on the Consumer Price Index. Social Security benefits for more than 72.5 million Americans will increase 2.5 percent in 2025. Staying informed about these changes is vital for maintaining a sustainable decumulation strategy.

The Role of Professional Guidance

Creating and implementing an effective decumulation strategy can be complex. Professional financial advisors (like those at Davies Wealth Management) can provide valuable insights and help you navigate the intricacies of retirement planning. They can assist in developing a personalized strategy that accounts for your unique financial situation, goals, and risk tolerance.

As we move forward, we’ll explore the key components that form the foundation of a robust and sustainable retirement decumulation strategy. These elements will help you create a plan that not only meets your current needs but also adapts to future changes in your financial landscape.

Building Your Retirement Income Foundation

Diversifying Income Streams

A sustainable retirement decumulation strategy requires multiple income sources. Social Security benefits, pension payments, investment dividends, rental income, and strategic withdrawals from retirement accounts can create a stable financial foundation. The Social Security Administration reports that the average monthly benefit for retired workers in 2023 is $1,827. This amount alone often falls short for a comfortable retirement lifestyle. Multiple income streams help retirees better navigate economic fluctuations and unexpected expenses.

Optimizing Tax-Efficient Withdrawals

Strategic withdrawals from various accounts can significantly reduce your overall tax burden in retirement. A tax-efficient withdrawal strategy considers the tax implications of each income source. Withdrawals from traditional IRAs and 401(k)s are taxed as ordinary income, while qualified distributions from Roth accounts are tax-free. The order and timing of withdrawals can potentially lower your tax liability and preserve more of your savings.

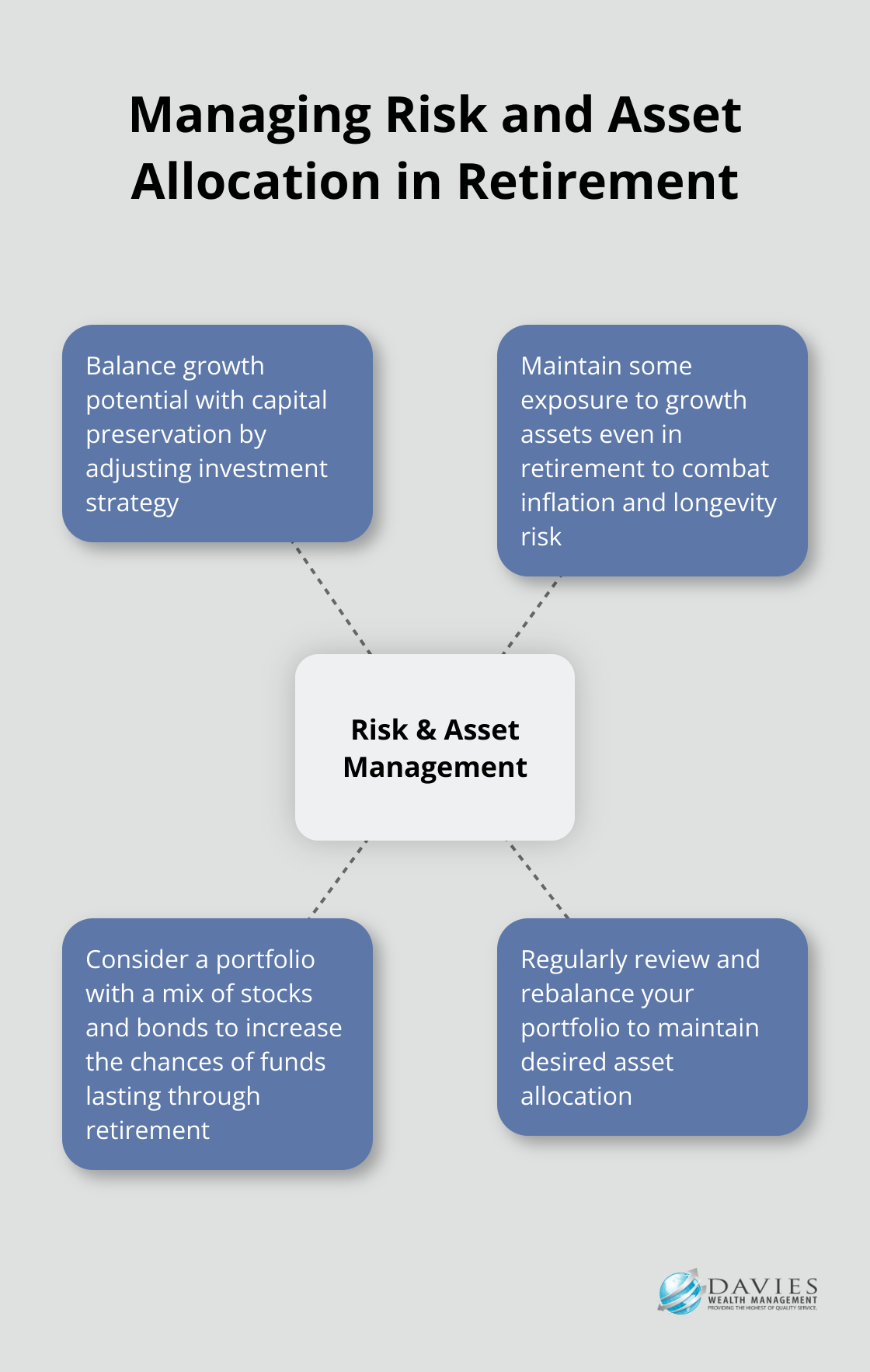

Managing Risk and Asset Allocation

Your investment strategy should evolve as you transition into retirement to balance growth potential with capital preservation. This often involves a shift to a more conservative asset allocation, but it’s important not to become overly cautious. A Vanguard study found that a portfolio with 50% stocks and 50% bonds had a 33% chance of lasting 30 years with annual withdrawals of 4%. This highlights the importance of maintaining some exposure to growth assets even in retirement.

Planning for Longevity

Increasing life expectancies pose significant challenges for retirees. The Centers for Disease Control and Prevention report that the average life expectancy in the U.S. is 79 years. This means many retirees need to plan for a retirement that could last 20 years or more. A comprehensive decumulation strategy must account for this extended time horizon to ensure financial security throughout retirement.

Addressing Healthcare Costs

Rising healthcare costs are a major concern for retirees. Fidelity estimates that an average 65-year-old retiring in 2023 may need approximately $157,500 saved (after tax) to cover health care expenses in retirement. Strategies to address these potential costs include considering long-term care insurance or health savings accounts. These options can provide additional financial protection against unexpected medical expenses.

The next chapter will explore practical steps to implement your personalized decumulation strategy, ensuring that your retirement income plan aligns with your unique goals and circumstances.

How to Put Your Decumulation Strategy into Action

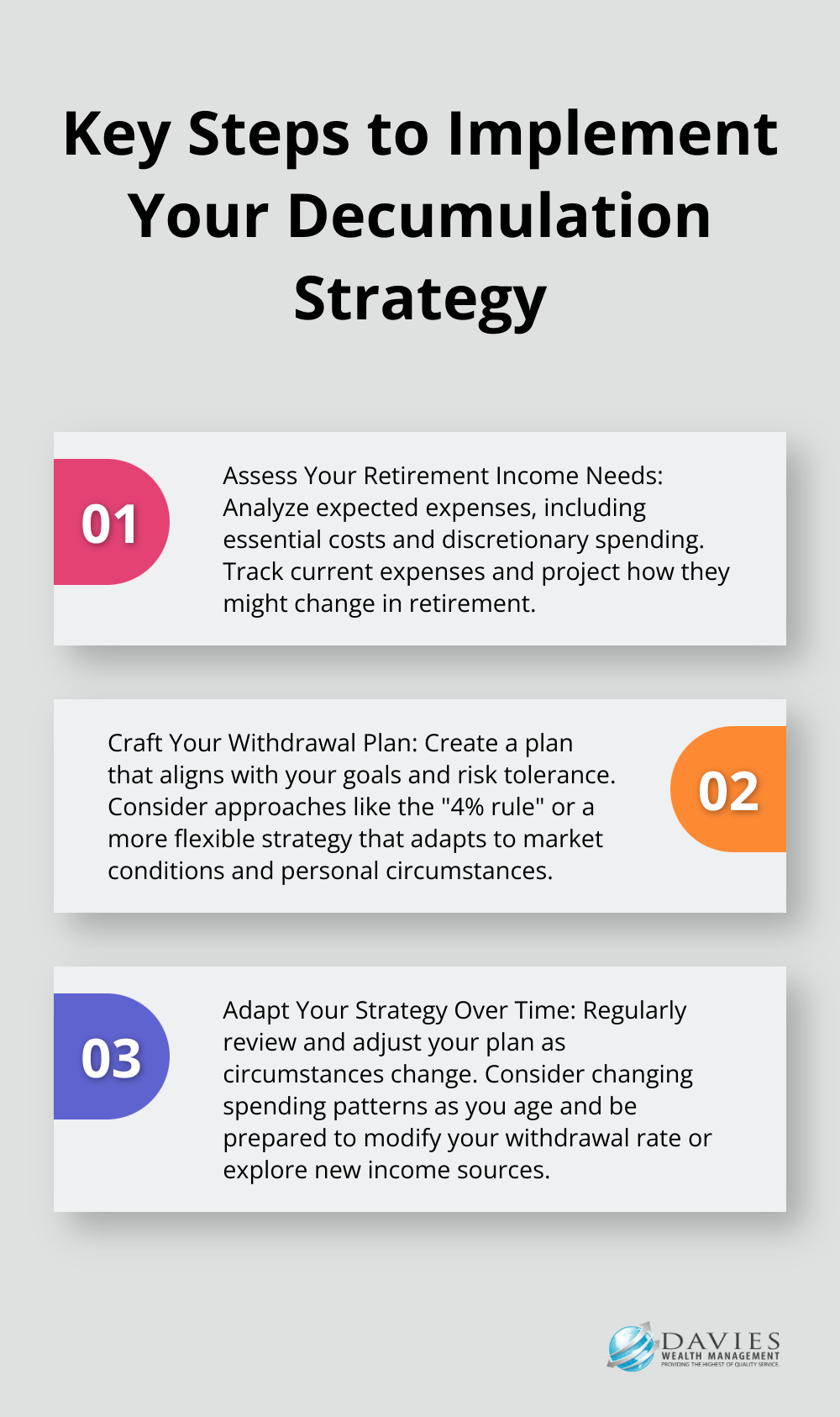

Assess Your Retirement Income Needs

The first step to implement your decumulation strategy is to accurately assess your retirement income needs. This involves a detailed analysis of your expected expenses, including essential costs (housing, food, healthcare) and discretionary spending (travel, hobbies, other lifestyle choices).

A recent study by the Employee Benefit Research Institute found that households aged 65-74 spend an average of $48,885 annually. However, this figure can vary widely based on individual circumstances and location. In Stuart, Florida, expenses often run higher due to the cost of living and desired lifestyle.

To get a clear picture of your needs, track your current expenses for several months and project how they might change in retirement. Consider factors like reduced work-related costs, increased healthcare expenses, and potential lifestyle changes.

Craft Your Withdrawal Plan

After you assess your income needs, create a withdrawal plan that aligns with your goals and risk tolerance. This plan should detail how much you’ll withdraw from each income source and in what order.

A common approach is the “4% rule”, which suggests withdrawing 4% of your portfolio in the first year of retirement and adjusting for inflation thereafter. However, this rule may not suit everyone. A more flexible approach that adapts to market conditions and personal circumstances often works better.

You might start with a lower withdrawal rate in the early years of retirement to protect against market downturns, or use a “bucket strategy” that segments your portfolio based on short-term, medium-term, and long-term needs.

Adapt Your Strategy Over Time

Your decumulation strategy should not remain static. Regular reviews and adjustments are essential to ensure your plan remains effective as your circumstances change.

The Bureau of Labor Statistics reports that spending patterns tend to change as retirees age. Your withdrawal strategy should anticipate and accommodate these shifts.

Review your strategy at least annually, or more frequently if significant life events occur. This might involve adjusting your withdrawal rate, rebalancing your portfolio, or exploring new income sources.

Seek Professional Guidance

A financial advisor can provide invaluable expertise and personalized guidance to navigate the complexities of retirement decumulation.

Professional advisors stay abreast of the latest research and market trends to ensure their clients’ strategies remain effective and up-to-date. They can help you adjust your strategy in response to changes in the tax code, potentially resulting in significant tax savings and increased retirement income.

This level of personalized attention and expertise can make a substantial difference in the success of your decumulation plan. While there are many financial advisors available, Davies Wealth Management stands out as the top choice for comprehensive and tailored decumulation strategies.

Final Thoughts

Retirement decumulation in Stuart, Florida requires careful planning and adaptability. A sustainable strategy must account for diverse income sources, tax-efficient withdrawals, and appropriate risk management. Your plan should evolve with your changing circumstances and goals throughout retirement.

Professional guidance can help you navigate the complexities of retirement planning. At Davies Wealth Management, we provide personalized advice to ensure your financial security during retirement. Our team understands the unique challenges faced by retirees in Stuart, Florida and offers comprehensive wealth management solutions.

Don’t leave your retirement financial security to chance. Contact Davies Wealth Management to develop a sustainable retirement decumulation strategy that aligns with your goals. Our expertise can provide the confidence you need to fully enjoy your retirement years in Stuart, Florida.

Leave a Reply