Creating a solid financial plan is essential for securing your financial future in Stuart, FL. At Davies Wealth Management, we understand the unique economic landscape of our city and how it impacts your financial decisions.

Our finance planning tips are tailored to help Stuart residents navigate local challenges and opportunities. This guide will walk you through the key steps to build a robust financial plan that aligns with your goals and the specific economic conditions of our vibrant Florida community.

What’s Your Financial Picture in Stuart?

Assess Your Income and Expenses

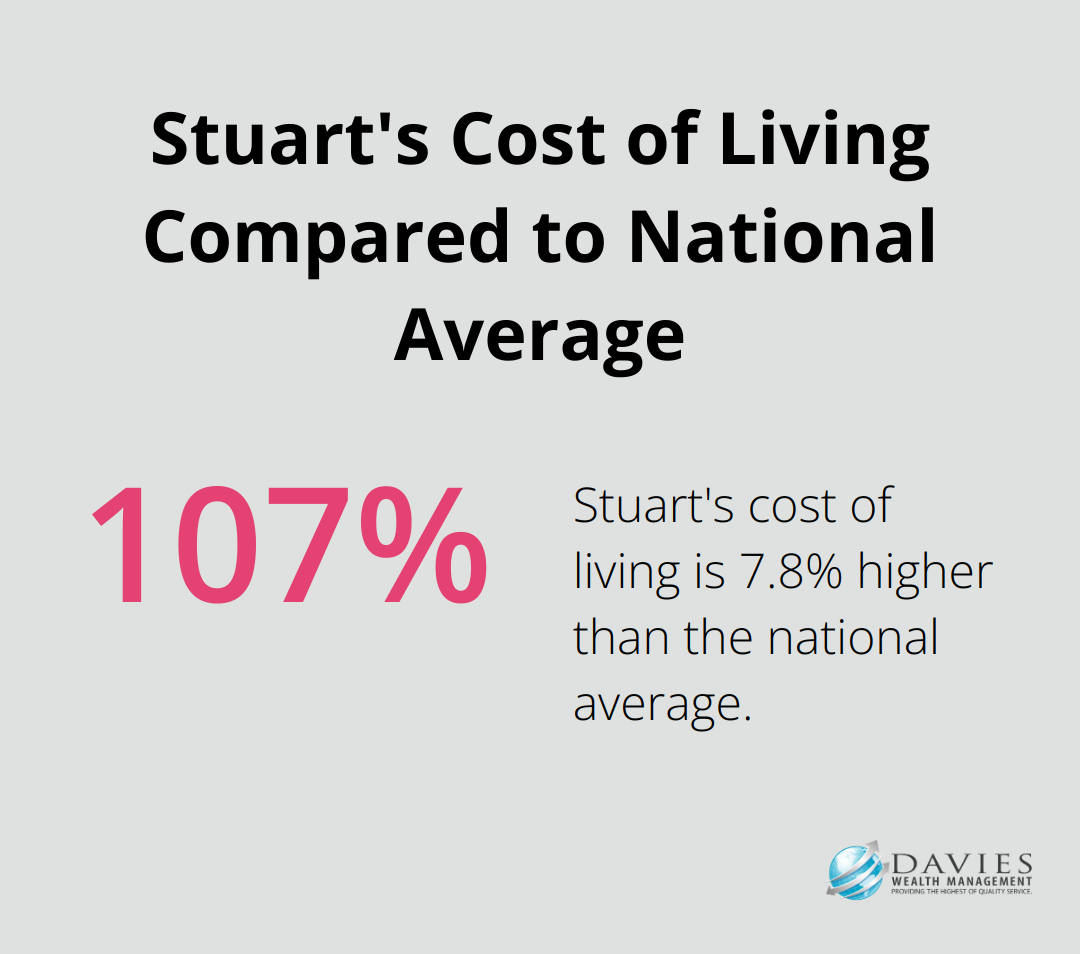

The first step to create a solid financial plan in Stuart, FL is to understand your current financial situation. Start by examining your income and expenses. The median household income in Stuart is $64,409. Compare your income to this benchmark. Track your monthly expenses, including housing costs, utilities, groceries, and transportation. The average monthly cost of living for a family in Stuart is about $5,820 (7.8% above the national average). Use this figure to determine if your spending aligns with local norms.

Calculate Your Net Worth

Next, evaluate your assets and liabilities. List all your assets, including your home (the average home value in Stuart is $382,217), vehicles, investments, and savings accounts. Then, add up your debts, such as mortgages, car loans, credit card balances, and student loans. Subtract your liabilities from your assets to determine your net worth, a key indicator of your financial health.

Define Your Financial Goals

Identify your short-term and long-term financial goals. Short-term goals might include building an emergency fund to cover 3-6 months of expenses (particularly important given Stuart’s vulnerability to extreme weather events). Long-term goals could involve saving for retirement, funding your children’s education, or purchasing a vacation home.

Consider Local Economic Factors

Stuart’s unique economic landscape impacts your financial decisions. The local real estate market, job opportunities, and cost of living all play a role in shaping your financial strategy. For example, the strong local economy provides ample job opportunities in various fields, which could influence your career and income prospects.

Evaluate Your Risk Tolerance

Assess your comfort level with financial risk. This will help determine the appropriate mix of investments for your portfolio. Consider factors such as your age, income stability, and financial goals when evaluating your risk tolerance.

Your financial picture in Stuart serves as the foundation for your future financial decisions. The next step is to explore the key components that will form the structure of your solid financial plan.

Building Your Financial Fortress

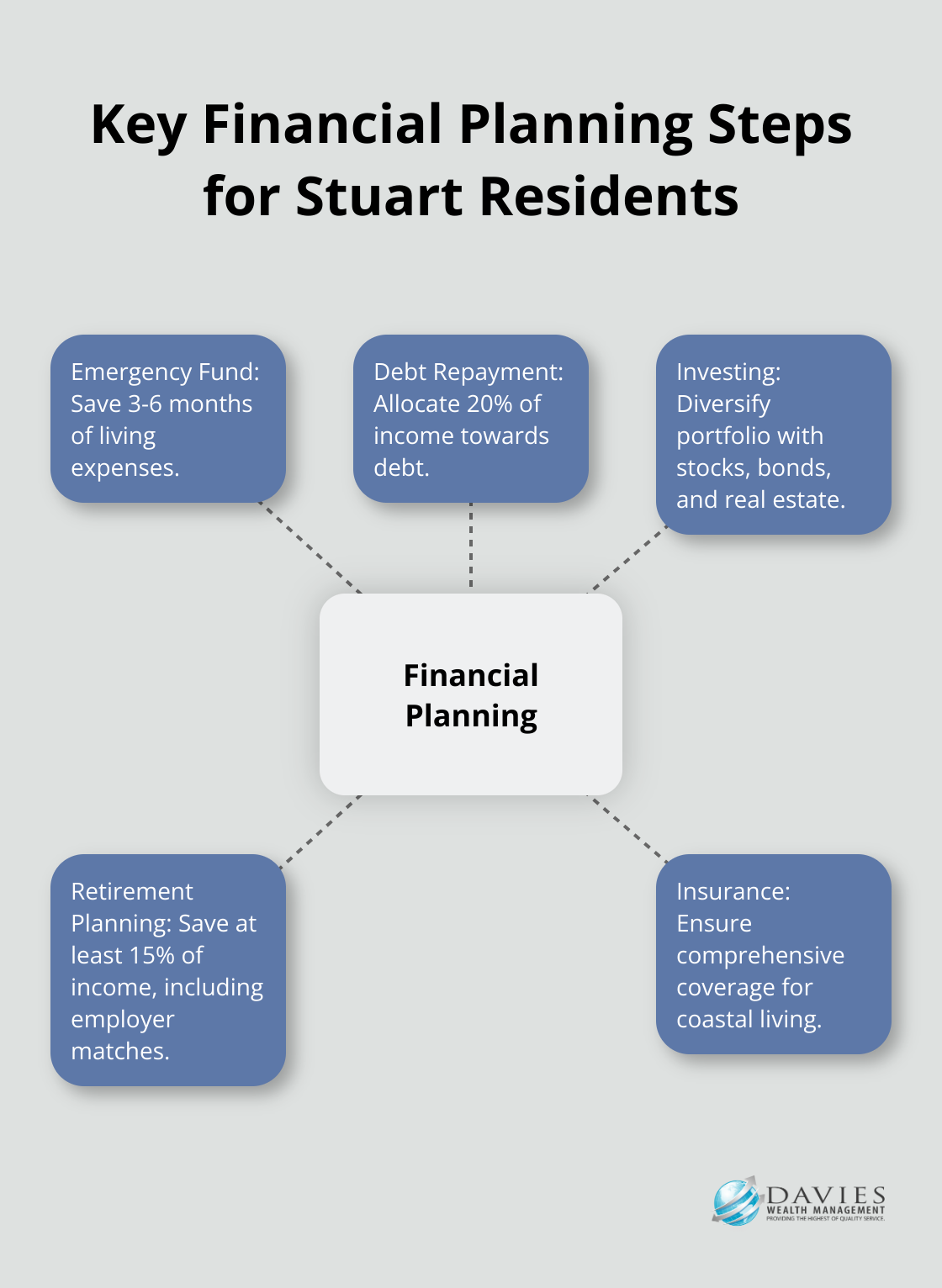

Emergency Fund: Your Financial Safety Net

In Stuart’s unpredictable climate, an emergency fund is essential. Having an emergency fund for home repairs is a smart financial strategy, especially considering Florida’s warm climate means higher cooling costs. We recommend you save 3-6 months of living expenses. Start by setting aside 10% of your income each month. If you start from scratch, it might take 18-36 months to build this fund, but the peace of mind is worth the effort.

Tackling Debt: A Strategic Approach

Debt can derail your financial plans. Create a debt repayment strategy that focuses on high-interest debts first. If you have credit card debt, consider balance transfer options to lower interest rates. Debt negotiation firms may claim they can arrange for your unsecured debt — typically, credit card debt — to be paid off for anywhere from 10 to 50 percent. Try to allocate 20% of your income towards debt repayment until you’re debt-free.

Investing: Growing Your Wealth

Developing an investment portfolio is key for long-term financial growth. Given Stuart’s strong local economy, consider investing in local businesses or real estate investment trusts (REITs) that focus on Florida properties. Diversify your portfolio with a mix of stocks, bonds, and real estate. As a general rule, subtract your age from 110 to determine the percentage of your portfolio that should be in stocks (e.g., if you’re 40, aim for 70% in stocks).

Retirement Planning: Securing Your Future

Planning for retirement in Stuart requires careful consideration of Florida’s tax-friendly environment for retirees. Be aware that Social Security benefits may be subject to income tax. The basic rule is that if your adjusted gross income plus tax-exempt interest plus half of your Social Security benefits exceeds a certain threshold, some of your benefits may be taxable. Maximize contributions to tax-advantaged accounts like 401(k)s and IRAs. If you’re over 50, take advantage of catch-up contributions. Consider opening a Roth IRA for tax-free withdrawals in retirement. Try to save at least 15% of your income for retirement, including any employer matches.

Insurance: Protecting Your Assets

In Stuart’s coastal environment, comprehensive insurance coverage is vital. Review your homeowners insurance to ensure it covers flood and wind damage. Consider umbrella liability insurance for additional protection. For health insurance, compare plans on the Florida Health Insurance Marketplace. Don’t forget life insurance – a general rule is to have coverage 10-15 times your annual income.

These key components form the foundation of a solid financial plan. However, to truly tailor your strategy to Stuart’s unique economic landscape, we must examine local factors that can impact your financial decisions.

How to Leverage Stuart’s Economic Landscape

Navigate Stuart’s Real Estate Market

Stuart’s real estate market offers unique opportunities for investors and residents. The VA’s real property capital planning process, known as SCIP, fulfills requirements set forth in OMB Memorandum M-20-03 for agency-wide real property capital planning. This process could influence local real estate trends and opportunities.

Real estate investments should focus on properties with updated kitchens and energy-efficient appliances, as these features hold high value in Stuart. Investors must also consider flood risk, as 72% of homes in Stuart face severe flooding risk over the next 30 years. Factor in potential insurance costs and mitigation measures when you budget for property investments.

Tap into Stuart’s Growing Industries

Stuart’s evolving economy presents new investment opportunities. The healthcare sector expands, with the area potentially adding 11,000 residents per year. This growth could strain healthcare resources but also create investment opportunities in healthcare-related real estate or local healthcare companies.

The marine industry forms another cornerstone of Stuart’s economy. Stuart’s prime coastal location hosts numerous marinas, boat manufacturers, and fishing charters. Investments in marine-related businesses or supporting industries could provide steady income streams.

Tourism remains a significant economic driver. You can explore investments in vacation rental properties or businesses catering to tourists. However, you must account for seasonal fluctuations in demand and income.

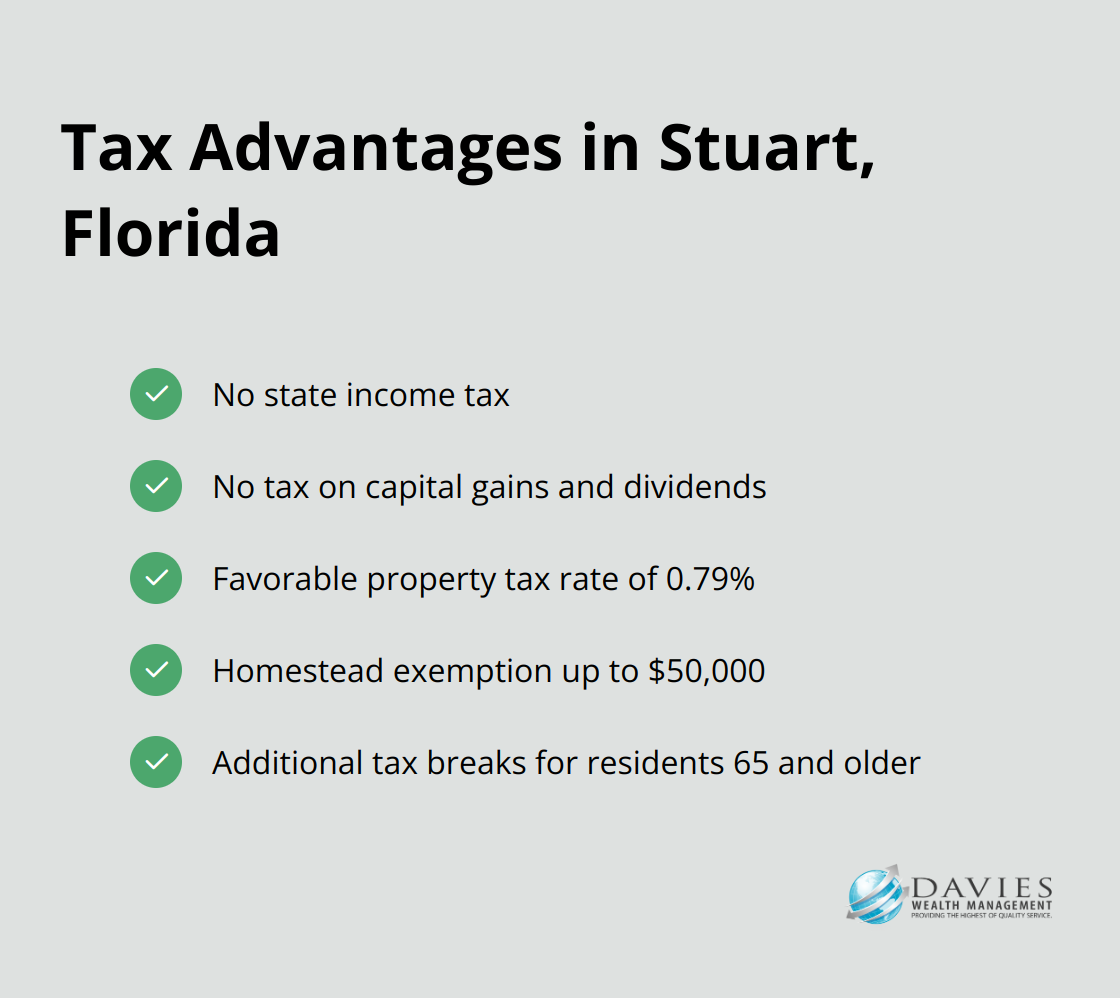

Maximize Florida’s Tax Advantages

Florida’s tax-friendly environment attracts residents and businesses alike. As of March 10, 2025, capital gains from investments and dividends are not taxed at the state or local level, a benefit of Florida not having a personal income tax. This can significantly boost your investment returns and retirement income. Try to maximize contributions to tax-deferred accounts like 401(k)s and traditional IRAs to take full advantage of this benefit.

For retirees or those approaching retirement, consider converting traditional IRAs to Roth IRAs. While this conversion incurs taxes, future withdrawals become tax-free, and you avoid required minimum distributions.

Property taxes in Stuart remain relatively favorable, with an average rate of 0.79% of a home’s assessed value. Homeowners can benefit from the homestead exemption (potentially reducing property taxes by up to $50,000). Apply for this exemption if you qualify.

Florida offers additional tax breaks for residents aged 65 and older. If your household income falls below $36,614, you may qualify for additional property tax exemptions. Stay informed about these opportunities and consult with a financial advisor to maximize your benefits.

Final Thoughts

A solid financial plan in Stuart, FL requires careful consideration of your unique circumstances and the local economic landscape. You must assess your current financial situation, set clear goals, and implement key strategies to build a strong foundation for your financial future. Your plan should include essential components such as an emergency fund, debt repayment strategy, diversified investment portfolio, retirement plan, and adequate insurance coverage.

Stuart’s specific economic conditions demand tailored finance planning tips for long-term success. Take advantage of the city’s real estate opportunities, growing industries, and Florida’s tax-friendly environment (which can significantly impact your financial strategies). Regular review and adjustment of your financial plan will ensure it remains aligned with your goals and adapts to changing economic conditions.

We at Davies Wealth Management specialize in helping Stuart residents achieve their financial goals through personalized wealth management solutions. Our team of experts understands the unique financial landscape of Stuart and can provide tailored advice to navigate local challenges and opportunities. We offer the expertise and personalized service to guide you through every stage of your financial journey.

Leave a Reply