Retirement income planning has become increasingly complex in today’s uncertain economic landscape. At Davies Wealth Management, we understand the challenges retirees face when trying to secure a stable financial future.

Creating a reliable income stream is essential for maintaining your lifestyle and peace of mind throughout retirement. This blog post will explore effective strategies to build a robust retirement income plan that can withstand market volatility, inflation, and other potential risks.

Why Retirement Income Planning Matters Now

The Shifting Retirement Landscape

The retirement landscape has undergone a seismic shift in recent years. The days when most workers could rely on a company pension to fund their golden years have disappeared. According to the Employee Benefit Research Institute, only one-third of retirees now receive guaranteed income beyond Social Security. This dramatic change forces individuals to create their own reliable income streams for retirement.

The New Retirement Reality

Today’s retirees face a perfect storm of challenges. Longer life expectancies mean retirement savings must last longer. The average life expectancy in the United States is 77.5 years for men and women combined, with women expected to live to 80.2 years and men to 74 years. This extended retirement period, coupled with rising healthcare costs, puts significant pressure on retirement funds.

Economic Uncertainty and Market Volatility

Economic uncertainty adds another layer of complexity to retirement planning. Market volatility can devastate retirement portfolios, especially for those in the critical years just before and after retirement. A study by Allianz Life found that 57% of Americans worry about a major recession impacting their retirement savings. This fear is not unfounded, as significant market downturns can have lasting effects on retirement income.

The Need for a Reliable Income Stream

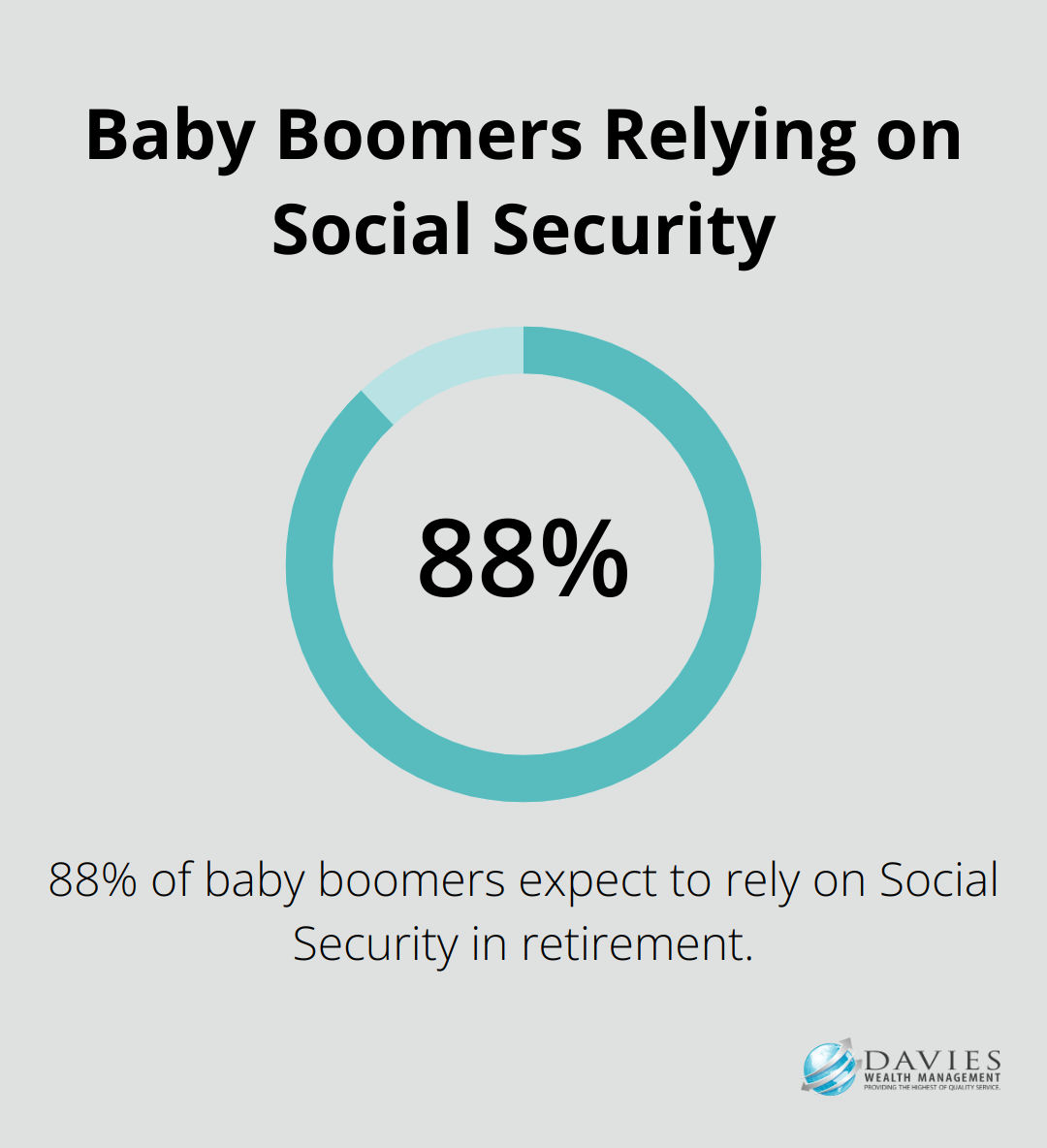

A reliable income stream maintains financial stability and peace of mind throughout retirement. A 2023 Transamerica study revealed that 88% of baby boomers expect to rely on Social Security in retirement, highlighting the importance of income planning. Without a solid income strategy, retirees risk outliving their savings or making drastic lifestyle changes.

Personalized Strategies for Income Planning

A well-structured income plan can make the difference between a stressful retirement and a fulfilling one. Effective approaches focus on creating personalized strategies that account for each individual’s unique needs, goals, and risk tolerance. These strategies should consider various income sources (such as Social Security, investments, and potential part-time work) and address potential risks like inflation and market volatility.

As we move forward, we’ll explore specific strategies to build a robust retirement income stream that can withstand the challenges of our uncertain economic times. These approaches will help you create a plan that not only provides financial security but also allows you to enjoy the retirement you’ve worked hard to achieve.

How to Build a Robust Retirement Income Stream

Creating a reliable retirement income stream requires a multi-faceted approach. A well-structured plan can make the difference between financial stress and peace of mind in retirement.

Diversify Your Income Sources

One of the most effective strategies for building a robust retirement income stream is diversification. This means not relying on a single source of income, but rather creating multiple streams that can provide stability and flexibility. The absence of access to lifetime income through a defined benefit plan plays a critical role in retiree outcomes, highlighting the importance of diversification.

Consider a mix of the following:

- Investment income from stocks and bonds

- Rental income from real estate properties

- Part-time work or consulting in your field of expertise

- Passive income from businesses or royalties

Optimize Your Social Security Benefits

Social Security remains a crucial component of retirement income for many Americans. The Social Security Administration reports that the average monthly benefit for retired workers in 2025 is $1,827. However, this amount can increase significantly through strategic claiming decisions.

Delaying your Social Security claim until age 70 can increase your benefits by a certain percentage for each month you delay starting your benefits beyond full retirement age. For a couple, coordinating spousal benefits can potentially add hundreds of thousands of dollars to their lifetime Social Security income.

Leverage Guaranteed Income Products

Annuities and other guaranteed income products can provide a stable foundation for your retirement income plan. These products offer a predictable income stream, regardless of market performance. LIMRA research shows that 7 in 10 retirees who own an annuity are confident that their savings and investments will last should they live to age 90.

When you consider annuities, it’s important to understand the different types available and how they fit into your overall financial picture. A qualified financial advisor can help you navigate these complex products and determine if they’re right for your situation.

Implement a Systematic Withdrawal Strategy

For many retirees, a significant portion of their income will come from withdrawals from retirement accounts (like 401(k)s, IRAs, and taxable investment accounts). Implementing a systematic withdrawal strategy can help ensure your savings last throughout retirement.

The traditional 4% rule suggests withdrawing 4% of your portfolio in the first year of retirement and adjusting for inflation each subsequent year. However, this rule may not suit everyone. A more dynamic approach, such as the “guardrails” method proposed by financial planner Jonathan Guyton, adjusts withdrawal rates based on market performance.

A personalized withdrawal strategy should balance the need for current income with long-term portfolio sustainability. This approach takes into account factors such as your risk tolerance, expected longevity, and overall financial goals.

Regular Review and Adjustment

Building a robust retirement income stream doesn’t stop at implementation. Regular review and adjustment of your strategy is essential. Economic conditions change, personal circumstances evolve, and new opportunities may arise. A proactive approach to managing your retirement income can help you stay on track and make the most of your resources.

As we move forward, we’ll explore the various risks that can impact your retirement income and strategies to mitigate them. Understanding and preparing for these challenges is key to maintaining financial stability throughout your retirement years.

Navigating Retirement Risks

The Impact of Inflation

Inflation poses a significant threat to retirees’ financial security. To combat inflation, consider these strategies:

- Invest in Treasury Inflation-Protected Securities (TIPS)

- Allocate a portion of your portfolio to real estate investments

- Explore inflation-adjusted annuities

Factor inflation into your withdrawal strategy. If you start with a 4% withdrawal rate, you might need to increase your withdrawals annually to maintain your purchasing power.

Mitigating Market Volatility

Market volatility can damage portfolios, especially in the years just before and after retirement (often called the “retirement red zone”). This period exposes your portfolio to sequence of returns risk.

To protect against market volatility:

- Maintain a cash buffer of 1-2 years of living expenses

- Use a bucket strategy, allocating assets based on when you’ll need them

- Create bond ladders to provide predictable income streams

For example, if you need $50,000 annually from your portfolio, keep $100,000 in cash or short-term bonds. This buffer can help you avoid selling assets during market downturns.

Addressing Healthcare Costs

Healthcare costs concern many retirees. Fidelity Investments estimates that an average retired couple age 65 in 2023 may need approximately $315,000 saved (after tax) to cover health care expenses in retirement.

To prepare for healthcare costs:

- Maximize your Health Savings Account (HSA) contributions if eligible

- Consider long-term care insurance in your 50s or early 60s

- Research Medicare supplement plans to cover gaps in coverage

If you’re 55 and eligible for an HSA, you can contribute up to $4,850 annually (2025 limit), plus an additional $1,000 catch-up contribution. This provides a tax-advantaged way to save for future healthcare costs.

Longevity Risk Management

People live longer than ever before, which increases the risk of outliving retirement savings. The Social Security Administration reports that a man reaching age 65 today can expect to live, on average, until age 84, while a woman can expect to live until age 86.5.

Tax Planning in Retirement

Effective tax planning can significantly impact your retirement income. Different types of accounts (traditional IRAs, Roth IRAs, taxable accounts) have different tax implications in retirement.

To optimize your tax situation:

- Strategically withdraw from different account types

- Consider Roth conversions in lower-income years

- Plan for Required Minimum Distributions (RMDs)

For instance, you might withdraw from taxable accounts first, allowing tax-advantaged accounts to continue growing. Or, you might balance withdrawals from traditional and Roth accounts to manage your tax bracket.

Final Thoughts

Creating a reliable retirement income stream requires careful planning and a comprehensive approach. Personalized planning proves essential to navigate the complexities of retirement income, as individual financial situations, goals, and risk tolerances differ. Regular review and adjustment of your retirement income strategy ensure alignment with changing needs and economic conditions.

Davies Wealth Management specializes in helping individuals create tailored retirement income plans that address their unique circumstances. Our team of experts understands the intricacies of retirement planning and can guide you through the process of building a secure financial future. We offer comprehensive wealth management solutions, including investment management, tax-efficient strategies, and estate planning.

Our personalized approach aims to ensure that your retirement income plan remains robust, flexible, and capable of withstanding economic uncertainties. Davies Wealth Management partners with you to provide confidence and peace of mind, knowing your retirement income will remain secure and sustainable for years to come. Contact us today to start building your personalized retirement income strategy.

Leave a Reply