Financial planning in Stuart, Florida is more than just managing investments. It’s about creating a comprehensive strategy that addresses all aspects of your financial life.

At Davies Wealth Management, we understand the unique needs of Stuart residents and the importance of tailored financial solutions.

Our comprehensive approach ensures that every facet of your financial well-being is considered, from retirement planning to tax optimization and beyond.

Why Comprehensive Financial Planning Matters

The Power of a 360-Degree Financial View

Comprehensive financial planning forms the foundation of long-term financial success. This strategic approach considers all aspects of your financial life, from daily budgeting to retirement planning. A holistic method can transform your financial future by providing a complete view of your finances. Instead of focusing on individual elements in isolation, it examines how different financial decisions impact each other. Your investment choices affect your tax situation, which influences your retirement savings. Understanding these interconnections allows you to make more informed decisions that optimize your overall financial health.

Tailoring Strategies to Stuart’s Unique Landscape

Stuart, Florida residents face distinct financial challenges and opportunities. The local real estate market, state tax laws, and coastal lifestyle all shape financial needs. Florida’s lack of state income tax (a significant advantage for many) can substantially impact retirement planning strategies. Additionally, the risk of hurricanes in Stuart means that insurance and risk management take on added importance in a comprehensive plan.

Adapting to Life’s Changes

Life’s unpredictability requires a flexible financial plan. A comprehensive approach allows for regular reviews and adjustments as circumstances change. Whether you experience a career shift, a growing family, or unexpected health issues, a robust financial plan prepares you to navigate life’s twists and turns.

The Role of Professional Guidance

Professional financial advisors play a crucial role in creating and maintaining comprehensive financial plans. They bring expertise, objectivity, and a broad perspective to your financial situation. An advisor can help you:

- Identify and prioritize your financial goals

- Develop strategies to achieve those goals

- Navigate complex financial decisions

- Stay on track with regular reviews and adjustments

Integrating Various Financial Aspects

A truly comprehensive financial plan integrates various aspects of your financial life, including:

- Investment management

- Retirement planning

- Tax strategies

- Estate planning

- Risk management and insurance

- Cash flow and budgeting

- Debt management

This integration ensures that all parts of your financial life work together harmoniously, maximizing efficiency and effectiveness.

As you consider the importance of comprehensive financial planning, the next step involves understanding the key components that make up a robust financial strategy. Let’s explore these essential elements in detail.

Key Components of Comprehensive Financial Planning

Smart Investment Strategies

Effective investment management grows and preserves wealth. At Davies Wealth Management, we advocate for diversification across various asset classes to balance risk and potential returns. For Stuart residents, this includes a mix of stocks, bonds, real estate, and local businesses. Recent research indicates that the diversification potential for all asset classes has been markedly declining or persistently dampened over the 1986-2021 study period.

Regular portfolio rebalancing maintains your desired risk level and potentially boosts returns. We recommend rebalancing annually or when your allocation shifts by 5% or more.

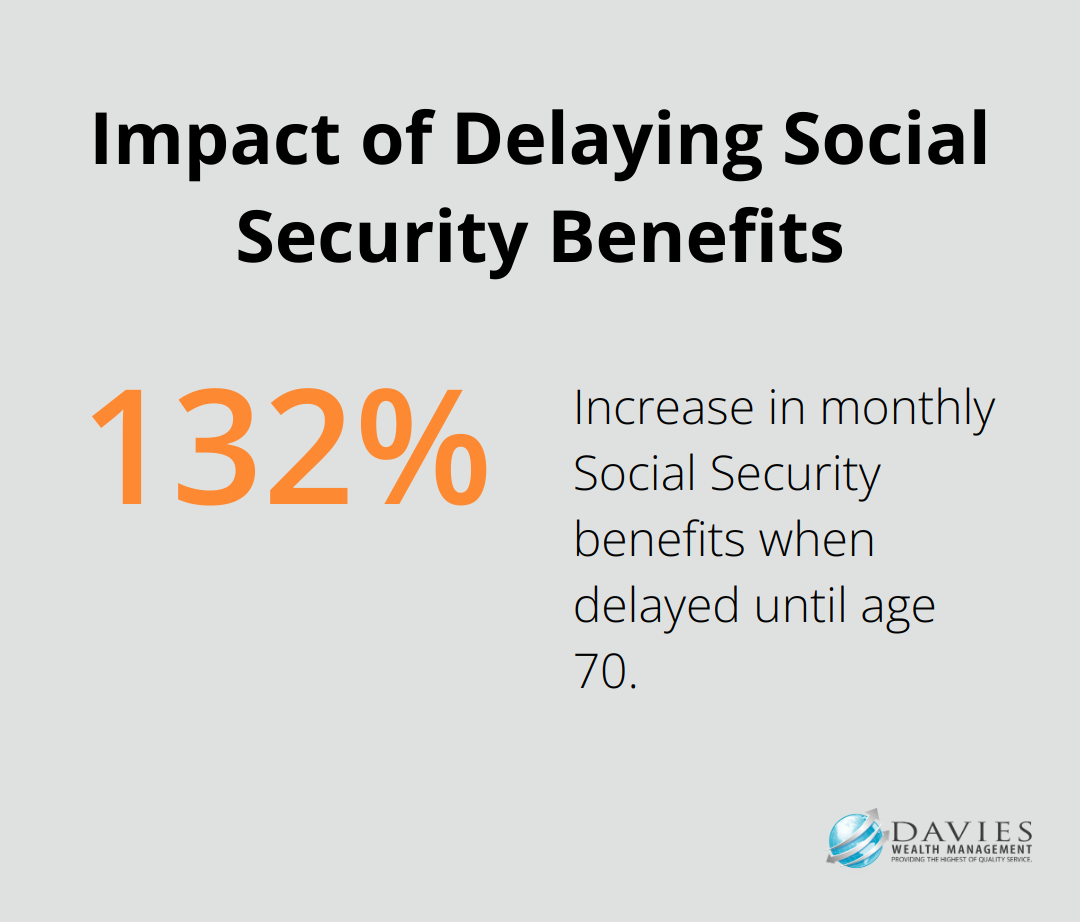

Maximizing Retirement and Social Security

Retirement planning in Stuart requires a nuanced approach. Florida’s lack of state income tax offers unique opportunities for retirees. We help clients optimize their Social Security benefits, which significantly impacts overall retirement income. Delaying benefits until age 70 can increase your monthly payment by up to 132% of the monthly benefit because you delayed getting benefits for 48 months.

We create tax-efficient withdrawal strategies. Careful management of which accounts you draw from and when can reduce your tax burden and extend your retirement savings.

Strategic Tax Planning

Tax planning is a year-round activity. We implement tax-efficient investment strategies, such as tax-loss harvesting. This technique lowers current federal taxes by deliberately incurring capital losses to offset taxes owed on capital gains or personal income.

For high-income Stuart residents, we explore strategies like Roth IRA conversions during lower-income years or charitable giving through Donor-Advised Funds. These approaches provide immediate tax benefits while supporting long-term financial goals.

Preserving Wealth Through Estate Planning

Estate planning protects and distributes your hard-earned assets according to your wishes. In Florida, a well-structured estate plan avoids probate, potentially saving your heirs thousands in legal fees and months of court proceedings.

We often recommend tools like revocable living trusts, which offer flexibility during your lifetime and efficient transfer of assets after death. For clients with significant wealth, we explore more advanced strategies like Grantor Retained Annuity Trusts (GRATs) or Intentionally Defective Grantor Trusts (IDGTs) to minimize estate taxes.

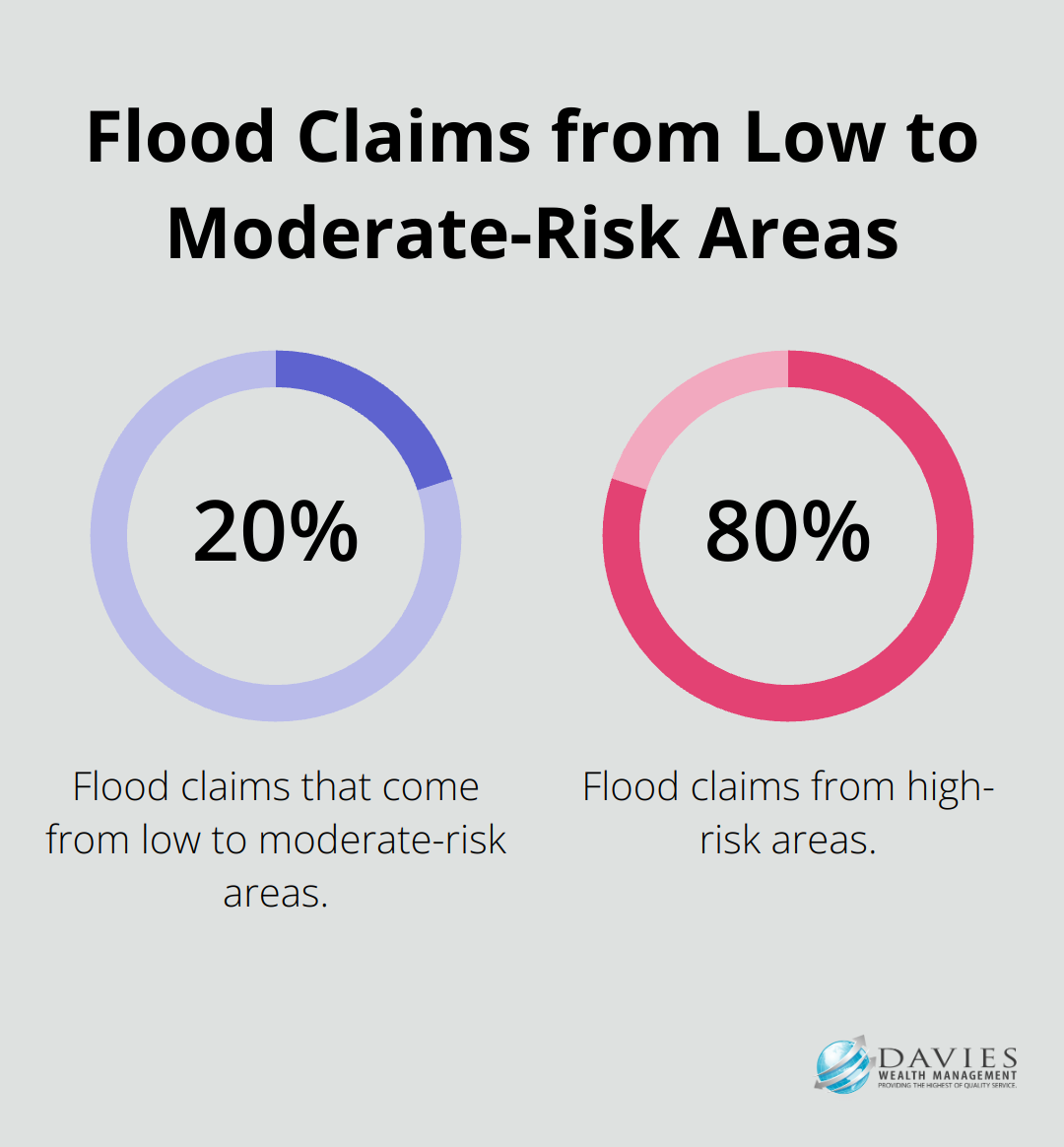

Comprehensive Risk Management

Living in Stuart means facing unique risks, particularly from natural disasters like hurricanes. We develop comprehensive insurance strategies that go beyond basic coverage. This includes flood insurance, even for properties not in high-risk zones (20% of flood claims come from low to moderate-risk areas).

We address often-overlooked risks. For instance, umbrella liability policies provide crucial protection for high-net-worth individuals. A $1 million policy typically costs only $150 to $300 per year but safeguards your assets from potential lawsuits.

As we move forward, let’s explore how Davies Wealth Management applies these key components to create personalized financial strategies for Stuart, Florida residents.

How Davies Wealth Management Tailors Financial Plans

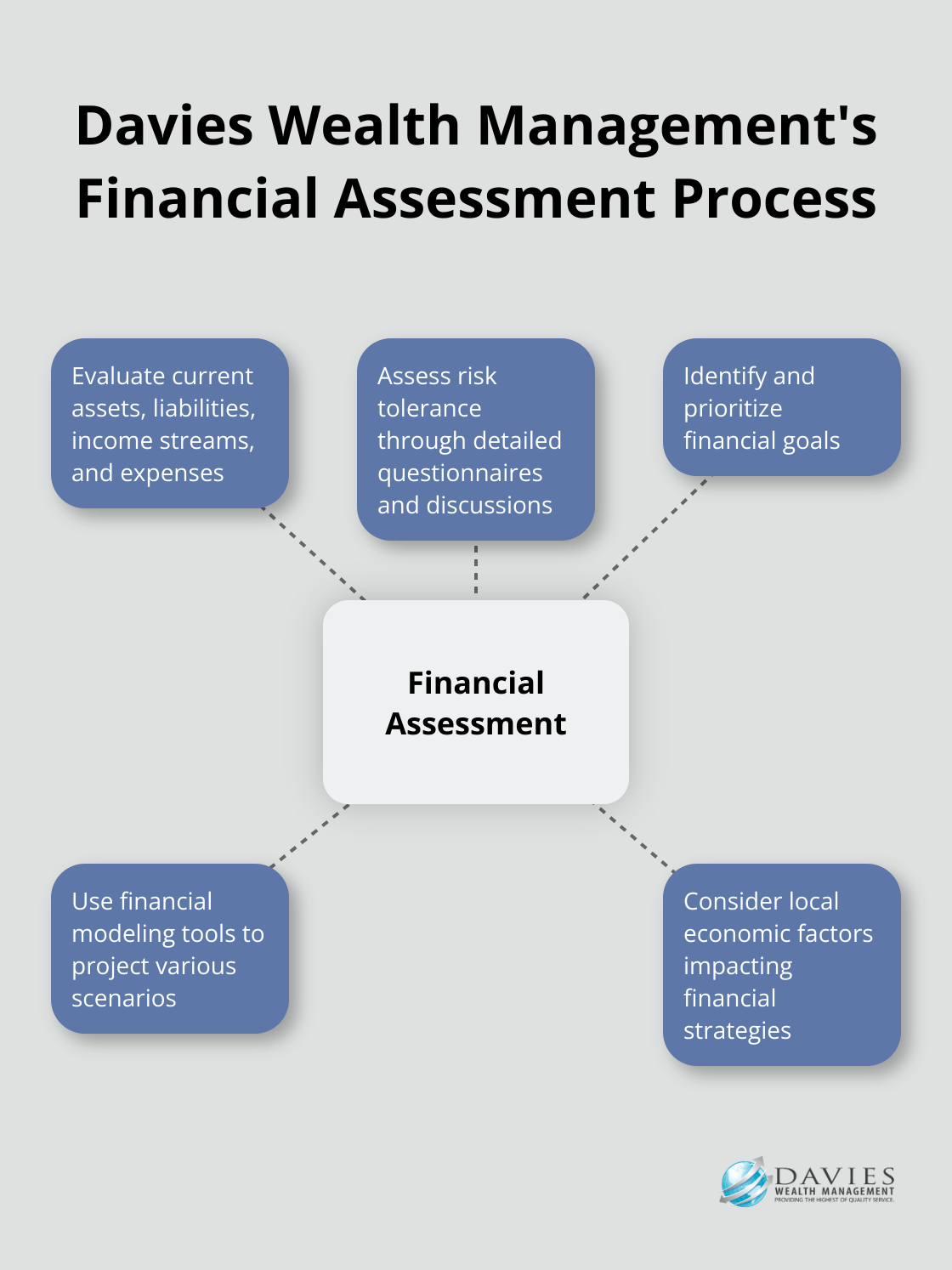

Personalized Financial Assessment

Davies Wealth Management starts with an in-depth analysis of each client’s financial situation. This includes an evaluation of current assets, liabilities, income streams, and expenses. The team assesses risk tolerance through detailed questionnaires and discussions. For Stuart residents, special attention is paid to local economic factors, such as the real estate market and tourism industry fluctuations, which can impact financial strategies.

The team then works closely with clients to identify and prioritize their financial goals. These might range from early retirement to funding a child’s education or leaving a lasting legacy. Sophisticated financial modeling tools project various scenarios, helping clients visualize the potential outcomes of different financial decisions.

Customized Strategies for Stuart Residents

Living in Stuart, Florida presents unique financial opportunities and challenges. Strategies take into account Florida’s tax-friendly environment, particularly the ability to avoid any state estate taxes and pass more wealth on to loved ones. For retirees or those planning for retirement, withdrawal strategies maximize tax efficiency, potentially saving thousands in taxes over the retirement years.

The team also addresses the specific risks faced by Stuart residents. Insurance recommendations include comprehensive coverage for natural disasters, particularly hurricanes. Excess flood insurance is often suggested, even for properties not in high-risk zones, as standard homeowners policies typically don’t cover flood damage.

For clients interested in local investment opportunities, insights into Stuart’s real estate market and potential business ventures are provided. The team stays informed about local economic trends, allowing them to offer timely and relevant advice.

Continuous Monitoring and Adjustments

Financial planning is not a one-time event but an ongoing process. A systematic review schedule is implemented, typically meeting with clients quarterly or semi-annually to assess progress and make necessary adjustments. This regular review process ensures that financial plans remain aligned with clients’ goals and responsive to changing market conditions or personal circumstances.

Advanced portfolio management software tracks investment performance daily. This allows for quick identification and response to market shifts or opportunities. Clients receive secure online access to their financial dashboards, offering real-time insights into their financial progress.

Expertise in Specialized Financial Planning

Davies Wealth Management offers specialized services for high-net-worth individuals and professional athletes. For high-net-worth clients, advanced tax minimization strategies are employed, such as charitable remainder trusts or private placement life insurance. These sophisticated tools can significantly reduce tax liabilities while supporting philanthropic goals.

Work with professional athletes addresses their unique financial challenges. Davies Wealth Management provides expert guidance to ensure long-term financial security for athletes and other high-net-worth individuals in Stuart, Florida. Strategies are developed to manage irregular income streams (often setting up trusts or other vehicles to ensure long-term financial security). The team also provides guidance on contract negotiations and endorsement deals, helping athletes maximize their earning potential during their often short career spans.

Financial Education Emphasis

For all clients, financial education is emphasized. Regular workshops and resources are provided on topics ranging from basic budgeting to complex estate planning techniques. This educational approach empowers clients to make informed financial decisions and actively participate in their financial planning process.

Final Thoughts

Comprehensive financial planning in Stuart, Florida empowers individuals to secure their financial future. Davies Wealth Management tailors strategies to meet the specific needs of Stuart residents, addressing investments, retirement, taxes, and estate planning. Our personalized approach ensures that financial plans remain aligned with client objectives, even as circumstances change.

We provide specialized services for high-net-worth individuals and professional athletes, recognizing the complex financial challenges these clients face. Our team offers expert guidance to navigate these challenges successfully, while our emphasis on financial education empowers all clients to make informed decisions about their financial future. The benefits of comprehensive financial planning extend far beyond simple investment management.

Don’t leave your financial future to chance. Take the first step towards comprehensive financial planning today. Davies Wealth Management stands ready to help you create a tailored financial strategy that addresses your unique needs and goals in Stuart, Florida.

Leave a Reply