At Davies Wealth Management, we understand the importance of multi-generational planning in securing a family’s financial future. Building wealth that lasts across generations requires careful strategy and foresight.

This blog post explores key strategies for creating a robust multi-generational wealth plan. We’ll discuss effective methods for preserving assets, educating future generations, and overcoming common challenges in long-term wealth management.

Understanding Multi-Generational Wealth Planning

Defining Multi-Generational Wealth Planning

Multi-generational wealth planning is a comprehensive approach to manage and preserve assets across multiple generations. This strategy is critical for families who want to secure their financial legacy. It extends beyond simple estate planning and creates a sustainable financial ecosystem that can support and grow family wealth for decades.

The Urgency of Long-Term Planning

A study reveals that 70% of wealthy families lose their wealth by the second generation. This underscores the urgent need for robust, long-term financial strategies. Without proper planning, even substantial fortunes can dissipate quickly.

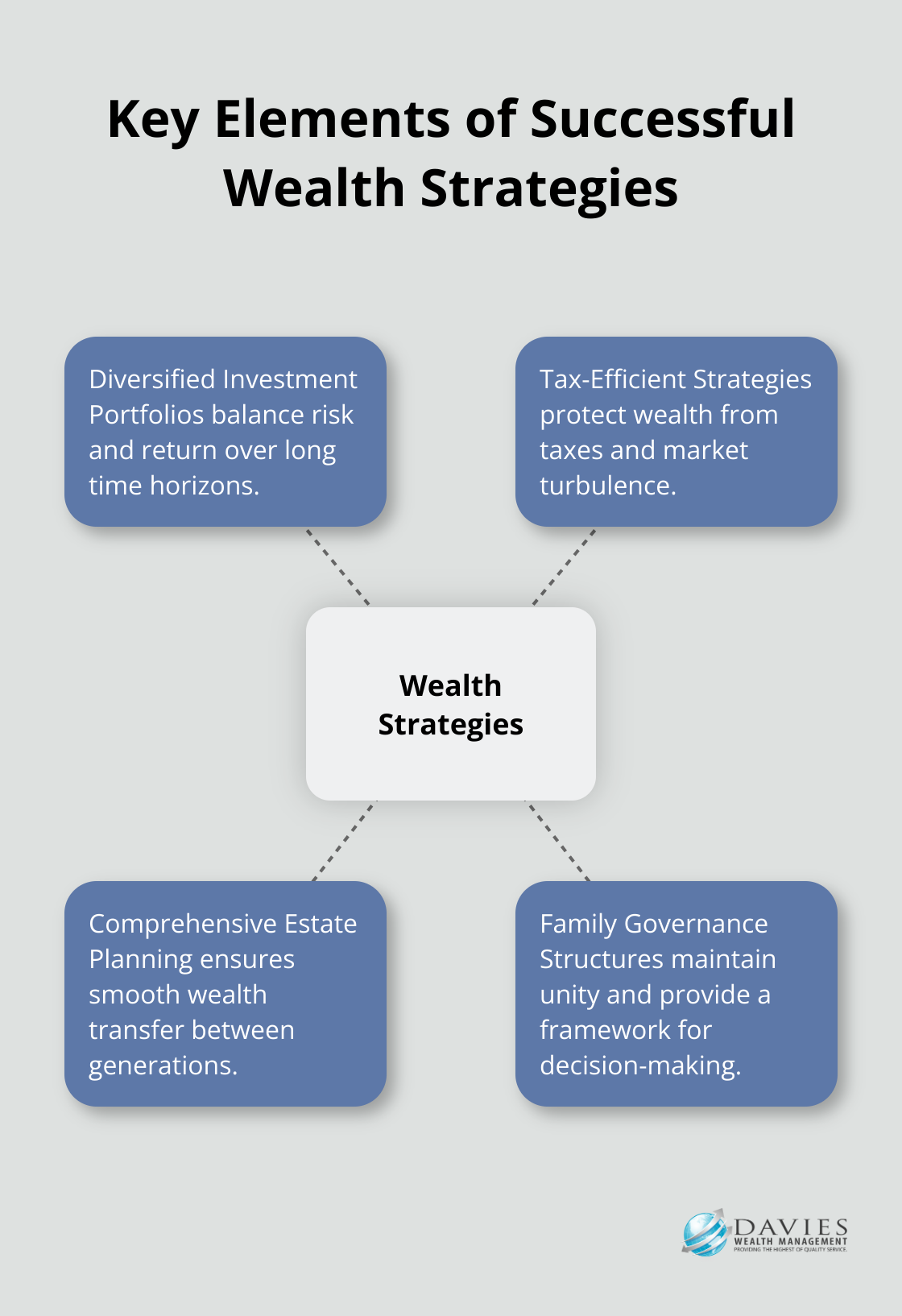

Key Elements of Successful Wealth Strategies

Successful multi-generational wealth plans typically include several key elements:

- Diversified Investment Portfolios: These balance risk and return over long time horizons.

- Tax-Efficient Strategies: These are designed to protect your wealth from taxes and market turbulence, going beyond simple savings plans.

- Comprehensive Estate Planning: This ensures smooth wealth transfer between generations.

- Family Governance Structures: These maintain family unity and provide a framework for decision-making about shared assets.

A UBS study found that families with strong governance structures are more likely to preserve wealth across generations. This highlights the importance of not just financial planning, but also organizational planning within the family unit.

Navigating Wealth Preservation Challenges

Preserving wealth across generations comes with its own set of challenges:

- Lack of Financial Education: Financial literacy programs for all family members can address this issue.

- Failure to Adapt: Wealth strategies that worked for previous generations may not be effective in today’s rapidly evolving financial landscape. Regular reviews and adjustments of financial plans are essential.

- Family Conflicts: These can significantly impact wealth preservation. Open communication about financial matters and clear succession plans can help mitigate these issues. Some families benefit from working with wealth management teams to navigate complex interpersonal dynamics.

As we move forward, it’s clear that building and preserving wealth requires more than just smart investments. The next section will explore specific strategies for building and preserving wealth, including diversification techniques and tax-efficient planning methods.

How to Build and Preserve Wealth

Diversification: The Foundation of Wealth Preservation

At Davies Wealth Management, we recognize that building and preserving wealth requires a comprehensive strategy. Diversification stands as a cornerstone of this approach. From an investment and portfolio perspective, diversification and reducing systematic risk is about investing in different assets classes. This strategy involves spreading investments across various asset classes, sectors, and geographic regions.

A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and alternative investments. Each asset class responds differently to market conditions, which helps balance potential losses in any one area.

Tax-Efficient Strategies: Maximizing Your Wealth

Tax efficiency plays a vital role in wealth preservation. To combat this, we implement strategies such as tax-loss harvesting and strategic charitable giving.

Tax-loss harvesting is the method of selling investments at a loss in order to reduce the amount of money you’ll owe for income taxes. Strategic charitable giving through donor-advised funds or private foundations provides significant tax benefits while supporting causes you care about.

Regular Financial Reviews: Adapting to Change

The financial landscape constantly evolves, and your wealth management strategy should adapt accordingly. Regular financial reviews ensure your plan remains aligned with your goals and market conditions.

We recommend quarterly reviews for most clients, with more frequent check-ins during periods of significant market volatility or personal life changes.

These reviews should cover investment performance, changes in personal circumstances, risk tolerance, and long-term goals. They also provide an opportunity to reassess your estate plan and insurance coverage for comprehensive wealth protection.

Leveraging Professional Expertise

While self-education is valuable, professional guidance can significantly enhance your wealth-building efforts. Studies like Morningstar’s Gamma and Vanguard’s Advisor Alpha have aimed to quantify how much value advisors truly provide.

At Davies Wealth Management, our team of experts stays abreast of the latest financial trends and strategies. We provide personalized advice tailored to your unique financial situation and goals.

Embracing Technology in Wealth Management

Technology has revolutionized wealth management. From robo-advisors to sophisticated financial planning software, these tools can enhance decision-making and portfolio management.

However, it’s important to strike a balance between technological solutions and human expertise. While algorithms can provide valuable insights, they can’t replace the nuanced understanding and personalized advice that experienced financial advisors offer.

As we move forward, the next chapter will explore how to prepare future generations to manage and grow the wealth you’ve worked hard to build. This includes strategies for financial education and involving younger family members in wealth management decisions.

Preparing Heirs for Financial Success

Implementing Effective Financial Education

At Davies Wealth Management, we recognize that educating future generations is essential for long-term wealth preservation. This process involves more than passing on financial assets; it’s about instilling financial wisdom and responsibility.

Financial literacy across generations forms the foundation of successful wealth management. To address this, we recommend early financial education.

For younger children, introduce basic concepts like saving and budgeting through age-appropriate activities. As they grow older, introduce more complex topics such as investing, tax planning, and estate management.

Many clients find success in organizing family financial workshops. These sessions, led by financial professionals, can cover a range of topics tailored to the family’s specific needs and wealth structure.

Hands-On Experience in Wealth Management

Involving younger generations in wealth management decisions serves as a powerful educational tool. This approach not only teaches practical skills but also fosters a sense of responsibility and stewardship.

One effective strategy establishes a family investment committee. This committee can include members from different generations, allowing younger family members to participate in investment decisions under the guidance of more experienced relatives or advisors.

Modern tools and strategies can help master family wealth planning. Learning how values, financial literacy, and active involvement can preserve and grow wealth is crucial for next-generation heirs.

Developing a Family Wealth Mission

A family mission statement and governance structure are essential for maintaining unity and purpose across generations. This process defines shared values, goals, and responsibilities related to family wealth.

Creating a family mission statement is key to effective family wealth governance. It involves agreeing on the family’s values, both individually and as a family unit.

The governance structure establishes clear roles and decision-making processes. This might include regular family meetings, a system for resolving conflicts, and protocols for major financial decisions.

Professional facilitation in developing these structures often benefits families. An objective third party can help navigate complex family dynamics and ensure all voices are heard in the process.

Continuous Learning and Adaptation

Preparing future generations for financial success requires an ongoing commitment. It demands patience, open communication, and a willingness to adapt as family circumstances and the financial landscape evolve.

Regular family discussions about financial matters (perhaps quarterly or bi-annually) can keep everyone informed and engaged. These meetings can cover topics such as investment performance, charitable giving, and upcoming financial decisions.

Encouraging ongoing financial education through workshops, seminars, or even formal courses can help family members stay current with financial trends and best practices.

Fostering a Culture of Financial Responsibility

Creating a culture of financial responsibility within the family is key to long-term wealth preservation. This involves leading by example and instilling values such as prudent spending, thoughtful investing, and generous giving.

Consider implementing a family bank or investment fund where younger members can propose and manage small projects or investments. This provides real-world experience in financial decision-making and accountability.

Ultimately, preparing heirs for financial success is a multifaceted process that requires time, effort, and dedication. It’s an investment in the family’s future that can yield significant returns in terms of financial stability and family unity.

Final Thoughts

Multi-generational planning requires a comprehensive approach to secure a family’s financial legacy. We emphasize the importance of diversified investment portfolios, tax-efficient strategies, and regular financial reviews to adapt to changing market conditions. Educating future generations plays a vital role in successful wealth preservation, fostering financial literacy and responsibility among heirs.

Professional guidance is essential to navigate the complexities of wealth management effectively. At Davies Wealth Management, we offer tailored solutions for individuals, families, and businesses, including professional athletes with unique financial needs. Our expertise can help develop a robust multi-generational wealth plan that aligns with your family’s values and goals.

A well-structured plan provides financial security, preserves family unity, and creates a lasting legacy beyond monetary assets. Multi-generational planning is an ongoing process that demands commitment, open communication, and adaptability. With the right approach and support, you can build a financial legacy that empowers future generations to thrive.

Leave a Reply