At Davies Wealth Management, we understand the importance of staying informed about retirement planning strategies.

Best-selling retirement planning books offer valuable insights and expert advice to help you prepare for your financial future.

In this post, we’ll explore some of the most influential and popular books in the field, covering classic works, recent best-sellers, and specialized guides.

Timeless Wisdom for Retirement Success

At Davies Wealth Management, we believe that classic retirement planning books offer invaluable insights that stand the test of time. These books have shaped the financial landscape and continue to guide individuals towards a secure retirement.

The Total Money Makeover: A Proven Plan for Financial Fitness

Dave Ramsey’s “The Total Money Makeover” introduces the “7 Baby Steps” method, which has helped countless readers eliminate debt and build wealth. Ramsey’s approach emphasizes creating an emergency fund, paying off debt, and investing for retirement. While some critics argue that his investment advice is overly conservative, his debt-reduction strategies have proven effective for many.

The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life

JL Collins’ “The Simple Path to Wealth” advocates for a straightforward approach to investing. Collins recommends low-cost index funds, which seek market-average returns. He argues that this strategy outperforms actively managed funds over the long term. According to the source, index funds typically have lower fees compared to active mutual funds.

How to Make Your Money Last: The Indispensable Retirement Guide

Jane Bryant Quinn’s “How to Make Your Money Last” addresses a critical concern for retirees: outliving their savings. Quinn provides practical advice on Social Security claiming strategies, pension options, and sustainable withdrawal rates. She introduces the “Safe Withdrawal Rate” concept, suggesting that retirees can typically withdraw a certain percentage of their portfolio annually without depleting their savings.

The Bogleheads’ Guide to Retirement Planning

“The Bogleheads’ Guide to Retirement Planning” builds on John Bogle’s investment philosophy. The book covers a wide range of topics, including asset allocation, tax-efficient investing, and estate planning. One key takeaway is the importance of diversification.

These classic retirement planning books provide a solid foundation for anyone looking to secure their financial future. They offer time-tested principles that many financial advisors (including those at Davies Wealth Management) incorporate into personalized retirement strategies. As we move forward, we’ll explore more recent best-sellers that build upon these classic works and address the evolving landscape of retirement planning.

Modern Retirement Planning Insights

Navigating the Retirement Maze

Wade Pfau’s “Retirement Planning Guidebook” has quickly become a go-to resource for those who seek a comprehensive approach to retirement planning. Pfau introduces the concept of the Retirement Income Style Awareness profile, which helps readers identify how they feel and prefer to fund retirement. This personalized approach aligns well with many financial advisors’ philosophies, where strategies are tailored to each client’s unique situation.

Pfau’s book also examines the “4% rule” for retirement withdrawals, suggesting that this traditional guideline may be too optimistic in today’s low-interest-rate environment. He proposes alternative withdrawal strategies that account for market volatility and longevity risk.

Maximizing Social Security Benefits

Larry Swedroe and Kevin Grogan’s “Your Complete Guide to a Successful & Secure Retirement” offers practical advice on maximizing Social Security benefits. They highlight that for many retirees, delaying Social Security claims can be beneficial.

The authors also stress the importance of tax-efficient withdrawal strategies. They suggest that retirees should consider drawing from taxable accounts first, then tax-deferred accounts, and finally Roth accounts to minimize their tax burden over time.

Adapting to Changing Retirement Realities

Robert C. Carlson’s “The New Rules of Retirement” addresses the shifting retirement landscape, including increased longevity and the decline of traditional pensions. Carlson emphasizes the need for retirees to plan for a potentially longer retirement period. He suggests that a well-diversified portfolio should include not just stocks and bonds, but also alternative investments like real estate investment trusts (REITs) to provide additional income streams.

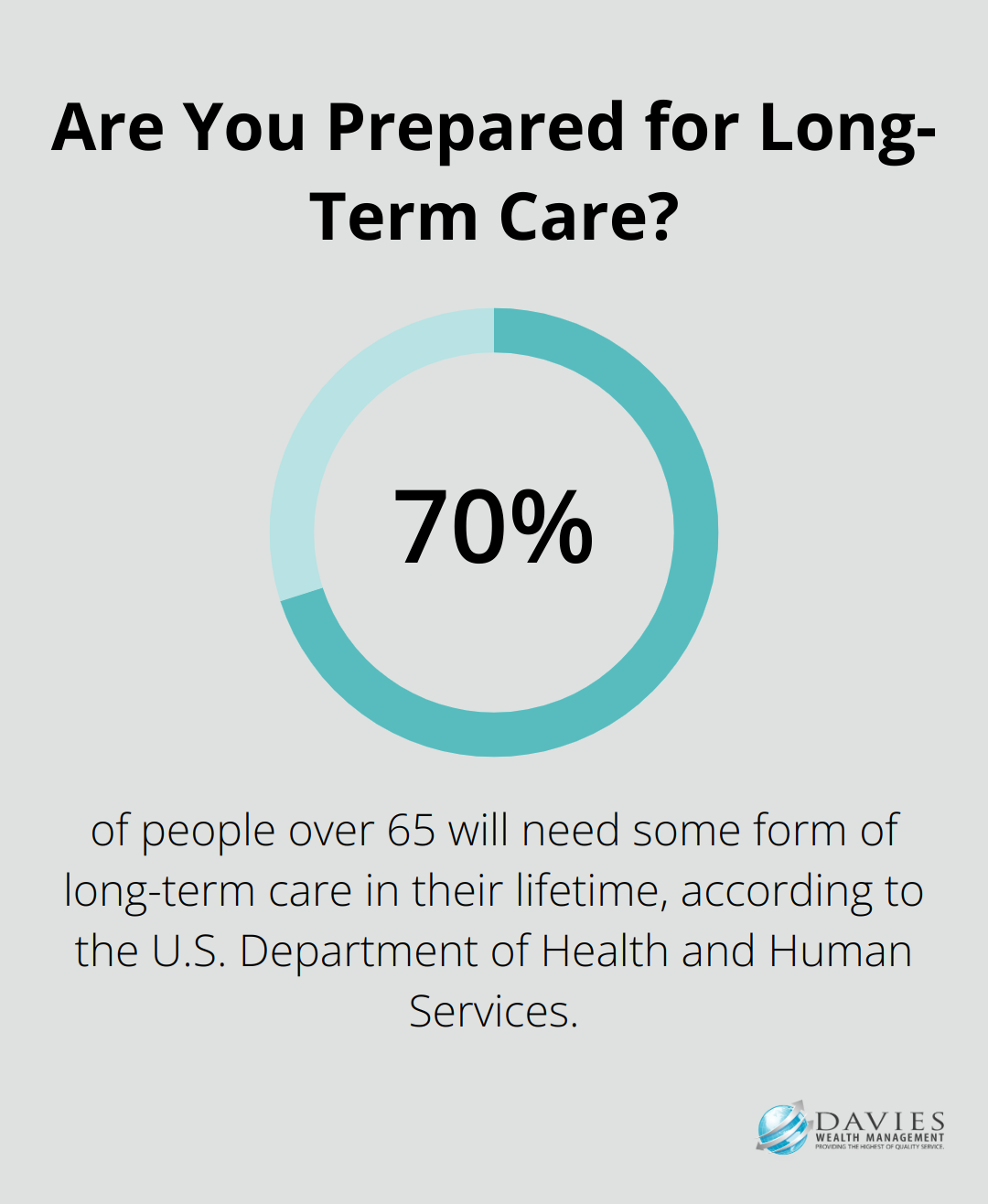

Carlson also discusses the importance of long-term care planning, noting that about 70% of people over 65 will need some form of long-term care in their lifetime, according to the U.S. Department of Health and Human Services.

Preparing for the Retirement Transition

Emily Guy Birken’s “The 5 Years Before You Retire” focuses on the critical period leading up to retirement. She provides a practical checklist of tasks to complete before retiring, including estimating retirement expenses, reviewing insurance coverage, and creating a retirement budget.

Birken emphasizes the importance of stress-testing your retirement plan. She suggests running multiple scenarios, including potential market downturns or unexpected health expenses, to ensure your retirement savings can withstand various challenges.

These modern retirement planning books offer valuable insights that complement the timeless wisdom of classic works. They provide up-to-date strategies that address the evolving landscape of retirement planning. As we move forward, we’ll explore specialized retirement planning books that cater to specific retirement goals and lifestyles.

Tailored Retirement Strategies for Unique Goals

At Davies Wealth Management, we recognize that retirement planning isn’t one-size-fits-all. Specialized retirement books offer insights for those with unique goals or circumstances. Let’s explore some standout works that cater to specific retirement aspirations.

Financial Independence and Early Retirement

Scott Rieckens’ book on the FIRE movement has gained significant traction. The FIRE approach prioritizes greater financial independence through a program of extreme frugality and aggressive investment. This strategy typically involves living well below one’s means and investing heavily in low-cost index funds.

While the FIRE movement isn’t for everyone, its principles can apply more moderately. For instance, increasing your savings rate by just 10% can significantly impact your retirement timeline.

Encore Careers and Purposeful Retirement

Marci Alboher’s “The Encore Career Handbook” addresses a growing trend: retirees seek meaningful work in their later years. This concept aligns with observations where clients thrive when they find purpose in retirement.

Alboher suggests practical steps for those who consider an encore career:

- Identify transferable skills from your primary career

- Explore volunteer opportunities to test new fields

- Consider part-time work or consulting in your area of expertise

AARP Research shows that two-thirds of older workers are interested in additional skills training, highlighting the relevance of encore career planning.

Embracing a Fulfilling Retirement Lifestyle

Ernie J. Zelinski’s “How to Retire Happy, Wild, and Free” shifts focus from finances to lifestyle. While financial planning matters, Zelinski argues that a fulfilling retirement requires more than just money.

He encourages retirees to:

- Develop new hobbies and interests

- Nurture social connections

- Set personal goals unrelated to work

A study in the Journal of Happiness Studies found that retirees who engaged in leisure activities reported higher life satisfaction (supporting Zelinski’s approach).

Designing Your Ideal Retirement

Ida Abbott’s “Retirement by Design” offers a structured approach to retirement planning. Abbott suggests creating a retirement “blueprint” that covers not just finances, but also health, relationships, and personal growth.

One practical tip from Abbott is to create a “retirement diary” for a week, jotting down how you spend your time. This exercise can help identify areas where you might want to make changes or invest more energy in retirement.

These specialized books offer valuable insights for those who seek a tailored approach to retirement. They provide diverse perspectives that can inform personalized retirement strategies, ensuring that each individual’s unique goals and circumstances receive proper attention.

Final Thoughts

Best-selling retirement planning books offer a wealth of knowledge for anyone looking to secure their financial future. These books provide readers with the latest strategies and time-tested principles to navigate the complex landscape of retirement planning. We at Davies Wealth Management encourage you to apply the knowledge gained from these books to your personal retirement strategies.

Your unique circumstances may require a tailored approach, which is where professional financial advisors can provide invaluable assistance. At Davies Wealth Management, we specialize in creating personalized retirement plans that align with your specific goals and circumstances. We combine the wisdom found in these best-selling retirement planning books with our expertise to develop strategies that work for you.

Retirement planning is an ongoing process that requires continuous learning and adaptation. You can work towards a secure and fulfilling retirement by staying informed, seeking professional advice, and regularly reviewing your retirement strategy. Take the first step today by exploring these insightful books and considering how their principles can apply to your financial future.

Leave a Reply