At Davies Wealth Management, we understand that financial planning is the cornerstone of a secure future. It’s more than just budgeting; it’s a comprehensive strategy to achieve your short-term and long-term financial goals.

Financial planning advantages include improved stability, better retirement preparation, and effective debt management. By tailoring strategies to different life stages, we help our clients build a strong financial foundation that evolves with their needs.

What is Financial Planning?

The Essence of Financial Planning

Financial planning forms the foundation of a secure financial future. It encompasses a comprehensive approach to manage money, investments, and financial goals. This process aligns financial decisions with life aspirations, going beyond simple budgeting or retirement savings.

Key Components of a Financial Plan

A robust financial plan includes several essential elements:

- Cash flow management: This involves the optimization of income and expenses.

- Investment strategy: We develop portfolios that match risk tolerance and goals.

- Risk management: We protect assets through insurance and other safeguards.

- Tax planning: This component focuses on legal and efficient tax burden minimization.

- Retirement planning: We ensure adequate savings for the golden years.

- Estate planning: This determines the distribution of assets after one’s passing.

Financial Planning vs. Budgeting

While budgeting focuses on short-term cash flow, financial planning takes a long-term view of one’s financial life. A Charles Schwab survey reveals that 65% of Americans with a written financial plan feel financially stable, compared to only 40% without a plan. This stark difference highlights the impact of comprehensive planning on financial confidence and stability.

Adapting to Life’s Stages

Financial needs evolve over time, and a good plan adapts accordingly. Young professionals often focus on building emergency savings and initiating retirement contributions. According to the Federal Reserve, 63 percent of adults in 2022 said they would cover a $400 emergency expense exclusively using cash or savings. Mid-career individuals typically balance current lifestyle needs with future goals, such as saving for children’s education or planning for early retirement. As retirement approaches, the focus shifts to maximizing savings and adjusting investment strategies to preserve wealth.

The Ongoing Nature of Financial Planning

Financial planning requires regular review and adjustment. It’s not a one-time event but an ongoing process that responds to life changes, economic shifts, and evolving goals. This dynamic approach ensures that your financial strategy remains relevant and effective throughout your life’s journey.

As we move forward, we’ll explore the specific benefits that a well-crafted financial plan can bring to your life, from improved financial stability to enhanced goal achievement.

How Financial Planning Transforms Your Life

Achieving Financial Stability

Financial stability forms the bedrock of a stress-free life. A comprehensive financial plan paints a clear picture of your income, expenses, and savings. This clarity empowers you to make informed decisions about your money, which reduces financial stress and increases your sense of control.

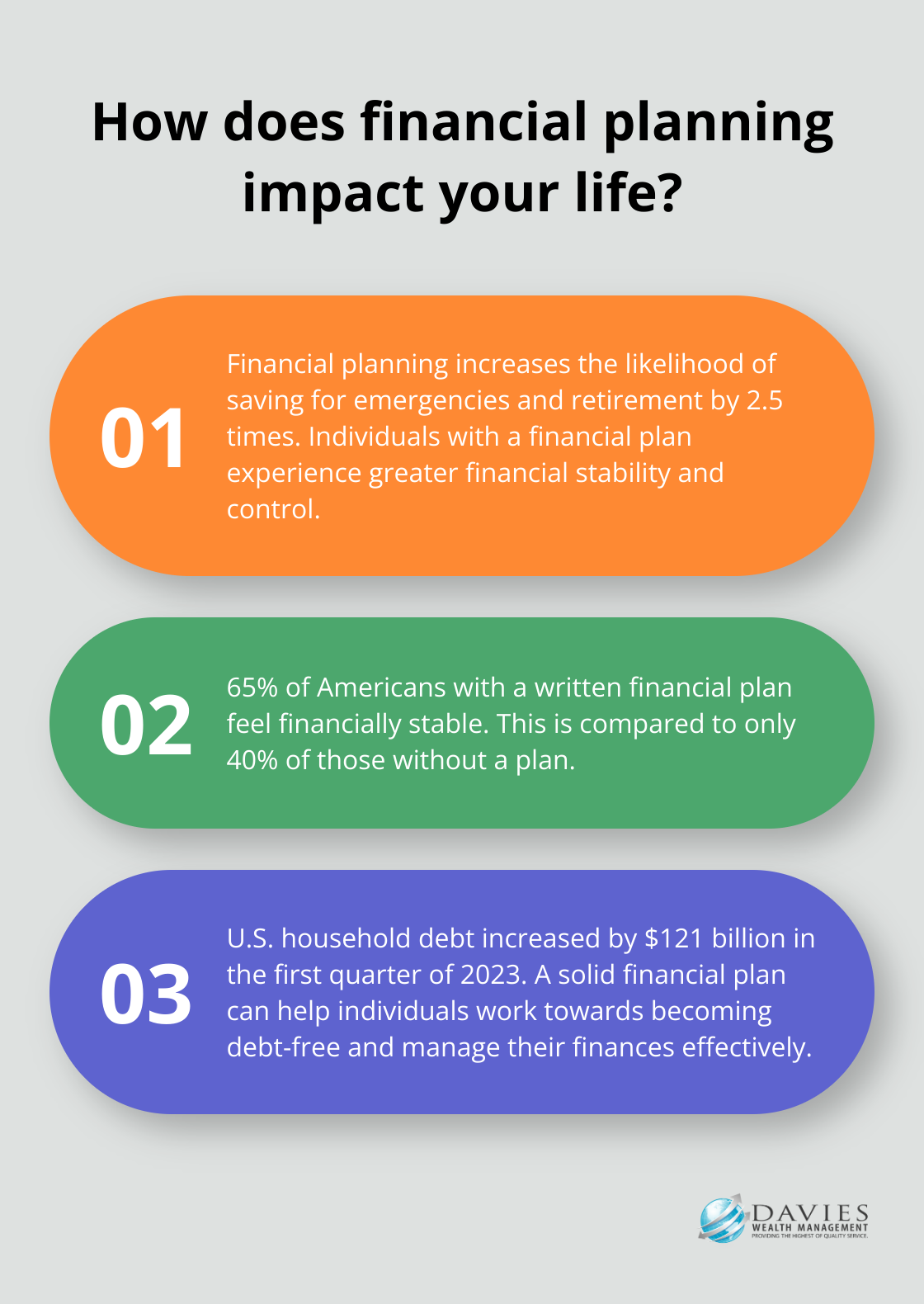

A study by the Consumer Financial Protection Bureau reveals that individuals with a financial plan are 2.5 times more likely to save for emergencies and retirement. This increased savings rate directly contributes to greater financial stability, providing a buffer against unexpected expenses and economic downturns.

Securing Your Retirement

Financial planning significantly impacts retirement preparedness. A well-structured plan ensures you save enough and invest wisely for your golden years. Data from the 2022 P-Fin Index show that retirees with high financial literacy were more likely to plan and save for retirement while still working compared to those with lower financial literacy. Financial planning helps you avoid this pitfall and enter retirement with confidence.

A robust retirement strategy accounts for factors like inflation, healthcare costs, and desired lifestyle. This proactive approach can make the difference between a comfortable retirement and financial stress in your later years.

Mastering Debt Management

Effective debt management plays a crucial role in financial health. A financial plan provides strategies to tackle debt systematically, prioritizing high-interest debts and creating a realistic repayment schedule. The composition of U.S. household debt showed an increase of $121 billion in the first quarter of 2023, while home equity lines of credit (HELOC) increased as well. A solid financial plan can help you buck this trend and work towards becoming debt-free.

Turning Goals into Reality

Financial planning transforms your dreams into achievable goals. Whether you save for a home, plan for your children’s education, or aim to start a business, a financial plan provides a roadmap to success.

A study by Charles Schwab found that 65% of Americans with a written financial plan feel financially stable, compared to only 40% of those without a plan. This increased confidence stems from having clear, actionable steps towards your goals.

Tailoring Strategies to Your Unique Situation

Financial planning isn’t a one-size-fits-all solution. It requires a personalized approach that considers your unique circumstances, goals, and risk tolerance. Professional financial advisors (like those at Davies Wealth Management) can provide expert guidance tailored to your specific situation, helping you navigate complex financial decisions with confidence.

As we move forward, we’ll explore how financial planning strategies evolve throughout different life stages, ensuring your financial plan remains relevant and effective as your needs change over time.

How Financial Strategies Evolve Throughout Life

Financial planning adapts as we progress through different life stages, each presenting unique challenges and opportunities. Effective financial strategies must adjust to changing needs and goals.

Young Professionals: Building a Strong Foundation

Young professionals should focus on establishing good habits and making smart choices that will benefit them in the future. A 2023 Bank of America survey revealed that 73% of Gen Z and millennials actively save for financial goals, indicating a positive trend in early financial planning.

One key strategy for young professionals is to start investing early. The power of compound interest can significantly grow your money over time. For example, if you invest $500 monthly at age 25 (assuming an average annual return of 7%), you could accumulate over $1.2 million by age 65. However, if you start at 35, that number drops to about $600,000.

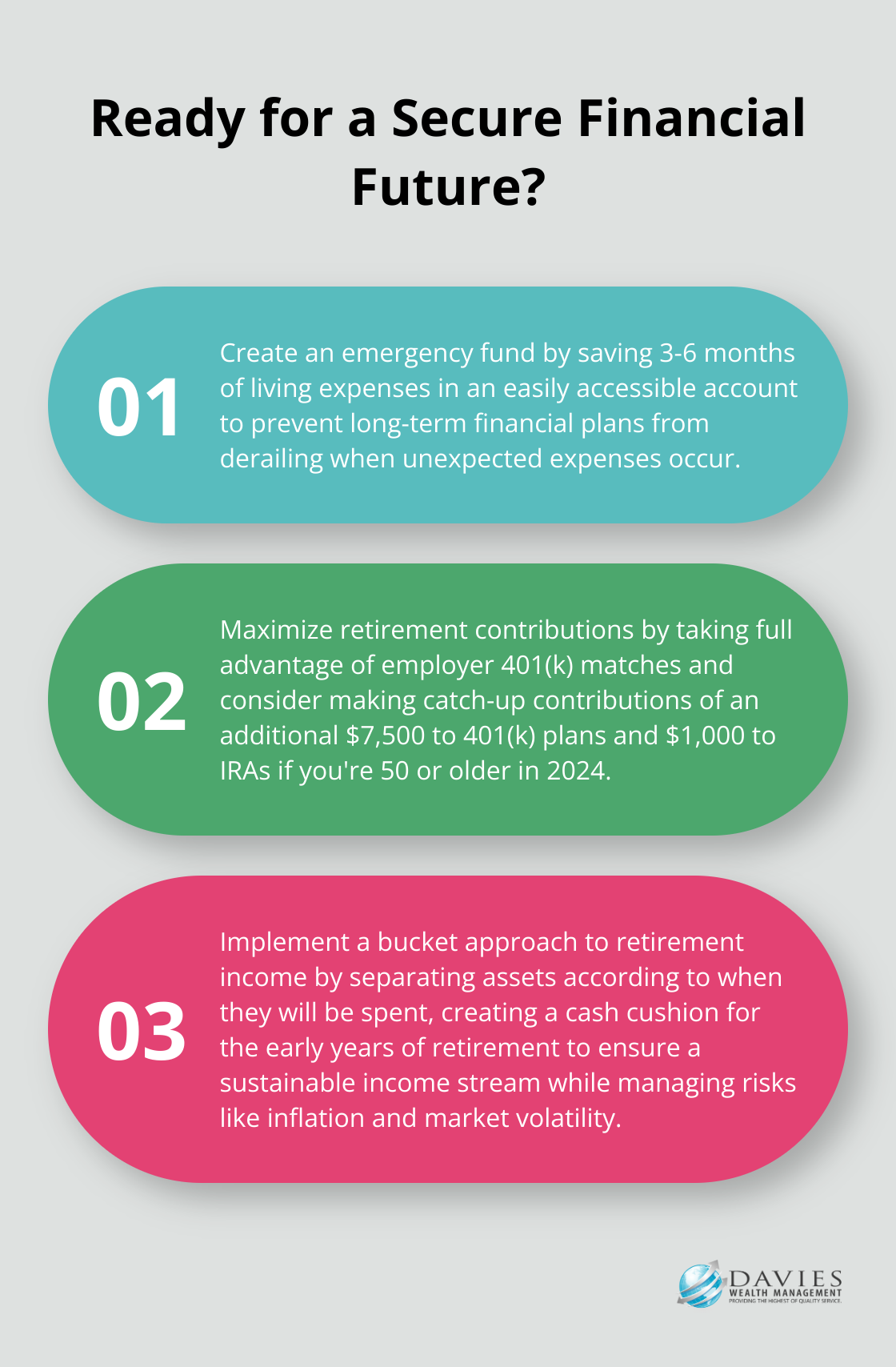

Another important step is to create an emergency fund. Try to save 3-6 months of living expenses in an easily accessible account. This buffer can prevent long-term financial plans from derailing when unexpected expenses occur.

Mid-Career Individuals: Balancing Present and Future

Mid-career individuals often face the challenge of balancing current lifestyle needs with future financial goals. This might include saving for children’s education, planning for early retirement, or starting a business.

One effective strategy at this stage is to maximize retirement contributions. If your employer offers a 401(k) match, take full advantage of it. The average 401(k) balance for those in their 70s is $431,962, with a median of $106,654. However, financial experts often recommend having 1-3 times your annual salary saved by age 40.

It’s also important to review and adjust your insurance coverage at this stage. As your assets and responsibilities grow, so should your protection. This includes life insurance, disability insurance, and potentially long-term care insurance.

Pre-Retirees: Maximizing Savings and Adjusting Strategies

As retirement approaches, the focus shifts to maximizing savings and adjusting investment strategies. This is the time to get serious about your retirement timeline and lifestyle expectations.

One key strategy is to take advantage of catch-up contributions. In 2024, individuals 50 and older can contribute an additional $7,500 to their 401(k) plans and an extra $1,000 to IRAs. These catch-up contributions can significantly boost retirement savings in the final years of your career.

It’s also important to start thinking about your retirement income strategy. This might involve gradually shifting your investment portfolio to a more conservative allocation to protect your wealth as you near retirement. However, with increasing life expectancies, it’s important not to become too conservative too quickly.

Retirees: Ensuring Sustainable Income

For retirees, the focus shifts from accumulation to distribution. The key is to ensure a sustainable income stream while managing risks like inflation and market volatility.

One effective strategy is the bucket approach to retirement income. This involves separating assets according to when they are going to be spent, creating a cash cushion for the early years of retirement.

Estate planning also becomes important at this stage. This involves more than just drafting a will. It includes strategies for efficient wealth transfer, potentially using tools like trusts to minimize estate taxes and ensure your legacy is preserved according to your wishes.

Final Thoughts

Financial planning transforms your financial life at every stage. The advantages of financial planning include improved stability, better retirement preparation, and effective debt management. These benefits empower you to achieve both short-term and long-term objectives with greater confidence and security.

Professional guidance can provide you with personalized strategies tailored to your unique situation. At Davies Wealth Management, we create comprehensive financial plans that address your specific needs and goals. Our expertise extends to serving professional athletes, business owners, and individuals seeking financial security.

Financial planning requires regular reviews and adjustments to align with your evolving life circumstances and financial goals. You take a proactive step towards securing your financial future by embracing financial planning. This ongoing process helps you build, protect, and transfer your wealth with confidence, ensuring you’re prepared for whatever life may bring.

Leave a Reply