In 2025, wealth protection has become more critical than ever for high-net-worth individuals. The financial landscape is constantly evolving, presenting new challenges and opportunities for safeguarding assets.

At Davies Wealth Management, we understand the importance of implementing robust asset protection strategies tailored to your unique circumstances. This blog post explores cutting-edge techniques and legal considerations to help you preserve and grow your wealth in today’s complex financial environment.

Understanding Asset Protection for High-Net-Worth Individuals

Defining Asset Protection

Asset protection forms a cornerstone of wealth management for high-net-worth individuals. This strategy involves the implementation of legal measures to shield assets from potential creditors, lawsuits, and other financial risks. The effectiveness of asset protection can determine whether wealth is preserved or lost.

The Increasing Need for Asset Protection

High-net-worth individuals face unique challenges in today’s litigious society. The American Bar Association offers countless resources to lawyers, judges, law students and those who are interested in law-related issues, highlighting the importance of legal knowledge in asset protection.

Common Threats to High-Net-Worth Assets

Several threats can endanger the wealth of high-net-worth individuals:

- Lawsuits: Professional liability, personal injury claims, and contract disputes pose significant legal threats.

- Divorce: Without proper planning, a divorce can substantially impact an individual’s wealth. According to the National Survey of Family Growth, the refined divorce rate in the United States is approximately 14.9 per 1,000 married women.

- Business Failures: Entrepreneurs and business owners may face personal liability for business debts if proper structures are not in place.

- Economic Downturns: Market volatility can quickly erode wealth. The 2008 financial crisis, for example, eliminated an estimated $16 trillion in household wealth.

- Cybercrime: High-net-worth individuals are prime targets for cybercriminals. Over the last 21 years from 2001 to 2021, cyber crime has claimed at least 6.5 million victims with an estimated loss of nearly $26 billion.

Proactive Strategies for Asset Protection

To mitigate these risks, high-net-worth individuals should consider several strategies:

- Legal Entities: Limited Liability Companies (LLCs) and Family Limited Partnerships (FLPs) can separate personal and business assets, reducing liability exposure.

- Trust Structures: Irrevocable trusts can shield assets from creditors while maintaining control over asset distribution.

- Insurance Coverage: Comprehensive liability insurance and umbrella policies provide an essential first line of defense.

- Investment Diversification: A well-diversified portfolio can help protect against market volatility and economic downturns.

- Regular Reviews: Frequent assessments of asset protection strategies are essential as laws and personal circumstances change.

High-net-worth individuals (including professional athletes who face unique financial challenges) should seek specialized advice to create tailored asset protection plans. These plans should adapt to the latest legal and financial developments to ensure wealth remains secure in an ever-changing landscape. The next section will explore key asset protection strategies for 2025, providing a roadmap for safeguarding wealth in the coming years.

Fortifying Your Wealth in 2025: Advanced Asset Protection Strategies

Advanced Portfolio Diversification

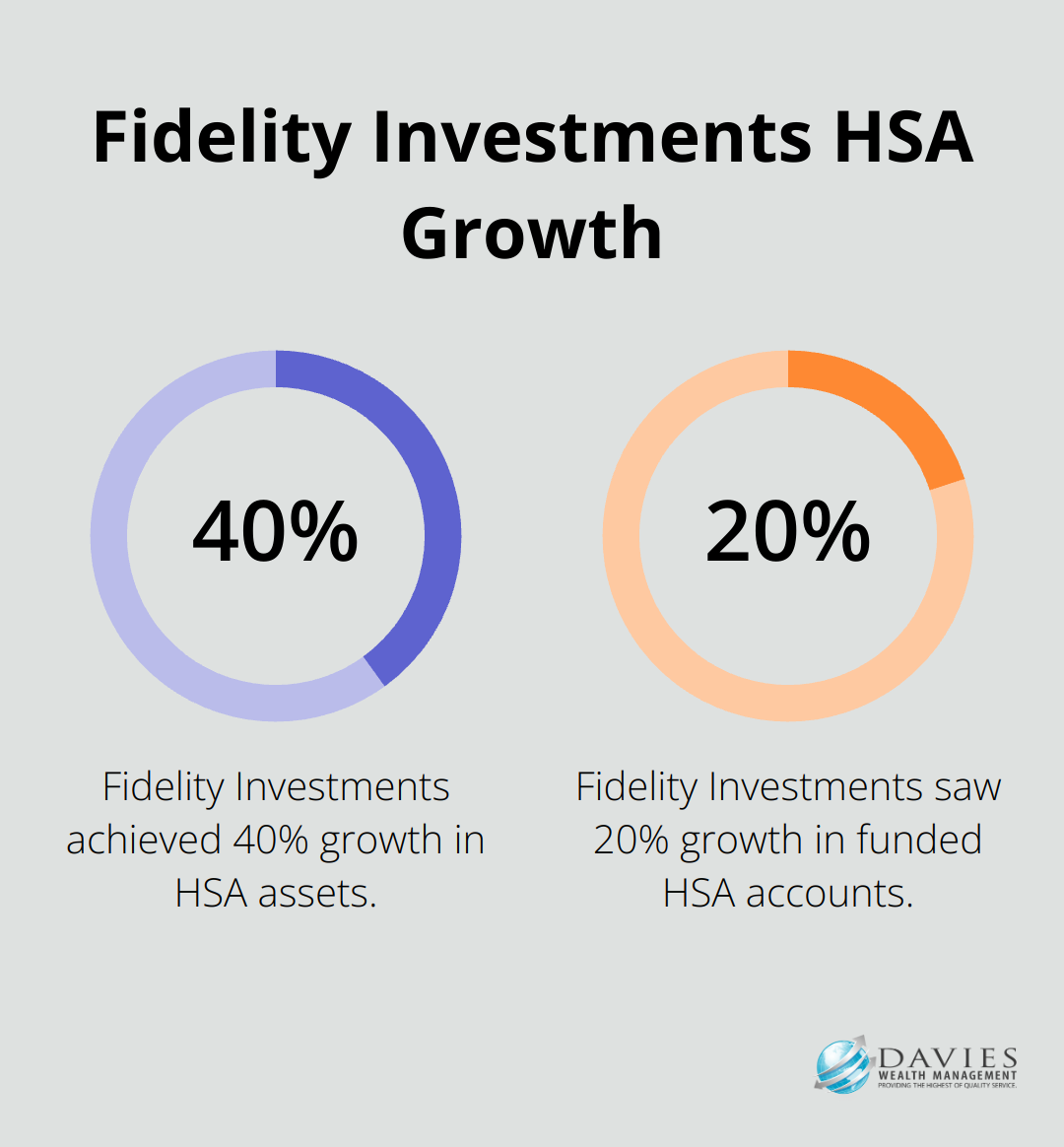

High-net-worth individuals must adopt sophisticated approaches to protect their assets in 2025’s complex financial landscape. Traditional methods of spreading investments across stocks and bonds no longer suffice. Fidelity Investments reported that by prioritizing investments in the HSA product lineup, the business achieved 40% growth in assets and 20% growth in funded accounts.

We recommend the exploration of assets such as private equity, real estate investment trusts (REITs), and commodities. Farmland, for instance, has outperformed the S&P 500 by 6.1% annually since 1990 (according to AcreTrader). These alternatives provide uncorrelated returns, which buffer wealth against market fluctuations.

Sophisticated Trust Structures

Trusts remain fundamental to asset protection, but their application has evolved. The use of hybrid trusts, which combine features of domestic and foreign trusts, has seen a 35% increase among high-net-worth clients in the past year.

The Delaware Asset Protection Trust (DAPT) stands out as a particularly effective structure. It may allow you to avoid the state death tax, state income tax, and more. With seventeen states now having DAPT legislation, new possibilities for strategic asset placement have opened up.

Cutting-Edge Insurance Solutions

Insurance strategies have become increasingly sophisticated. Private placement life insurance (PPLI) has gained popularity among high-net-worth individuals. PPLI allows for tax-free growth of investments within the policy, potentially saving millions in taxes over time.

Captive insurance companies represent another trend. These self-owned insurance subsidiaries provide coverage for risks not typically insured by commercial policies, while also offering significant tax benefits. The Insurance Information Institute reports a 10% annual growth in the number of captive insurers over the past five years.

Robust Cybersecurity Measures

In 2025, cybersecurity extends beyond device protection to safeguarding one’s entire digital footprint. A multi-layered approach includes:

- Regular security audits of all financial accounts

- Advanced encryption for all digital communications

- Multi-factor authentication across all platforms

Cybersecurity Ventures expects global cybercrime costs to grow by 15 percent per year over the next five years, reaching $10.5 trillion USD annually by 2025. High-net-worth individuals must take proactive steps to protect their wealth from this growing threat.

As we move forward, it’s essential to consider the legal and tax implications of these advanced asset protection strategies. The next section will explore how recent changes in legislation and tax codes impact wealth preservation efforts for high-net-worth individuals.

Navigating Legal and Tax Complexities in Asset Protection

Evolving Asset Protection Laws

The legal landscape for high-net-worth individuals continues to shift, necessitating constant vigilance to protect assets effectively. In 2025, several key changes have emerged that significantly impact asset protection strategies.

The Uniform Voidable Transactions Act (UVTA) has replaced the older Uniform Fraudulent Transfer Act in many states as of 2025. This change affects how courts view transfers of assets in legal proceedings, potentially altering the effectiveness of certain protection strategies.

The Supreme Court’s decision in Carmack v. Reynolds has limited the protection offered by spendthrift trusts in some cases. High-net-worth individuals must now consider alternative trust structures or additional layers of protection to safeguard their assets.

Tax Implications of Protection Strategies

The tax implications of various asset protection strategies have become increasingly complex. The IRS has intensified scrutiny on certain types of trusts and offshore accounts. The Foreign Account Tax Compliance Act (FATCA) reporting requirements have expanded, making it essential for individuals with foreign assets to maintain meticulous records and reporting.

The step-up in basis at death is under review. Potential changes to this provision could significantly impact estate planning strategies for high-net-worth individuals. It’s important to stay informed about these potential changes and adjust strategies accordingly.

Collaboration with Professionals

The intricate nature of asset protection in 2025 requires working with a team of specialized professionals. This team should include financial advisors, tax attorneys, estate planning lawyers, and cybersecurity experts.

A coordinated approach ensures that all aspects of your asset protection strategy align and optimize for your specific situation. High-net-worth individuals should schedule annual reviews with their professional team to ensure their strategies remain robust and compliant with current laws and regulations.

Proactive Implementation

The most effective asset protection strategies require proactive implementation. Waiting until a threat emerges often proves too late. High-net-worth individuals should take immediate action to protect their assets.

Comprehensive Asset Protection Plan

Integrating legal and tax considerations with broader asset protection strategies creates a comprehensive plan. This holistic approach (which includes diversification, trust structures, and cybersecurity measures) provides the strongest defense against potential threats to wealth.

Final Thoughts

Wealth protection for high-net-worth individuals in 2025 requires a multifaceted approach. The landscape has evolved, demanding sophisticated strategies to safeguard wealth effectively against numerous and ever-changing threats. Proactive planning stands as the cornerstone of successful asset protection, making it essential to implement comprehensive strategies early and review them regularly.

Legal and tax considerations play a pivotal role in shaping effective asset protection plans. As laws continue to evolve, individuals must stay informed and adapt their strategies accordingly. Working with a team of specialized professionals ensures that all aspects of wealth protection receive proper attention, from legal structures to tax optimization.

At Davies Wealth Management, we understand the intricacies of wealth protection for high-net-worth individuals. Our team of experts crafts personalized asset protection strategies that align with your specific goals and circumstances. We offer comprehensive wealth management solutions, including investment management, retirement planning, and estate planning. Don’t leave your wealth vulnerable to potential threats. Take action now to protect what you’ve worked hard to build. Contact Davies Wealth Management to secure your financial future.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

Book an Appointment Today

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

Read the Latest Blog Posts

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

Subscribe for Weekly Insights

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

Connect with Davies Wealth Management

Website: tdwealth.net

Podcast: 1715tcf.com

Follow Us on Social Media:

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply