Stuart’s tropical climate and tax-friendly environment make it an attractive retirement destination. But retirement readiness involves more than just picking the perfect location.

We at Davies Wealth Management see many retirees who underestimate the financial complexities of relocating to Florida. From healthcare costs to housing market fluctuations, proper planning makes the difference between a comfortable retirement and financial stress.

What Does Retirement in Stuart Really Cost?

Stuart’s median home value of $383,958 sits below many Florida coastal markets, but housing costs tell only part of the financial story. The overall cost of living index of 99.5 positions Stuart favorably against the national average, yet retirees face specific expense categories that demand attention.

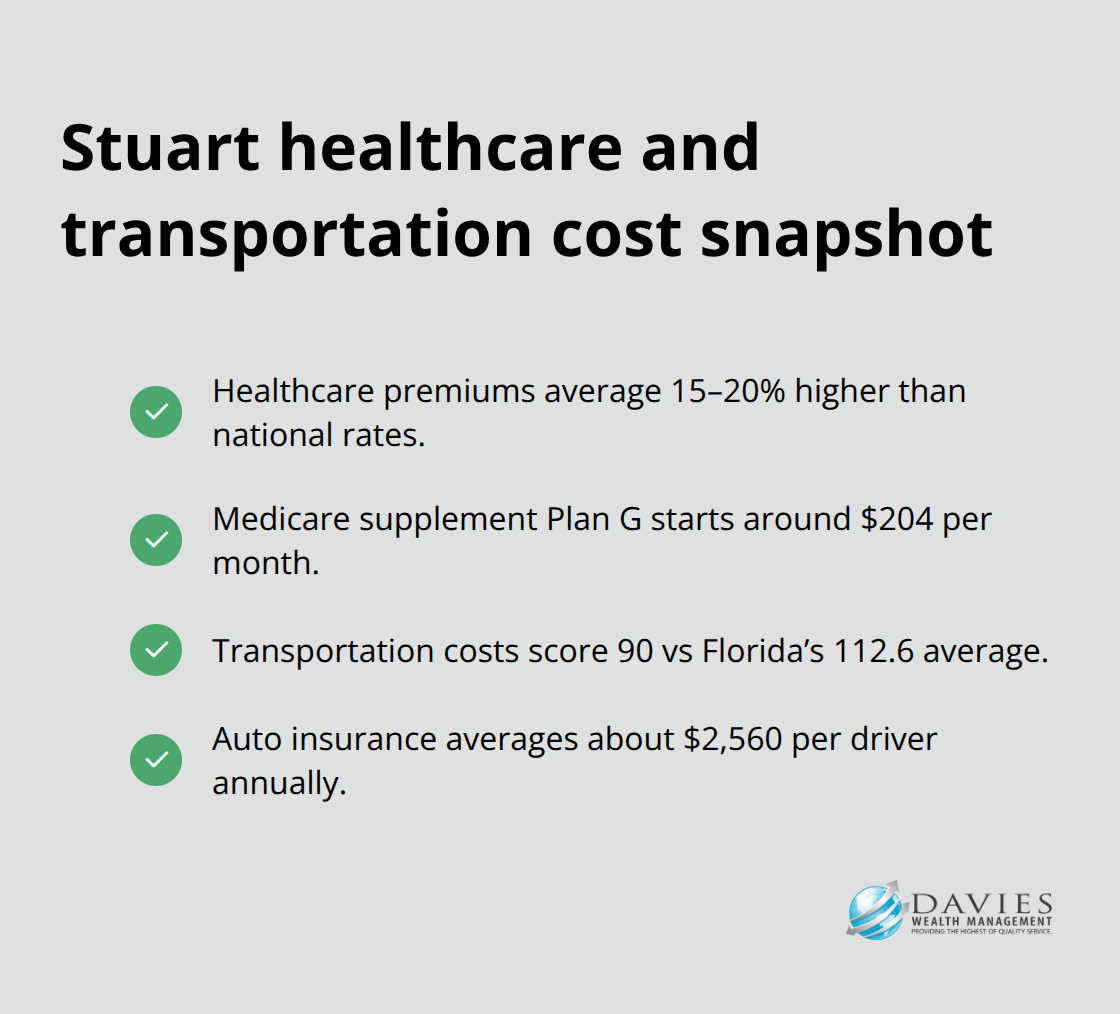

Healthcare premiums in Florida average 15-20% higher than national rates, while Medicare supplement policies start around $204 monthly for Plan G coverage. Transportation costs score lower at 90 compared to Florida’s 112.6 average, but vehicle insurance rates in Florida rank among the nation’s highest at roughly $2,560 annually per driver.

Housing Market Reality Check

Stuart’s housing market shows significant price variations, with condos that start around $82,000 and luxury waterfront properties that reach multi-million dollar ranges. Recent market data reveals substantial price reductions on multiple listings, including a $28,000 cut on one condo, which indicates negotiation opportunities for prepared buyers.

Property taxes in Martin County average 0.87% of assessed value, lower than many Florida counties. Homeowners insurance presents the biggest surprise for newcomers, with coastal properties that face premiums of $3,000-8,000 annually due to hurricane risk. Budget 2.5-3% of home value annually for combined property taxes and insurance.

Healthcare Cost Realities

Florida’s healthcare landscape creates unique financial pressures for retirees. Medicare Advantage plans in the state often limit provider networks, which forces many retirees into supplement insurance plans. Long-term care costs average $5,885 monthly for assisted living facilities in Stuart, exceeding in-home care options.

Prescription drug costs vary dramatically based on Medicare Part D plan selection. The average retiree spends $1,200-2,400 annually on medications not fully covered by insurance.

Income Planning Beyond Social Security

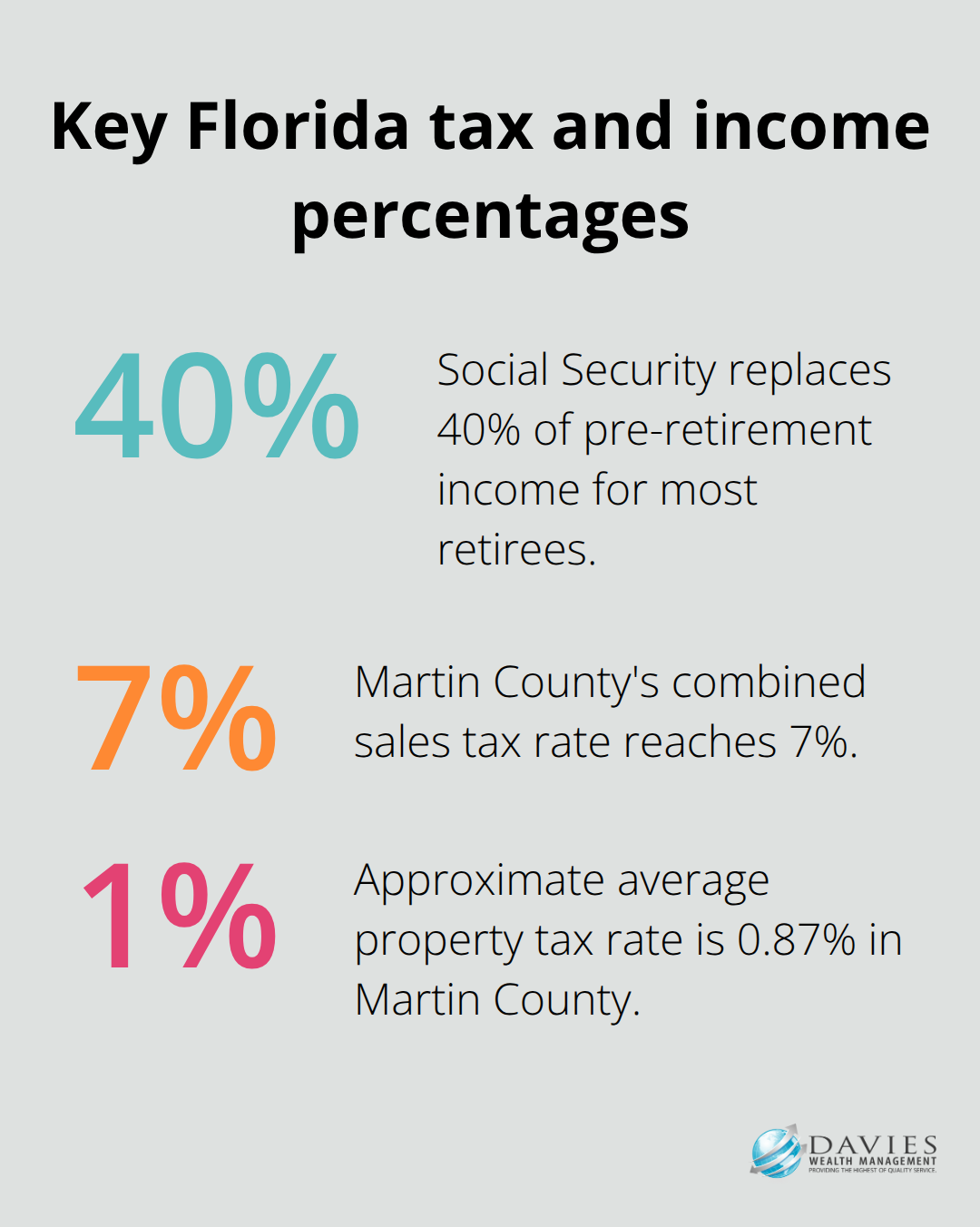

Social Security replaces only 40% of pre-retirement income for most retirees, which makes additional income streams necessary. Florida’s lack of state income tax saves retirees an average of $1,200-3,500 annually compared to high-tax states.

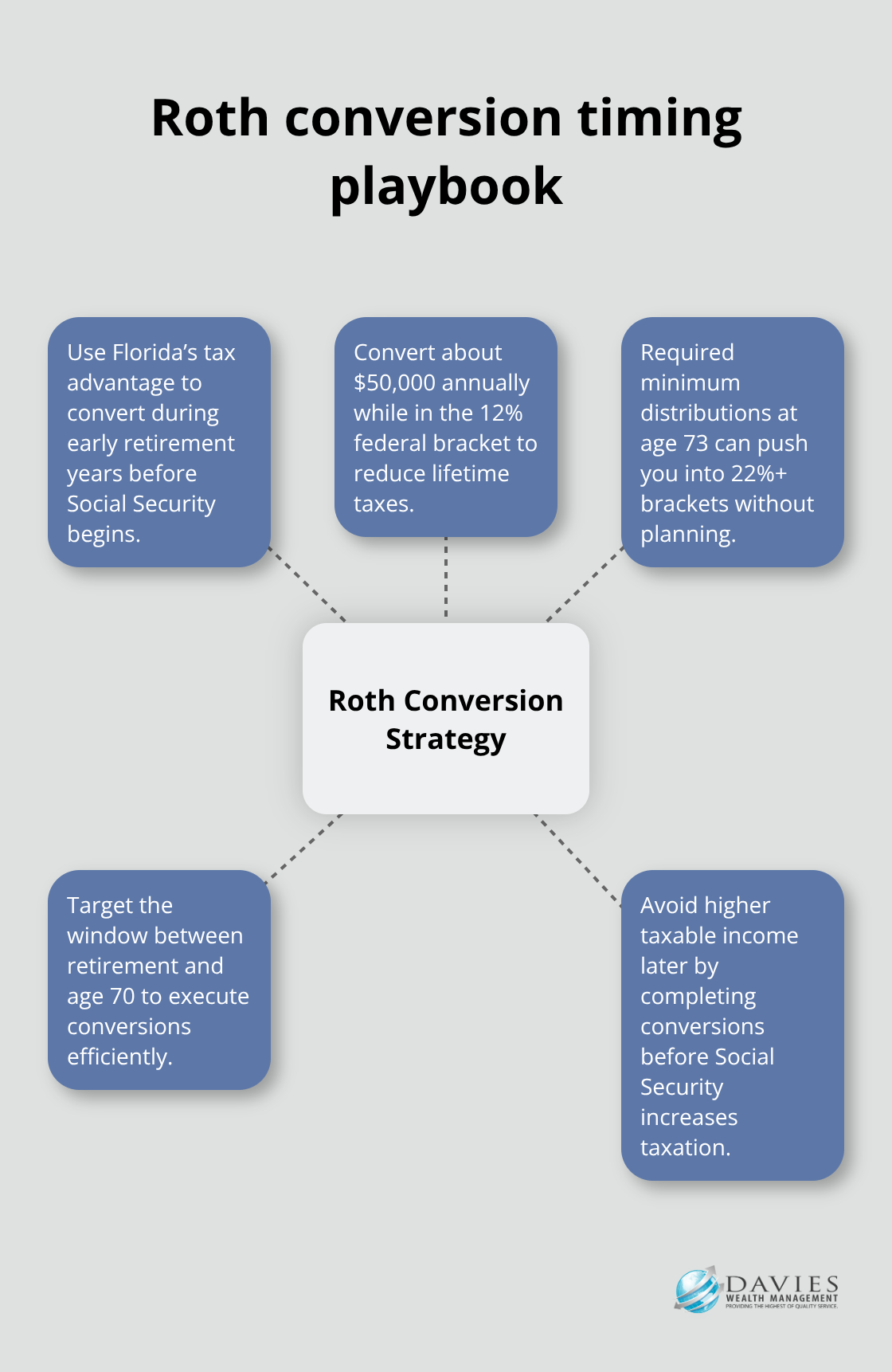

However, this tax advantage disappears quickly without proper retirement account management. Required minimum distributions from traditional IRAs and 401(k)s begin at age 73, which potentially pushes retirees into higher federal tax brackets. Convert traditional retirement accounts to Roth IRAs during lower-income years to reduce future tax burdens significantly.

These financial realities shape daily life in Stuart, but money represents just one aspect of retirement preparation. The lifestyle you envision will determine how these costs impact your overall retirement satisfaction.

What Will Your Stuart Lifestyle Actually Cost?

Stuart’s recreational landscape demands a realistic budget that many retirees underestimate. Golf memberships at Martin County courses range from $2,500 annually at public facilities to $15,000 for premium private clubs like Sailfish Point. Boating costs hit harder than expected, with marina slips that average $180-350 monthly, plus insurance, maintenance, and fuel that easily add $8,000-12,000 annually for a modest vessel.

Recreation and Entertainment Expenses

The Florida Oceanographic Coastal Center charges $12 for adults, while Stuart Heritage Museum costs $5, but frequent entertainment expenses accumulate quickly when you factor in meals at The Gafford where entrees start at $28 or casual spots like Riverwalk Cafe that average $18 per meal. Many retirees discover that their active lifestyle costs $300-600 monthly when they include golf fees, boat maintenance, and regular restaurant visits.

Transportation Realities in Coastal Florida

Vehicle ownership becomes expensive in Stuart due to Florida’s harsh climate and insurance requirements. Salt air accelerates rust and maintenance needs, which increases annual vehicle costs by 25-30% compared to inland locations. Auto insurance varies significantly by state with Florida ranking among the nation’s costliest states. Public transportation remains limited despite a local bus service and downtown tram, which forces most retirees to maintain personal vehicles. Ride-share services cost $12-18 for typical local trips, so car ownership becomes the practical choice for active retirees.

Social Connection Costs

Community involvement in Stuart requires financial commitment beyond membership fees. The Rock’n Riverwalk events are free, but regular participation in social clubs, fitness centers, and volunteer organizations typically costs $150-400 monthly when you include associated meals, travel, and activity expenses. Many retirees spend $200-500 monthly on entertainment and social activities to maintain the active lifestyle that attracted them to Stuart initially.

These social connections prove worthwhile for residents who value community engagement, but proper budget allocation for regular social activities prevents financial surprises that can limit participation. While lifestyle costs shape your daily retirement experience, retirement planning strategies can significantly impact how far your retirement dollars stretch in Florida’s unique tax environment.

How Much Can Florida’s Tax Benefits Really Save You?

Florida’s zero state income tax saves Stuart retirees substantial money, but maximizing these benefits requires strategic planning that most retirees overlook. A retiree with $80,000 annual income from pensions and withdrawals saves approximately $2,400-4,000 annually compared to high-tax states like New York or California. However, Florida compensates through higher sales tax at 6% statewide, plus local taxes that push Martin County’s rate to 7%. Property taxes remain moderate at 0.87% of assessed value, but newcomers often face reassessment at current market values rather than the previous owner’s tax basis.

Roth Conversion Opportunities in Low-Tax Years

Smart retirees use Florida’s tax advantage to execute Roth IRA conversions during their first retirement years before Social Security begins. Convert $50,000 annually from traditional IRAs to Roth accounts while in the 12% federal bracket to save thousands in future taxes. The IRS requires minimum distributions at age 73, which can push retirees into 22% or higher brackets without proper planning. Execute conversions between retirement and age 70 when income drops but before Social Security payments increase taxable income significantly.

Federal Tax Strategy Optimization

Florida residents can implement aggressive federal tax planning strategies without state tax complications. Tax-loss harvesting becomes more valuable when you don’t worry about state capital gains implications. Municipal bond income from other states becomes tax-free at the federal level while avoiding Florida’s sales tax on investment services (which doesn’t exist). Charitable deductions provide full federal benefits without state tax considerations that complicate planning in other jurisdictions.

Estate Planning Advantages and Complications

Florida offers no state estate tax, which saves wealthy retirees significant amounts compared to states with aggressive estate taxes. However, Florida’s homestead exemption creates complications for non-resident heirs who inherit property. The state’s forced heirship laws restrict how married couples can distribute assets, potentially creating unintended consequences for blended families.

Residency Requirements and Documentation

Establish Florida residency properly by spending 183+ days annually in the state, registering to vote, and obtaining a Florida driver’s license within 30 days to qualify for all tax benefits. Document your residency carefully because aggressive state tax authorities from your former state may challenge your Florida residency status for up to four years after relocation. Maintain detailed records of your time in Florida, including utility bills, medical appointments, and social activities that demonstrate genuine residency rather than temporary presence.

Final Thoughts

Retirement readiness in Stuart requires more than wishful thinking about Florida’s beaches and tax benefits. The financial realities we’ve outlined demand systematic preparation that begins years before your target retirement date. Start comprehensive planning at least five years before retirement to address Stuart’s unique cost structure.

Healthcare premiums, hurricane insurance, and lifestyle expenses create budget pressures that catch unprepared retirees off guard. Execute Roth conversions during low-income years, establish proper Florida residency documentation, and budget realistically for recreation costs that can easily reach $500 monthly. Professional guidance becomes valuable when you navigate Florida’s tax advantages alongside federal requirements (complex decisions around Medicare supplements, property insurance, and estate planning benefit from expert analysis rather than guesswork).

We at Davies Wealth Management specialize in comprehensive wealth management solutions that address these retirement complexities through personalized strategies. Take action now by calculating your true Stuart retirement costs, including healthcare, housing, and lifestyle expenses. Document your current financial position and create a timeline for necessary adjustments.

Leave a Reply