Stuart, Florida offers unique opportunities for building wealth along the Treasure Coast. The combination of no state income tax and growing real estate values creates an ideal environment for financial independence.

We at Davies Wealth Management understand the specific challenges local residents face, from hurricane preparedness to seasonal income variations. This guide provides actionable strategies tailored to Martin County’s economic landscape.

What Does Financial Freedom Actually Cost in Stuart?

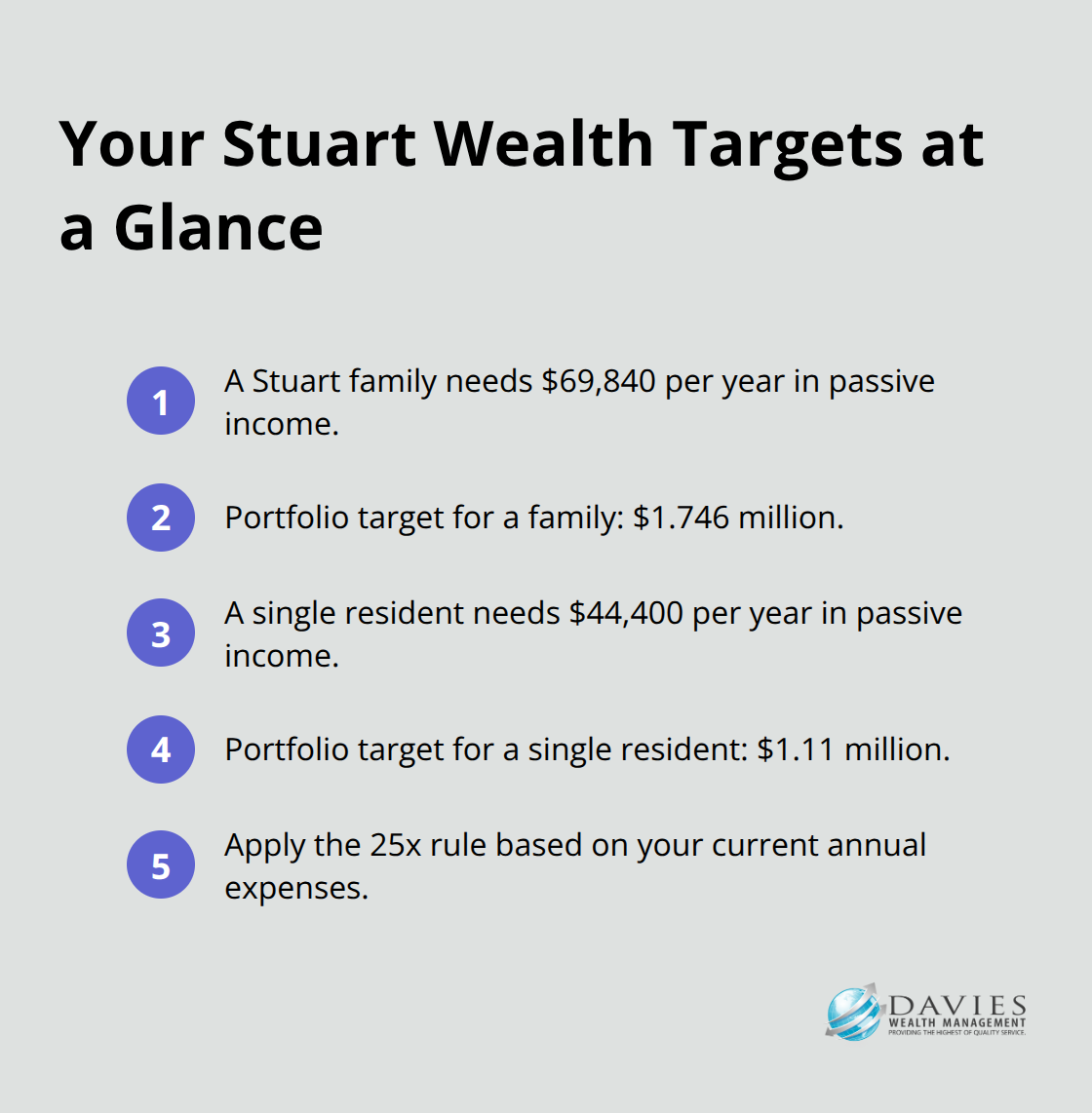

Financial freedom in Stuart means you have enough passive income to cover your monthly expenses without relying on employment. For a family, this translates to generating approximately $5,820 per month or $69,840 annually based on current cost of living data from BestPlaces. Single individuals need roughly $3,700 monthly or $44,400 yearly to maintain their lifestyle without traditional employment income.

The Real Numbers Behind Stuart Living

Stuart’s cost of living sits at 106 on the national index, making it 6% more expensive than the average American city. Housing dominates expenses with median home prices reaching $363,600, while rental costs average $1,400 for a two-bedroom unit. Transportation costs run particularly high at 112.6% of the national average, which significantly impacts monthly budgets. Grocery expenses register at 104.4% of national averages, while healthcare costs reach 102.3%. Utilities cost only 94.9% of national averages (providing some relief to monthly expenses).

Your Wealth Target Calculation

Financial independence requires you to accumulate 25 times your annual expenses, following the proven 4% withdrawal rule. For Stuart families, this means you must build a portfolio worth $1.746 million to generate the necessary $69,840 annually. Single residents need approximately $1.11 million in invested assets.

These targets assume a diversified portfolio generates 4% annual returns through dividends, interest, and capital appreciation.

Florida’s Tax Advantage Impact

The calculation becomes more favorable when you factor in Florida’s tax advantages, particularly the absence of state income tax. This effectively reduces your required portfolio size compared to high-tax states (where residents lose 5-13% of their income to state taxes). Your investment returns compound faster without state tax drag on dividends and capital gains.

These wealth targets provide the foundation for your investment strategy, but successful wealth accumulation requires understanding the specific opportunities available in South Florida’s dynamic market.

How Should Stuart Residents Build Wealth?

Real Estate Investment Opportunities

Stuart’s real estate market presents compelling opportunities for wealth accumulation, with median home prices at $372,490 and a 7.4% decrease over the past year according to current data. This market correction creates entry points for investors. Properties in Potsdam, Old Palm City, and Hutchinson Island South offer the strongest appreciation potential.

Investment properties generate rental income that averages $1,400 monthly for two-bedroom units (providing 4.6% gross yields before expenses). Focus on waterfront properties and newer developments with minimal HOA restrictions, as these command premium rents from seasonal residents and retirees who relocate from high-tax states.

Tax-Advantaged Account Strategies

Florida residents should prioritize Roth IRA conversions while they benefit from zero state income tax on the conversion amounts. Convert traditional IRA funds during market downturns when account values are temporarily reduced. Max out 401k contributions at $23,000 annually ($30,500 if over 50), plus employer matches.

Health Savings Accounts provide triple tax advantages with $4,150 individual and $8,300 family contribution limits for 2025. These accounts become powerful retirement vehicles after age 65 when withdrawals for any purpose avoid penalties. Consider tax planning strategies to maximize these benefits.

Portfolio Construction for Coastal Risks

Stuart investors must balance growth with hurricane preparedness through geographic diversification. Allocate no more than 30% of your portfolio to Florida real estate and local investments. Maintain 6-12 months of expenses in high-yield savings accounts that earn 4.5-5.0% annually through online banks.

Build positions in utility stocks, REITs outside hurricane zones, and dividend-focused ETFs that provide quarterly income. The combination of Florida’s tax advantages and strategic diversification accelerates wealth accumulation while it protects against regional economic disruptions.

However, even the best investment strategy faces unique challenges in coastal Florida that require specific preparation and risk management techniques.

What Financial Risks Actually Threaten Your Wealth in Stuart?

Hurricane Protection for Your Portfolio

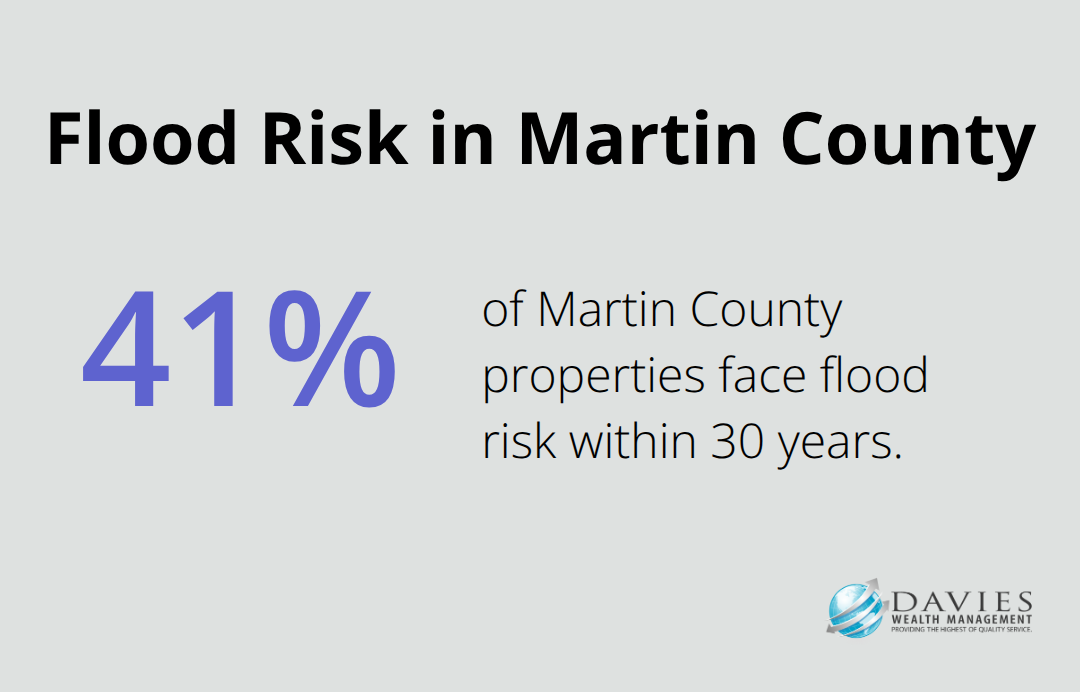

Stuart faces extreme weather risks that demand specific financial preparation beyond standard emergency funds. Climate data shows 40.7% of properties in Martin County will have flood risk in 30 years, which makes flood insurance essential even when your mortgage doesn’t require it. Standard homeowner’s policies exclude flood damage, so this coverage protects your wealth from catastrophic losses.

You must purchase flood insurance 30 days before hurricane season since policies include mandatory waiting periods.

Create a hurricane fund separate from your emergency savings that covers deductibles, temporary housing, and income replacement for 3-6 months. Keep this fund in high-yield savings accounts at banks outside Florida to avoid regional disruptions. Document all possessions with photos and receipts stored in cloud storage (not local safes that flood damage destroys).

Tax Strategy Mistakes That Cost Florida Residents

Florida’s zero income tax creates dangerous overconfidence about tax planning. You still owe federal taxes on retirement account withdrawals, and up to 85% of Social Security benefits may be taxable for singles with more than $34,000 income, and investment gains. Many retirees who relocate from high-tax states withdraw too much from traditional IRAs in their first Florida years, which pushes them into higher federal brackets unnecessarily.

Execute Roth conversions gradually over multiple years rather than large lump sums. Convert $50,000-75,000 annually from traditional accounts while you stay within the 22% federal bracket. This strategy eliminates future required minimum distributions that force large taxable withdrawals after age 73. Property taxes in Martin County remain significant on expensive waterfront properties.

Income Volatility Solutions for Seasonal Workers

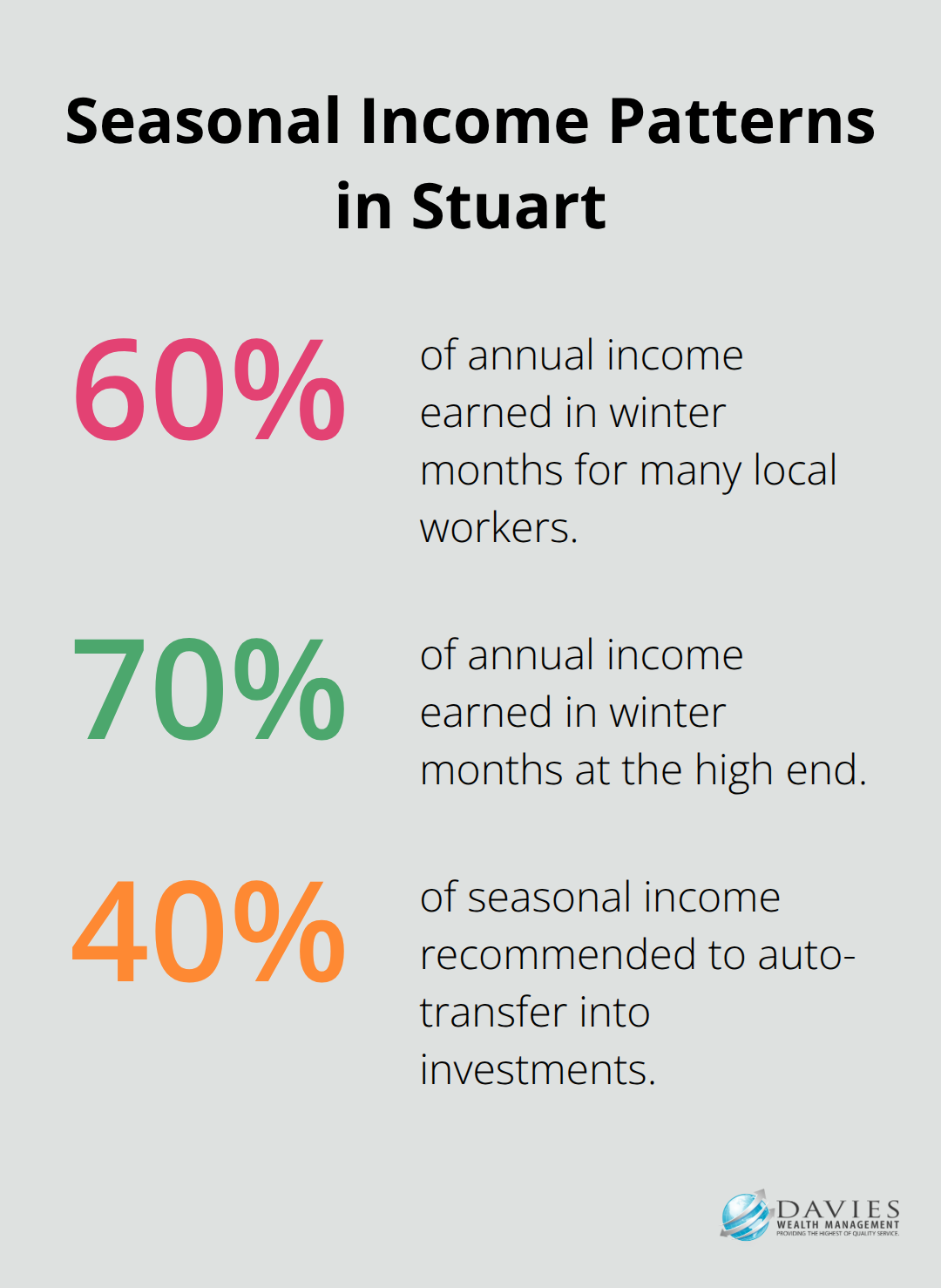

Stuart’s tourism-dependent economy creates income swings for restaurant workers, real estate agents, and service providers who earn 60-70% of annual income during winter months. Build your wealth accumulation around this reality rather than fight it. Open high-yield savings accounts during peak season and automatically transfer 40% of seasonal income to investment accounts before you spend it.

Construction workers and marine industry employees face similar patterns with busy periods from October through April. Use tax refunds and bonus payments for IRA contributions rather than lifestyle inflation. Set up automatic investments during high-income months that continue through slower periods, which creates dollar-cost averaging that smooths market volatility while it builds consistent wealth accumulation habits.

Final Thoughts

Your financial independence journey in Stuart starts with three immediate actions. Calculate your exact wealth target with the 25x rule based on current expenses, open tax-advantaged accounts, and build your hurricane preparedness fund alongside emergency savings. Florida’s zero state income tax maximizes your investment returns while you protect against coastal risks.

Your timeline spans 15-25 years with distinct phases that accelerate wealth accumulation. The first five years establish automated investment habits and maximize employer 401k matches. Years 6-15 emphasize aggressive wealth accumulation through real estate investments and Roth conversions, while the final decade shifts toward income generation as you approach your target portfolio value.

Professional guidance becomes essential for Martin County’s unique challenges and opportunities. We at Davies Wealth Management help individuals, families, and businesses achieve their financial goals through personalized advice and long-term relationships. The combination of Florida’s tax advantages, Stuart’s economy, and strategic planning creates exceptional opportunities for wealth accumulation along the Treasure Coast.

Leave a Reply