At Davies Wealth Management, we understand the unique financial challenges faced by young professionals. Wealth accumulation in the early stages of your career can set the foundation for long-term financial success.

This blog post explores effective strategies to accelerate your wealth-building journey, from smart investment choices to career growth opportunities and efficient budgeting techniques.

How Young Professionals Can Invest Smartly

At Davies Wealth Management, we’ve observed how smart investment strategies can significantly accelerate wealth accumulation for young professionals. The key is to start early and make informed decisions that align with your long-term financial goals.

The Power of Early Investing

Time is your greatest asset when it comes to investing. The power of compound interest allows money to grow exponentially over time and can help savers and investors turn small capital sums into large cash piles over many years.

Diversification: Your Shield Against Market Volatility

Spreading your investments across different asset classes, industries, and geographic regions is essential for managing risk and maximizing returns. A well-diversified portfolio might include a mix of stocks, bonds, real estate investment trusts (REITs), and potentially alternative investments like commodities or private equity.

Maximizing Tax Advantages

Tax-efficient strategies are important when you’re building your career in your 20s and 30s. Consider contributing to your employer-sponsored 401(k) plan, especially if there’s a company match. Additionally, opening an Individual Retirement Account (IRA) can be beneficial. A Roth IRA, in particular, can be an excellent choice for young professionals as it offers tax-free withdrawals in retirement.

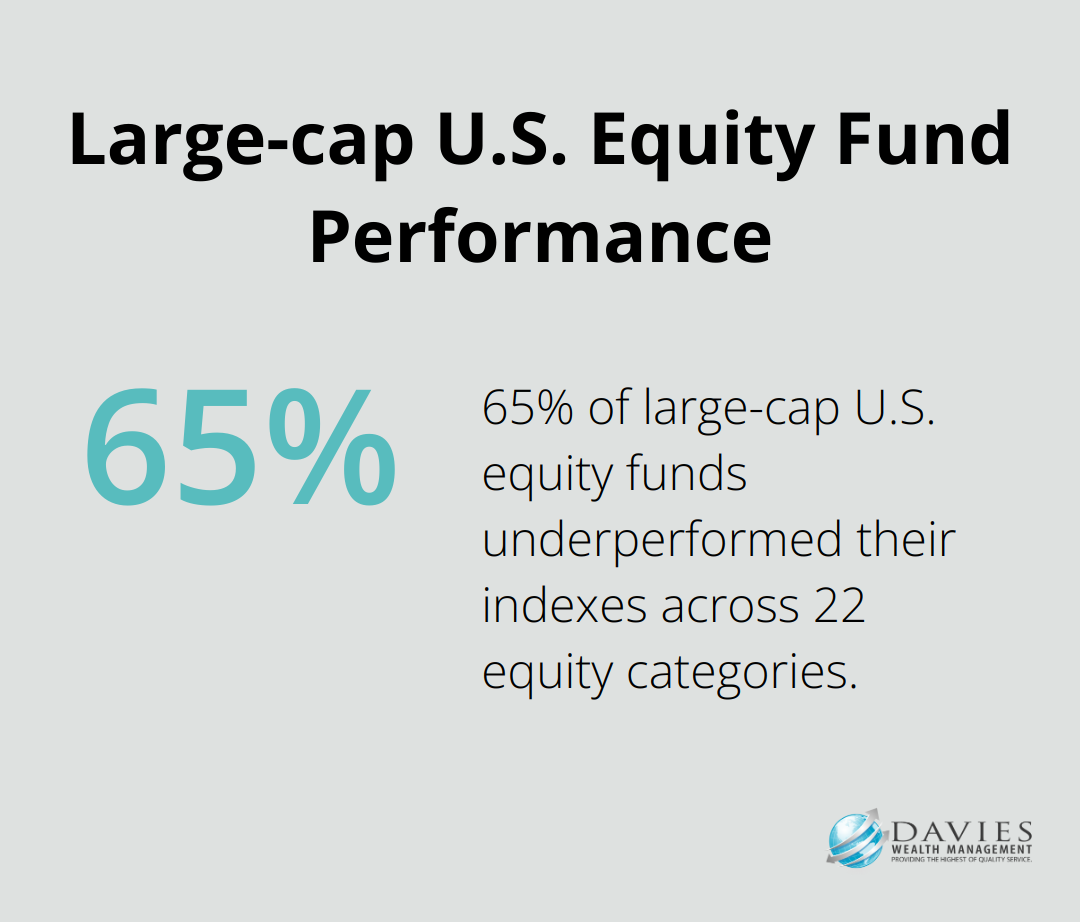

The Appeal of Low-Cost Index Funds

For many young investors, low-cost index funds are an excellent investment option. These funds track market indices like the S&P 500 and offer broad market exposure with minimal fees. A recent study found that 65% of all large-cap U.S. equity funds underperformed their indexes across 22 equity categories. This underscores the value of index investing for long-term wealth accumulation.

As you navigate these investment strategies, it’s important to tailor your approach to your individual goals and risk tolerances. The next section will explore how to maximize your income and career growth, which can provide you with more resources to invest wisely and accelerate your wealth accumulation journey.

How to Boost Your Income and Career

At Davies Wealth Management, we’ve observed how maximizing income and advancing your career can significantly accelerate wealth accumulation. Let’s explore some practical strategies to help you increase your earning potential and propel your professional growth.

Master In-Demand Skills

In today’s rapidly evolving job market, you must continuously develop high-demand skills. A recent LinkedIn report highlights that employers seek skills such as cloud computing, artificial intelligence, and UX design. Platforms like Coursera, edX, and Udacity offer courses in these areas, often in partnership with leading universities and tech companies. Investing in these skills can lead to salary increases of 10-20% or more (depending on your industry).

Perfect the Art of Salary Negotiation

Many young professionals underestimate the impact of effective salary negotiation. Research shows that failing to negotiate salary can create a starting salary difference of 7.4%, which over time can lead to substantial gaps. When you approach negotiations, research industry standards using resources like Glassdoor or PayScale. Prepare a list of your accomplishments and quantify your contributions to the company. Negotiation isn’t just about base salary – consider other benefits like stock options, flexible working arrangements, or professional development opportunities.

Diversify Your Income Streams

Creating multiple income streams can significantly boost your wealth accumulation efforts. A recent study found that already a third of Americans report having a side gig, with many of these side hustles being relatively new. Popular options include freelancing on platforms like Upwork or Fiverr, starting a blog or YouTube channel, or investing in dividend-paying stocks.

Build a Powerful Professional Network

Your network can be a powerful asset in accelerating your career growth and income potential. According to a LinkedIn survey, 85% of jobs are filled through networking. Attend industry conferences, join professional associations, and leverage LinkedIn to connect with peers and leaders in your field. Consider finding a mentor – studies show that mentored employees receive promotions five times more often than those without mentors.

These strategies can significantly boost your income and career prospects. However, earning more is only part of the equation. The next section will explore how effective budgeting and expense management can help you make the most of your increased earnings and further accelerate your wealth accumulation journey.

Mastering Your Money: Effective Budgeting and Expense Management

Create a Budget That Works

The foundation of financial control starts with a realistic budget. Track your expenses for a month using apps like Mint or YNAB (these tools automatically categorize your spending). Once you have this information, allocate your income using the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

A study by the National Foundation for Credit Counseling found that only 41% of Americans use a budget. You can put yourself ahead of the curve by joining this minority. Review and adjust your budget regularly to ensure it aligns with your financial goals and lifestyle changes.

Automate Your Financial Life

Automation serves as a powerful tool for efficient finance management. Set up automatic transfers to your savings account on payday. This “pay yourself first” approach ensures consistent savings before you have a chance to spend. Automated tools can also track your spending habits, categorize your expenses, and provide insights into your financial behavior.

For bill payments, use your bank’s online bill pay service or set up automatic payments with your service providers. This saves time and helps avoid late fees and potential credit score impacts. A survey by FICO found that payment history accounts for 35% of your credit score, making on-time payments essential for your financial health.

Tackle High-Interest Debt

High-interest debt (particularly credit card debt) can significantly hinder your wealth accumulation efforts. The average credit card interest rate in the U.S. is around 16% (according to the Federal Reserve). At this rate, a $5,000 balance could cost you over $800 in interest annually.

To address this, consider using the debt avalanche method. This method focuses on paying the loan with the highest interest rate first, while making minimum payments on the others. This approach minimizes the total interest you’ll pay over time.

If you struggle with multiple high-interest debts, a debt consolidation loan or a balance transfer credit card with a 0% introductory APR could benefit you. However, exercise caution with these options and make sure you have a solid plan to pay off the debt during the promotional period.

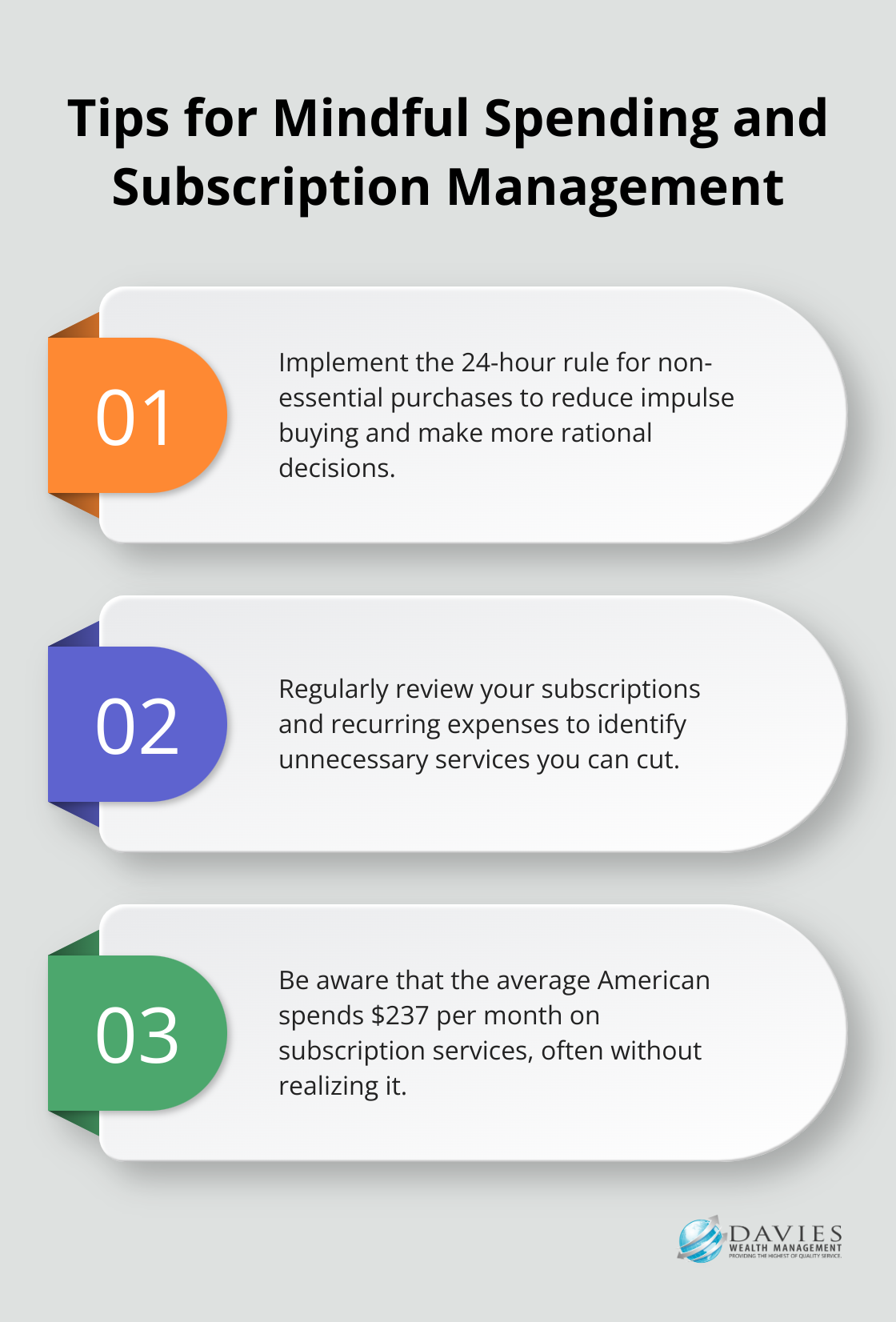

Practice Mindful Spending for Long-Term Wealth

Mindful spending aligns your purchases with your values and long-term financial goals. Before making a purchase, especially a large one, ask yourself if it aligns with your priorities and if it will contribute to your long-term financial well-being.

A practical way to implement this is the 24-hour rule for non-essential purchases. When tempted to buy something, wait 24 hours before making the purchase. This cooling-off period often leads to more rational decision-making and can significantly reduce impulse buying.

Additionally, review your subscriptions and recurring expenses regularly. A study by West Monroe found that the average American spends $237 per month on subscription services, often without realizing it. Cutting unnecessary subscriptions can free up a substantial amount for savings or debt repayment.

Final Thoughts

Wealth accumulation for young professionals requires a multifaceted approach. Smart investment strategies, career growth, and effective budgeting form the foundation for financial success. These elements work together to create a powerful wealth-building engine that can propel you towards your financial goals.

Professional financial advice can tailor these strategies to your unique circumstances and objectives. At Davies Wealth Management, we provide personalized wealth management solutions for individuals, families, and businesses (including professional athletes). Our expertise can help you navigate the complexities of wealth accumulation and optimize your financial strategy.

The path to financial prosperity demands consistent application of sound principles and regular review of your financial plan. Take control of your finances today to lay the groundwork for a secure and prosperous future. Contact Davies Wealth Management to start your journey towards accelerated wealth accumulation.

Leave a Reply