As a Florida business owner, you're sitting at the intersection of unprecedented opportunity and potential legislative uncertainty. The recent passage of the One Big Beautiful Bill Act of 2025 has dramatically shifted the succession planning landscape, creating a window that savvy entrepreneurs can leverage to protect their life's work while minimizing tax burdens for the next generation.

If you've been postponing your business succession planning, now is the time to act. The new federal estate tax exemptions, combined with Florida's business-friendly tax environment, present unique opportunities that may not be available indefinitely.

Revolutionary Changes in Federal Estate Tax Exemptions

The One Big Beautiful Bill Act of 2025 permanently raised the federal estate tax exemption to $15 million per individual and $30 million for married couples, effective January 1, 2026. This represents a substantial increase from the previous $13.99 million threshold and creates significant planning opportunities for business owners.

Here's why this matters for your succession planning: under previous law, the exemption was scheduled to sunset on December 31, 2025, and revert to approximately $6-7 million per person without Congressional intervention. While Congress has now permanently elevated the exemption, political landscapes can shift quickly. Future legislative changes could potentially reduce these favorable exemptions, making current planning more valuable than ever.

For Florida business owners, this means you can now transfer up to $15 million in business value to your heirs without triggering federal estate taxes. If you're married, that protection extends to $30 million – enough to cover most family business transitions while preserving wealth for future generations.

Florida's Unique Tax Advantages for Business Succession

Florida's most significant advantage remains its complete absence of state income tax, which substantially reduces the overall tax burden on business transfers and succession planning. However, this doesn't eliminate all tax considerations. When you sell a business in Florida, federal capital gains taxes may still apply, making comprehensive tax planning essential.

The state's business-friendly legal framework also supports succession planning through several key statutes:

- Florida Revised Limited Liability Company Act: Governs LLC formation, operation, and ownership transfers

- Florida Business Corporation Act: Outlines requirements for corporate ownership transitions

- Florida Uniform Fiduciary Income and Principal Act (FUFIPA): Effective January 1, 2025, this new law updated how trusts handle income and principal distributions

These legal structures, combined with Florida's tax advantages, create a foundation for efficient wealth transfer strategies that may not be available in other states.

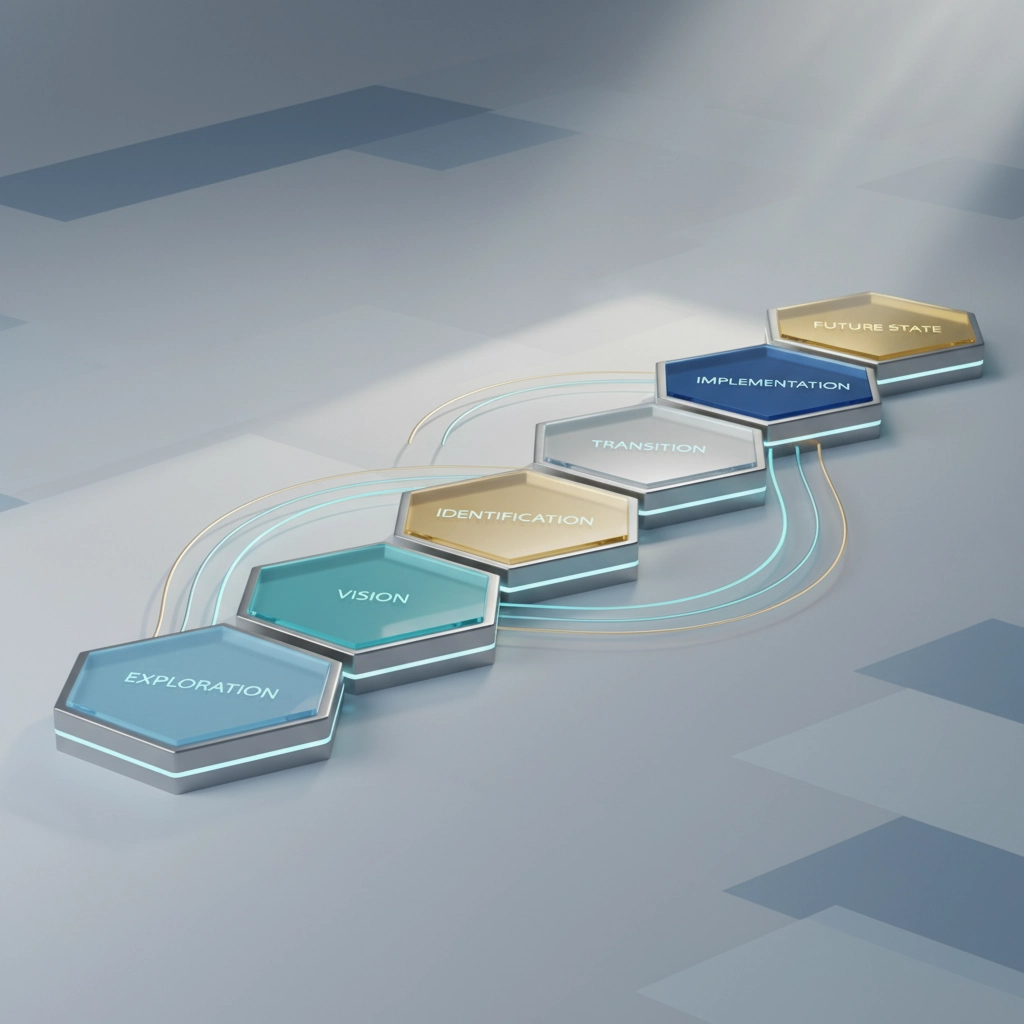

Seven Essential Steps for Effective Business Succession Planning

1. Identify and Develop Your Successor

Your first critical decision involves determining who will lead your business after you step away. This might be a family member, key employee, business partner, or external buyer. Each option requires different preparation strategies and timeline considerations.

Family successors need years of mentoring and gradually increased responsibilities. Employee successors require formal training programs and possibly equity participation plans. External buyers necessitate business valuation optimization and confidentiality agreements.

2. Determine Your Transfer Method

You have three primary options: sale, gift, or bequest. Each carries distinct tax implications under the new 2025 rules:

- Sale: Generates immediate liquidity but may trigger capital gains taxes

- Gift: Utilizes your $15 million lifetime exemption while removing future appreciation from your estate

- Bequest: Transfers ownership at death, potentially using step-up basis advantages

Many successful succession plans combine these methods, perhaps gifting partial ownership while maintaining voting control through trust structures.

3. Establish a Realistic Timeline

Effective succession planning typically requires 5-10 years for full implementation. This timeline allows for gradual ownership transfer, successor development, and tax-efficient strategies that spread impacts over multiple years.

Consider phases like initial gift transfers, management transition periods, and final ownership completion. Each phase should include specific milestones and contingency plans for unexpected circumstances.

4. Optimize Your Business Structure

Your current business entity type significantly affects succession options and tax treatment. LLCs offer flexibility for gradual ownership transfers and income distribution strategies. C-corporations may benefit from qualified small business stock (QSBS) exemptions. S-corporations provide pass-through taxation but limit ownership transfer options.

As we discuss on our podcast at www.1715tcf.com, many Florida business owners benefit from restructuring before implementing succession plans, optimizing for both current operations and future transfer efficiency.

5. Implement Tax-Efficient Transfer Strategies

With the new $15 million exemption, several advanced strategies become more accessible:

Family Limited Partnerships (FLPs): These structures can provide valuation discounts of 20-40% for gift and estate tax purposes, allowing you to transfer more business value within your exemption limits.

Grantor Retained Annuity Trusts (GRATs): Particularly effective in low interest rate environments, GRATs can transfer business appreciation to heirs while minimizing gift tax consumption.

Installment Sales: These arrangements spread capital gains over multiple years while providing guaranteed income streams, particularly useful when selling to family members or employees.

6. Address Liquidity and Cash Flow Needs

Business succession often creates cash flow challenges. Estate taxes, even with higher exemptions, may require liquidity. Buy-sell agreements with life insurance funding can provide immediate cash to surviving family members while ensuring smooth ownership transitions.

Consider your personal financial needs during retirement. Will the business provide ongoing income through consulting agreements or retained ownership percentages? These decisions affect both your financial security and the business's operational flexibility.

7. Create Comprehensive Legal Documentation

Your succession plan requires several coordinated legal documents:

- Buy-sell agreements governing ownership transfers and valuation methods

- Employment agreements for family successors or key employees

- Trust agreements for wealth transfer strategies

- Powers of attorney with specific business authority

- Updated wills coordinating personal and business estate plans

Strategic Timing Considerations for 2025

The current legislative environment creates urgency around certain planning strategies. While the new exemptions are designated as permanent, political changes could affect future tax policy. Additionally, business valuations may be more favorable now than in recovering economic conditions.

Consider accelerating gift strategies in 2025 to lock in current valuations and utilize exemptions before potential legislative changes. This might include gifting non-voting interests while retaining management control, or implementing installment sale structures that begin immediately.

Integration with Personal Wealth Management

Business succession planning cannot operate in isolation from your overall financial strategy. Your business represents a significant portion of your wealth, and its transition affects retirement income, estate planning, and family financial security.

This integration is where comprehensive wealth management becomes crucial. As a fiduciary planner serving Florida entrepreneurs, Davies Wealth Management coordinates business succession with retirement planning, tax optimization, and estate planning to ensure all elements work together seamlessly.

Consider how business succession affects your investment portfolio diversification, retirement income needs, and estate planning goals. The transition from business owner to retiree requires careful coordination of all wealth management components.

Common Pitfalls to Avoid

Many Florida business owners make critical mistakes in succession planning:

Waiting Too Long: Effective succession planning requires years of implementation. Starting too late limits your options and may force suboptimal tax strategies.

Ignoring Family Dynamics: Business succession affects family relationships for generations. Clear communication, fair treatment of non-participating family members, and professional mediation can prevent conflicts that destroy both businesses and families.

Underestimating Tax Implications: The interplay between federal estate taxes, gift taxes, generation-skipping taxes, and income taxes creates complex planning challenges that require professional expertise.

Failing to Plan for Contingencies: Disability, death, or business crises can derail succession plans. Proper insurance coverage, updated legal documents, and clear emergency procedures protect against unexpected circumstances.

Moving Forward with Confidence

The combination of Florida's business-friendly environment, new federal estate tax exemptions, and current economic conditions creates exceptional opportunities for business succession planning in 2025. However, these opportunities require decisive action and professional guidance to implement effectively.

Your business represents more than financial value – it embodies your professional legacy and provides security for future generations. Proper succession planning ensures this legacy continues while maximizing tax efficiency and family wealth preservation.

The complexity of business succession planning, particularly under new tax laws, makes professional guidance essential. Working with experienced advisors who understand both Florida's unique advantages and federal tax implications helps ensure your succession plan achieves your goals while protecting your family's financial future.

Don't let this opportunity pass. The time to act on business succession planning is now, while favorable exemptions remain available and your business value can be optimized for efficient transfer to the next generation.

Leave a Reply