Stuart retirees face unique opportunities to maximize their retirement income through Florida’s tax-friendly environment. The average retiree needs 70-80% of their pre-retirement income to maintain their lifestyle.

We at Davies Wealth Management see many retirees leaving money on the table by not optimizing their withdrawal strategies. Smart planning can add thousands to your annual income.

What Income Sources Fund Your Stuart Retirement

Social Security Timing Changes Everything

Stuart retirees who claim Social Security at 62 receive only 75% of their full benefit, while those who wait until age 70 increase monthly payments by 132%. A typical Stuart resident who earned $50,000 annually would receive $1,341 monthly at full retirement age versus $1,770 at age 70. The difference adds $5,148 annually to your income for life.

Part-time work in Stuart’s tourism industry (which generates $310 million in tax revenues) can help bridge the gap while you delay benefits. Many retirees find seasonal hospitality work that pays $15-18 hourly during peak months.

401k Withdrawals Need Strategic Sequence

Florida’s zero state income tax makes 401k withdrawals significantly more valuable than in high-tax states. A retiree who withdraws $40,000 annually saves $5,200 compared to California residents who pay 13% state tax. Start withdrawals from taxable accounts first, which allows tax-deferred accounts to grow longer.

Required minimum distributions begin at age 73, but Roth conversions during lower-income years between retirement and RMD age can reduce future tax burdens. Target 4% withdrawal rates from retirement accounts to maintain power against Stuart’s 16% higher cost of living compared to national averages.

Investment Income Supplements Fixed Benefits

Dividend stocks currently yield 1.16% on average through the S&P 500, but utilities and REITs offer higher returns. Florida commercial property REITs yield 4.2% annually and provide steady income tied to local economic growth. Stuart’s median rent of $2,600 monthly makes rental properties attractive for retirees with sufficient capital.

Short-term rentals average 226 booked nights yearly with 62% occupancy rates. Health Savings Accounts provide triple tax advantages after age 65 and function as additional retirement accounts once medical expenses are covered.

These income sources work best when you structure them within tax-efficient withdrawal strategies that maximize your after-tax income.

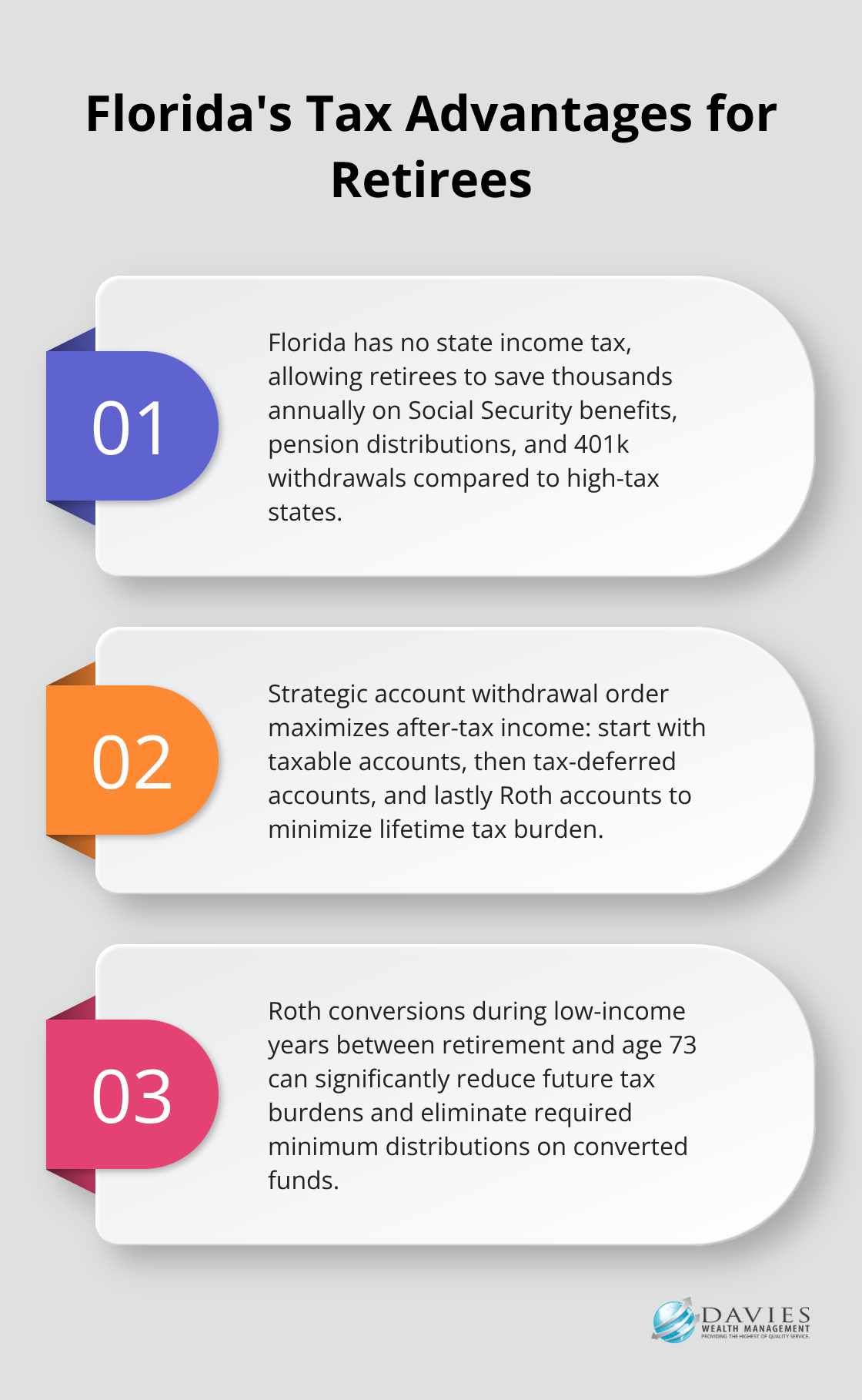

How Florida Tax Laws Boost Your Stuart Retirement Income

Florida retirees save massive amounts through strategic tax planning that other states cannot match. Stuart residents pay zero state income tax on Social Security benefits, pension distributions, and 401k withdrawals, while California retirees lose 13.3% to state taxes on the same income. A retiree who withdraws $60,000 annually saves $7,980 compared to high-tax states. Clients who moved from New York save $15,000-$20,000 annually on identical retirement income levels.

Strategic Account Withdrawal Order Maximizes After-Tax Income

Withdraw from taxable accounts first to allow tax-deferred accounts maximum growth time. Touch Roth accounts last since they provide tax-free income throughout retirement. This sequence minimizes lifetime tax burden significantly. Between retirement and age 73, convert traditional IRA funds to Roth accounts during low-income years when tax brackets drop. A retiree in the 12% bracket who converts $25,000 annually pays only $3,000 in taxes while eliminating future required minimum distributions on those funds.

Required Minimum Distributions Demand Active Management

RMDs begin at age 73 and force taxable withdrawals whether you need the money or not. Calculate RMDs when you divide account balances by IRS life expectancy factors. A $500,000 traditional IRA requires approximately $18,248 in distributions at age 73. Qualified Charitable Distributions allow donors over 70½ to transfer up to $100,000 directly from IRAs to charities, which satisfies RMD requirements without creating taxable income.

Health Savings Accounts Provide Triple Tax Benefits

Health Savings Accounts never require distributions and function as tax-free inheritance vehicles for beneficiaries. After age 65, HSAs work like traditional IRAs for non-medical expenses (with ordinary income tax) but remain tax-free for medical costs. Stuart’s healthcare costs ($110,000 annually for private nursing home rooms) make HSAs particularly valuable for long-term care planning and medical expense management throughout retirement.

Healthcare expenses represent one of the largest retirement costs that require careful planning and budgeting strategies.

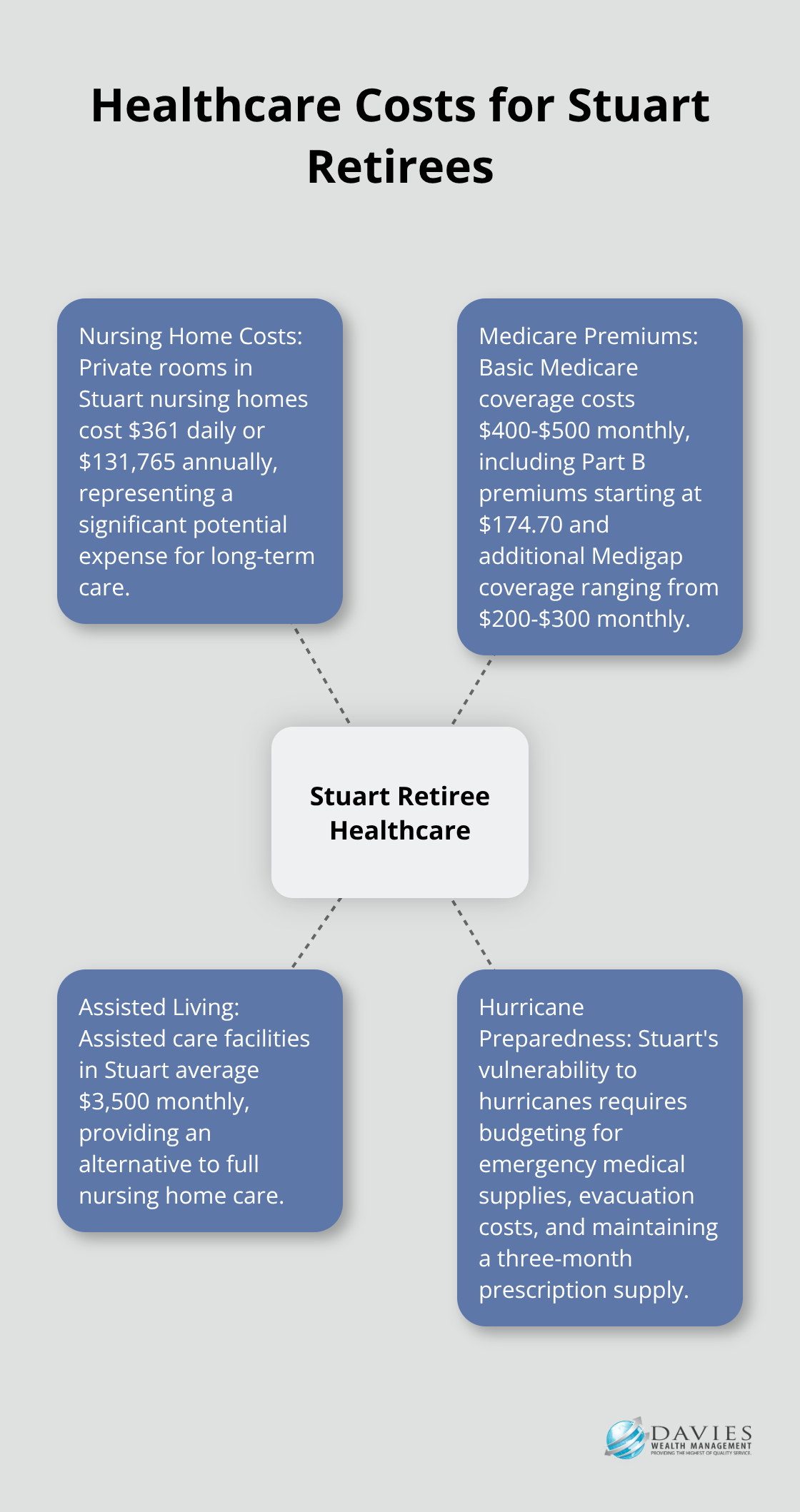

How Much Will Healthcare Cost You in Stuart

Healthcare expenses represent a significant portion of retirement spending nationwide, with future healthcare costs for an average 65-year-old potentially reaching $281,000 for men and $320,000 for women with traditional Medicare. Stuart retirees face higher costs due to premium medical facilities and hurricane-related health risks. Medicare Part B premiums start at $174.70 monthly in 2025, while Medigap Plan F costs an additional $200-$300 monthly in Florida. Stuart residents should budget $400-$500 monthly for basic Medicare coverage before they consider prescription drug plans that average $35-$50 monthly. The annual Medicare Part B deductible reaches $240 in 2025, and coinsurance requirements leave retirees responsible for 20% of medical costs after they meet deductibles.

Long-Term Care Insurance Protects Against Catastrophic Costs

Private rooms in Stuart nursing homes cost $361 daily or $131,765 annually, while assisted care averages $3,500 monthly. Long-term care insurance premiums for a 65-year-old couple range from $3,000-$5,000 annually but protect against costs that devastate retirement savings. Policies should cover at least $200 daily for care facilities and $150 for home care services. Florida’s Medicaid program requires asset depletion to $2,000 for individuals before coverage begins, which makes insurance protection vital for middle-class retirees who want to preserve wealth for spouses who survive them.

Hurricane Preparedness Adds Healthcare Budget Complexity

Stuart’s hurricane vulnerability requires emergency medical supply stockpiles and backup power for medical equipment. Prescription medication costs can become problematic during post-storm shortages, while evacuation expenses for medically fragile seniors average $2,000-$4,000 per event. Health Savings Accounts provide tax-free funds for emergency medical supplies and evacuation costs. Retirees should maintain three-month prescription supplies and budget $1,500 annually for storm-related medical preparations beyond standard healthcare expenses.

Medicare Supplement Options Reduce Out-of-Pocket Exposure

Medigap policies fill coverage gaps that original Medicare leaves open (particularly the 20% coinsurance on medical services). Plan G offers comprehensive coverage for $180-$250 monthly in Florida and covers Medicare Part B deductibles after you pay them. Plan N provides lower premiums at $140-$180 monthly but requires copays for doctor visits and emergency room visits. Medicare Advantage plans average $25 monthly in premiums but limit provider networks and may increase costs during serious illnesses when you need care most frequently.

Final Thoughts

Stuart retirees who coordinate Social Security timing, withdrawal strategies, and healthcare planning can add thousands to their annual retirement income. Social Security optimization alone provides $5,148 extra annually when you delay benefits until age 70, while Florida’s tax advantages save $7,980 on $60,000 in withdrawals. Healthcare costs demand immediate attention with nursing home expenses at $131,765 annually and Medicare coverage requirements of $400-$500 monthly.

Professional guidance helps you navigate complex withdrawal sequences, Roth conversions, and required minimum distributions that begin at age 73. We at Davies Wealth Management work with Stuart residents to develop personalized strategies that maximize after-tax retirement income while protecting against healthcare inflation and market volatility. Start your retirement income planning five years before you retire to optimize Social Security projections and establish tax-efficient withdrawal strategies.

Stuart’s unique combination of tax benefits and economic opportunities creates significant advantages for retirees who plan strategically. Davies Wealth Management helps you coordinate these complex financial decisions through comprehensive planning that addresses your specific retirement income needs. Contact us to develop a tailored approach that maximizes your retirement income potential in Stuart’s favorable tax environment.

Leave a Reply