Digital assets now represent over $2.3 trillion in global market value, fundamentally changing investment portfolios worldwide. Understanding how to manage digital assets has become essential for modern investors seeking portfolio diversification.

We at Davies Wealth Management recognize that effective digital asset management requires strategic planning, robust security measures, and disciplined risk assessment to navigate this rapidly evolving market successfully.

What Digital Assets Should You Consider?

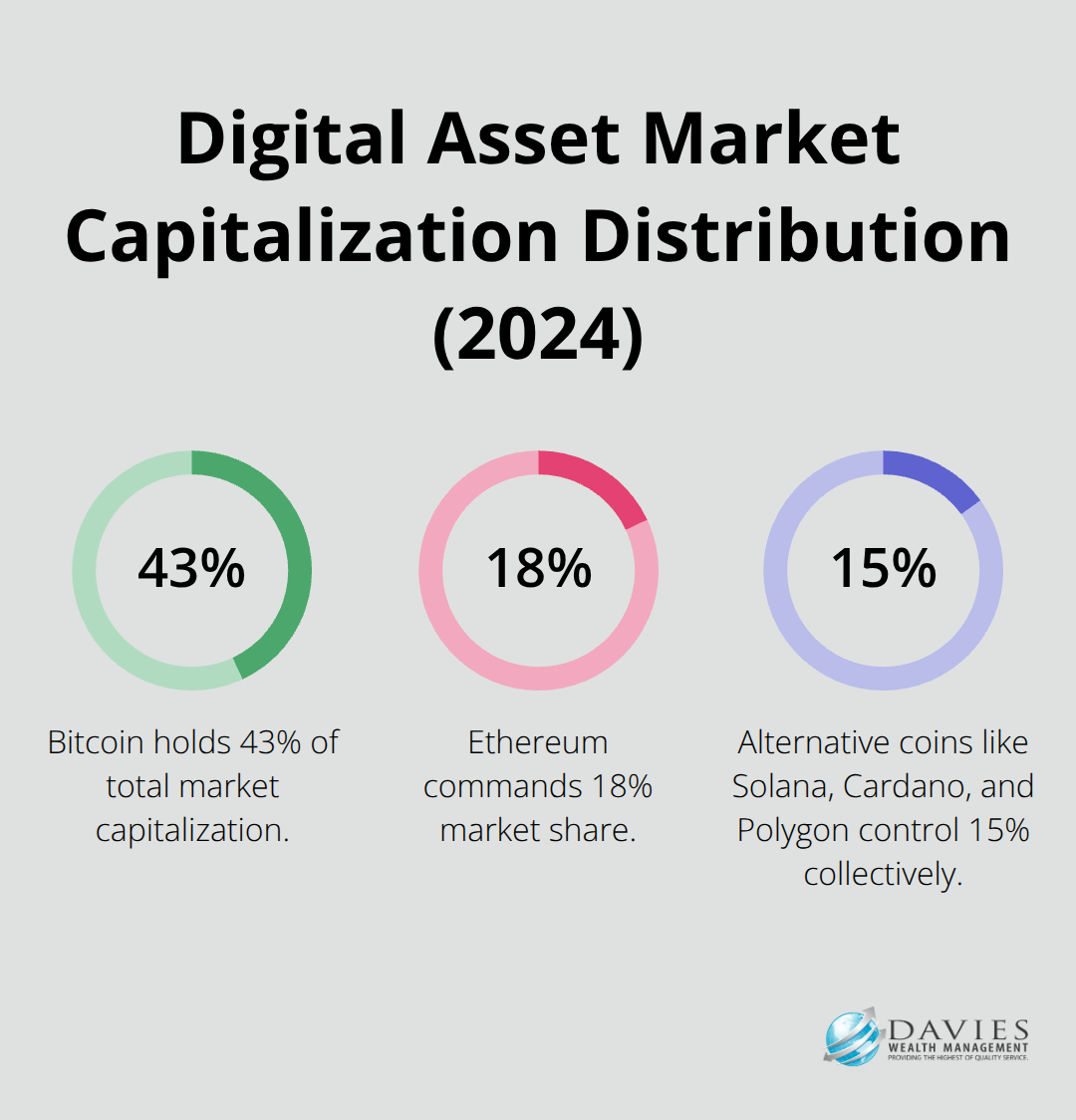

Cryptocurrency dominates the digital asset landscape, with Bitcoin holding 43% of total market capitalization as of 2024. Ethereum commands 18% market share, while alternative coins like Solana, Cardano, and Polygon control another 15% collectively. Non-fungible tokens reached $25 billion in trading volume during 2021 but now maintain $3 billion annually, which signals market maturation rather than collapse. Digital real estate tokens and tokenized securities exceed $1.2 billion in market value, providing exposure to traditional assets through blockchain infrastructure.

Market Growth Reveals Clear Performance Leaders

The digital asset market grew 400% between 2020 and 2024, surpassing traditional equity markets significantly. Bitcoin delivered a compound annual growth rate of 160% over the past decade, while the S&P 500 returned 13% annually during the same period. Institutional adoption accelerated dramatically as companies like MicroStrategy, Tesla, and Square added Bitcoin to corporate treasuries. Exchange-traded funds focused on digital assets attracted $8.2 billion in net inflows during 2023 alone.

Volatility Demands Strategic Position Management

Digital assets experience significant price fluctuations, with historical volatility measuring past price movements through various analytical methods. Bitcoin’s maximum drawdown reached 84% during bear markets, while Ethereum dropped 94% from peak to trough in 2018. Smart investors limit digital asset exposure to 5-15% of total portfolio value to manage downside risk effectively. Professional athletes and high-net-worth individuals benefit most from systematic dollar-cost averaging over 12-24 month periods, which reduces timing risk substantially.

These market dynamics create both opportunities and challenges that require specific management strategies to navigate successfully.

How Should You Structure Your Digital Asset Portfolio?

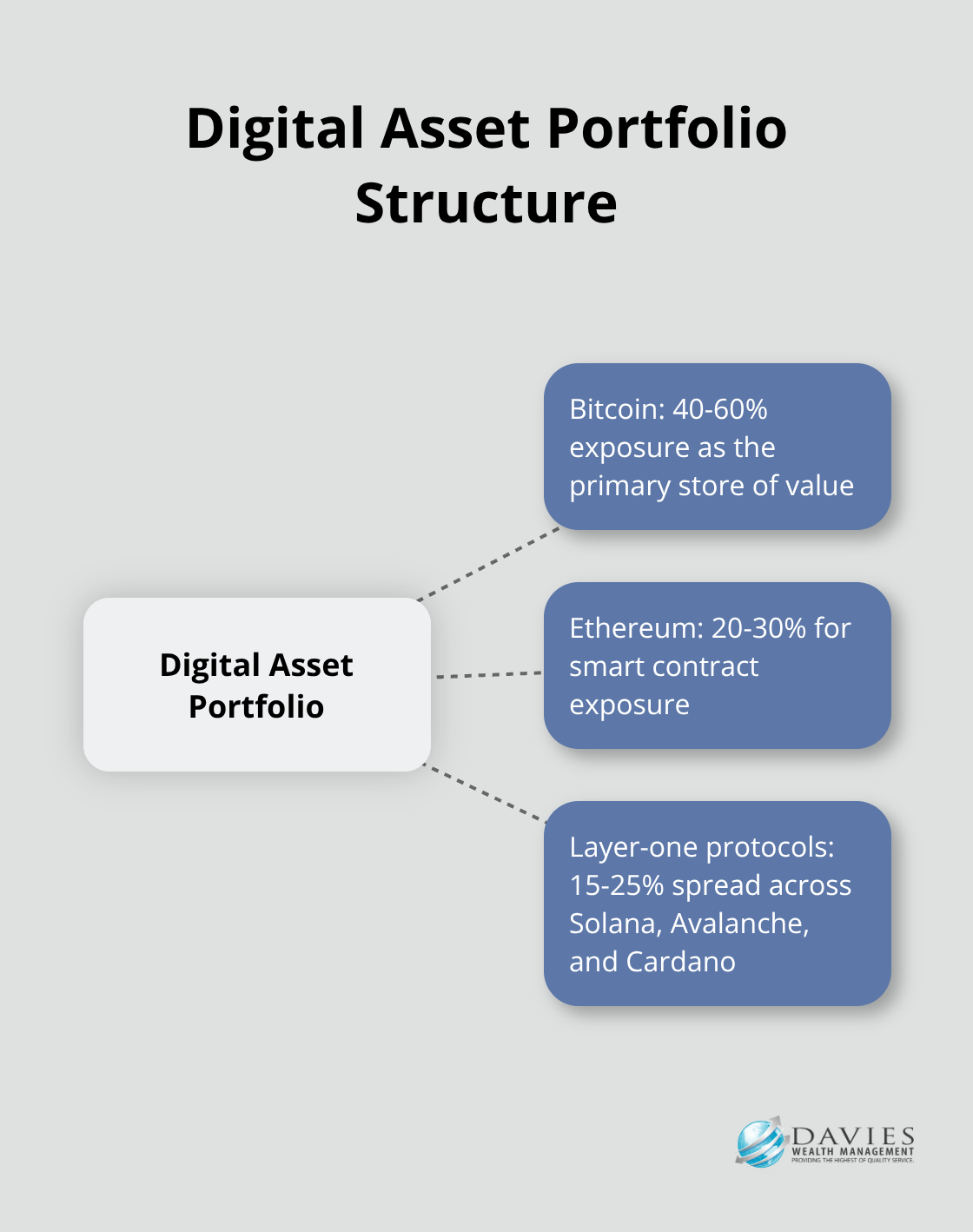

Effective digital asset management starts with strategic allocation across multiple blockchain networks and asset types. Professional investors maintain 40-60% Bitcoin exposure as the primary store of value, 20-30% in Ethereum for smart contract exposure, and 15-25% spread across layer-one protocols like Solana, Avalanche, and Cardano. This approach reduces single-point failures while it captures growth across different blockchain ecosystems. Research indicates that institutional adoption continues growing, with 271% of institutional investors having invested in digital assets as of mid-2025.

Dollar-Cost Averaging Beats Market Timing

Dollar-cost averaging into digital assets over 12-18 month periods consistently outperforms lump-sum investments due to extreme price volatility. DCA strategies seek to reduce the impact of market volatility on large acquisitions of financial assets such as equities or cryptocurrencies. Set automated purchases for $500-2,000 monthly (depending on your risk tolerance), and focus on major assets during the first six months before you add smaller positions. Professional athletes benefit most from this approach since their income streams allow consistent contributions regardless of market conditions.

Tax Optimization Through Strategic Harvesting

Tax-loss harvesting in digital assets generates significant savings when you execute it properly. Sell underperforming positions after you hold them for 31 days to avoid wash sale complications, then immediately repurchase similar but different assets to maintain market exposure. Ethereum Classic can substitute for Ethereum, while Litecoin replaces Bitcoin during harvest periods. High earners save 37% on capital gains through proper timing, while positions held for periods that exceed one year reduce tax rates to 15-20% for most investors. Structure large positions through self-directed IRAs to defer taxes entirely until retirement withdrawals begin.

Security Protocols Form the Foundation

These portfolio strategies require robust security measures to protect your digital assets from theft and loss, which makes proper storage solutions the next critical component of effective management.

How Do You Protect Your Digital Assets From Theft?

Cold storage represents the only secure method for substantial digital asset protection, with hardware wallets like Ledger Nano X and Trezor Model T that store private keys offline and away from internet threats. Store 80-90% of your assets in cold storage, and use hot wallets only for active positions worth less than $5,000. Hardware wallets cost $100-200 but protect millions in assets, while exchange hacks resulted in $3.8 billion in losses during 2022. Set up multiple hardware devices with identical seed phrases, and store backup devices in separate physical locations like safe deposit boxes or fireproof safes.

Multi-Signature Wallets Add Professional-Grade Security

Multi-signature wallets require two or three private keys to authorize transactions, which eliminates single points of failure that plague individual wallet solutions. Casa and Unchained Capital offer 2-of-3 multisig services where you control two keys while they hold the third (this creates geographic distribution and inheritance plans simultaneously). Professional athletes particularly benefit from multisig setups that require spouse approval for large transactions, which prevents impulsive purchases during emotional periods. Setup costs range from $100-300 monthly but protect eight-figure portfolios from both external attacks and internal mistakes.

Insurance Coverage Fills Critical Protection Gaps

Cryptocurrency insurance through providers like Coincover and BitGo protects against theft, exchange failures, and human error for premiums that start at 1-2% annually. Lloyd’s of London underwrites policies that cover up to $100 million per wallet, while smaller policies start at $10,000 coverage minimums. Document all wallet addresses, transaction histories, and recovery seed phrases in bank safety deposit boxes to create multiple inheritance pathways for beneficiaries. Professional-grade estate plans require specific cryptocurrency addendums in wills, since traditional probate courts cannot access blockchain assets without proper documentation and key management protocols (this step proves essential for wealth transfer).

Final Thoughts

Successful digital asset management requires three fundamental principles: strategic diversification across blockchain networks, disciplined risk management through position sizing, and robust security protocols that protect against both external threats and human error. Professional investors who limit exposure to 5-15% of total portfolio value while they maintain 80-90% in cold storage consistently outperform those who chase market trends or compromise on security measures. These investors understand how to manage digital assets within comprehensive wealth management frameworks that address taxation, estate planning, and inheritance protocols.

The integration of digital assets into traditional portfolios will accelerate as institutional adoption reaches mainstream acceptance. Exchange-traded funds attracted $8.2 billion in 2023, while corporate treasuries now hold Bitcoin as a strategic reserve asset. This trend creates opportunities for investors who master the complexities of digital asset management and position themselves for long-term growth.

We at Davies Wealth Management help professional athletes and high-net-worth individuals navigate these challenges through personalized financial planning that integrates digital assets with traditional wealth management solutions. Our approach addresses the unique needs of clients with fluctuating income streams and complex asset structures (particularly those transitioning beyond their primary earning years). Professional guidance becomes essential as digital assets mature from speculative investments into legitimate portfolio components that require sophisticated management strategies.

Leave a Reply