At Davies Wealth Management, we understand that building generational wealth is a goal for many families. It’s about creating a lasting financial legacy that can benefit your children, grandchildren, and beyond.

In this guide, we’ll explore actionable steps on how to build generational wealth, from smart investment strategies to effective wealth transfer techniques. We’ll also debunk common misconceptions and provide practical advice to help you secure your family’s financial future.

What Is Generational Wealth?

The True Meaning of Generational Wealth

Generational wealth transfer extends beyond simply passing money to your children. It creates a financial foundation that supports your family for generations. This wealth includes assets, investments, and financial education that can benefit multiple generations. It encompasses cash, property, businesses, investment portfolios, and the knowledge to manage these resources effectively.

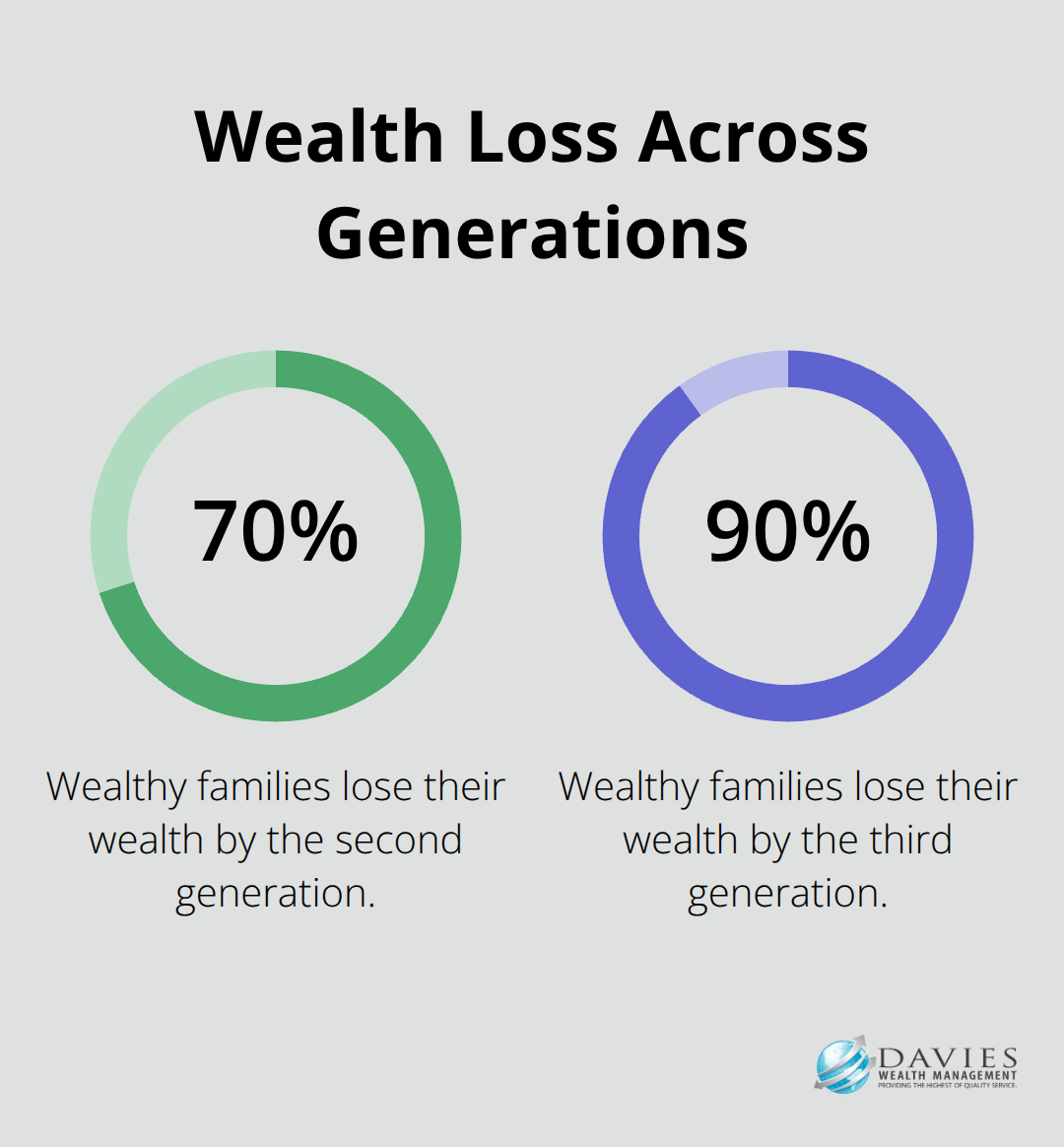

A study estimates that 70% of wealthy families lose their wealth by the second generation, and 90% by the third. This fact highlights the importance of not just accumulating wealth, but also preserving it for future generations.

The Importance of Long-Term Financial Planning

Building generational wealth requires a long-term perspective. It’s not about quick riches or overnight success. Instead, it focuses on consistent, strategic financial decisions made over decades. This type of long-term planning proves especially crucial for clients in professional sports, who often have shorter career spans but higher earning potential.

Common Misconceptions About Wealth Building

Many people believe that building generational wealth is only for the ultra-rich or those born into money. This is simply not true. Anyone can start building wealth with the right strategies and discipline.

Another common myth is that a high income automatically translates to wealth. In reality, it’s not about how much you make, but how much you keep and how wisely you invest it. Clients with modest incomes can build significant wealth through smart saving and investing strategies.

The Role of Financial Education

Financial literacy plays a critical role in building and maintaining generational wealth. It’s not enough to simply pass down assets; the next generation must understand how to manage and grow that wealth. Financial literacy empowers informed decision-making about budgeting, investing, and managing debt. This education should start early, teaching children about budgeting, saving, and investing from a young age.

The Power of Compound Interest

Compound interest acts as a powerful tool in wealth building. It allows your money to grow exponentially over time, as you earn returns not just on your initial investment, but also on the accumulated interest. This concept underscores the importance of starting to invest early, even with small amounts.

As we move forward, we’ll explore effective strategies for building generational wealth, including diversifying investment portfolios and maximizing tax-advantaged savings opportunities.

Building Wealth That Lasts

Strategic Investment Diversification

At Davies Wealth Management, we have identified key strategies that consistently yield results in building generational wealth. These approaches go beyond simple saving; they involve active wealth creation and preservation.

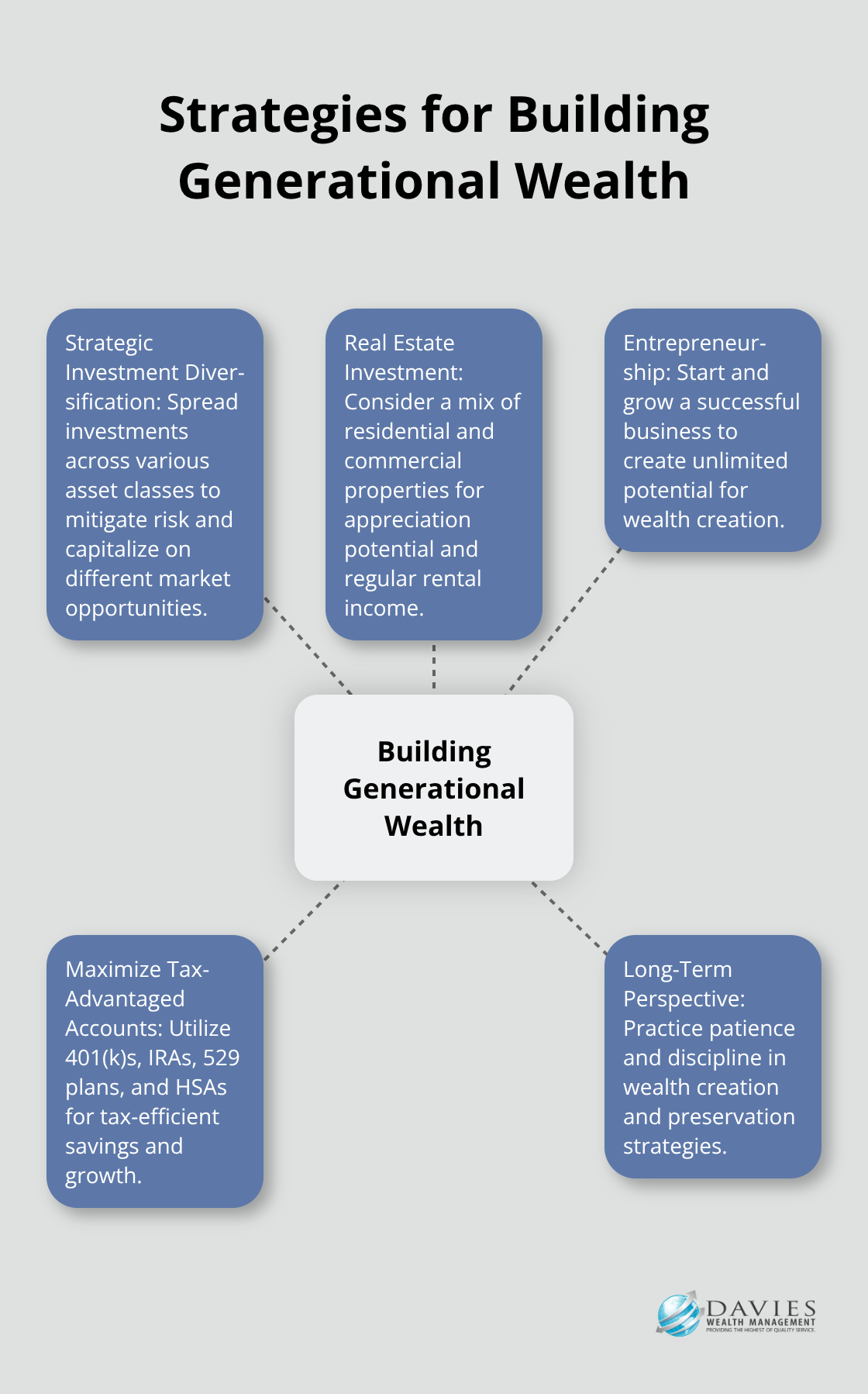

Diversification forms the cornerstone of a robust investment strategy. We recommend spreading investments across various asset classes, including stocks, bonds, real estate, and alternative investments. This approach helps mitigate risk and capitalize on different market opportunities.

The S&P 500 has historically returned an average of 9.96% annually (though past performance doesn’t guarantee future results). We often suggest a mix that includes both growth-oriented stocks and more stable, income-producing assets like dividend stocks or bonds.

Real Estate: A Tangible Asset for Wealth Building

Real estate has long been a favored vehicle for building generational wealth. According to the Federal Reserve, real estate accounted for about 23% of household wealth in the United States as of 2021. This asset class offers multiple benefits:

- Potential for appreciation

- Regular income through rentals

- Tax advantages through depreciation and mortgage interest deductions

We often advise clients to consider a mix of residential and commercial properties, depending on their risk tolerance and management capabilities. For those new to real estate investing, a single-family rental property can serve as a good entry point.

Entrepreneurship: Creating Wealth Through Business Ownership

Starting and growing a successful business can be one of the most powerful ways to build generational wealth. The U.S. Small Business Administration reports that small businesses accounted for 1.0 million openings and 833,458 closings. While entrepreneurship carries risks, it also offers unlimited potential for wealth creation.

We work with business owners to develop comprehensive financial strategies that support both personal and business growth. This includes succession planning to ensure the business can be effectively passed down to future generations or sold for maximum value.

Maximizing Tax-Advantaged Accounts

Utilizing tax-advantaged accounts is an essential strategy for wealth accumulation. These include:

- 401(k)s and IRAs for retirement savings

- 529 plans for education expenses

- Health Savings Accounts (HSAs) for medical costs

Contributing the maximum to a 401(k) ($22,500 in 2023, or $30,000 if you’re 50 or older) can significantly boost your retirement savings over time, especially when coupled with employer matching.

The Long-Term Perspective

Building generational wealth requires patience, discipline, and expert guidance to navigate the complexities of wealth creation and preservation. It’s a marathon, not a sprint. The next chapter will explore how to effectively preserve and transfer this hard-earned wealth to future generations, ensuring your financial legacy endures.

How Can You Safeguard Your Family’s Financial Future?

The Cornerstone of Estate Planning

Estate planning and asset protection are both tools for wealth preservation and key components of personal financial planning. It protects your assets and loved ones, regardless of your wealth level. A well-structured estate plan minimizes taxes, avoids probate, and ensures the execution of your wishes.

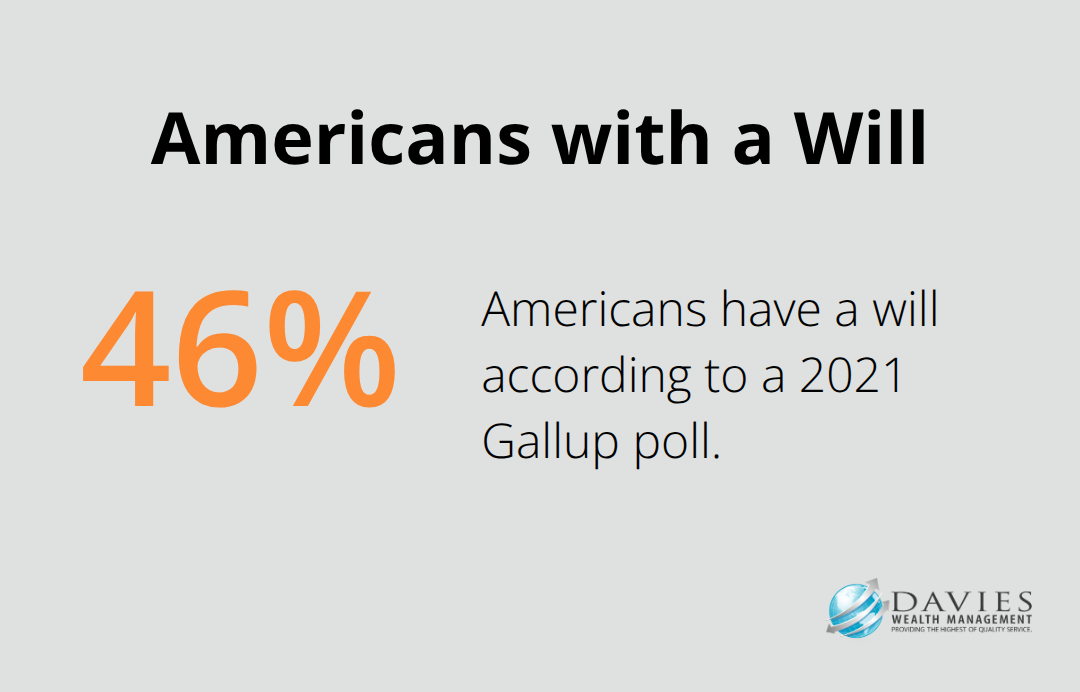

A will stands as a key component of estate planning. A 2021 Gallup poll revealed that only 46% of Americans have a will, which can lead to significant complications for heirs. We recommend collaborating with an experienced estate planning attorney to draft a comprehensive will that clearly outlines your asset distribution preferences.

Establishing power of attorney is another vital element. This legal document allows you to designate someone to make financial and medical decisions on your behalf if you become incapacitated. Without it, your family may face lengthy and costly court proceedings to gain authority over your affairs.

Trusts: Powerful Tools for Wealth Preservation

Trusts offer flexibility, privacy, and potential tax benefits for preserving and transferring wealth. Revocable living trusts can help safeguard your finances. They offer benefits over a will, including probate avoidance and asset management during incapacity.

For those with substantial assets, more specialized trusts might prove beneficial. An irrevocable life insurance trust (ILIT), for example, can reduce estate taxes by removing life insurance proceeds from your taxable estate.

Financial Literacy for the Next Generation

Teaching your children and grandchildren about money management plays a critical role in preserving generational wealth. Studies indicate that financial habits form as early as age seven. Start early by involving your children in age-appropriate financial discussions and decisions.

Try setting up a “family bank” where children can earn money for chores and learn about saving, spending, and investing. As they grow older, involve them in family financial meetings. Explain your investment strategies, discuss your family’s philanthropic goals, and share your experiences with money management.

For adult children, consider gifting them shares in a family investment account. This provides hands-on experience with investing while allowing you to guide their financial decisions.

Philanthropy’s Role in Wealth Preservation

Philanthropy can significantly contribute to preserving family wealth while making a positive societal impact. A family foundation, for instance, can help reduce estate taxes while creating a lasting legacy.

Among family foundations, more than two-thirds (69%) had paid staff. Of the family foundations with paid staff, 39% employed full-time staff who were related. Beyond the tax benefits, family philanthropy can unite generations around shared values and teach important lessons about financial stewardship.

Consider involving your children in charitable giving decisions from an early age. This can help them develop a sense of social responsibility and understand wealth’s power to effect positive change.

Final Thoughts

Building generational wealth requires strategic planning and long-term commitment. We at Davies Wealth Management specialize in guiding families through this complex process. Our tailored approach helps clients navigate investment strategies, tax planning, and estate management to achieve their financial goals.

Professional guidance proves invaluable when creating a lasting financial legacy. We offer expertise in wealth preservation techniques that can benefit your family for generations. Our team works closely with clients to develop comprehensive plans that align with their unique circumstances and aspirations.

You can start building generational wealth today by taking action on the strategies discussed in this guide. Contact Davies Wealth Management to learn how we can help you create a financial legacy that extends far into the future (and secures your family’s prosperity for years to come).

Leave a Reply