As young professionals embark on their careers, making smart investment decisions can set the stage for long-term financial success. At Davies Wealth Management, we understand the unique challenges and opportunities that come with investing in your 20s and 30s.

This guide explores essential investment strategies for young professionals, tailored to help you build wealth and achieve your financial goals. From maximizing retirement accounts to diversifying your portfolio, we’ll cover the key steps to create a solid financial foundation for your future.

What Are Your Financial Goals?

Short-Term vs. Long-Term Objectives

As young professionals, you must set clear financial objectives to create a successful investment strategy. Those who define their goals early often make more informed decisions and achieve better long-term results.

Your financial goals should span both the near future and decades ahead. Short-term goals might include saving for a house down payment, paying off student loans, or building an emergency fund. Long-term objectives typically focus on retirement planning, funding your children’s education, or achieving financial independence.

The Retirement Confidence Survey, conducted by the Employee Benefit Research Institute, is the longest-running survey of its kind, measuring worker and retiree confidence about retirement.

Understanding Your Risk Profile

Your risk tolerance plays a key role in shaping your investment strategy. It’s influenced by your age, income stability, and personal comfort with market fluctuations. Younger investors often have a higher risk tolerance due to a longer investment horizon, allowing them to withstand market volatility.

To assess your risk tolerance, consider how you’d react to a 20% drop in your portfolio’s value. Would you sell in a panic or see it as an opportunity to buy more? Your answer can guide the allocation of your investments between stocks, bonds, and other assets.

The Debt-Investment Balance

Young professionals often struggle to balance debt repayment with investment growth. While it’s tempting to focus solely on paying off debt, this approach might cost you valuable years of compound growth in the market.

A strategic approach prioritizes high-interest debt while simultaneously investing, especially in tax-advantaged accounts like 401(k)s with employer matching. For example, if your employer offers a 5% match on 401(k) contributions, and your student loan interest rate is 4%, it makes financial sense to contribute enough to get the full match before accelerating student loan payments.

Aligning Goals with Investment Strategies

Once you’ve identified your financial goals, risk tolerance, and debt situation, you can align these factors with appropriate investment strategies. This alignment ensures that your investment choices support your specific objectives and time horizons.

For short-term goals (1-5 years), you might consider more conservative investments like high-yield savings accounts or short-term bond funds. For long-term goals (10+ years), you can afford to take on more risk with a higher allocation to stocks or stock-based mutual funds.

As you move forward in your financial journey, it’s essential to explore the various investment vehicles available to young professionals. These tools can help you maximize your savings and work towards your financial objectives efficiently.

Smart Investment Vehicles for Young Professionals

Employer-Sponsored Retirement Plans: Your First Investment Priority

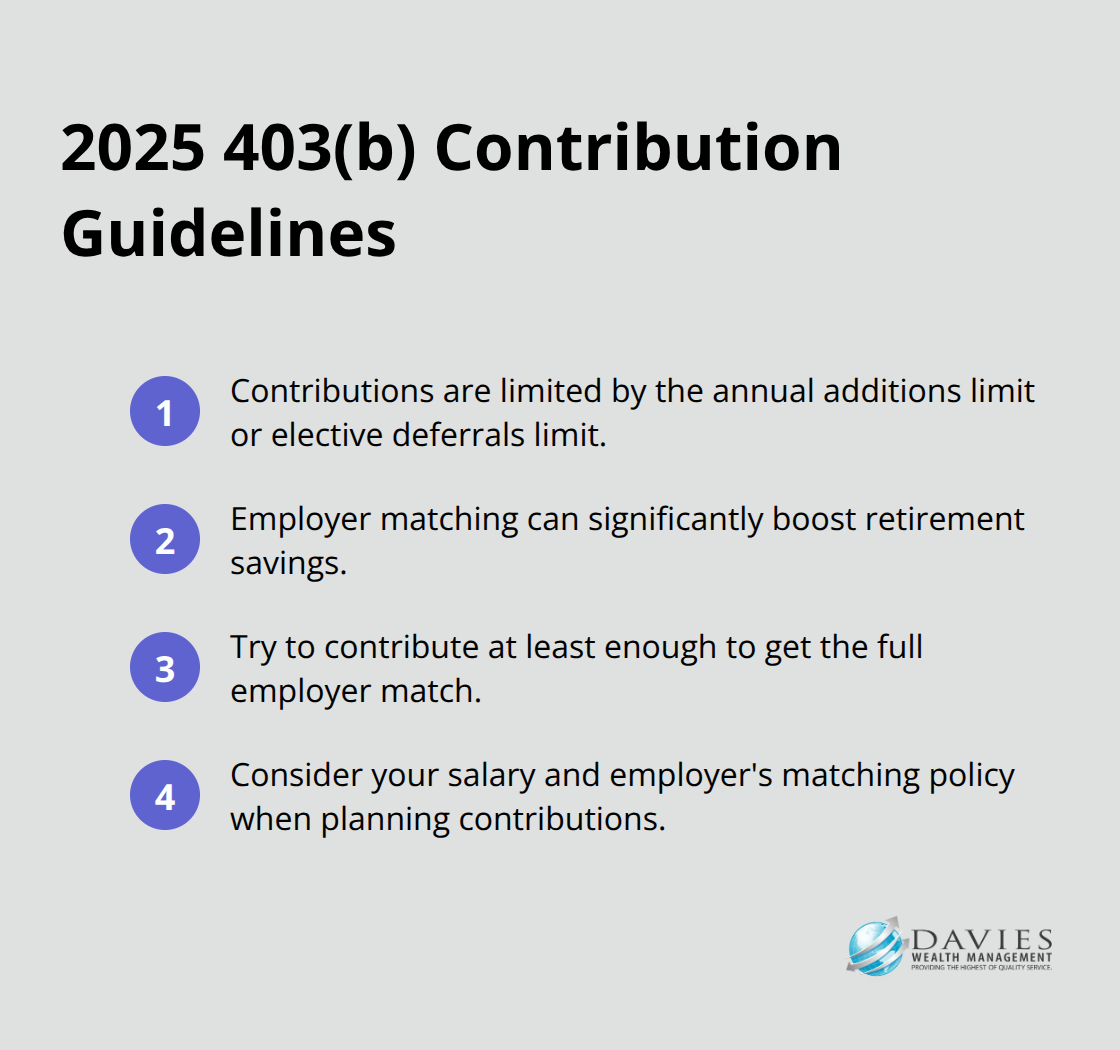

Your employer-sponsored retirement plan (typically a 401(k) or 403(b)) should be your first investment priority. These plans offer significant tax advantages and often include employer matching contributions, which is essentially free money.

For 2025, contributions to an employee’s 403(b) account are limited by the limit on annual additions or the limit on an employee’s elective deferrals. If your employer offers a match, try to contribute at least enough to get the full match. For example, if your company matches 50% of your contributions up to 6% of your salary, and you earn $60,000 annually, you should contribute at least $3,600 to receive the full $1,800 match.

Roth IRA: Tax-Free Growth for Your Future

After you maximize your employer-sponsored plan, consider opening a Roth IRA. In 2024, you can contribute up to $7,000 if you’re under 50 and your income is below certain thresholds. The beauty of a Roth IRA lies in its tax treatment: while contributions are made with after-tax dollars, your earnings grow tax-free, and you pay no taxes on qualified withdrawals in retirement.

A study by T. Rowe Price showed that a 25-year-old who maximizes their Roth IRA contributions until age 65 could potentially have over $1.5 million in tax-free money at retirement (assuming a 7% annual return).

Health Savings Accounts: The Triple Tax Advantage

If you have a high-deductible health plan, a Health Savings Account (HSA) offers a unique triple tax advantage. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. In 2025, you can contribute up to $4,300 for individual coverage or $8,550 for family coverage.

Many people overlook the investment potential of HSAs. Instead of using it solely for current medical expenses, consider paying out-of-pocket for health costs and invest your HSA funds for long-term growth.

Low-Cost Index Funds and ETFs: Simplicity and Diversification

For young investors, low-cost index funds and Exchange-Traded Funds (ETFs) offer an excellent way to gain broad market exposure. These funds track market indexes, providing diversification at a low cost. The average expense ratio for index funds is around 0.06%, compared to 0.66% for actively managed funds, according to Morningstar’s 2022 fee study.

Consider allocating a portion of your portfolio to a total stock market index fund, which provides exposure to the entire U.S. stock market. For international exposure, look into international stock index funds.

Real Estate: Building Wealth Through Property

Real estate can be an excellent way to diversify your investment portfolio. While buying property might seem daunting, there are accessible ways to invest in real estate. Real Estate Investment Trusts (REITs) allow you to invest in real estate without the hassle of property management. Many REITs trade on major stock exchanges and can be purchased through your brokerage account.

For those interested in direct property ownership, house hacking – buying a multi-unit property, living in one unit, and renting out the others – can be a smart strategy. This approach can help offset your mortgage and build equity while you live there.

Now that we’ve explored various investment vehicles suitable for young professionals, it’s important to understand how to optimize your investment portfolio for maximum growth and stability. The next section will discuss strategies to help you make the most of your investments and build long-term wealth.

How to Optimize Your Investment Portfolio

At Davies Wealth Management, we believe that portfolio optimization is essential for long-term financial success. This process involves more than selecting the right investments; it requires a strategic approach to manage and grow your wealth over time.

Dollar-Cost Averaging: A Consistent Approach

Dollar-cost averaging is one of the most effective strategies for young professionals. This approach involves investing a fixed amount of money at regular intervals, regardless of market conditions. You buy more shares when prices are low and fewer when prices are high, which potentially lowers your average cost per share over time.

For instance, if you invest $500 monthly in a broad market index fund, you’ll automatically purchase more shares when the market dips and fewer when it rises. This strategy can mitigate the impact of market volatility and reduce the temptation to time the market.

A study by Vanguard found that dollar-cost averaging can potentially reduce the average cost per share by up to 5% over a 12-month period compared to lump-sum investing.

Portfolio Diversification: Spread Your Risk

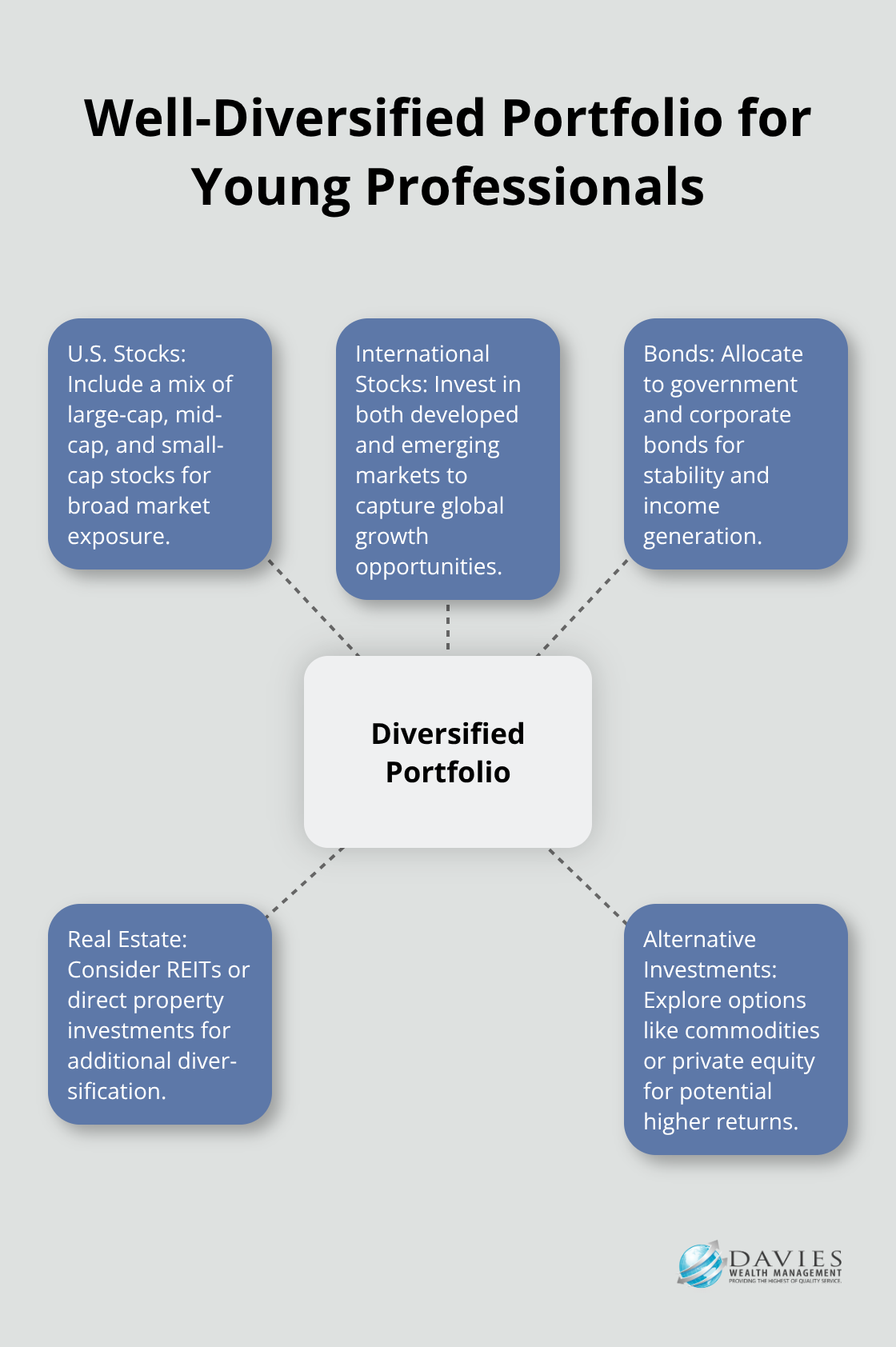

Diversification is a fundamental principle of sound investing. It involves spreading your investments across various asset classes, sectors, and geographic regions to reduce risk. While it doesn’t guarantee against loss, it can help manage risk and potentially improve returns over the long term.

A well-diversified portfolio might include:

- U.S. stocks (large-cap, mid-cap, and small-cap)

- International stocks (developed and emerging markets)

- Bonds (government and corporate)

- Real estate (REITs or direct property investments)

- Alternative investments (commodities, private equity)

The specific allocation depends on your risk tolerance and financial goals. For young professionals with a long time horizon, a higher allocation to stocks (70-80%) might be appropriate, with the remainder in bonds and other assets.

Regular Portfolio Rebalancing: Maintain Your Strategy

Market movements can cause your portfolio to drift from its target allocation over time. Rebalancing involves periodically adjusting your portfolio back to its target mix. This process helps maintain your desired risk level and can potentially improve returns.

A study by Vanguard found that portfolios rebalanced annually or when allocations drifted by 5% outperformed those that were never rebalanced by about 0.4% per year.

You should set a schedule for rebalancing, such as quarterly or annually, or use threshold-based rebalancing when your allocation drifts by a certain percentage (e.g., 5% or 10%).

Stay Informed, Avoid Overreaction

It’s important to stay informed about market trends and economic indicators, but it’s equally important not to overreact to short-term market movements. The S&P 500 has historically delivered varying annual returns, with performance calculated as the percentage change from the last trading day of each year.

Focus on reliable sources of financial information, such as:

- Financial news outlets (e.g., Bloomberg, The Wall Street Journal)

- Economic reports from government agencies (e.g., Bureau of Labor Statistics)

- Research from reputable financial institutions

However, you should avoid making impulsive decisions based on short-term market fluctuations or sensationalized headlines. Your investment strategy should align with your long-term goals, not short-term market movements.

Final Thoughts

Investment strategies for young professionals should start early and maintain consistency to build long-term wealth. Understanding financial goals, using smart investment vehicles, and optimizing portfolios set the foundation for a secure financial future. The power of compound interest works best with time, making early investments in your 20s or 30s significantly impact wealth accumulation over decades.

Diversification across various asset classes helps weather market volatility and potentially improves returns. Regular portfolio rebalancing ensures alignment with risk tolerance and financial objectives. While self-education is valuable, navigating the complex world of investments can challenge even the most diligent investors.

Professional guidance can prove invaluable in creating personalized investment strategies. At Davies Wealth Management, we specialize in tailoring investment approaches to unique financial situations and goals. Our team of experts can help you make informed decisions, optimize your investment approach, and adjust your strategy as your life circumstances change.

Leave a Reply