At Davies Wealth Management, we often encounter the question: What does a wealth management advisor do?

The role of these financial professionals extends far beyond simple investment advice.

Wealth management advisors provide comprehensive financial planning, investment strategy, risk assessment, and specialized services tailored to each client’s unique needs and goals.

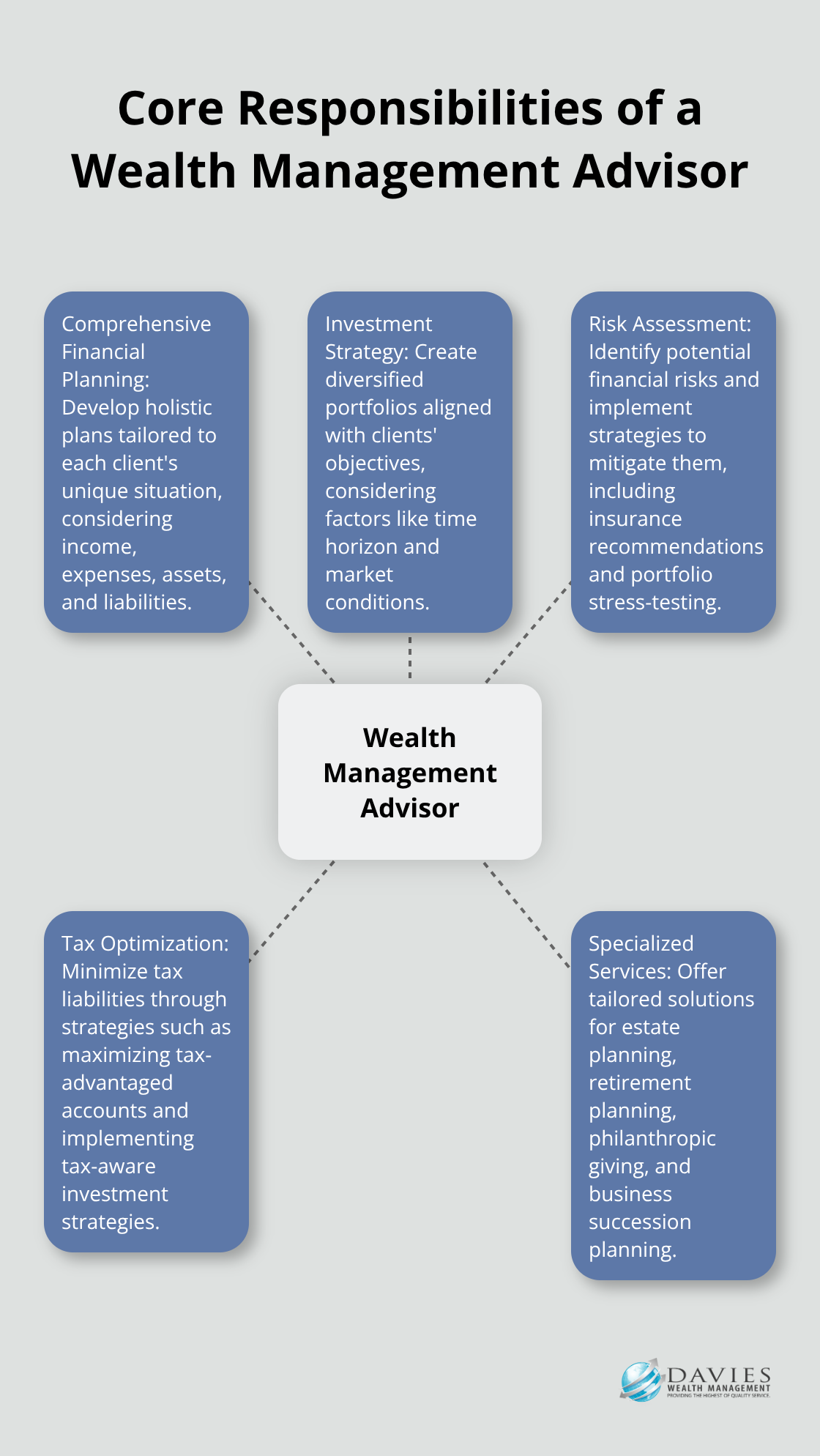

What Are the Core Responsibilities of a Wealth Management Advisor?

At Davies Wealth Management, our wealth management advisors take on a multifaceted role that extends far beyond basic financial advice. Our core responsibilities encompass a wide range of financial services designed to address the needs of affluent clients.

Crafting Comprehensive Financial Plans

We develop a holistic financial plan tailored to each client’s unique situation. Using a consultative process, we glean information about a client’s wants and specific situation. We then tailor a personalized plan that examines income streams, expenses, assets, and liabilities to create a roadmap for financial success. For instance, when working with professional athletes (a key area of our expertise), we account for their potentially short career spans and fluctuating incomes to ensure long-term financial stability.

Implementing Strategic Investment Management

Our wealth management advisors create diversified investment portfolios aligned with our clients’ objectives. We consider factors such as time horizon, tax implications, and market conditions. For example, we might recommend a mix of 60% stocks and 40% bonds for a client nearing retirement, while suggesting a more aggressive 80/20 split for younger investors with a longer time horizon.

Conducting Thorough Risk Assessments

Risk management plays a vital role in wealth preservation. We identify potential financial risks and implement strategies to mitigate them. This could involve recommending appropriate insurance coverage (such as disability insurance for athletes) or structuring investments to hedge against market volatility. We also stress-test financial plans against various scenarios, like economic downturns or unexpected life events, to ensure robustness.

Optimizing Tax Strategies

Tax planning forms an integral part of wealth management. We work to minimize tax liabilities through various strategies such as maximizing tax-advantaged accounts, investing in stocks more tax-efficiently, considering tax-smart bond strategies, and implementing tax-aware investment strategies.

As we move forward, it’s important to note that our responsibilities don’t end here. Wealth management advisors also offer specialized services that cater to specific client needs and situations. Let’s explore these additional areas of expertise in the next section.

Tailored Wealth Management Services

At Davies Wealth Management, we offer a suite of specialized services designed to address the unique financial needs of our clients. These services extend beyond standard financial planning and investment management, providing comprehensive solutions for complex wealth management challenges.

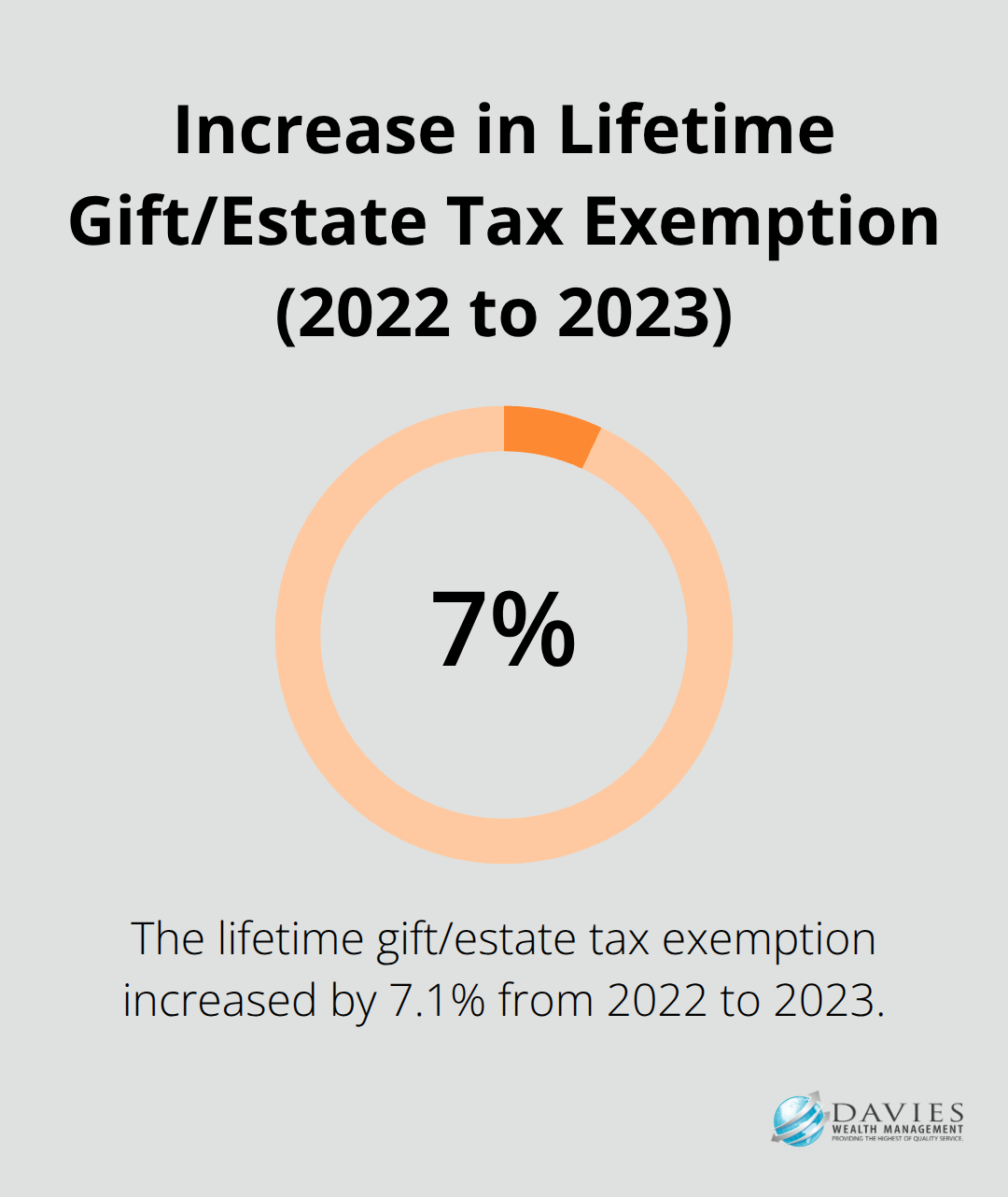

Estate Planning and Wealth Transfer

Estate planning forms a critical component of wealth management, especially for high-net-worth individuals. We help clients navigate the intricacies of estate taxes, trusts, and wealth transfer strategies. For example, we might recommend establishing a Grantor Retained Annuity Trust (GRAT) to transfer wealth to heirs while minimizing gift taxes. The lifetime gift/estate tax exemption was $12.06 million in 2022 and increased to $12.92 million in 2023, making proactive planning essential.

Retirement Planning for High-Net-Worth Individuals

Retirement planning for affluent clients requires a nuanced approach. We develop strategies that transcend traditional 401(k)s and IRAs. Our recommendations might include a combination of Roth conversions, backdoor Roth IRA contributions, and cash balance plans for business owners. These strategies can help maximize retirement savings while managing tax liabilities.

Strategic Philanthropic Giving

For clients interested in charitable giving, we develop tax-efficient philanthropic strategies. This might include setting up a Donor-Advised Fund (DAF) or a private foundation. Donor-advised funds can potentially maximize charitable giving and increase tax savings, with no minimum to open and low fees. We assist clients in maximizing the impact of their giving while optimizing tax benefits, such as bunching charitable donations to surpass the standard deduction threshold.

Business Succession Planning

For business owner clients, we provide comprehensive succession planning services. This includes valuation strategies, tax-efficient transfer methods, and liquidity planning. We might recommend a family limited partnership to transfer business ownership gradually while maintaining control.

Our specialized services at Davies Wealth Management address individual needs, whether it involves preserving wealth for future generations, planning for a comfortable retirement, making a meaningful philanthropic impact, or ensuring a smooth business transition. These advanced strategies help our clients navigate complex financial landscapes and achieve their long-term wealth management goals. The next section will explore how wealth management advisors add value beyond these specialized services, enhancing the overall financial well-being of their clients.

How Wealth Management Advisors Enhance Your Financial Success

At Davies Wealth Management, we provide a comprehensive, tailored approach to financial planning that extends far beyond simple investment advice or basic financial planning.

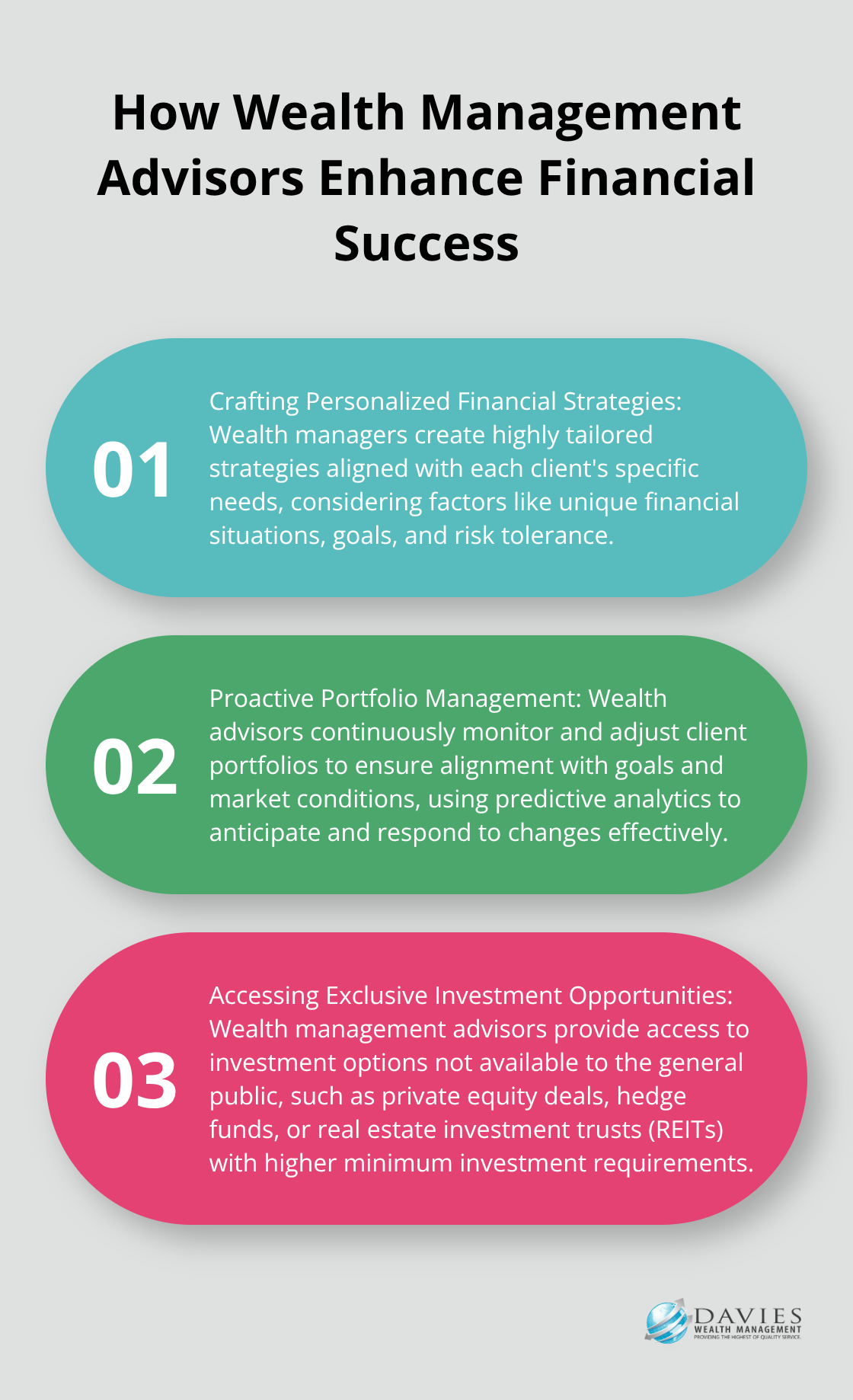

Crafting Personalized Financial Strategies

We create highly personalized strategies that align with each client’s specific needs. This process starts with a deep understanding of their unique financial situation, goals, and risk tolerance. For professional athletes (a key area of our expertise), we factor in their potentially short career spans and fluctuating incomes to ensure long-term financial stability.

Our approach considers tax implications, estate planning needs, and risk management strategies to create a holistic financial plan. This might include a mix of tax-efficient investments, trusts for wealth transfer, or risk mitigation strategies through appropriate insurance coverage.

Proactive Portfolio Management

We don’t believe in a “set it and forget it” approach. The financial markets constantly change, as do our clients’ lives. We continuously monitor and adjust our clients’ portfolios to ensure they remain aligned with their goals and market conditions.

Wealth managers can forecast market movements and client behavior, leading to more proactive investment strategies. This predictive analytics approach allows us to anticipate and respond to changing market conditions and client life events more effectively.

Accessing Exclusive Investment Opportunities

Working with a wealth management advisor provides access to investment opportunities that may not be available to the general public. Alternative investments can open doors to unique opportunities to help grow and protect your wealth. These go beyond traditional stocks and bonds and might include private equity deals, hedge funds, or real estate investment trusts (REITs) with higher minimum investment requirements.

We might recommend a private equity investment in a promising startup to a client with a high risk tolerance and long investment horizon. For a client interested in real estate, we could provide access to a REIT that offers steady income and potential for capital appreciation.

Coordinating with Other Financial Professionals

Effective wealth management often requires collaboration with other financial professionals. We act as the central point of contact, coordinating with accountants, attorneys, and insurance specialists to ensure all aspects of a client’s financial life work in harmony.

When developing an estate plan, we might work closely with an estate attorney to set up trusts, while simultaneously coordinating with a tax professional to ensure the most tax-efficient wealth transfer strategy. This coordinated approach helps avoid potential conflicts or oversights that could occur if each professional worked in isolation.

Final Thoughts

Wealth management advisors serve as essential partners in navigating complex financial landscapes. They offer a wide range of services, from crafting comprehensive financial plans to implementing strategic investment management and conducting thorough risk assessments. Their expertise extends to specialized areas such as estate planning, retirement planning for high-net-worth individuals, and business succession planning.

Professional wealth management proves invaluable in today’s intricate financial world. A wealth management advisor brings a personalized approach to financial goals, monitors and adjusts strategies, and provides access to exclusive investment opportunities. They also coordinate with other financial professionals to ensure a holistic approach to wealth management (including tax specialists and attorneys).

Davies Wealth Management understands the complexities of wealth management and offers personalized solutions to help you navigate your financial future with confidence. Our team of experienced advisors provides clear, actionable strategies that align with your specific needs and objectives. Partnering with a professional wealth management advisor can help you make informed financial decisions and work towards a secure financial future.

Leave a Reply