Wealth protection in Stuart, Florida presents unique challenges and opportunities for residents of this coastal community. From safeguarding assets against natural disasters to navigating the state’s tax-friendly environment, there’s much to consider.

At Davies Wealth Management, we understand the specific needs of Stuart residents when it comes to preserving and growing their wealth. This guide will explore essential strategies tailored to our local context, helping you make informed decisions about your financial future.

Why Wealth Protection Matters in Stuart

Unique Coastal Challenges

Stuart, Florida’s coastal location creates distinct financial challenges for its residents. The thriving marine economy and growing healthcare sector offer numerous opportunities for wealth accumulation, but these opportunities come with specific risks that require robust wealth protection strategies.

One of the primary concerns for Stuart residents is the vulnerability of coastal properties to natural disasters. Stuart faces a high Storm Events risk score, primarily due to a moderate risk from Tornadoes and a high risk from Hurricanes. This underscores the need for comprehensive property insurance and disaster preparedness plans.

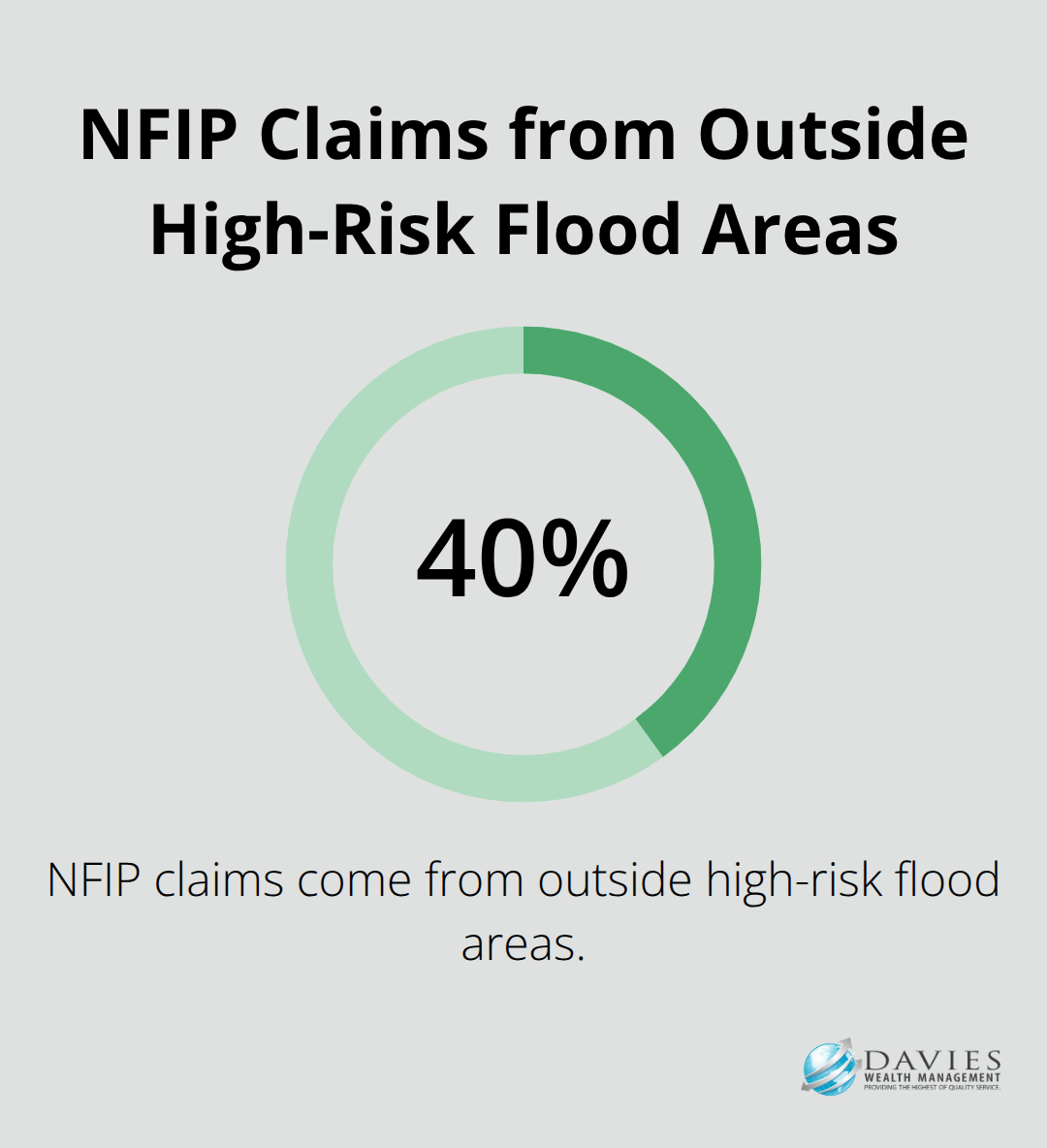

Many Stuart residents underestimate the importance of flood insurance. Even properties not in designated flood zones face risks. About 40% of NFIP claims come from outside high-risk flood areas. All Stuart homeowners should consider flood insurance as part of their wealth protection strategy.

Economic Diversification

Stuart’s economy heavily relies on its marine sector, which contributes significantly to local tax revenue. While this presents lucrative investment opportunities, it also exposes residents to sector-specific risks. Diversifying investments beyond the marine industry is essential for long-term financial stability.

Navigating Florida’s Tax Landscape

Florida’s tax-friendly environment, including the absence of state income tax, offers significant advantages for wealth accumulation. However, this can lead to complacency in tax planning. Effective wealth protection in Stuart requires a nuanced understanding of federal tax obligations and strategic planning to maximize the benefits of Florida’s tax structure.

Common Misconceptions

A prevalent misconception among Stuart residents is that wealth protection only benefits the ultra-rich. In reality, individuals across various income levels can benefit from tailored wealth protection strategies. Another misconception is that wealth protection solely safeguards assets from lawsuits or creditors. While this is an important aspect, comprehensive wealth protection also involves strategic investment planning, tax optimization, and estate planning.

As we move forward, we’ll explore specific strategies that Stuart residents can employ to protect and grow their wealth in this unique coastal environment. These strategies will address the challenges we’ve discussed and provide actionable steps for financial security.

Tailored Wealth Protection Strategies for Stuart

Stuart’s unique economic landscape and coastal location demand specialized wealth protection strategies. We’ve developed approaches that address the specific needs of Stuart residents, ensuring their assets are safeguarded against local risks while capitalizing on regional opportunities.

Diversifying Beyond the Marine Economy

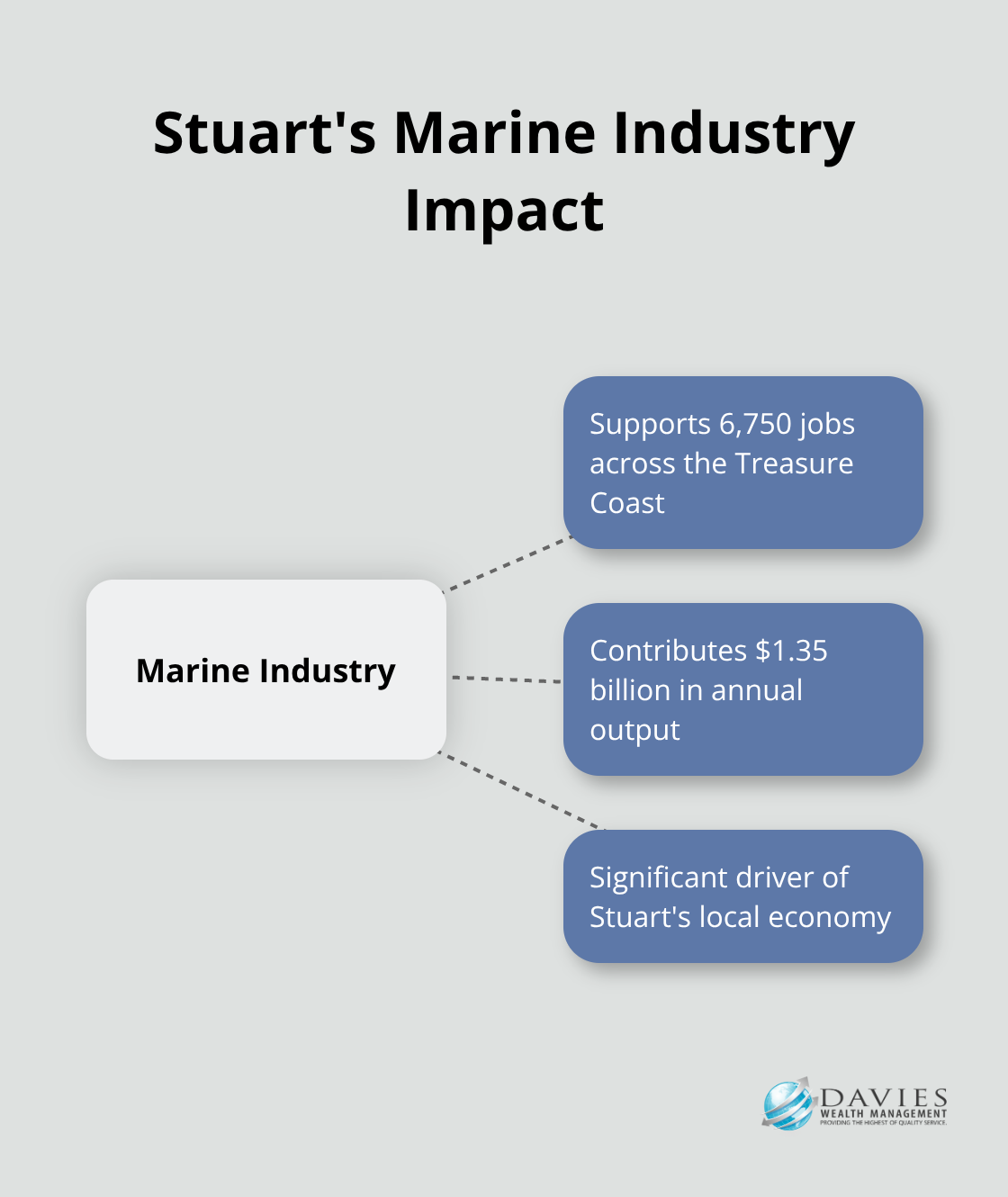

Stuart’s marine industries support 6,750 jobs and contribute $1.35 billion in annual output across the Treasure Coast. However, overreliance on a single industry can be risky. We recommend investment diversification across multiple sectors. The healthcare industry, anchored by Martin Health System, offers promising investment opportunities. Additionally, the growing education sector, supported by Indian River State College, presents potential for long-term growth.

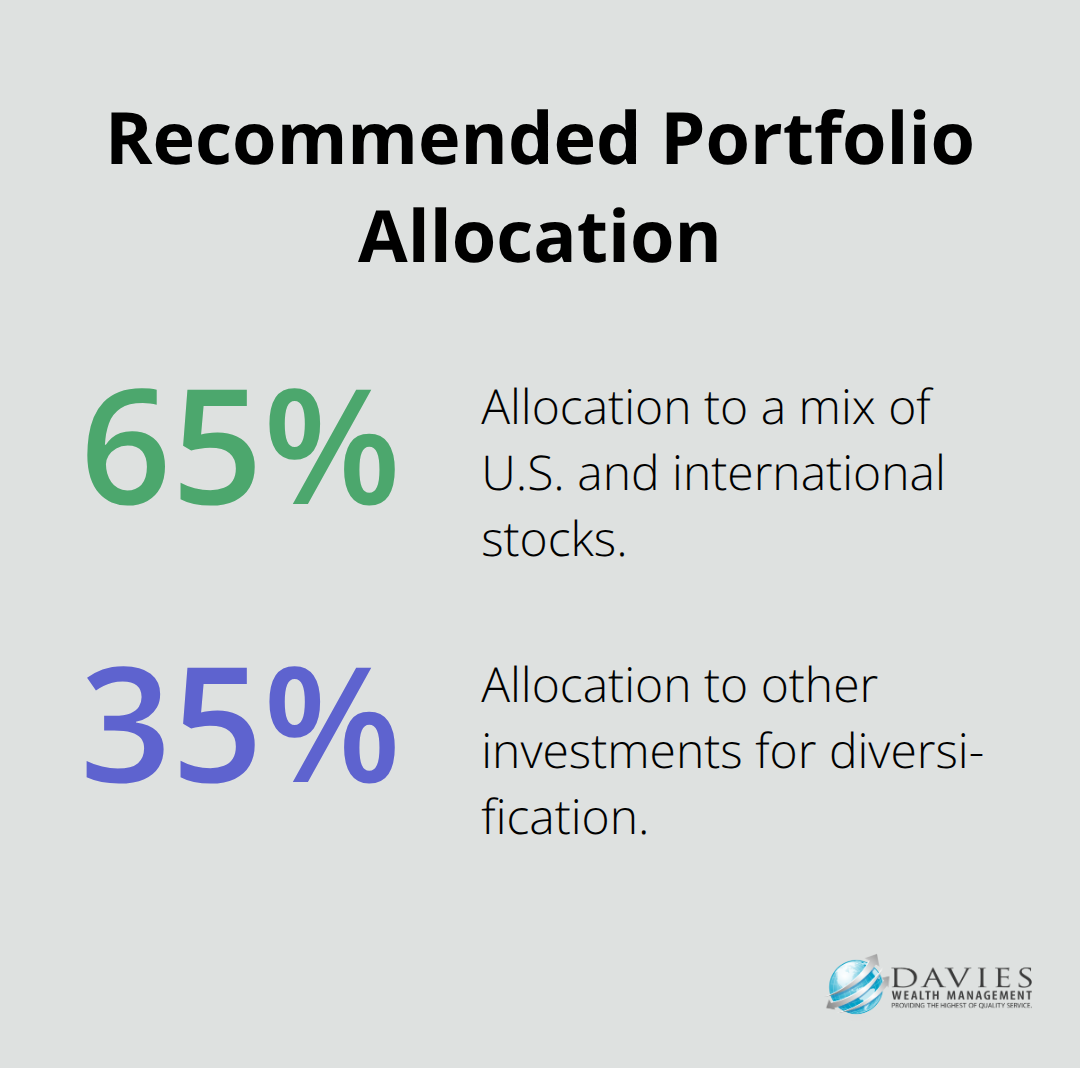

We typically suggest a 60-70% allocation of portfolios to a mix of U.S. and international stocks. This approach helps mitigate risks while capturing growth opportunities both locally and globally. We also explore options in healthcare-focused Real Estate Investment Trusts (REITs), which can provide income and capital appreciation aligned with Stuart’s expanding healthcare sector.

Comprehensive Insurance for Coastal Living

Living in a coastal area like Stuart requires a robust insurance strategy. Standard homeowners insurance often falls short in covering the full spectrum of risks faced by coastal property owners. We advise our clients to consider:

- Flood Insurance: Flood insurance is required for homes with a federally-backed mortgage that are located in a Special Flood Hazard Area (SFHA), although all property owners are encouraged to consider this coverage. The National Flood Insurance Program (NFIP) provides coverage, but we often recommend supplementing this with private flood insurance for more comprehensive protection.

- Wind Insurance: Many standard policies exclude wind damage, a significant risk in hurricane-prone areas. We help our clients secure separate wind insurance or ensure their policy includes wind coverage.

- Umbrella Liability Insurance: This provides an extra layer of protection beyond standard homeowners and auto insurance limits. For high-net-worth individuals in Stuart, we typically recommend coverage of at least $1 million to $5 million.

Leveraging Florida’s Trust and Estate Laws

Florida’s trust and estate laws offer unique advantages for wealth protection and transfer. The state’s homestead exemption allows unlimited value protection for qualified primary residences from most creditor claims. We help our clients structure their assets to maximize this protection.

For business owners and high-net-worth individuals, we often recommend establishing Limited Liability Companies (LLCs) or certain types of trusts. Florida’s trust laws allow for the creation of asset protection trusts, which can safeguard wealth from potential creditors while still allowing you to benefit from the assets.

Estate planning in Florida also benefits from the state’s lack of estate and inheritance taxes. We work with our clients to develop comprehensive estate plans that take advantage of these tax benefits while ensuring their wealth is transferred according to their wishes.

Effective wealth protection in Stuart requires a nuanced approach that addresses local economic factors, coastal risks, and state-specific legal advantages. Our tailored strategies help Stuart residents not just protect their wealth, but grow it securely in this unique coastal environment. As we move forward, we’ll explore how Stuart residents can optimize their tax strategies within Florida’s favorable tax landscape.

How Stuart Residents Can Optimize Their Taxes

Florida’s tax-friendly environment offers Stuart residents unique opportunities for wealth protection and growth. Davies Wealth Management helps clients leverage these advantages while implementing strategies to minimize capital gains taxes and explore charitable giving options.

Maximizing Florida’s Tax Benefits

Florida’s lack of state income tax provides a significant advantage for Stuart residents. Income from Social Security, pensions, and retirement accounts (IRAs and 401(k)s) remains tax-free at the state level. A retiree with $50,000 in annual retirement income could save $2,000 to $3,000 per year compared to states with income taxes.

To fully capitalize on this benefit, Roth IRA conversions often prove beneficial for Stuart clients. While you’ll pay taxes on the pre-tax retirement assets the first year you convert, future earnings on your money will be tax-free when certain requirements are met.

Strategies to Minimize Capital Gains Taxes

While Florida doesn’t impose state-level capital gains taxes, federal capital gains taxes still apply. Several strategies can help Stuart clients minimize these taxes:

- Tax-loss harvesting: This involves selling investments at a loss and using those losses to offset gains in other investments.

- Long-term holding: Capital gains on investments held for more than a year incur lower tax rates. Holding investments for at least a year when possible can benefit from these lower rates.

- Strategic gifting: Gifting appreciated assets to family members in lower tax brackets can reduce overall capital gains tax liability. The annual gift tax exclusion for 2025 stands at $17,000 per recipient, allowing for significant tax-free transfers.

Charitable Giving as a Wealth Protection Tool

Charitable giving not only supports causes you care about but can also play an important role in wealth protection. For Stuart residents, consider these options:

- Donor-Advised Funds (DAFs): DAFs allow you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. This can prove particularly useful in high-income years to offset tax liabilities.

- Qualified Charitable Distributions (QCDs): For those aged 70½ or older, QCDs allow you to transfer up to $100,000 annually from your IRA directly to a qualified charity. This satisfies Required Minimum Distributions (RMDs) without increasing your taxable income.

- Charitable Remainder Trusts (CRTs): These trusts provide income to you for a specified period, after which the remaining assets go to your chosen charity. CRTs can provide immediate tax deductions and help manage capital gains taxes on appreciated assets.

Implementing these tax-efficient strategies can significantly enhance wealth protection efforts for Stuart residents. However, tax laws remain complex and constantly changing. Working with a knowledgeable financial advisor ensures these strategies align with your overall financial goals and current tax regulations.

Final Thoughts

Wealth protection in Stuart, Florida demands a tailored approach that addresses the unique challenges of this coastal community. Stuart residents must consider strategies such as investment diversification, comprehensive insurance coverage, and utilization of Florida’s favorable trust and estate laws. These methods help mitigate risks specific to Stuart’s economic and geographical landscape while capitalizing on local growth opportunities.

Tax optimization plays a significant role in wealth protection for Stuart residents. Florida’s lack of state income tax provides a substantial advantage, allowing individuals to keep more of their earnings. Strategies to minimize capital gains taxes and explore charitable giving options can further enhance wealth preservation efforts.

Professional guidance becomes invaluable when navigating the complexities of wealth protection in Stuart. Davies Wealth Management offers expert advice and personalized solutions tailored to the specific needs of Stuart residents. Our team understands the local economic factors and coastal risks that impact wealth management in this area (including natural disaster preparedness).

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply