At Davies Wealth Management, we understand that a well-crafted finance strategy plan is the cornerstone of financial success.

Creating a winning strategy involves more than just saving money or making investments. It requires a comprehensive approach that aligns your current financial situation with your future goals.

This guide will walk you through the essential steps to develop a robust finance strategy plan that can help you achieve your financial objectives and secure your financial future.

Where Do You Stand Financially?

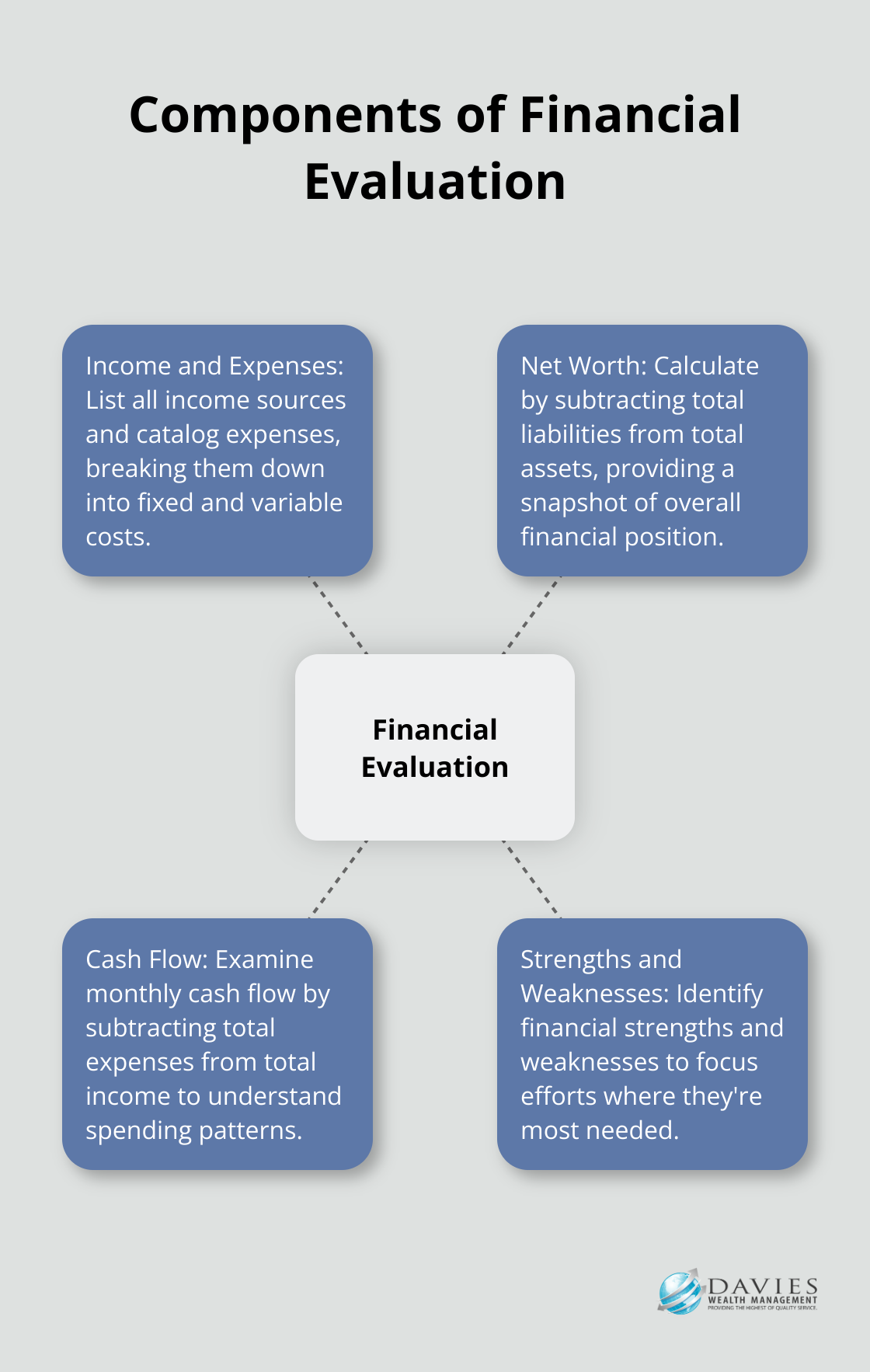

Evaluate Your Income and Expenses

At Davies Wealth Management, we believe that understanding your current financial position is the first essential step in creating a winning finance strategy plan. This process involves a thorough examination of your financial landscape, providing you with a clear picture of where you stand and where you need to go.

Start by listing all your income sources. This includes your salary, investment returns, rental income, and any other regular or irregular inflows. Next, catalog your expenses, breaking them down into fixed costs (like rent or mortgage payments) and variable expenses (such as groceries, entertainment, and utilities). This exercise often reveals surprising spending patterns and potential areas for improvement.

Calculate Your Net Worth

Your net worth is a key indicator of your financial health. Calculate your net worth by subtracting your total liabilities (debts) from your total assets (what you own). Assets might include your home, vehicles, investments, and savings accounts. Liabilities typically encompass mortgages, car loans, credit card balances, and student loans. This figure provides a snapshot of your overall financial position and helps track progress over time.

Examine Your Cash Flow

Understanding your cash flow is vital for financial planning. Examine your cash flow by calculating your monthly cash flow, subtracting your total expenses from your total income. A positive cash flow indicates you’re living within your means and potentially saving, while a negative cash flow suggests you’re spending more than you earn. This analysis helps identify areas where you can cut back or redirect funds towards savings and investments.

Identify Financial Strengths and Weaknesses

This comprehensive assessment allows you to pinpoint your financial strengths and weaknesses. Perhaps you excel at saving but struggle with debt management. Or maybe you have a strong income but lack diversification in your investments. Recognizing these aspects helps you focus your efforts where they’re most needed.

At Davies Wealth Management, we’ve observed how this process can be eye-opening for many clients, including professional athletes who often have complex income structures. This assessment isn’t a one-time event. We recommend revisiting your financial situation regularly (at least annually) to ensure your strategy remains aligned with your current circumstances and future aspirations.

With a clear understanding of your financial standing, you’re now ready to set clear, achievable financial goals that will guide your strategy moving forward.

What Are Your Financial Objectives?

Defining Your Financial Horizon

At Davies Wealth Management, we recognize that clear financial goals form the bedrock of a successful finance strategy plan. Financial objectives typically fall into three categories: short-term (under 1 year), medium-term (1-5 years), and long-term (over 5 years). We recommend you start with 2-3 goals in each category. This approach provides a balanced focus across different time horizons without becoming overwhelming.

Aligning Goals with Personal Values

Your financial goals should reflect your personal values and lifestyle aspirations. Ask yourself: What truly matters to you? Is it financial independence, supporting your family, or making a positive impact in your community?

Aligning your financial decisions with your personal values can lead to higher levels of financial satisfaction. This alignment ensures that your financial strategy isn’t just about numbers, but about creating a life that’s meaningful to you.

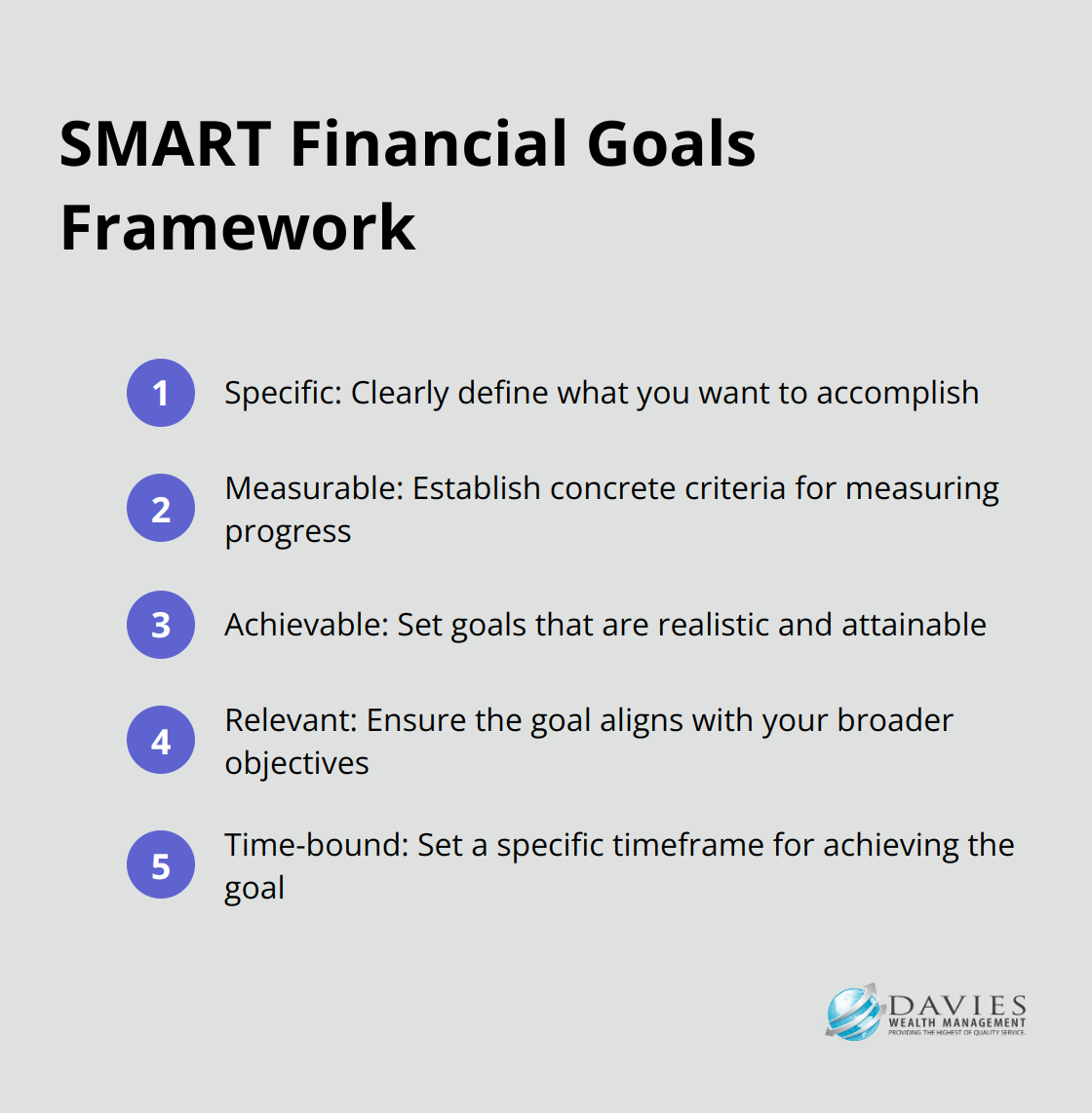

Creating SMART Financial Goals

To make your goals actionable, use the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of a vague goal like “save more money,” a SMART goal would be “save $10,000 for an emergency fund within 12 months by setting aside $833 monthly.”

This specificity makes your goals tangible and trackable. It also allows for regular check-ins to assess progress and make necessary adjustments. A study by Dominican University indicates that writing down goals can enhance goal achievement.

Prioritizing Your Financial Objectives

Not all goals are created equal. Some may be more urgent or important than others. We recommend you use a prioritization matrix, considering both the importance and urgency of each goal. This helps you focus your resources where they’ll have the most significant impact.

For example, paying off high-interest debt might take precedence over increasing retirement contributions in the short term. However, don’t neglect long-term goals entirely. Striking a balance is key.

Setting financial goals is not a one-time event. As your life circumstances change, so too should your financial objectives. You should review your goals at least annually, or whenever significant life events occur (such as marriage, birth of a child, or career change).

With clear, personalized financial goals in place, you’ve laid the groundwork for a robust finance strategy plan. The next step involves developing and implementing strategies to achieve these objectives. Let’s explore how to turn your financial goals into actionable plans.

How to Execute Your Finance Strategy

Build a Comprehensive Budget

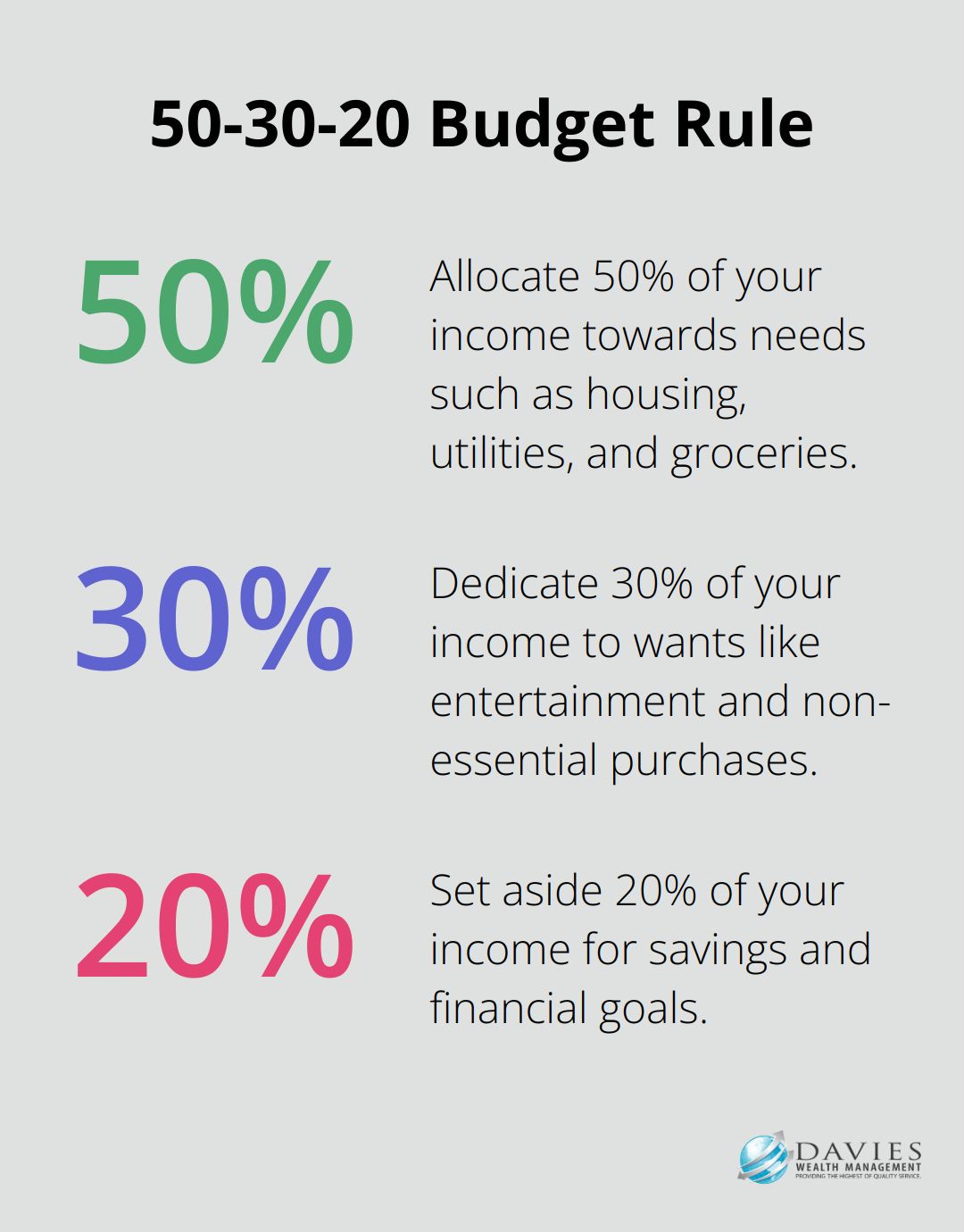

At Davies Wealth Management, we believe that executing a finance strategy transforms financial goals into tangible actions. The foundation of any successful finance strategy is a well-structured budget. A budget isn’t just about restricting spending; it’s a tool for aligning your financial resources with your goals. Start by categorizing your expenses into fixed (like rent or mortgage) and variable (such as groceries or entertainment). Try to allocate 20% of your income towards savings, with 50% going towards needs and 30% towards wants. Use budgeting apps or spreadsheets to track your spending and adjust as needed.

Create Financial Safety Nets

Establishing an emergency fund is essential for financial stability. We recommend saving 3-6 months of living expenses in a readily accessible account. This fund acts as a buffer against unexpected events (like job loss or medical emergencies). For professional athletes, who may have irregular income streams, we often suggest a larger emergency fund, potentially covering 12-18 months of expenses.

Debt reduction is another critical aspect of financial safety. Prioritize high-interest debts, such as credit card balances. Consider the debt avalanche method, where you focus on paying off the highest interest debt first while making minimum payments on others. This approach can save you significant money in interest over time.

Diversify Your Investment Portfolio

Diversification is key to managing risk and maximizing returns. We advocate for a mix of asset classes tailored to your risk tolerance and financial goals. This might include a combination of stocks, bonds, real estate, and alternative investments. For example, a young professional might have a portfolio weighted towards growth stocks, while someone nearing retirement might lean more towards bonds and dividend-paying stocks.

Optimize Tax Efficiency

Tax efficiency is an often-overlooked aspect of investment strategy. Consider utilizing tax-advantaged accounts like 401(k)s and IRAs. For high-income earners, such as professional athletes, more sophisticated tax strategies like charitable remainder trusts or opportunity zone investments might be appropriate.

Review Insurance Coverage

Insurance is a critical component of risk management. Regularly review your coverage to ensure it aligns with your current life stage and financial situation. This includes health insurance, life insurance, disability insurance, and property insurance. For athletes, we often recommend additional coverage like career-ending injury insurance.

Final Thoughts

A finance strategy plan requires careful planning, execution, and ongoing adjustment. It builds on a solid understanding of your financial situation and aligns with your personal values and aspirations. The execution involves budgeting, establishing safety nets, diversifying investments, optimizing taxes, and reviewing insurance coverage.

A finance strategy plan is not static. You should review and adjust it regularly to ensure it aligns with your evolving financial situation and goals. Life circumstances change, markets fluctuate, and new opportunities arise, necessitating periodic updates to keep your strategy on track.

For complex financial situations, professional advice can prove invaluable. At Davies Wealth Management, we create tailored finance strategy plans that address the unique needs of our clients, including professional athletes with complex income structures. Our expertise can help you navigate intricate financial landscapes and achieve your long-term financial objectives.

Leave a Reply