At Davies Wealth Management, we understand the critical role of Finance Planning and Analysis (FP&A) in driving business success. This powerful discipline combines financial expertise with strategic insight to guide decision-making and fuel growth.

In this blog post, we’ll explore the essential components of mastering FP&A, from foundational concepts to advanced techniques. Whether you’re a finance professional or a business leader, these insights will help you harness the full potential of FP&A in your organization.

Understanding Financial Planning and Analysis (FP&A)

The Foundation of Strategic Financial Management

Financial Planning and Analysis (FP&A) forms the backbone of strategic financial management. This critical process combines financial data analysis, forecasting, and performance evaluation to guide business decisions and drive growth. At its core, FP&A provides leaders with the insights needed to make informed decisions about resource allocation, investment opportunities, and risk management.

The Impact of FP&A on Decision-Making

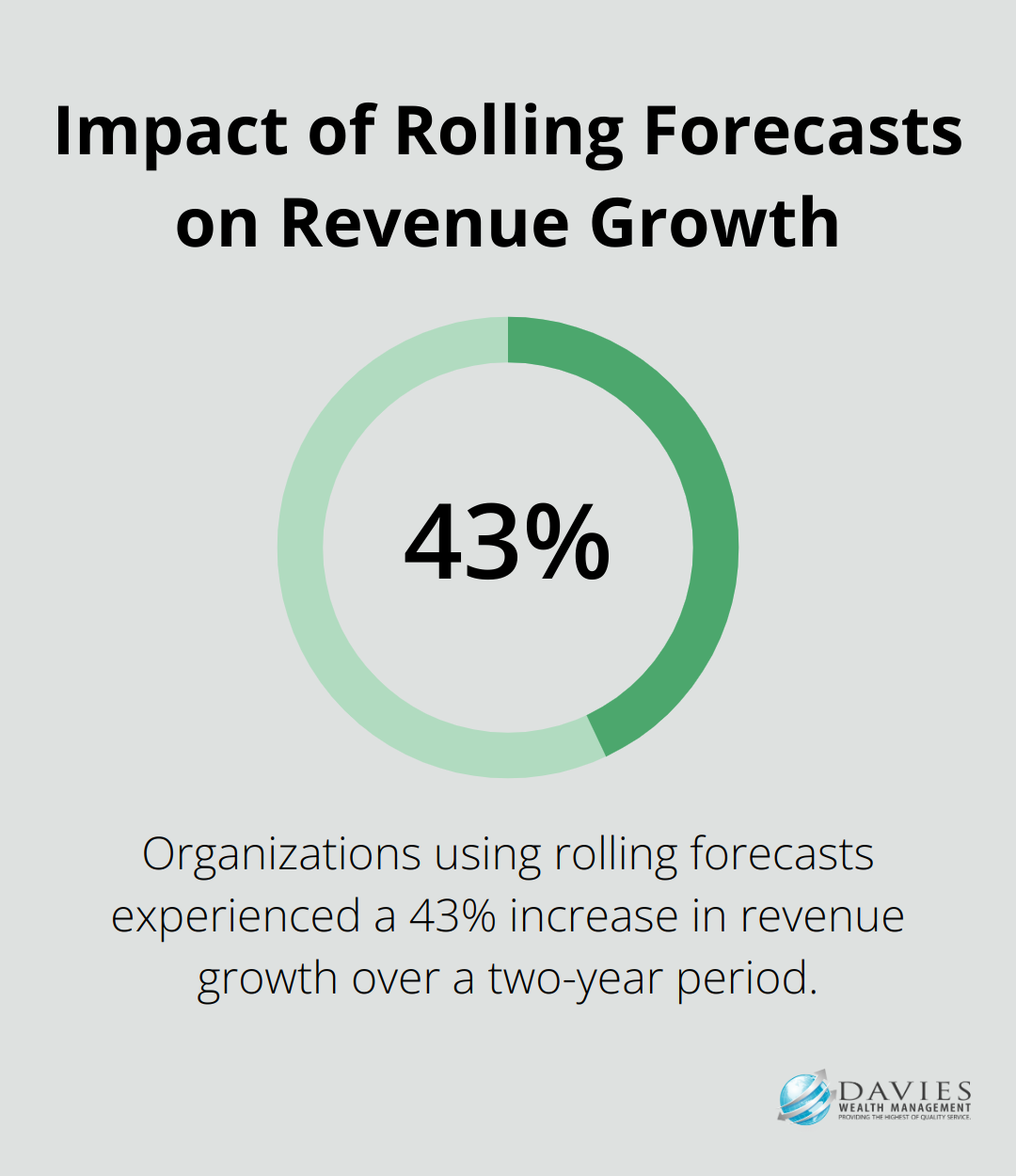

FP&A significantly shapes business strategy. A study highlights its effectiveness: organizations using rolling forecasts (a key FP&A technique) showed a 43% increase in revenue growth over a two-year period. This statistic underscores the power of FP&A in driving tangible business results.

Essential Components of FP&A

Effective FP&A involves several interconnected processes:

- Budgeting: The creation of detailed financial plans that align with organizational goals.

- Forecasting: The prediction of future financial performance based on historical data and market trends.

- Variance Analysis: The identification and explanation of differences between actual and projected results.

- Performance Reporting: The communication of financial insights to stakeholders through clear, actionable reports.

Navigating FP&A Challenges

Despite its importance, FP&A faces significant hurdles. The 2025 AFP FP&A Benchmarking Survey reveals that 86% of typical FP&A manager job descriptions list business intelligence skills as a requirement. To address these challenges, organizations should invest in robust data management systems and foster a data-driven culture across all departments.

Technology: The FP&A Game-Changer

Modern FP&A relies heavily on technology. Cloud-based FP&A software can help optimize the budgeting and forecasting processes of your financial function with a single source of data truth. The adoption of these tools can transform financial planning from a time-consuming task into a strategic advantage.

As we move forward, it’s clear that mastering FP&A requires a combination of analytical skills, technological proficiency, and strategic thinking. The next section will explore the essential skills and tools that finance professionals need to excel in FP&A and drive their organizations toward financial success.

Mastering Essential FP&A Skills and Tools

The Cornerstone: Financial Modeling

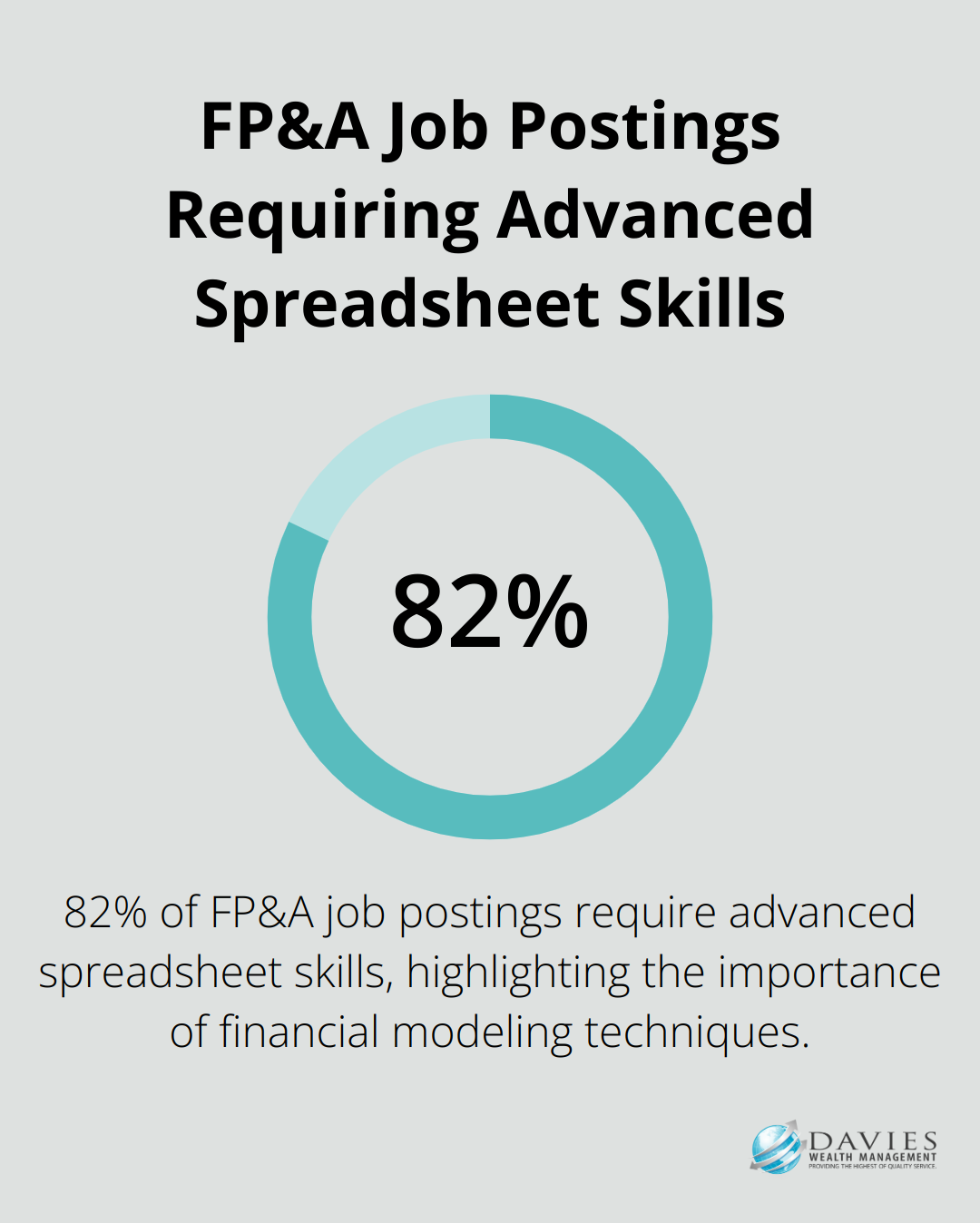

Financial modeling forms the foundation of effective FP&A. It involves the creation of mathematical representations of a company’s operations to forecast future performance. A 2025 survey by the Association for Financial Professionals reveals that 82% of FP&A job postings require advanced spreadsheet skills. This statistic underscores the importance of financial modeling techniques.

To excel in financial modeling, FP&A professionals should focus on:

- Development of robust three-statement models (income statement, balance sheet, and cash flow statement)

- Creation of sensitivity analyses to understand the impact of changing variables

- Construction of scenario models to prepare for various economic conditions

Data Analysis and Visualization Tools

Modern FP&A professionals must expand beyond traditional spreadsheets. Advanced data analysis and visualization tools are essential for insight discovery and effective presentation.

A 2024 Gartner report shows that 58% of finance functions use AI, a significant increase from previous years. This adoption highlights the value of modern FP&A tools.

Powerful tools for FP&A professionals include:

- Tableau for interactive dashboard creation

- Power BI for advanced data analysis and visualization

- Python for automation of complex financial calculations and data processing

Communication and Presentation Skills

While technical skills are important, the ability to communicate financial insights effectively is equally valuable. FP&A professionals must translate complex financial data into actionable recommendations for non-financial stakeholders.

A 2024 survey by PwC found that 52% of CFOs prioritize hiring people with necessary communication skills. This emphasis on soft skills reflects the evolving role of FP&A in strategic decision-making.

To improve communication skills, FP&A professionals should:

- Practice data storytelling to make financial insights more engaging

- Develop clear and concise executive summaries for financial reports

- Tailor presentations to different audiences (from C-suite executives to operational managers)

Excel Mastery and Specialized FP&A Software

Excel remains a staple in FP&A, but professionals must go beyond basic functions to leverage its full potential. Advanced features like pivot tables, macros, and data modeling are essential for efficient FP&A work.

Additionally, specialized FP&A software has become increasingly important. A 2024 study by McKinsey found that organizations using AI for financial modeling reduced the time FP&A teams spend on data capture by up to 65%. This significant time-saving allows FP&A professionals to focus more on analysis and strategic recommendations.

Key areas to focus on when mastering Excel and FP&A software include:

- Advanced Excel functions (SUMIFS, VLOOKUP, and INDEX-MATCH)

- VBA programming for repetitive task automation

- Integration of Excel with other data sources and tools

The mastery of these essential FP&A skills and tools empowers finance professionals to enhance their value to organizations and drive better business outcomes. The next section will explore best practices for implementing FP&A in your organization, ensuring these skills are applied effectively within a strategic framework.

Implementing Effective FP&A Strategies

Strategic Alignment and Budgeting

The first step in implementing effective FP&A is to align it with your overall business strategy. This means you should develop a budgeting process that reflects your organization’s long-term objectives. To avoid pitfalls in financial planning and analysis, we recommend:

- Define your organization’s strategic goals clearly

- Identify key performance indicators (KPIs) that align with these goals

- Develop a budget that allocates resources based on these KPIs

For example, if your goal is to expand into new markets, your budget should reflect increased spending in areas like market research, product development, and marketing.

Rolling Forecasts: A Dynamic Approach

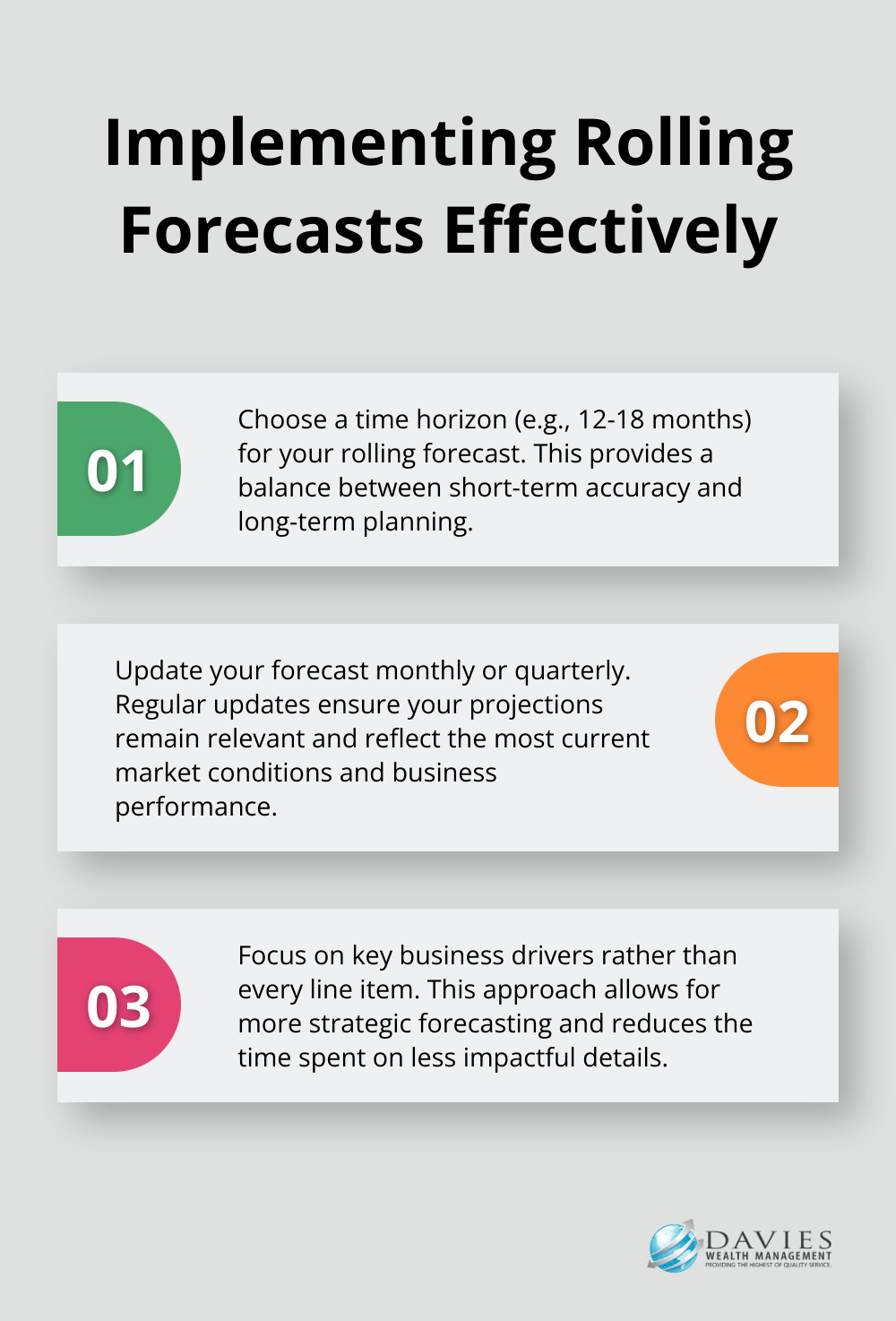

Traditional annual budgets often become outdated quickly in today’s fast-paced business environment. That’s why we advocate for rolling forecasts. This approach involves regular updates to your financial projections based on the most recent data and market conditions.

Companies using rolling forecasts experienced a 43% increase in revenue growth over a 24-month period. To implement rolling forecasts effectively:

Technology: The Efficiency Catalyst

In today’s digital age, technology is a must for efficient FP&A. To combat inefficiencies, consider:

- Implement cloud-based FP&A software for real-time data access and collaboration

- Utilize artificial intelligence and machine learning for predictive analytics

- Automate routine tasks to free up time for strategic analysis

Cloud FP&A tools shorten budgeting cycles and accelerate scenario modeling, enabling CFOs to respond swiftly to market changes.

Cross-Departmental Collaboration: Breaking Silos

Effective FP&A isn’t just about numbers; it’s about understanding the story behind those numbers. This requires close collaboration between finance and other departments.

To foster better collaboration:

- Establish regular cross-functional meetings to discuss financial performance and forecasts

- Provide financial training to non-finance managers to help them understand and contribute to the FP&A process

- Create dashboards that present financial data in a way that’s accessible to all departments

These strategies can transform an organization’s FP&A function from a number-crunching department to a strategic partner driving business growth. Many companies have achieved significant improvements in financial performance and decision-making by adopting these best practices.

Final Thoughts

Finance planning and analysis (FP&A) requires dedication, continuous learning, and adaptability. FP&A professionals must stay updated on the latest financial modeling techniques, data analysis tools, and industry trends to enhance their capabilities and provide value to their organizations. Effective FP&A enables organizations to make informed decisions, allocate resources efficiently, and navigate market uncertainties with confidence.

Davies Wealth Management understands the critical role of FP&A in achieving financial success. Our team of experts uses advanced FP&A techniques to provide comprehensive wealth management solutions tailored to our clients’ unique needs. We offer personalized financial planning and analysis to help clients navigate their financial journey with confidence.

FP&A is not just about numbers; it translates financial insights into actionable strategies that drive business success. Professionals who continuously hone their skills, embrace new technologies, and foster collaboration across departments can elevate their FP&A practice and make a significant impact on their organization’s financial future. The landscape of FP&A evolves constantly (driven by technological advancements and changing business environments), so staying ahead requires ongoing education and skill development.

Leave a Reply