At Davies Wealth Management, we understand the unique financial landscape of Stuart, FL, and its impact on wealth management strategies.

Finance planning and wealth management in this vibrant coastal city require a tailored approach that considers local market trends, tax implications, and retirement-friendly policies.

Our comprehensive guide explores investment strategies, retirement planning, and essential components of wealth management specifically for Stuart residents.

We’ll provide practical insights to help you navigate your financial journey in this beautiful Florida community.

What Makes Stuart’s Financial Landscape Unique?

Stuart, Florida boasts a financial landscape that sets it apart from other regions in the state and country. This coastal city in Martin County offers residents a distinctive environment for wealth management, combining seaside charm with economic opportunities.

No State Income Tax

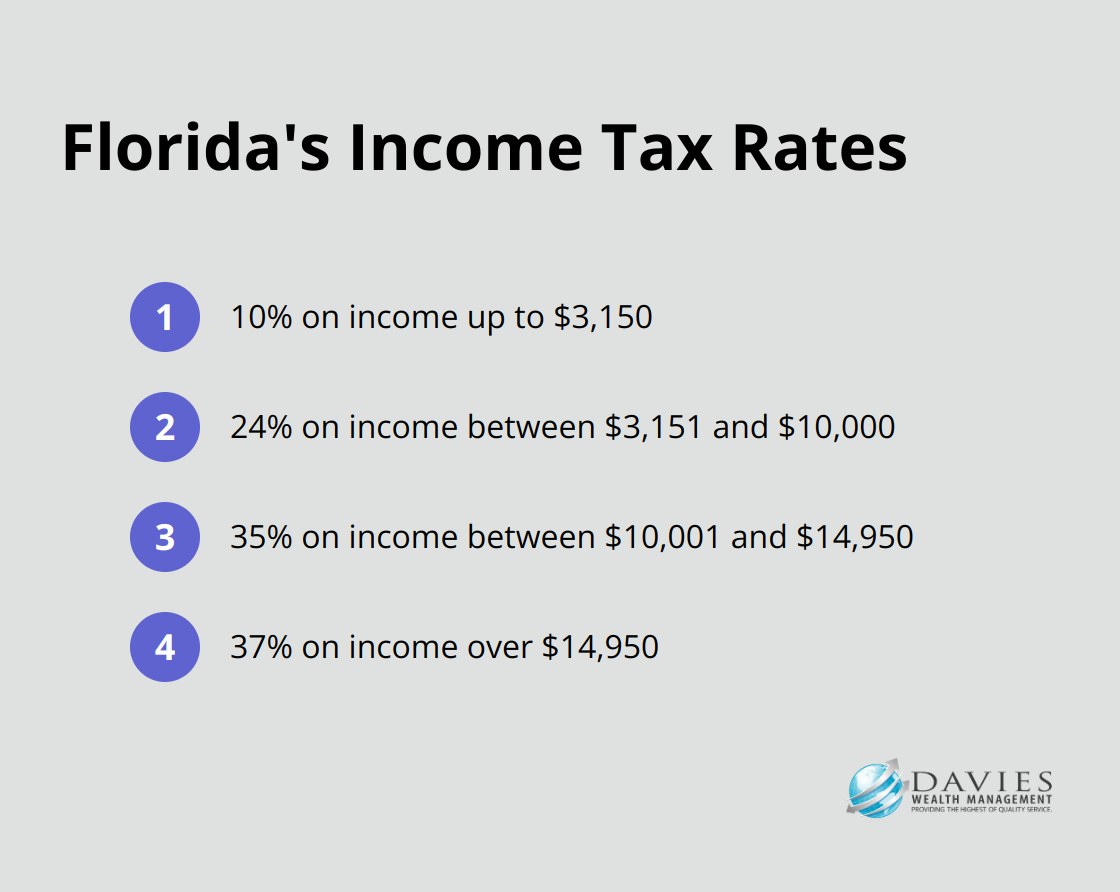

Florida’s state income tax structure is different from what was initially stated. According to the Palm City Lawyer, Florida’s income tax rates are as follows:

- 10% on income up to $3,150

- 24% on income between $3,151 and $10,000

- 35% on income between $10,001 and $14,950

- 37% on income over $14,950

This tax structure impacts wealth management strategies for Stuart residents, influencing how individuals allocate their earnings towards investments, savings, or lifestyle expenses.

Real Estate Market Dynamics

The real estate market in Stuart plays a pivotal role in wealth management strategies. The city’s waterfront properties and luxury homes contribute to a robust real estate sector, offering potential for appreciation and investment opportunities. According to Norada Real Estate Investments, the South Florida housing market is expected to remain relatively strong in 2025 and 2026, but with more moderate price appreciation than seen in recent years.

Retirement-Friendly Environment

Stuart’s appeal as a retirement destination influences wealth management approaches significantly. The city’s amenities, healthcare facilities, and recreational options attract retirees, creating a demand for specialized financial planning services. This demographic shift impacts local investment trends and retirement planning strategies.

Local Economic Factors

Stuart’s local economy presents unique investment opportunities that wealth managers must consider. The city’s diverse economic sectors include:

- Marine Industries: According to the Florida Inland Navigation District, Martin County has at least three hidden sectors of economic impact related to marine industries.

- Healthcare: A growing sector with expanding facilities and services.

- Tourism: A consistent driver of economic activity in the region.

Understanding these local factors is essential for effective wealth management. Professionals in this field must develop strategies that capitalize on Stuart’s unique economic environment while aligning with clients’ personal goals and risk tolerances.

The next chapter will explore specific investment strategies tailored to Stuart residents, taking into account these distinctive local factors and opportunities.

Maximizing Investment Potential in Stuart

Stuart’s unique financial landscape offers a wealth of investment opportunities for residents. We have identified several key strategies to help clients capitalize on local market trends while maintaining a diversified and tax-efficient portfolio.

Leveraging Stuart’s Real Estate Market

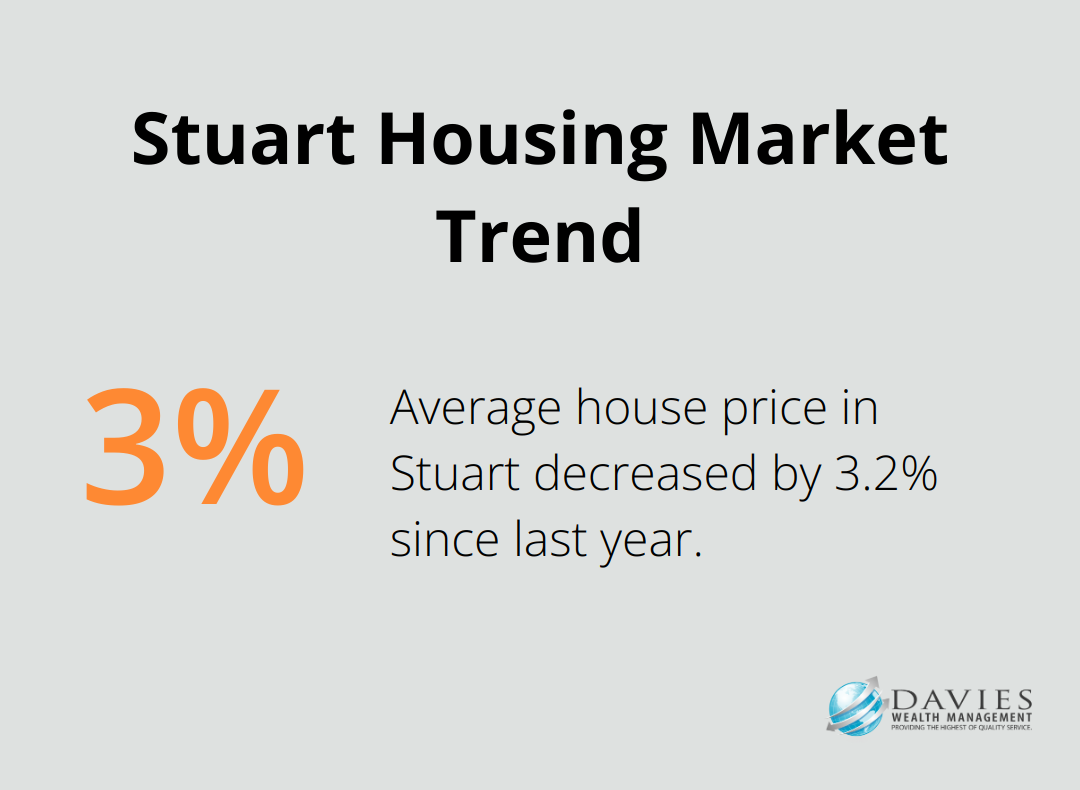

The real estate sector in Stuart continues to be an investment avenue worth considering. According to recent data, the housing market in Stuart (34951 zip code) is not very competitive, scoring 21 out of 100. The average house price in this area was $317K last month, down 3.2% since last year. This trend presents opportunities for both residential and commercial real estate investments.

We recommend the consideration of multi-family properties or vacation rentals, which can provide steady income streams. The growing tourism industry in Stuart, particularly eco-tourism, has increased demand for short-term rentals. Investors should explore properties near popular attractions like the Florida Oceanographic Coastal Center or the Elliott Museum.

Investing in Stuart’s Marine Economy

Stuart’s thriving marine industry offers unique investment prospects. Investors can explore opportunities in marine-related businesses, such as boat manufacturing, marine technology, or eco-friendly fishing equipment.

For those interested in public markets, we suggest research into companies with a strong presence in Stuart’s marine economy. These might include boat manufacturers, marine electronics firms, or companies specializing in sustainable fishing practices.

Diversification Through Local and Global Assets

While local investments are important, diversification remains key to a robust portfolio. We advise our clients to maintain a balance between local opportunities and broader market exposure. This might include a mix of:

- Local real estate investments

- Stocks of companies with a strong presence in Stuart or Florida

- Municipal bonds from Martin County or neighboring areas (which can offer tax advantages)

- National and international index funds or ETFs

This approach allows investors to benefit from Stuart’s economic growth while mitigating risk through broader market exposure.

Tax-Efficient Strategies for Florida Residents

Florida’s tax environment offers unique advantages for investors. We recommend:

- The maximization of contributions to tax-advantaged accounts like 401(k)s and IRAs

- The consideration of Roth conversions, especially in years with lower income

- The exploration of tax-free municipal bonds issued by Florida municipalities

For high-net-worth individuals, we often suggest the establishment of a donor-advised fund. This allows for immediate tax deductions while providing flexibility in charitable giving over time.

As we move forward, it’s essential to consider how these investment strategies integrate with comprehensive retirement planning, especially given Stuart’s retirement-friendly environment. The next section will explore how to effectively plan for retirement in this unique Florida locale.

Retirement Planning in Stuart: Maximizing Your Golden Years

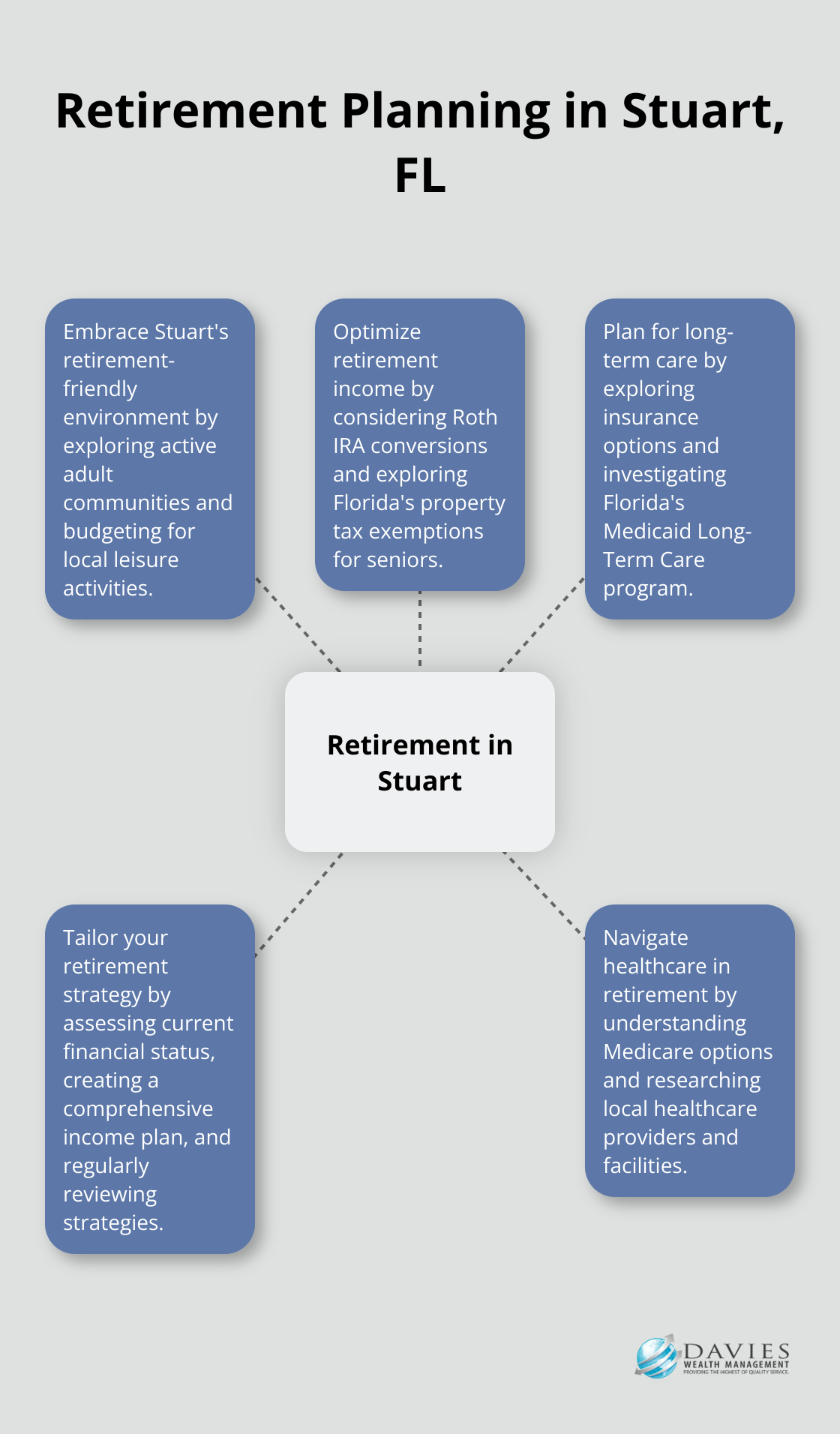

Embracing Stuart’s Retirement-Friendly Environment

Stuart, FL offers an ideal setting for retirees. The pleasant climate and abundance of recreational activities create a perfect backdrop for your golden years. We recommend our clients:

- Downsize to a more manageable property (potentially freeing up capital for investment or leisure activities)

- Explore Stuart’s active adult communities

- Budget for leisure activities unique to Stuart, such as golf memberships or boating expenses

Optimizing Retirement Income in Florida

Florida’s tax-friendly policies for retirees provide opportunities to maximize retirement income. We advise our clients to:

- Consider Roth IRA conversions during lower-income years

- Explore Florida’s property tax exemptions for seniors

- Investigate local part-time employment opportunities in Stuart’s tourism or marine industries

Long-Term Care Planning: A Florida Perspective

Long-term care is a critical component of retirement planning. We recommend our clients:

- Explore long-term care insurance options early, ideally in their 50s or early 60s

- Consider hybrid life insurance policies that offer long-term care benefits

- Investigate Florida’s Medicaid Long-Term Care program

Tailoring Your Retirement Strategy

Retirement planning is not a one-size-fits-all process. We work closely with our clients to develop personalized strategies that align with their unique goals and Stuart’s distinctive retirement landscape. This includes:

- Assessing current financial status and future needs

- Creating a comprehensive retirement income plan

- Regularly reviewing and adjusting strategies as needed

Navigating Healthcare in Retirement

Healthcare is a significant concern for retirees. In Stuart, we advise our clients to:

- Understand Medicare options and supplemental insurance plans

- Research local healthcare providers and facilities

- Consider setting aside funds specifically for healthcare expenses

At Davies Wealth Management, we help ensure our clients can enjoy a secure and fulfilling retirement in this beautiful Florida community. Our expertise in Stuart’s unique financial landscape allows us to provide tailored advice that maximizes the benefits of retiring in this coastal paradise.

Final Thoughts

Finance planning and wealth management in Stuart, FL require a tailored approach that considers the city’s unique financial landscape. Stuart offers distinct opportunities for wealth accumulation and preservation through its tax-friendly environment, thriving real estate market, and marine economy. The retirement-friendly atmosphere enhances the appeal of this coastal gem for those who want to secure their financial future.

Effective wealth management in Stuart demands a comprehensive strategy that encompasses investment diversification, tax optimization, and long-term care planning. Professional guidance proves paramount in navigating the complexities of wealth management in Stuart. At Davies Wealth Management, we specialize in crafting personalized financial strategies that align with the unique needs of Stuart residents.

To secure your financial future in Stuart, assess your current financial situation and long-term goals. Explore local investment opportunities while maintaining a diversified portfolio (including both local and global assets). Develop a comprehensive retirement plan that accounts for Stuart’s distinctive retirement landscape and consult with experienced professionals to build a robust financial foundation that supports your lifestyle goals.

Leave a Reply