At Davies Wealth Management, we understand the importance of finding the right financial planner in Stuart, FL. Choosing a trusted advisor to guide your financial journey is a critical decision that can significantly impact your future.

In this comprehensive guide, we’ll explore the top financial planners in Stuart, FL for 2025, providing you with valuable insights to make an informed choice. We’ll also share key considerations to help you select the best financial planner for your unique needs and goals.

How to Choose the Best Financial Planner in Stuart

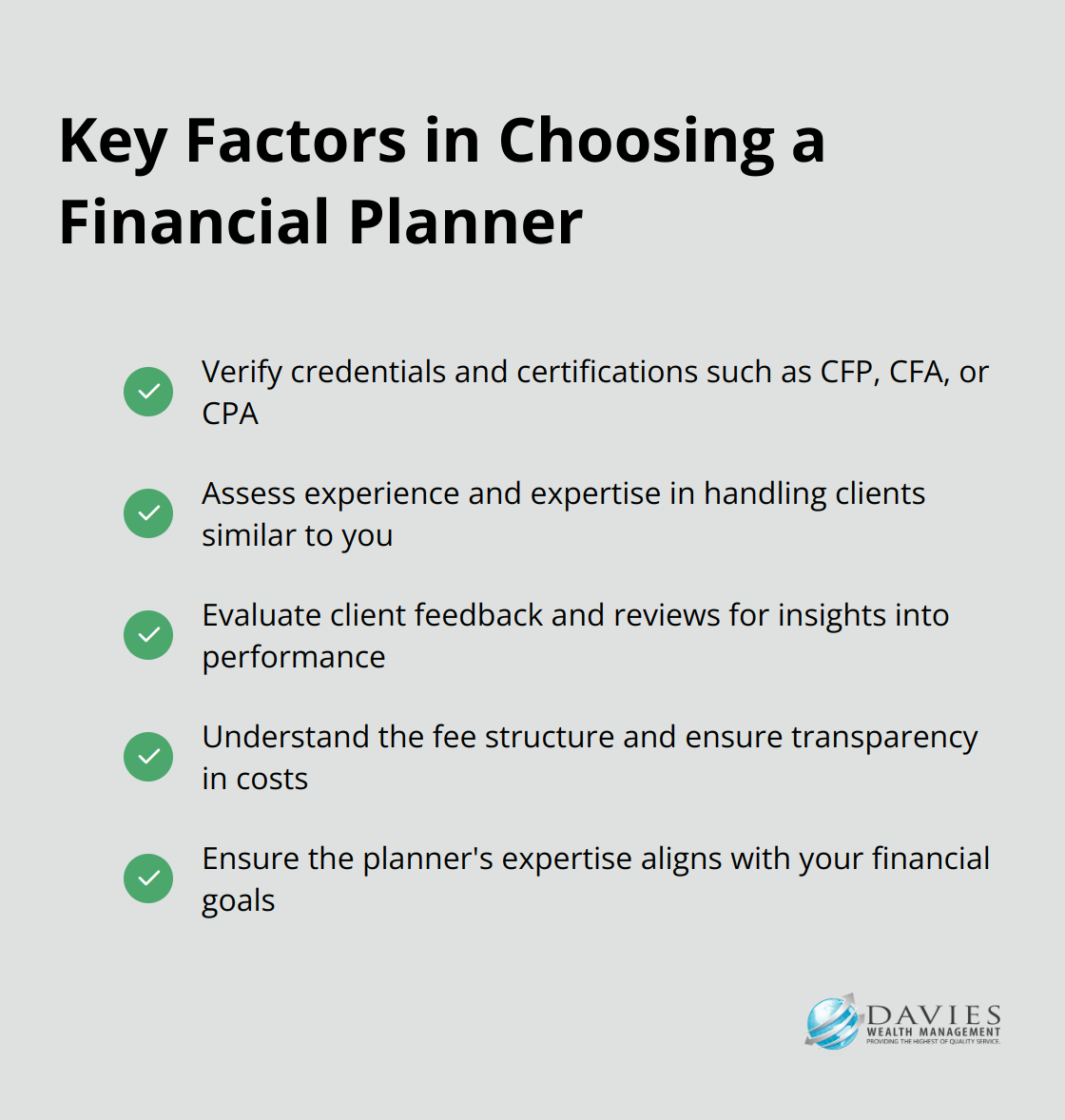

When you select a financial planner in Stuart, FL, you must consider several key factors to make an informed decision. The right financial advisor can make a significant difference in achieving your financial goals.

Verify Credentials and Certifications

The first step in choosing a financial planner is to verify their credentials and certifications. You should look for advisors who hold recognized designations such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). These certifications indicate a high level of expertise and adherence to ethical standards. CFP professionals, for example, must pass a comprehensive two-day, six-hour CFP® Certification Examination that tests their ability to apply financial planning knowledge in various situations.

Assess Experience and Expertise

Experience plays a vital role in financial planning. You should look for advisors who have a proven track record of helping clients similar to you. If you’re a professional athlete, you’ll want to work with a firm that has specific expertise in managing the unique financial challenges faced by athletes (such as Davies Wealth Management). Ask potential advisors about their years of experience, the types of clients they typically work with, and their areas of specialization.

Evaluate Client Feedback

Client reviews and testimonials can provide valuable insights into an advisor’s performance and client satisfaction. While positive reviews are encouraging, you should pay attention to how advisors handle challenges or negative feedback. This can give you a sense of their problem-solving skills and commitment to client service. You can find reviews on independent financial advisor directories or ask the advisor for client references.

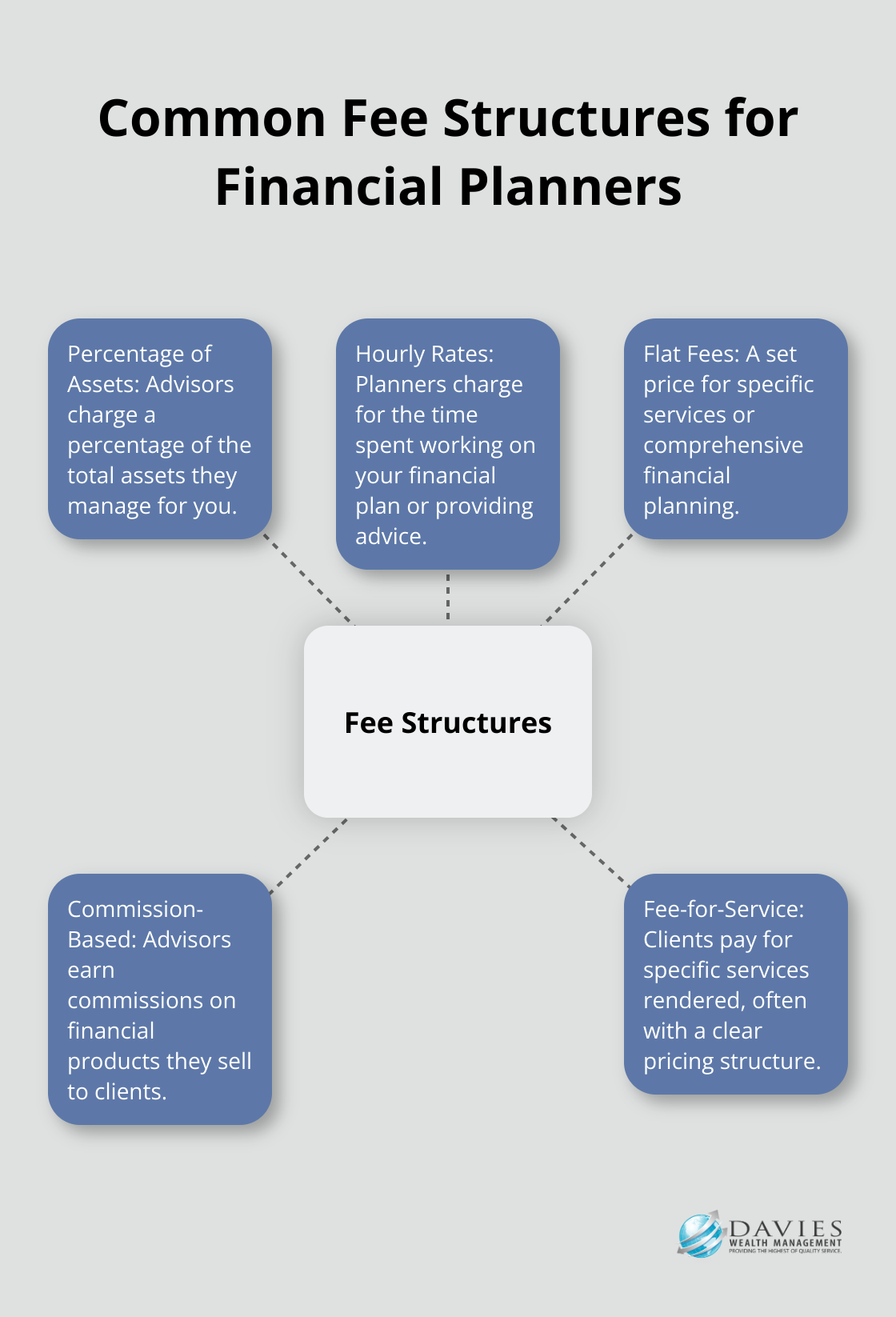

Understand the Fee Structure

Transparency in fee structures is essential. Financial planners may charge hourly rates, flat fees, or a percentage of assets under management. Some may also earn commissions on financial products they sell. The cost for financial advice will vary. Investment firms may charge commission and transaction-oriented fees, while a fee-only advisory firm may have a different structure. You should ask potential advisors to explain their fee structure in detail and how it aligns with your financial situation and goals.

Choosing a financial planner is a personal decision that should be based on your unique needs and circumstances. You should take the time to meet with several advisors and ask questions. The right financial planner will not only have the necessary qualifications but will also make you feel comfortable and confident in their ability to guide your financial future.

As we move forward, let’s spotlight some of the top financial planners in Stuart, FL, and compare their services and specializations.

Top Financial Planners in Stuart FL

Davies Wealth Management: A Leader in Specialized Financial Planning

Davies Wealth Management stands out as a premier choice for comprehensive financial planning in Stuart. Their expertise in serving professional athletes sets them apart, addressing the complex financial challenges unique to this demographic. Their services extend beyond athletes, catering to individuals, families, and businesses seeking tailored wealth management solutions.

Other Notable Financial Planning Firms

Several other firms have made their mark in Stuart’s financial planning scene. King Tide Advisors focuses on retirement strategies and tax-efficient planning. Their approach to comprehensive financial planning has garnered positive client feedback, particularly for their attention to detail in crafting personalized retirement plans.

Advise Financial is another firm worth noting. They emphasize their fiduciary responsibility, ensuring that all advice is unbiased and in the client’s best interest. This commitment to transparency has helped them build a strong reputation among Stuart residents seeking trustworthy financial guidance.

Comparing Services and Specializations

When evaluating financial planners in Stuart, it’s important to consider their specific areas of expertise. Davies Wealth Management offers a wide range of services including investment management, retirement planning, tax-efficient strategies, and estate planning. Their specialized focus on professional athletes demonstrates their ability to handle complex financial situations.

King Tide Advisors appears to have a strong focus on retirement planning and tax efficiency. This specialization could benefit individuals nearing retirement or those looking to optimize their tax strategies.

Advise Financial’s emphasis on fiduciary responsibility suggests they might suit clients who prioritize transparency and want to ensure their advisor’s interests align with their own. However, it’s worth noting that fiduciary financial advisors may have higher fees than non-fiduciary advisors due to their legal obligation to prioritize the client’s best interests.

Assets Under Management and Market Demand

The assets under management (AUM) for top firms in Stuart reflect a robust advisory market. As of February 18, 2025, the top class of advisors oversaw nearly $41.5 billion in client assets. This indicates a high demand for quality financial planning services in the area. When choosing a financial planner, consider not only their specializations but also their track record in managing assets similar to your portfolio size.

Making Your Decision

The best financial planner for you will depend on your specific needs, goals, and circumstances. Take the time to research and meet with several advisors before making your decision. Look for a planner who not only has the necessary qualifications and expertise but also makes you feel comfortable and confident in their ability to guide your financial future.

As you narrow down your options, you’ll want to consider several key factors that can help you make the best choice for your financial future. Let’s explore these important considerations in the next section.

How to Choose the Right Financial Planner for You

Align with Your Financial Goals

The first step in choosing a financial planner is to define your financial goals clearly. You should identify if you’re planning for retirement, looking to build wealth, or need help with tax strategies. Once you’ve identified your objectives, look for a planner whose expertise matches these goals. For example, if you’re a professional athlete, Davies Wealth Management’s specialized focus on athletes’ unique financial challenges could be particularly beneficial.

When you meet with potential advisors, ask specific questions about how they would approach your financial situation. A good planner should provide a clear, tailored strategy that addresses your unique needs and aspirations.

Evaluate Communication and Accessibility

Effective communication is essential in a successful client-advisor relationship. During initial consultations, assess the planner’s communication style. Does the planner explain complex financial concepts in terms you can understand? Is the planner patient with your questions? These factors indicate how your future interactions might unfold.

Ask about the frequency of meetings and updates. Some clients prefer monthly check-ins, while others are comfortable with quarterly reviews. Make sure the planner’s communication schedule aligns with your preferences. Additionally, inquire about their availability between scheduled meetings. Will you be able to reach them if urgent financial matters arise?

Understand Investment Philosophy and Risk Management

A financial planner’s investment philosophy and approach to risk management should align with your risk tolerance and financial goals. Some planners advocate for a more aggressive growth strategy, while others focus on conservative, income-generating investments.

Ask potential advisors about their investment strategy. How do they construct portfolios? How do they measure and manage risk? What’s their approach to market volatility? Their answers will give you insight into whether their philosophy matches your financial temperament.

For instance, if you’re nearing retirement, you might prefer a planner who emphasizes capital preservation and steady income over high-risk growth strategies. Conversely, if you’re in your early career stages, you might seek a planner who can balance growth opportunities with prudent risk management.

Seek Specialized Expertise

Financial planning isn’t one-size-fits-all. Your unique circumstances may require specialized expertise. For instance, if you’re a business owner, you’ll want a planner who understands the intricacies of business succession planning and corporate tax strategies. If estate planning is a priority, look for a planner with experience in strategies for high-net-worth individuals to protect assets, reduce taxes, and secure generational wealth for your family.

Don’t hesitate to ask about a planner’s experience with clients in similar situations to yours. A planner who has successfully guided clients through scenarios similar to yours (e.g., professional athletes, high-net-worth individuals, or small business owners) is likely better equipped to address your specific needs.

Consider Fee Structure and Transparency

The fee structure of a financial planner is an important consideration. Some planners charge a percentage of assets under management, while others use a fee-for-service model. Fee-based investment advisors charge the client for services, while commission-based advisors are paid by the companies whose products they sell.

Transparency is key. A reputable financial planner should be upfront about their fees and any potential conflicts of interest. Ask for a clear breakdown of all costs associated with their services, including any hidden fees or charges. This transparency will help you make an informed decision and avoid surprises down the road.

Final Thoughts

Stuart, FL offers a diverse range of financial planners to meet various needs. Davies Wealth Management stands out as a leader in specialized financial planning, particularly for professional athletes and high-net-worth individuals. Their comprehensive services include investment management, retirement planning, and estate planning.

The right financial planner can significantly impact your financial journey. You should evaluate potential advisors based on their credentials, experience, client feedback, and fee structure. Your financial goals, risk tolerance, and life circumstances require a personalized approach (not a one-size-fits-all solution).

Take action now to secure your financial future. We encourage you to schedule consultations with top financial planners in Stuart, FL that align with your needs. These initial meetings provide an excellent opportunity to determine if an advisor is the right fit for you.

Leave a Reply