Stuart, Florida, is home to a thriving wealth management industry, offering a wide array of financial services tailored to high-net-worth individuals and families. At Davies Wealth Management, we understand the unique financial challenges and opportunities that come with living in this vibrant coastal community.

Our wealth management services in Stuart, Florida, are designed to help you navigate complex financial landscapes and achieve your long-term financial goals. From investment management to estate planning, we provide comprehensive solutions to protect and grow your wealth.

Tailored Wealth Management Solutions in Stuart

At Davies Wealth Management, we provide comprehensive wealth management services in Stuart, Florida, designed to address the diverse needs of high-net-worth individuals and families. Our approach focuses on creating personalized strategies that align with each client’s unique financial situation and goals.

Investment Management and Portfolio Optimization

Our investment management strategy creates diversified portfolios that match your risk tolerance and financial objectives. We use advanced portfolio optimization techniques to maximize returns while minimizing risk. A 2024 Vanguard study found that a well-diversified portfolio can reduce risk by up to 35% compared to a concentrated portfolio.

We monitor market trends and adjust portfolios accordingly. In response to the growing interest in sustainable investing, we’ve incorporated ESG (Environmental, Social, and Governance) factors into our investment selection process. This approach has shown promising results, with sustainable funds hitting a record AUM of $3.56 trillion but posting a median return of 0.4%, compared to traditional funds’ 1.7% in 2024.

Retirement Planning and Income Strategies

Retirement planning forms a critical component of wealth management. We help create robust retirement plans that ensure financial security throughout your later years. Our strategies include a mix of traditional retirement accounts (such as 401(k)s and IRAs) and alternative investments like real estate and annuities.

We also develop sustainable income strategies for retirees. While the 4% withdrawal rule remains popular, it may not suit everyone. Our team analyzes your specific situation to determine an optimal withdrawal rate that balances your lifestyle needs with the longevity of your assets.

Estate Planning and Wealth Transfer

Effective estate planning preserves and transfers wealth to future generations. We collaborate with estate planning attorneys to create comprehensive plans that minimize estate taxes and distribute your assets according to your wishes.

We often recommend the use of irrevocable trusts, which can potentially reduce estate taxes by up to 40% (depending on the estate’s size). We also advise on charitable giving strategies, which provide tax benefits while supporting causes you care about.

Tax-Efficient Strategies for High Net Worth Individuals

Tax efficiency forms a cornerstone of our wealth management approach. We implement various strategies to minimize your tax burden, such as tax-loss harvesting. For example, assuming an average annual return of 6%, reinvesting $900 each year through tax-loss harvesting could potentially amount to approximately $35,000 after 20 years.

For high-income clients, we often recommend municipal bonds for their tax-exempt status. In Florida, these bonds can provide double tax-free income (exempt from both federal and state taxes). This strategy can significantly boost after-tax returns, especially for those in higher tax brackets.

Our commitment to providing comprehensive wealth management solutions addresses all aspects of your financial life. This tailored approach ensures that your wealth not only remains preserved but also grows over time, allowing you to achieve your financial goals and secure your legacy.

As we move forward, let’s explore how our specialized financial services cater to the unique needs of professional athletes, a key area of expertise at Davies Wealth Management.

Financial Game Plan for Pro Athletes

At Davies Wealth Management, we recognize the unique financial challenges professional athletes face. Our specialized services address the complex needs of this elite group, ensuring their financial success both during and after their sports careers.

Maximizing Career Earnings

Professional athletes often experience a concentrated earning period. We create strategies to maximize these earnings. Our approach includes cash flow management, strategic savings and investment planning, comprehensive retirement planning, and advanced tax planning strategies.

A study by the National Bureau of Economic Research found that nearly 16% of NFL players file for bankruptcy within 12 years of retirement. To combat this, we emphasize the importance of budgeting and saving. We typically advise our athlete clients to save at least 50% of their after-tax income (a strategy that has proven effective in maintaining long-term financial stability).

Mitigating Career Risks

The average career span of a professional athlete is short – approximately 3.3 years in the NFL, 4.5 years in the NBA, and 5.6 years in MLB (according to the RBC Sports Professionals division). Given this brevity, we focus on comprehensive insurance solutions to protect against career-ending injuries or unexpected early retirement.

We recommend a combination of disability insurance and career-ending insurance. These policies are tailored to each athlete’s specific sport, position, and career stage.

Building a Post-Career Financial Foundation

Transitioning from active play to retirement requires careful planning. We help athletes develop diverse income streams for their post-career lives. This includes investment strategies, retirement planning, and understanding the financial transition from college to professional sports.

For instance, we guide clients in purchasing multi-family rental properties, which provide steady passive income. Others have successfully invested in franchise opportunities, leveraging their name recognition to boost business success.

Customized Financial Strategies

Each athlete’s situation is unique. Our tailored approach ensures that whether you’re a rookie or a seasoned pro, you have a solid financial game plan that extends well beyond your playing days. We analyze individual circumstances, career trajectories, and personal goals to craft bespoke financial strategies.

As we shift our focus from the specialized needs of professional athletes, let’s explore how to select the right wealth management firm in Stuart. This decision is critical for anyone seeking to optimize their financial future, regardless of their profession or background.

How to Choose a Wealth Management Firm in Stuart

Selecting the right wealth management firm in Stuart will significantly impact your financial future. This process requires careful consideration and thorough research. Here’s what you need to know to make an informed choice.

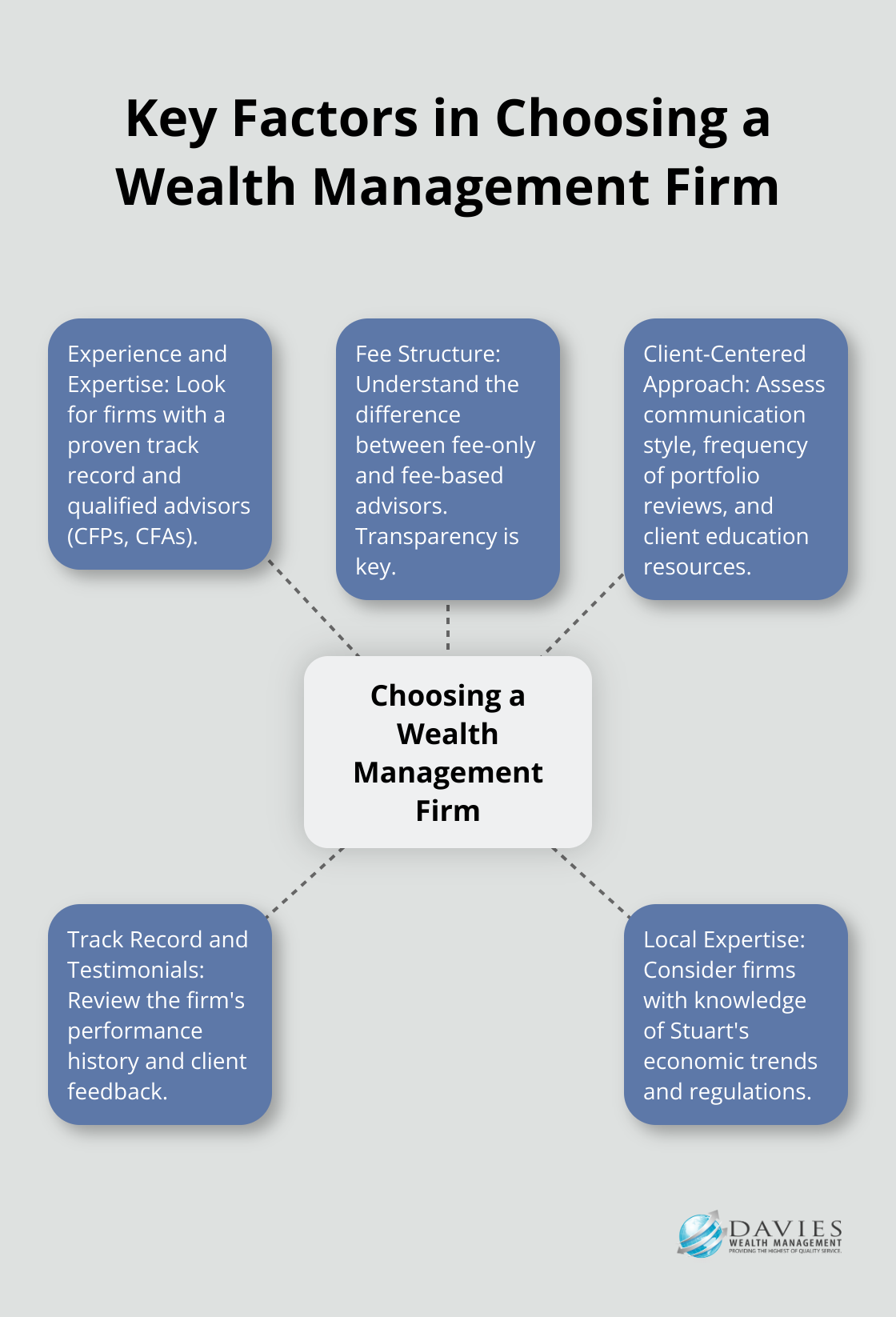

Evaluate Experience and Expertise

Experience matters when evaluating wealth management firms. Look for firms with a proven track record in the industry. Check the qualifications of the advisors. Certified Financial Planners (CFPs) and Chartered Financial Analysts (CFAs) have undergone rigorous training and adhere to strict ethical standards. The CFP Board reports approximately 95,000 CFP professionals in the U.S. as of 2025, indicating a growing emphasis on professional certifications in the industry.

Understand Fee Structures

Transparency in fee structures is essential. A fee-only structure reduces potential conflicts of interest. In contrast, a fee-based financial advisor in Stuart, FL is paid by clients for their services.

Fee-only advisors do not earn commissions on product sales, potentially reducing conflicts of interest. This model has gained popularity, with a 2023 Cerulli Associates study showing that 64% of advisors now prefer fee-based or fee-only compensation structures.

Assess Client-Centered Approaches

A client-centered approach is vital for effective wealth management. Let’s create a personalized plan to grow, protect, and maintain your wealth for life – so you can focus on what truly matters.

Consider the firm’s communication style and frequency. Regular portfolio reviews and proactive communication about market changes indicate attentive service. Some firms emphasize ongoing client education through resources such as podcasts and guides, keeping clients informed and engaged.

Review Track Record and Client Testimonials

Examine the firm’s track record and client testimonials. These provide insights into the firm’s performance and client satisfaction. Look for firms with a history of consistent performance and positive client feedback. Try to speak with current clients if possible to get first-hand accounts of their experiences.

Consider Local Expertise

A wealth management firm with local expertise in Stuart can offer valuable insights into regional economic trends and investment opportunities. They may have a better understanding of local tax laws and regulations that could impact your financial strategy. This local knowledge can complement broader financial expertise to provide a more comprehensive wealth management approach.

Final Thoughts

Stuart, Florida offers a diverse range of wealth management services tailored to meet the unique needs of high-net-worth individuals, families, and professional athletes. The wealth management landscape in Stuart is robust and sophisticated, providing comprehensive investment management, retirement planning, and specialized strategies for tax efficiency and estate planning. Local firms bring a deep understanding of the regional economic climate, tax laws, and investment opportunities specific to Stuart and the surrounding areas.

This local expertise, combined with broad financial knowledge, allows for the creation of truly tailored strategies that align with your goals and circumstances. Wealth management firms in Stuart offer the advantage of personalized service and face-to-face interactions, which can be crucial when discussing complex financial matters or making important decisions about your wealth. The ability to build a strong, long-term relationship with your wealth manager can lead to better outcomes and greater peace of mind.

For professional athletes, the specialized services available in Stuart are particularly valuable (due to unique financial challenges such as short career spans and fluctuating incomes). Davies Wealth Management provides expert guidance to ensure long-term financial security for athletes and other high-net-worth individuals in Stuart, Florida. We invite you to contact us to learn more about how our wealth management services can help you achieve your financial goals.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply