At Davies Wealth Management, we understand the unique challenges faced by high-income earners when it comes to financial planning. The complexities of tax implications, lifestyle management, and long-term wealth preservation require specialized strategies.

In this 2025 guide, we’ll explore effective financial planning for high-income earners, covering tax optimization, wealth building, and risk management techniques. Our goal is to help you navigate the intricate financial landscape and secure your financial future.

What Challenges Do High Income Earners Face?

High income earners often find themselves in a unique financial position, facing challenges that require specialized strategies and careful planning. Several key issues frequently arise for high-earning individuals.

The Tax Burden

One of the most significant challenges for high income earners is the management of their tax obligations. As income increases, so does the complexity of the tax code. High earners can minimize their taxes by maxing out contributions, recharacterizing income, and employing other proven strategies.

High earners often become subject to the Alternative Minimum Tax (AMT), which was designed to ensure that high-income individuals pay a minimum amount of tax. The AMT can significantly complicate tax planning and potentially negate certain deductions and credits.

The Lifestyle Creep Conundrum

Another challenge is the phenomenon of lifestyle inflation, or “lifestyle creep.” As income grows, there’s a natural tendency to increase spending on luxuries, larger homes, or more expensive cars. This occurs when an individual’s income increases, leading to an increase in their spending, which can hinder long-term financial goals.

Balancing Present and Future

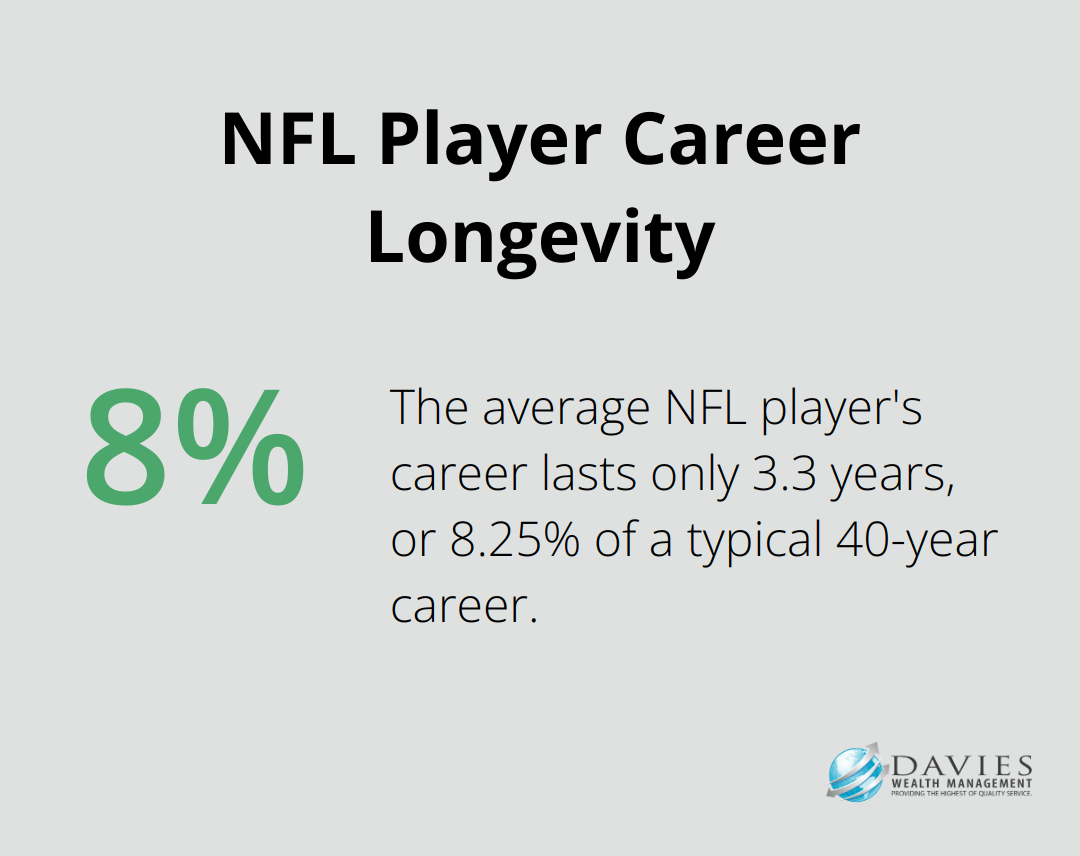

High income earners often struggle to strike a balance between enjoying their current lifestyle and securing their financial future. This challenge is particularly acute for those in high-paying but potentially unstable or short-term careers, such as professional athletes or executives in volatile industries.

For example, the average career span of an NFL player is just 3.3 years. This short career window emphasizes the need for careful financial planning to ensure long-term security.

Managing Complex Investment Portfolios

As wealth accumulates, investment portfolios often become more complex. High income earners may have access to a wider range of investment opportunities, including private equity, hedge funds, and real estate investments. While these can offer diversification and potentially higher returns, they also come with increased complexity and risk.

The management of these diverse portfolios requires a deep understanding of various asset classes, tax implications, and risk management strategies. It’s not uncommon for high-net-worth individuals to struggle with optimizing their investment allocations for both growth and tax efficiency.

Protecting Wealth

With increased wealth comes an increased need for protection. High income earners often require more sophisticated insurance and estate planning strategies to safeguard their assets. This might include umbrella liability policies, life insurance trusts, and other advanced wealth protection tools.

The complexity of these strategies can be daunting, and mistakes in implementation can have significant financial consequences. As we move into the next section, we’ll explore effective strategies to address these challenges and optimize financial planning for high income earners.

How High Earners Can Optimize Their Tax Strategy

At Davies Wealth Management, we’ve observed how proper tax planning significantly impacts the financial health of high-income earners. Let’s explore effective strategies to minimize your tax burden and maximize your wealth.

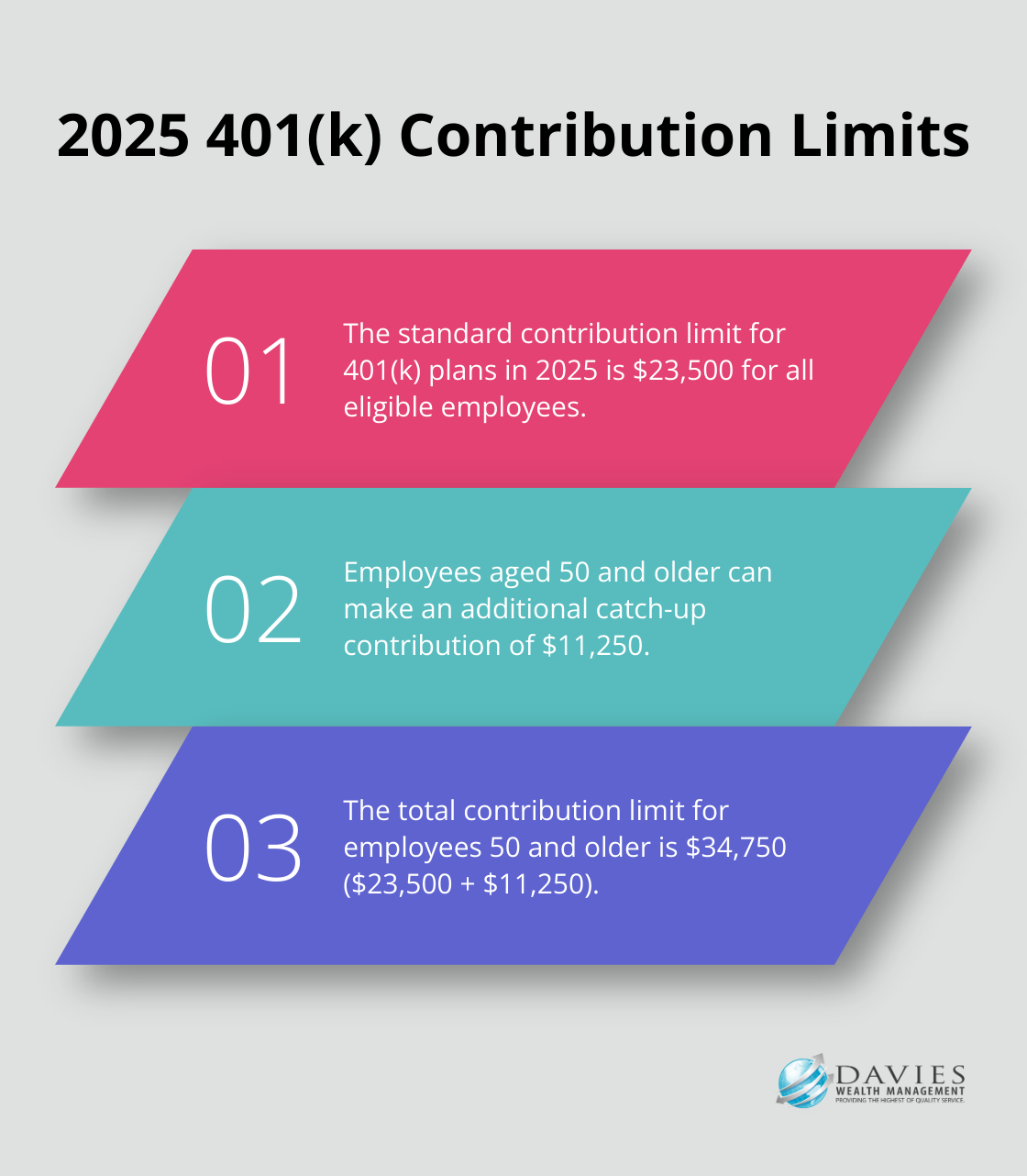

Maximize Retirement Contributions

One of the most straightforward ways to reduce your taxable income is to maximize contributions to tax-advantaged retirement accounts. In 2025, the contribution limit for 401(k) plans is $23,500, with an additional $11,250 catch-up contribution for those 50 and older. Self-employed individuals or those with a side business should consider setting up a SEP IRA or Solo 401(k), which have even higher contribution limits.

For those who have maxed out their traditional retirement accounts, a backdoor Roth IRA conversion can be an excellent strategy. This involves contributing to a traditional IRA and then immediately converting it to a Roth IRA, allowing for tax-free growth and withdrawals in retirement.

Leverage Tax-Advantaged Investments

Municipal bonds can be an attractive option for high-income earners. The interest from these bonds is typically exempt from federal taxes (and sometimes state and local taxes as well). While the returns may be lower than other investments, the tax savings can make them worthwhile for those in higher tax brackets.

Another strategy is to invest in Qualified Opportunity Zones. This program allows investors to defer capital gains taxes by reinvesting the gains into designated economically distressed communities. If held for at least 10 years, the appreciation on the investment can be completely tax-free.

Implement Tax-Loss Harvesting

Tax-loss harvesting is a sophisticated strategy that involves selling investments at a loss to offset capital gains. This technique can be particularly effective for high-income earners with substantial investment portfolios. Strategic realization of losses can reduce your overall tax liability while maintaining your investment strategy.

For example, if you have $50,000 in capital gains this year, you could sell underperforming investments at a $50,000 loss to offset those gains completely. However, be aware of the wash-sale rule, which prohibits repurchasing the same or substantially identical security within 30 days.

Strategic Charitable Giving

Charitable giving not only allows you to support causes you care about but can also provide significant tax benefits. Consider setting up a Donor-Advised Fund (DAF), which allows you to make a large charitable contribution in a single year for an immediate tax deduction, while spreading out the actual charitable gifts over time.

For those over 70½, Qualified Charitable Distributions (QCDs) from IRAs can be an excellent strategy. You can donate up to $105,000 directly from your IRA to a qualified charity, satisfying your Required Minimum Distribution (RMD) without increasing your taxable income.

Tax laws are complex and constantly changing. While these strategies can be powerful tools for high-income earners, it’s crucial to work with a knowledgeable financial advisor to ensure they’re implemented correctly and align with your overall financial goals. As we move forward, let’s explore how high earners can build and protect their wealth through diversification and risk management strategies.

How High Earners Can Build and Protect Their Wealth

Diversification: The Foundation of Wealth Building

High-income earners should look beyond traditional stocks and bonds to build and protect their wealth. A well-diversified portfolio that includes alternative investments can potentially increase returns while reducing risk. We recommend allocating a portion of your portfolio to private equity and venture capital investments, which often have low correlation with traditional markets, providing a buffer against market volatility.

Private equity investments have historically performed well. Cambridge Associates provides benchmark reports on private investment performance.

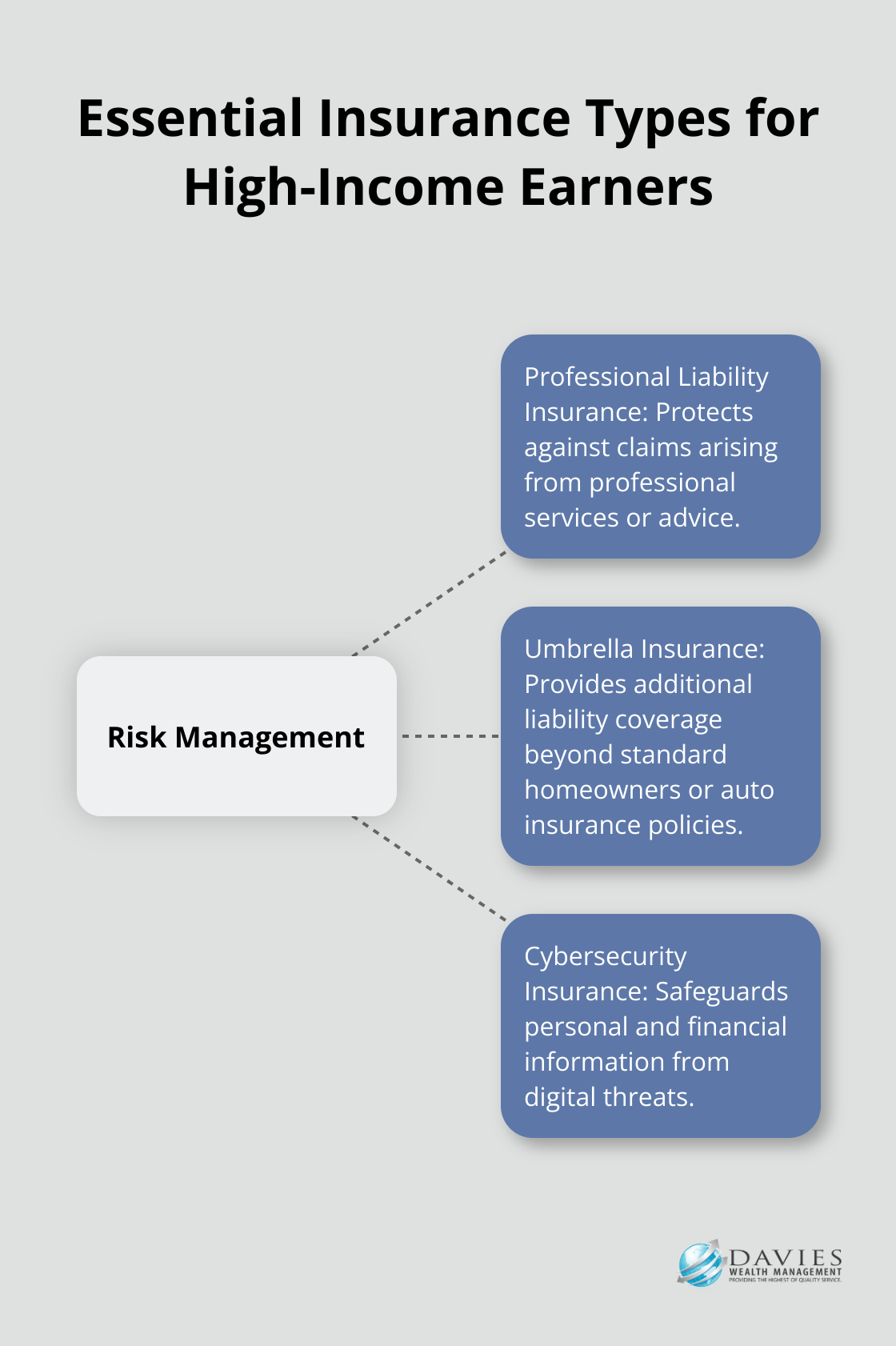

Risk Management: Safeguarding Your Hard-Earned Wealth

Effective risk management involves more than just investment risk; it also includes personal and professional liability risks. A comprehensive approach to risk management should include:

- Professional Liability Insurance: This is particularly important for high-income professionals (such as doctors, lawyers, and executives).

- Umbrella Insurance: This provides additional liability coverage beyond standard homeowners or auto insurance policies.

- Cybersecurity Insurance: With increasing digital threats, this type of insurance protects personal and financial information.

Advanced Financial Tools for Wealth Protection

High-income earners have access to sophisticated financial tools that can significantly enhance wealth protection and growth. Some strategies to consider include:

- Trusts: Irrevocable trusts can protect assets from creditors and potentially reduce estate taxes. A Grantor Retained Annuity Trust (GRAT) can transfer wealth to heirs with minimal gift tax consequences.

- Cash Value Life Insurance: These policies provide both a death benefit and a tax-advantaged investment component. For high-income earners, this can effectively build wealth while providing financial protection for beneficiaries.

- Structured Notes: These complex financial instruments offer customized risk-return profiles, potentially providing downside protection while still allowing for upside participation in market gains.

The Importance of Professional Guidance

The effectiveness of these strategies depends on proper implementation and ongoing management. Professional wealth managers specialize in creating tailored wealth management plans for high-income earners, including professional athletes who face unique financial challenges.

Experienced advisors stay informed about the latest financial products and strategies, ensuring their clients have access to the most effective tools for their specific situations. They understand that each client’s financial situation is unique and pride themselves on delivering personalized advice that aligns with individual goals and risk tolerances.

Retirement Planning and Legacy Creation

High earners should also focus on effective retirement planning and creating a lasting legacy. This involves maximizing retirement account contributions, considering Roth conversions, and exploring estate planning strategies to efficiently transfer wealth to future generations.

Final Thoughts

Financial planning for high-income earners requires strategic decision-making and careful consideration. We have explored unique challenges faced by high earners and provided actionable strategies to optimize tax planning, build wealth, and protect assets. Professional guidance becomes invaluable when navigating the complex financial landscape of tax laws, investment options, and wealth protection strategies.

At Davies Wealth Management, we offer tailored financial planning solutions for high-income earners. Our team of experts can develop a comprehensive financial plan that addresses your specific needs, maximizes your wealth-building potential, and ensures long-term financial security. We specialize in providing solutions for various high-income individuals, including those with unique financial challenges.

Effective financial planning is an ongoing process that evolves with your income growth and changing financial situation. Your financial strategies should adapt to capitalize on opportunities and mitigate potential risks. Take a proactive approach to stay ahead of changing market conditions, tax laws, and personal circumstances to secure a prosperous future for yourself and your loved ones.

Leave a Reply