Cryptocurrency has become a significant part of many investors’ portfolios, but its unique nature presents challenges for estate planning. At Davies Wealth Management, we’ve seen a growing need to address crypto inheritance in comprehensive estate plans.

As digital assets continue to gain prominence, it’s crucial to understand how to properly include and transfer cryptocurrency to your beneficiaries. This guide will explore the strategies and considerations for incorporating crypto assets into your estate plan, ensuring your digital wealth is protected and passed on according to your wishes.

Navigating Crypto in Estate Planning

The Essence of Cryptocurrency in Estate Planning

Cryptocurrency has revolutionized the financial landscape, and its impact on estate planning is undeniable. This digital or virtual currency uses cryptography for security and operates on decentralized networks based on blockchain technology. Unlike traditional assets, crypto exists solely in digital form, making it a valuable but complex asset to include in your estate plan.

The importance of addressing crypto in estate planning cannot be understated. A report by Gemini found that nearly half of all current crypto owners in the United States (44%) first bought crypto. With such widespread adoption, failure to account for these assets in your estate plan could result in substantial losses for your beneficiaries.

Overcoming Crypto’s Unique Challenges

Cryptocurrency presents several distinct challenges in estate planning:

- Access: Unlike traditional bank accounts, crypto wallets are secured by private keys. Without these keys, your beneficiaries cannot access your digital assets. In 2013, a tragic case highlighted this risk when $150 million worth of Bitcoin was lost forever after the owner died without sharing his private keys.

- Volatility: Cryptocurrency values can fluctuate wildly in short periods. This unpredictability complicates accurate valuation for estate tax purposes and can hinder equitable distribution of your estate.

Navigating the Legal Landscape

The legal and regulatory environment surrounding cryptocurrency inheritance continues to evolve. As of 2023, the IRS treats cryptocurrency as property for tax purposes. This classification means that inherited crypto is subject to capital gains tax, with the cost basis stepped up to the fair market value at the date of death.

The Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA), adopted by most U.S. states, provides a framework for fiduciaries to manage digital assets. This law allows users to designate who can access their digital accounts through specific provisions within their estate planning documents.

Practical Steps for Crypto Estate Planning

To effectively include cryptocurrency in your estate plan, consider these actionable steps:

Regular updates to your estate plan will reflect changes in your crypto portfolio and the evolving regulatory landscape. As we move forward, let’s explore specific strategies for including cryptocurrency in your estate plan, ensuring your digital wealth is protected and passed on according to your wishes.

How to Secure Your Crypto Assets for the Future

Document Your Digital Wealth

The first step to include cryptocurrency in your estate plan is to create a comprehensive record of your holdings. This inventory should list the types of cryptocurrencies you own, such as Bitcoin and Ethereum, and their current estimated value. Update this information regularly, as crypto values can fluctuate significantly.

For each cryptocurrency, note down the wallet addresses and any associated exchange accounts. This information will help your beneficiaries or executor locate and access your digital assets. However, never include private keys or passwords in this document. Instead, create a separate, secure document with access information that you can reference in your estate plan.

Choose Secure Storage Solutions

Selecting the right storage method for your cryptocurrency is essential to ensure its long-term security. Hardware wallets (such as Ledger or Trezor) offer one of the most secure options for storing large amounts of cryptocurrency. These physical devices store your private keys offline, which protects them from online threats.

For smaller amounts or more frequently traded crypto, consider using reputable custodial services. These services (like Coinbase Custody or Gemini Custody) provide institutional-grade security and often include inheritance planning features. Always research and choose a service with a strong track record in security and regulatory compliance.

Create a Crypto Access Plan

Develop a foolproof method for your beneficiaries to access your cryptocurrency. This plan should detail step-by-step instructions on how to retrieve and transfer your digital assets. Include information on the location of hardware wallets, login details for exchanges (but not passwords), and any multi-signature requirements.

Consider using a digital asset inheritance service that offers solutions specifically designed for cryptocurrency inheritance. These platforms can help prevent unauthorized access while ensuring your beneficiaries can claim your assets when the time comes.

Educate Your Beneficiaries

An often overlooked aspect of crypto estate planning is educating your beneficiaries about these digital assets. Many people are unfamiliar with cryptocurrency, which can lead to confusion or mistakes when handling inherited crypto. Take time to explain the basics of cryptocurrency to your beneficiaries, including how to securely store and manage these assets.

Consider creating a simple guide or arranging a meeting with a financial advisor who specializes in cryptocurrency. This education will help ensure your beneficiaries can effectively manage and benefit from the crypto assets they inherit.

As the cryptocurrency landscape continues to evolve, so too must our approaches to estate planning. The next section will explore the various options for transferring your crypto assets to beneficiaries, including the use of wills, trusts, and direct transfers.

How to Transfer Crypto Assets to Heirs

Wills vs. Trusts for Crypto Inheritance

Transferring cryptocurrency to your beneficiaries requires careful planning and execution. Both wills and trusts offer viable options for crypto inheritance. A will allows you to specify who inherits your cryptocurrency, but it goes through probate, which can take time and expose your crypto holdings to public scrutiny.

Trusts provide more privacy and control. A revocable living trust can hold your crypto assets, allowing for immediate transfer to beneficiaries upon your death, bypassing probate and related court fees. For larger crypto holdings, an irrevocable trust might reduce estate taxes.

Direct Transfer Methods

For smaller amounts of cryptocurrency, exchange-based inheritance features offer a solution. Some exchanges (like Coinbase) provide beneficiary designation options, allowing for direct transfer of assets to your chosen beneficiary without probate.

Another option involves setting up a multi-signature wallet. This method requires multiple private keys to access funds, with one key held by your beneficiary. A popular setup is a 2-of-3 configuration, where at minimum two key signatures are required to move your Bitcoin.

Preparing Beneficiaries for Crypto Management

Educating your beneficiaries about cryptocurrency is essential. Create a detailed guide that explains how to access and manage the inherited crypto assets. This guide should include:

- Basic principles of cryptocurrency

- Instructions on using hardware wallets or accessing exchange accounts

- Best practices for security and storage

- Guidance on converting crypto to fiat currency (if needed)

Arrange a meeting with a crypto-savvy financial advisor to walk your beneficiaries through the basics. This proactive approach can prevent costly mistakes and preserve your digital legacy.

Navigating Tax Implications

Cryptocurrency inheritance comes with complex tax considerations. The IRS treats digital assets such as cryptocurrency and non-fungible tokens (NFTs) as property, which may need to be reported on your tax return.

The volatile nature of cryptocurrency can complicate valuation. Work with a tax professional experienced in crypto assets to accurately determine the value for estate tax purposes and to plan for potential capital gains taxes when beneficiaries sell the inherited crypto.

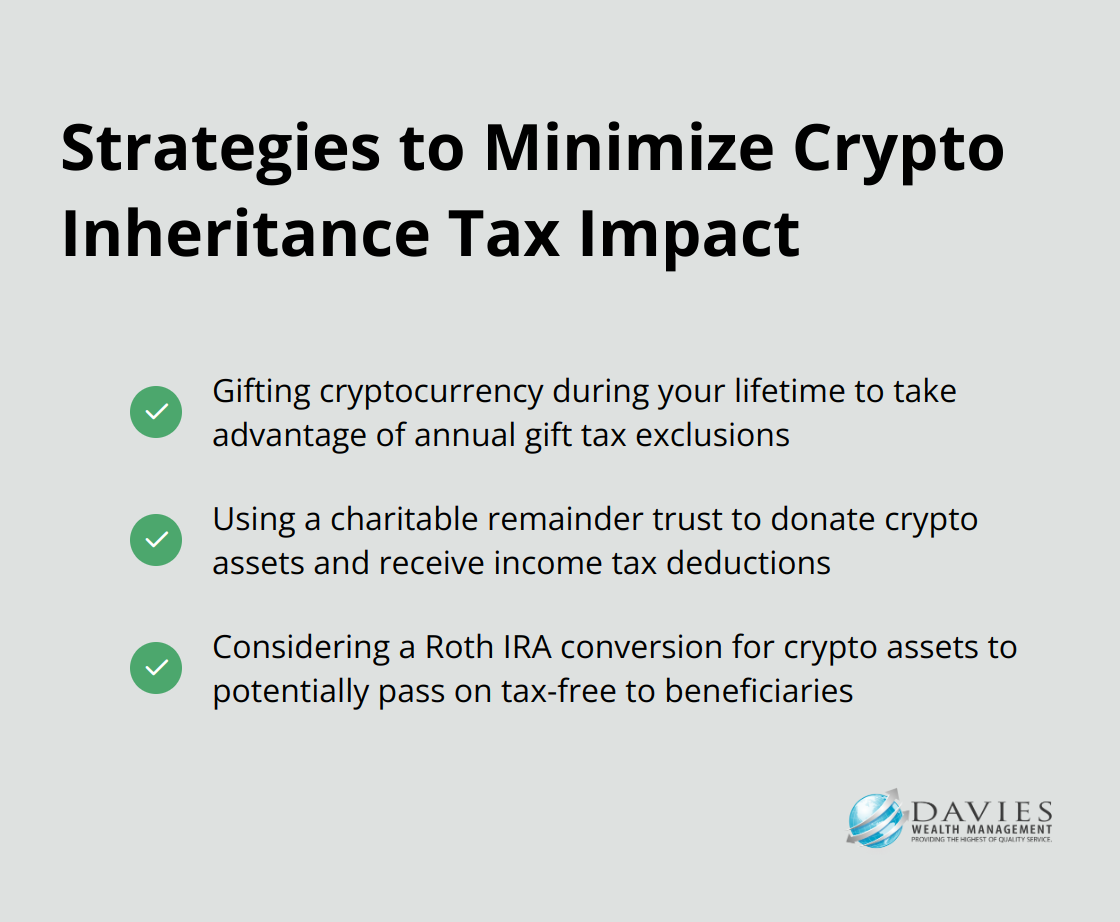

Some strategies to minimize tax impact include:

Selecting a Trusted Advisor

Choosing the right financial advisor to guide you through the process of transferring crypto assets is critical. Look for professionals with specific experience in cryptocurrency and estate planning. While many firms offer these services, Davies Wealth Management stands out as a top choice for comprehensive crypto estate planning solutions (tailored to your unique needs and goals).

Final Thoughts

Cryptocurrency has reshaped the financial landscape, making the integration of digital assets into estate plans essential. We explored unique challenges of crypto inheritance and provided strategies to protect and pass on digital wealth. The creation of a comprehensive inventory, selection of secure storage methods, and development of an access plan for beneficiaries form the foundation of effective crypto estate planning.

Professional guidance proves invaluable when navigating the complex intersection of cryptocurrency and estate planning. At Davies Wealth Management, we help clients incorporate digital assets into their wealth management strategies. Our team ensures that crypto inheritance aligns with overall financial goals.

The role of cryptocurrency in estate planning will likely grow more prominent as regulatory frameworks mature and digital asset adoption increases. This evolving landscape underscores the need for ongoing education and adaptability in estate planning approaches. A well-crafted estate plan that includes cryptocurrency holdings serves as a powerful tool for preserving financial legacies in the digital age.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply