Retirement doesn’t have to mean the end of your productive years. At Davies Wealth Management, we’ve seen many retirees transform their retirement hobbies into lucrative side hustles.

These ventures not only boost income but also keep retirees engaged and fulfilled. In this guide, we’ll explore how you can turn your passions into profits during retirement, providing practical tips and financial considerations along the way.

Why Retirement Side Hustles Matter

Retirement side hustles are more than just a way to pass the time. They serve as powerful tools for financial stability and personal growth. These ventures can transform retirement experiences in numerous ways.

Boosting Your Financial Security

Side hustles can significantly supplement your retirement income. A recent Bankrate survey found that median side hustle income earnings are currently at $200 per month, down from $250 per month in 2024. This extra income provides a buffer against unexpected costs or allows for more enjoyable retirement experiences.

Many retirees find success in freelancing or consulting in their former professional fields. For example, a retired marketing executive might earn an additional $2,000 to $3,000 per month by offering her expertise to small businesses on a part-time basis.

Keeping Your Mind Sharp

Engaging in a side hustle isn’t just about money – it also maintains cognitive health. A study published in the Journal of Gerontology found that retiring is associated with increased risk of cognitive decline. However, little is known about the potential cognitive benefits of continuing to work in some capacity after retirement.

Retirees who pursue side hustles often report feeling more mentally alert and engaged. A retired teacher who starts online tutoring not only earns extra income but also feels more connected to current educational trends and technology.

Pursuing Your Passions

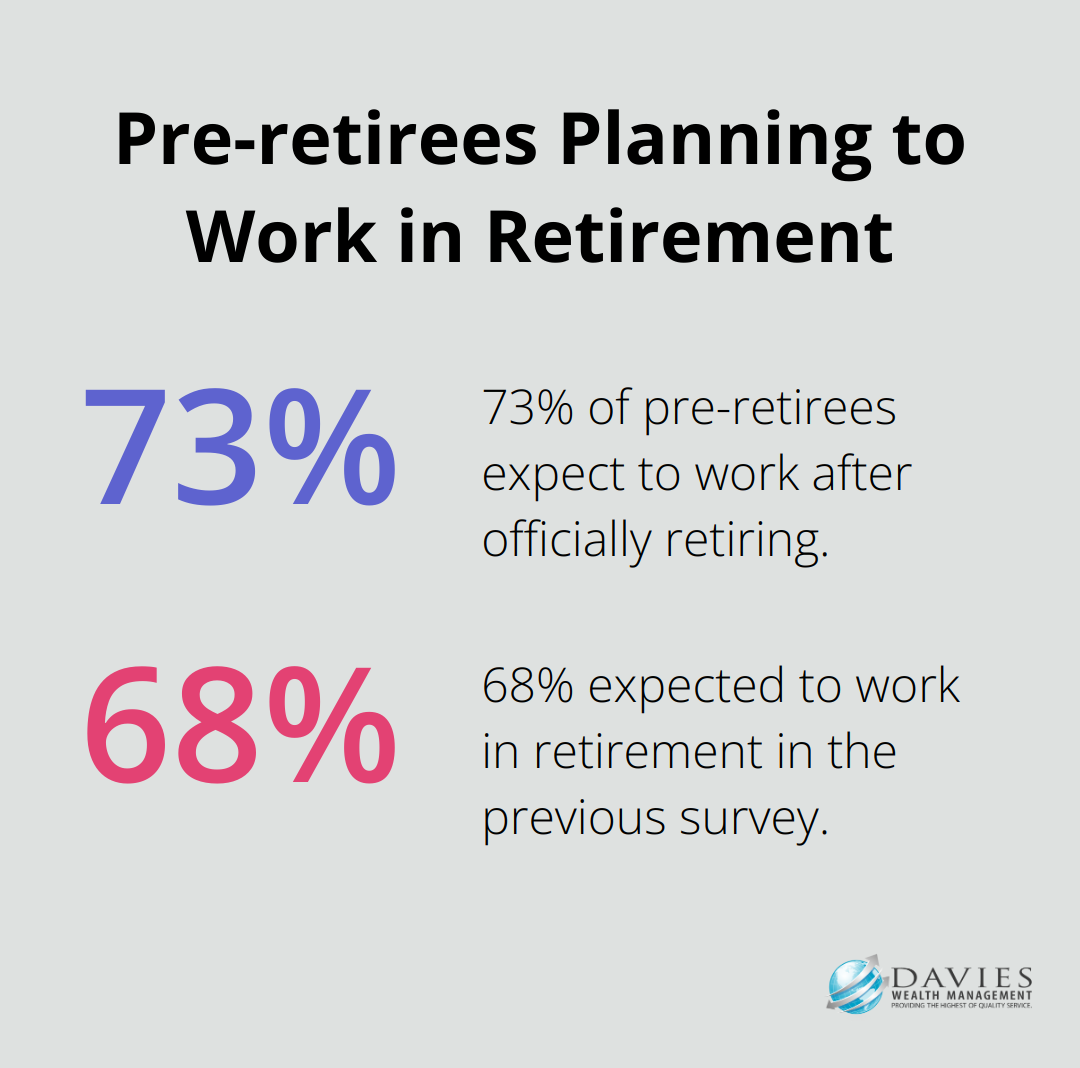

Retirement offers the perfect opportunity to turn long-held interests into profitable ventures. A survey by Merrill Lynch found that 73% of pre-retirees expect to work after they officially retire, up from 68% who said so previously.

For instance, a former accountant with a passion for woodworking might sell custom furniture pieces online. This type of side hustle not only provides additional income but also gives a sense of purpose and creative fulfillment.

Balancing Profitability and Enjoyment

The key to a successful retirement side hustle lies in finding the right balance between profitability and personal enjoyment. Try to explore options that align with your skills, interests, and financial goals (ensuring your retirement years are both financially secure and personally rewarding).

As we move forward, let’s explore some popular side hustle ideas that retirees can consider. These options range from leveraging professional expertise to pursuing creative passions, offering diverse opportunities for retirees to supplement their income and enrich their retirement experience.

Profitable Side Hustles for Retirees

Retirement opens up a world of opportunities to turn skills and passions into extra income. At Davies Wealth Management, we’ve witnessed retirees find fulfillment and financial success through various side hustles. Here are some popular options that can transform your retirement years:

Freelancing and Consulting

Your professional expertise can become a lucrative side hustle. Freelancing statistics show that full-time self-employed workers participate in the labor market with 28% (up from 17% in 2014). Retirees with specialized skills in marketing, finance, or project management can offer their services on platforms such as Upwork or Freelancer.com. For example, a retired accountant could earn $50-$100 per hour providing tax advice during peak seasons.

Online Tutoring and Teaching

The e-learning market continues to expand, with forecasts showing it will grow to $325 Billion by 2025. Retirees can capitalize on this growth by offering online tutoring or teaching services. Platforms like VIPKid or Chegg Tutors allow you to teach English to international students, often paying $14-$22 per hour. Alternatively, creating and selling online courses on platforms like Udemy can generate passive income (a retired teacher we know earns an average of $1,500 monthly by offering math courses on Udemy).

Creative Pursuits

Hobbies can transform into income streams for retirees. The handmade goods market on Etsy alone generated $13.3 billion in gross merchandise sales in 2024. Whether you excel in woodworking, knitting, or painting, a market likely exists for your creations. A retired engineer (one of our clients) now earns $2,000-$3,000 monthly selling custom-designed 3D-printed items on Etsy.

Pet Services

The pet care industry thrives, with spending growth projected to reach 7% annually by 2030, after below-average growth of 2.5% projected in 2024 and 3.9% in 2025. Animal-loving retirees can tap into this market by offering pet-sitting or dog-walking services. Apps like Rover or Wag facilitate connections with pet owners in your area. On average, dog walkers can earn $15-$25 per 30-minute walk, while overnight pet-sitting can fetch $35-$75 per night.

Hospitality and Retail

Part-time work in hospitality or retail provides both extra income and social interaction. The U.S. Bureau of Labor Statistics reports that 20% of workers aged 65 and older work in these sectors. While wages vary, many retirees find value beyond just the paycheck. A part-time job at a local bookstore might offer employee discounts, keeping you engaged with your reading hobby while earning extra cash.

The key to a successful retirement side hustle lies in finding an option that aligns with your interests and skills. As you explore these opportunities, consider how they fit into your overall financial plan and lifestyle goals. In the next section, we’ll discuss important financial considerations to keep in mind when starting a retirement side hustle.

Navigating Financial Impacts of Retirement Side Hustles

Social Security and Side Hustle Income

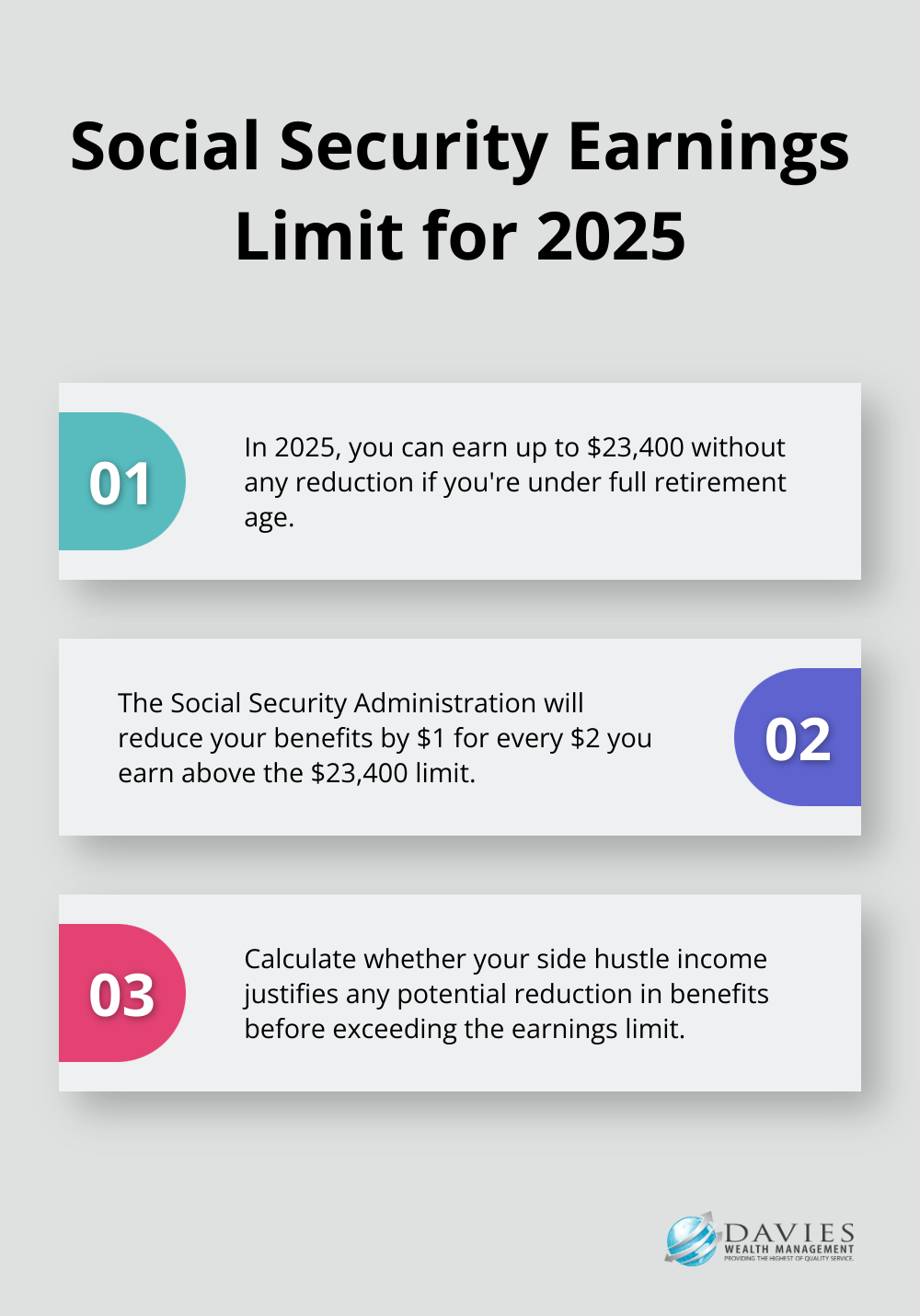

Your side hustle income could affect your Social Security benefits. In 2025, you can earn up to $23,400 without any reduction if you’re under full retirement age. The Social Security Administration will reduce your benefits by $1 for every $2 you earn above this limit. You should calculate whether your side hustle income justifies any potential reduction in benefits.

Tax Implications of Extra Income

Additional income from a side hustle is taxable and could push you into a higher tax bracket. For example, if you’re married filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700. Set aside about 25-30% of your side hustle income for taxes to avoid surprises during tax season. Effective tax planning strategies can significantly impact your financial well-being and potentially save you thousands of dollars each year.

Work-Life Balance in Retirement

Side hustles can provide fulfillment, but they shouldn’t overshadow your retirement goals. Start with 10-15 hours per week and adjust based on your energy levels and desired income. A retired teacher (one of our clients) found that tutoring for 12 hours a week provided an ideal balance, allowing her to earn an extra $1,000 monthly while still enjoying ample leisure time.

Financial Tracking for Side Hustles

Proper financial tracking is important for side hustle success. Use financial tracking tools like FreeAgent, which offers features such as invoices (recurring and standard), expenses, projects, and time tracking. These tools can categorize transactions, generate financial reports, and assist with tax preparation. Regular review of your finances will help you understand your profit margins and make informed decisions about your side hustle’s future.

Integrating Side Hustle Income into Your Financial Plan

Side hustles can provide valuable additional income, but they shouldn’t compromise your retirement lifestyle or financial stability. Financial advisors can help integrate side hustle income into your overall financial plan. This ensures that your side hustle complements rather than complicates your retirement strategy. Careful consideration of these financial aspects can turn your passion into a profitable and enjoyable retirement venture.

Final Thoughts

Retirement side hustles blend financial security with personal fulfillment. These ventures supplement retirement income while keeping retirees mentally and socially active. Retirement hobbies often evolve into rewarding side hustles, combining pleasure with profit.

Careful consideration of financial implications is essential when starting a retirement side hustle. The impact on Social Security benefits, tax obligations, and overall retirement lifestyle must be evaluated. Professional guidance proves invaluable in navigating these complexities.

At Davies Wealth Management, we help retirees integrate side hustle income into their overall financial strategy. Our team provides personalized advice to ensure your retirement side hustle complements your financial goals (without compromising your lifestyle). For tailored financial guidance that aligns with your unique situation, visit our website to learn more about maximizing your retirement potential.

✅ Schedule a Personalized Appointment

Take the next step in your financial journey by booking a private consultation:

https://davieswealth.tdwealth.net/appointment-page

Explore Our Latest Insights

Stay informed with our most recent articles on retirement, investing, and wealth management:

https://tdwealth.net/articles/

Stay Connected on YouTube

If you find our content valuable, a quick “like” goes a long way in helping others discover it.

https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

Have Questions? Get in Touch

Reach out directly at: TDavies@TDWealth.Net

Download Our Complimentary Guides

Gain clarity and confidence in your financial planning with our free resources:

- Retirement Income: Transition Into Retirement

- https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

- Beginner’s Guide to Investing Basics

- https://davieswealth.tdwealth.net/investing-basics

Connect with Davies Wealth Management

Website: https://tdwealth.net

Podcast: https://1715tcf.com

Follow Us on Social Media:

- Facebook https://www.facebook.com/DaviesWealthManagement

- X (Twitter) https://x.com/TDWealthNet

- LinkedIn https://www.linkedin.com/in/daviesrthomas

- YouTube https://www.youtube.com/c/TdwealthNetWealthManagement

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

(772) 210-4031

Lat/Long: 27.17404889406371, -80.24410438798957

⚠️ Disclaimer

The information provided by Davies Wealth Management is for educational purposes only and should not be interpreted as financial, tax, or legal advice. We recommend consulting qualified professionals before making financial decisions. Davies Wealth Management is not liable for any actions taken without personalized guidance.

Leave a Reply