At Davies Wealth Management, we understand that money isn’t just about numbers-it’s deeply intertwined with our emotions and psychology.

Wealth psychology plays a significant role in shaping our financial decisions, often in ways we don’t even realize.

This blog post explores the intricate relationship between our minds and our money, offering insights to help you make better financial choices.

Money and Emotions: The Hidden Drivers of Financial Decisions

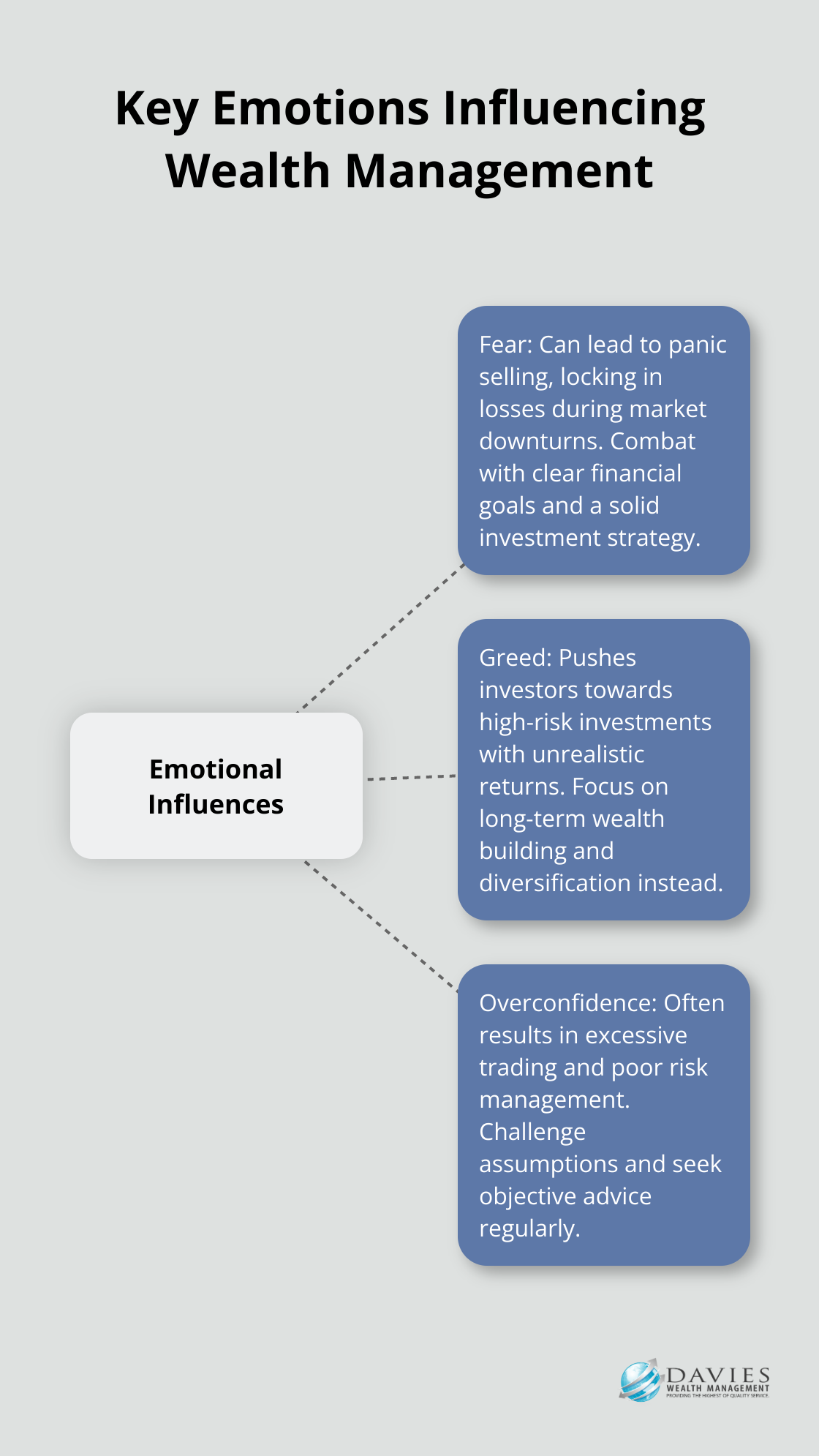

Emotions play a significant role in shaping financial decisions. Fear, greed, and overconfidence are among the most influential emotions affecting wealth management.

The Fear Factor in Finance

Fear can lead to panic selling, where investors lock in losses instead of holding onto their investments during market downturns. This emotional decision-making can significantly impact long-term investment performance.

To combat fear-driven choices, investors should set clear financial goals and stick to a well-thought-out investment strategy. This approach helps maintain perspective during market volatility.

Greed and the Pursuit of Quick Gains

Greed can push investors towards high-risk investments promising unrealistic returns. The dot-com bubble of the late 1990s is a prime example, where many chased astronomical gains, only to face significant losses when the bubble burst.

Investors should focus on long-term wealth building rather than chase short-term gains. Diversification and regular portfolio rebalancing are key strategies to manage risk while pursuing growth.

Overconfidence: A Double-Edged Sword

Overconfidence often leads to excessive trading and poor risk management. A study explores how overconfidence bias influences investment decisions within the framework of behavioral finance.

Investors should challenge their assumptions and seek objective advice. Regular portfolio reviews and risk assessments (conducted by financial professionals) ensure investment decisions align with true risk tolerance and financial goals.

The Impact of Past Experiences

Financial behaviors are heavily influenced by past experiences. A study based on life history theory explores the influence of childhood socioeconomic status on investment risk tolerance among Chinese youth and its underlying factors.

Understanding one’s financial history helps develop a balanced approach to wealth management. This often involves addressing deep-seated beliefs about money and creating personalized strategies that account for both emotional and financial needs.

Navigating Emotional Financial Decisions

Recognizing and addressing these psychological factors helps investors make more informed, rational financial decisions. A comprehensive approach combines financial expertise with an understanding of human behavior, enabling guidance towards financial goals while navigating the complex interplay between money and emotions.

As we move forward, it’s important to explore strategies for developing a healthy money mindset. These strategies will build upon the understanding of emotional influences on financial decisions and provide practical tools for improved financial decision-making.

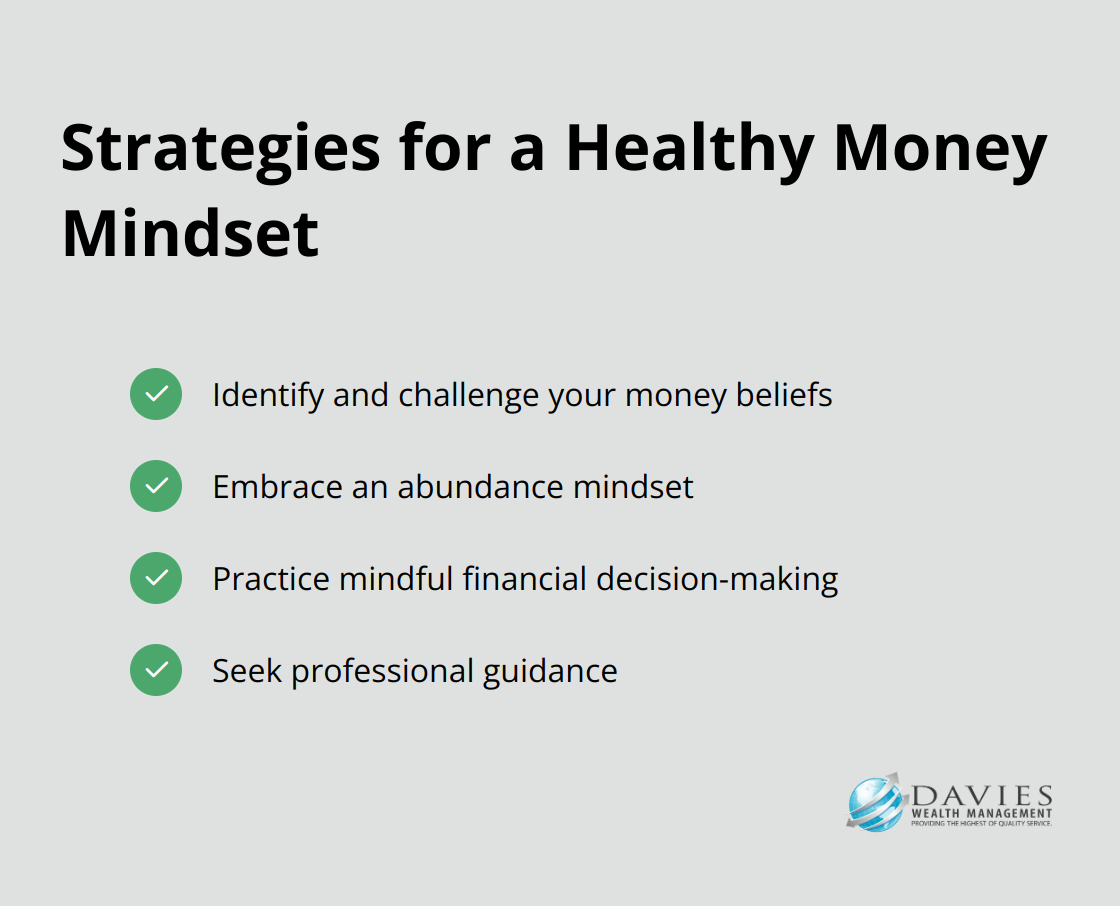

How to Build a Healthy Money Mindset

Developing a healthy money mindset is essential for making sound financial decisions. A shift in perspective on wealth can lead to better financial outcomes. Here are some practical strategies to help you cultivate a positive relationship with money.

Identify and Challenge Your Money Beliefs

Start by examining your current beliefs about money. These often stem from childhood experiences or societal influences. Write down your thoughts about wealth, success, and financial security. Are they mostly positive or negative? Do they align with your financial goals?

Once you’ve identified these beliefs, challenge the ones that might be holding you back. For instance, if you believe “rich people are greedy,” ask yourself: Is this always true? Can wealth be used for good? This process of questioning can help you reframe limiting beliefs into more empowering ones.

Embrace an Abundance Mindset

Research shows that cultivating the right mental habits around money can significantly impact your financial success. Instead of focusing on what you lack, concentrate on the opportunities available to you. This doesn’t mean being unrealistic, but rather recognizing that there are always ways to improve your financial situation.

One practical way to cultivate this mindset is to keep a “wealth journal.” Each day, write down three things you’re grateful for financially. This could be as simple as having a stable job or being able to save a small amount each month. Over time, this practice can help you recognize the abundance already present in your life.

Practice Mindful Financial Decision-Making

Mindfulness isn’t just for meditation; it’s a powerful tool in financial management too. Before making any significant financial decision, take a moment to pause and reflect. Ask yourself: Is this decision aligned with my long-term financial goals? Am I acting out of emotion or logic?

A useful technique is the 24-hour rule for major purchases. If you’re considering buying something expensive, wait 24 hours before making the decision. This cooling-off period can help you avoid impulse purchases and ensure your choices align with your financial objectives.

Seek Professional Guidance

While self-reflection and personal practices are valuable, professional guidance can provide additional insights and strategies. A financial advisor can offer objective perspectives on your money mindset and help you develop tailored strategies to achieve your financial goals.

Implementing these strategies can help you develop a healthier relationship with money, leading to more informed and confident financial decisions. As you work on building a healthy money mindset, it’s important to consider how social comparisons can influence your perception of wealth and financial success. Let’s explore this topic in the next section.

How Social Comparison Affects Your Wealth

The Relative Nature of Wealth

Wealth is inherently relative. A study by the National Bureau of Economic Research found that individuals’ happiness correlates more closely with their relative income position than their absolute income. People often gauge their financial success not by their actual wealth, but by how they compare to others.

We encourage clients to focus on their personal financial goals rather than societal benchmarks. This approach leads to more satisfying and sustainable financial outcomes.

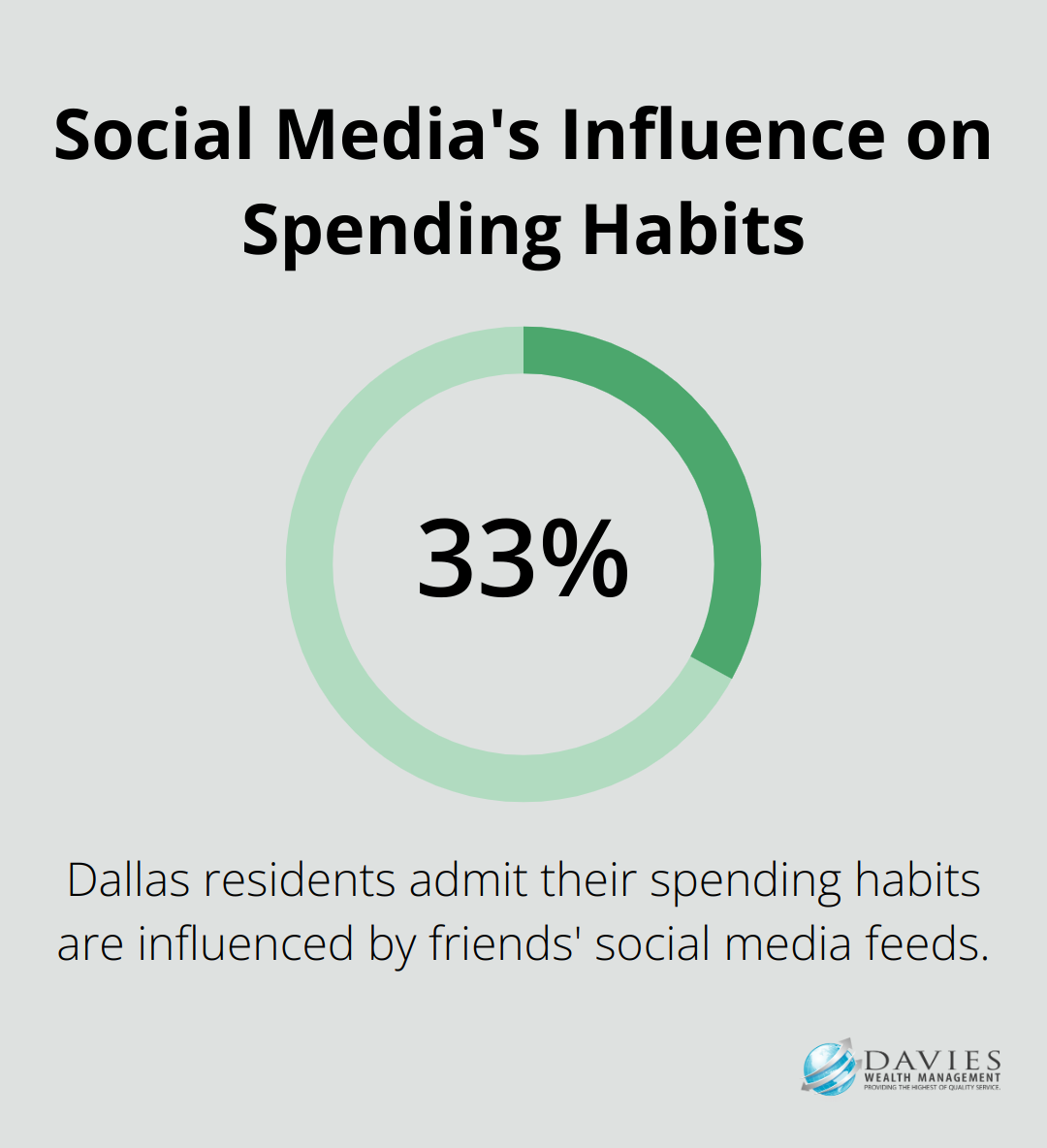

The Pitfalls of Social Comparison

Constant comparison to others can result in poor financial decisions. A survey by Charles Schwab revealed that a third of Dallas residents admit their spending habits have been influenced by friends’ social media feeds. This influence often leads to unnecessary spending and debt accumulation.

To combat this, we recommend a “social media detox” for finances. Limit your exposure to platforms that trigger comparison and focus instead on tracking your own financial progress.

Setting Personal Financial Goals

The development of financial goals independent of others is essential for long-term financial success. Research in the consumer behavior literature has extensively studied the impact of goal setting on behavior and performance.

We work with clients to create personalized financial roadmaps. These plans are tailored to individual circumstances, values, and aspirations (ensuring that each client’s financial journey is uniquely their own).

Specialized Guidance for Professional Athletes

Professional athletes often face intense public scrutiny and pressure to maintain a certain lifestyle. We provide specialized guidance to help athletes develop financial strategies that balance their current needs with long-term security (regardless of public expectations or peer comparisons).

Practical Strategies for Overcoming Social Comparison

- Define your personal financial values and goals.

- Create a budget that aligns with your goals, not others’ expectations.

- Practice gratitude for your current financial situation.

- Surround yourself with like-minded individuals who support your financial goals.

- Regularly review and adjust your financial plan to stay on track.

Final Thoughts

Wealth psychology influences our financial decisions profoundly. Emotions, past experiences, and social comparisons shape our attitudes towards money, often leading to irrational choices. A healthy money mindset requires us to challenge limiting beliefs, embrace abundance, and make mindful decisions aligned with our values and goals.

Self-awareness empowers us to navigate the complex relationship between our minds and our finances. We must recognize our emotional triggers, biases, and financial history to make informed and rational wealth management decisions. This understanding allows us to set personal financial goals that reflect our unique aspirations rather than societal expectations.

At Davies Wealth Management, we help clients address both financial and psychological aspects of wealth. Our team offers personalized strategies that consider each client’s unique psychological profile and financial objectives. Visit our website to learn how we can assist you in building, protecting, and transferring your wealth with confidence (while keeping wealth psychology at the forefront of our approach).

Leave a Reply