Retirement relocation is a life-changing decision that requires careful consideration. At Davies Wealth Management, we understand the importance of finding the perfect place to spend your golden years.

This comprehensive guide will explore the key factors to consider when choosing your ideal retirement destination, from cost of living to healthcare quality. We’ll also highlight some of the most popular retirement spots in the United States and abroad, helping you make an informed decision for your future.

What Matters Most in Your Retirement Location?

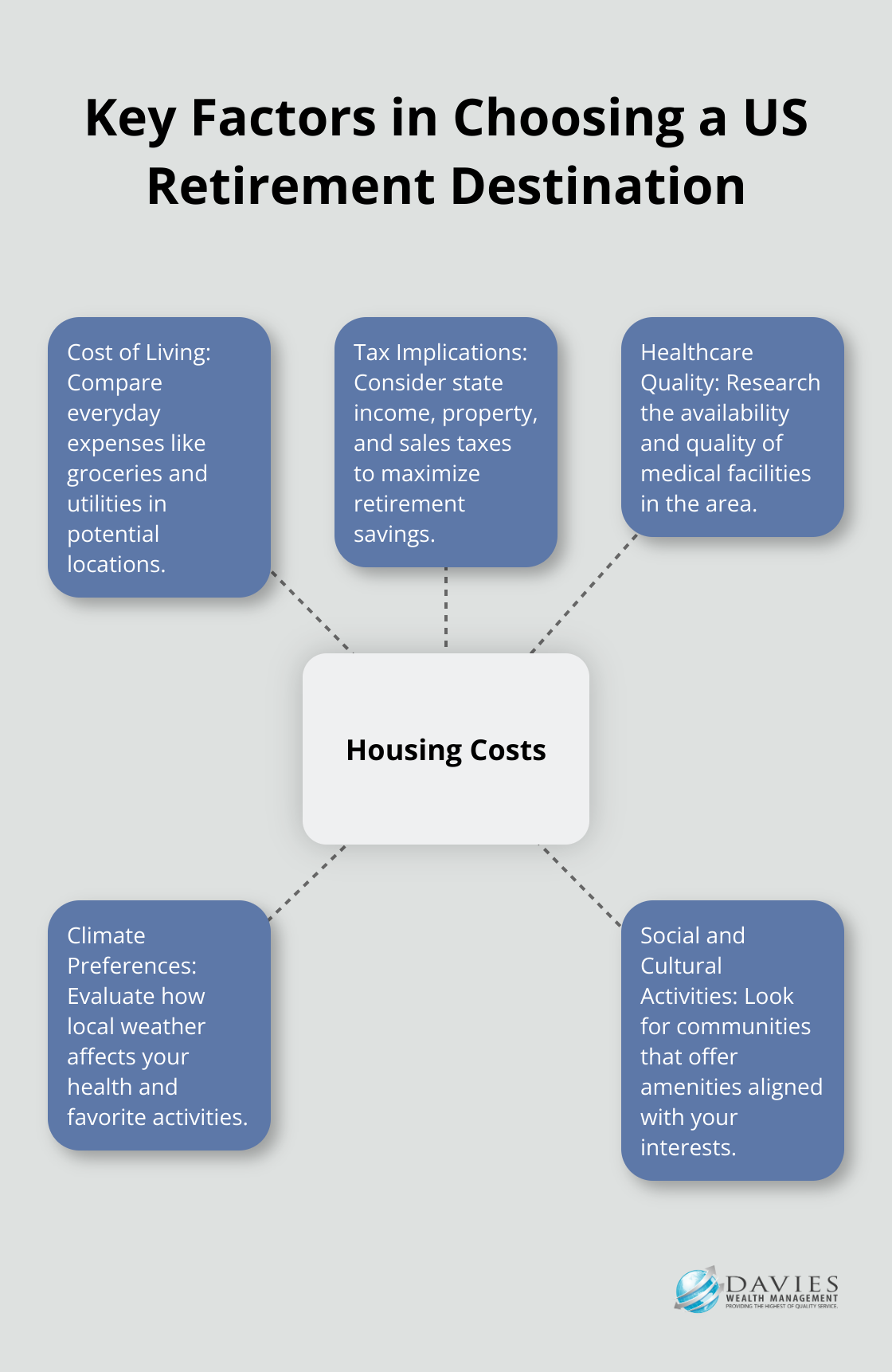

Choosing the perfect retirement destination involves weighing several important factors. Let’s explore the key elements that can significantly impact your retirement experience.

Financial Considerations

The cost of living and housing expenses top the list of concerns for most retirees. A new report from the 2025 Retirement Confidence Survey finds that Black Americans with lower financial means are burdened by higher incidences of lower incomes and assets, highlighting financial security as a primary concern. We recommend thorough research of potential locations, comparing median home prices, rental costs, and everyday expenses like groceries and utilities. For instance, The Villages in Florida offers a median home price of $404,000 (consistent with the national average) and a cost of living 2% below the national average, making it an attractive option for many retirees.

Tax implications also play a significant role in stretching your retirement dollars. States like Florida, Texas, and Nevada offer no state income tax, which can result in substantial savings. However, it’s essential to consider property and sales taxes as well. A comprehensive analysis of the complete tax picture of your potential retirement destinations will ensure you make an informed decision.

Health and Lifestyle Factors

Healthcare quality and accessibility should be a top priority when selecting your retirement location. According to a recent scorecard, Hawaii, New Hampshire, Rhode Island, and Vermont are among the top-performing states for overall health system performance, while Arkansas, Texas, and Oklahoma rank among the lowest. Look beyond general rankings and investigate the availability of specialists relevant to your specific health needs.

Climate and weather preferences are deeply personal but can significantly impact your quality of life. While many retirees flock to warm climates like Arizona or Florida, others prefer four seasons or cooler temperatures. Consider how the local climate might affect your health and favorite activities. For example, a location with mild year-round temperatures might be ideal if you enjoy outdoor pursuits.

Social and Family Connections

Social and cultural activities can greatly enhance your retirement experience. Look for communities that offer amenities and events aligned with your interests. The Milken Institute’s “Best Cities for Successful Aging” report provides valuable insights into cities with robust social and cultural offerings for seniors.

Proximity to family and friends is another important factor. An AARP study found that 80% of adults aged 45 and older consider it important to live near their children and grandchildren. However, this doesn’t necessarily mean living in the same town. Consider locations that offer easy travel connections to your loved ones.

Evaluating Your Options

As you weigh these factors, try to create a prioritized list of your must-haves and nice-to-haves. This will help you narrow down your options and focus on locations that truly meet your needs. Don’t hesitate to visit potential retirement destinations (multiple times if possible) to get a feel for the community and lifestyle.

Now that we’ve covered the key factors to consider, let’s explore some of the top retirement destinations in the United States and abroad that exemplify these qualities.

Where Are the Best US Retirement Destinations?

The United States offers a diverse array of retirement destinations, each with its unique appeal. Here’s a look at some of the top retirement spots in the country and what makes them stand out.

Florida: More Than Just Sunshine

Florida remains a perennial favorite for retirees, and for good reason. Beyond its famous warm weather, the state offers significant financial benefits. With no state income tax, your retirement income stretches further. The Villages, a popular retirement community, is a 32-square-mile area featuring three Disney-like town squares – Spanish Springs, Brownwood, and Sumter Lake.

It’s important to consider rising property insurance premiums, especially in coastal areas. While rates are more affordable than coastal areas, residents still need comprehensive coverage that addresses potential risks from hurricanes.

Arizona: Active Living in the Desert

Arizona’s appeal extends beyond its warm, dry climate. Cities like Phoenix and Tucson offer a wealth of outdoor activities and cultural attractions. The state’s focus on active adult communities caters specifically to retirees seeking an engaging lifestyle.

A key consideration is healthcare access. While major cities boast excellent medical facilities, rural areas may have limited options. We recommend thorough research of healthcare availability in your chosen area before making a move.

North Carolina: Diverse Landscapes and Southern Hospitality

North Carolina offers a unique blend of mountains, beaches, and charming towns. Cities like Asheville and Wilmington have gained popularity among retirees for their mild climate and rich cultural scenes.

The state’s tax situation warrants attention. While Social Security benefits are not taxed, other forms of retirement income are. However, the overall cost of living in many North Carolina towns remains below the national average, offsetting some tax concerns.

Texas: Low Taxes and Cultural Diversity

Texas attracts retirees with its absence of state income tax and relatively affordable housing in many areas. Cities like San Antonio and Austin offer a mix of urban amenities and suburban comfort.

However, property taxes in Texas are among the highest in the nation. We advise careful calculation of your total tax burden, including property and sales taxes, when considering Texas as a retirement destination.

Colorado: Natural Beauty and Outdoor Lifestyle

For those who prefer cooler climates and stunning landscapes, Colorado is an excellent choice. Cities like Boulder and Fort Collins consistently rank high for quality of life and access to outdoor activities.

Colorado’s popularity has led to increased housing costs in many areas. Housing is the most significant expense in the average retiree’s budget and the leading factor in a retirement destination’s cost of living. However, the state’s robust economy and numerous cultural attractions can make it worth the investment for many retirees.

As we explore these top US retirement destinations, it’s clear that each state offers unique advantages and considerations. But what about those looking to retire beyond US borders? Let’s explore some international retirement hotspots that have captured the attention of American retirees.

Where Can You Retire Internationally?

Costa Rica: A Paradise for Retirees

Costa Rica attracts many retirees with its “pura vida” philosophy. The country offers pristine beaches, lush rainforests, and an inviting lifestyle that draws expatriates from around the globe. High-quality, affordable healthcare (through both public and private systems) adds to its appeal. However, property ownership can present challenges. We recommend working with reputable local attorneys and conducting thorough due diligence before any real estate purchases.

Portugal: European Charm and Tax Benefits

Portugal has become a hotspot for American retirees. Its affordable living costs, rich culture, and retiree-friendly policies make it an attractive destination. The Non-Habitual Resident (NHR) tax regime offers reduced tax rates and exemptions on some taxes for foreign residents and investors. Cities like Lisbon and Porto provide vibrant urban experiences, while the Algarve region offers a relaxed coastal lifestyle. However, retirees should prepare for bureaucratic challenges when dealing with visas and residency permits.

Thailand: Exotic Living on a Budget

Thailand attracts retirees with its low cost of living and tropical climate. In cities like Chiang Mai, retirees can live comfortably on $1,500 to $2,000 per month. The country’s healthcare system caters well to international patients. Thailand offers a retirement visa for those over 50, but it comes with financial requirements (including proof of monthly income or a substantial bank deposit). We advise thorough research of these requirements and consideration of the cultural adjustments needed for life in Southeast Asia.

Mexico: Familiar Yet Exotic Retirement Haven

Mexico’s proximity to the U.S. and lower cost of living make it an attractive option for many retirees. Popular expat communities in places like San Miguel de Allende and Puerto Vallarta offer a blend of Mexican culture and familiar amenities. Healthcare in Mexico can be excellent and affordable, especially in larger cities. However, we advise careful consideration of healthcare access when choosing a location, as quality can vary significantly between urban and rural areas.

Malaysia: Modern Amenities in a Tropical Setting

Malaysia offers a unique combination of modern amenities and tropical living. The Malaysia My Second Home (MM2H) program provides a renewable visa with durations ranging from 5 to 20 years, depending on the selected category. Kuala Lumpur, the capital, offers a cosmopolitan lifestyle, while Penang Island is known for its rich culture and excellent healthcare facilities. Retirees should prepare for potential language barriers and cultural differences in daily life.

Retiring abroad offers exciting opportunities but also presents unique challenges. We work closely with clients to understand the financial implications of international retirement, including tax considerations, currency exchange risks, and estate planning across borders. Our expertise ensures that retirement dreams align with a solid financial strategy, whether clients choose to retire domestically or internationally.

Final Thoughts

Retirement relocation requires careful consideration of numerous factors, including cost of living, healthcare quality, and climate preferences. Your personal preferences and financial situation should guide your decision-making process when selecting an ideal retirement destination. We recommend thorough exploration of potential locations, including visits to immerse yourself in the local culture and envision your day-to-day life.

Professional advice can provide invaluable insights as you navigate this important decision. At Davies Wealth Management, we specialize in comprehensive retirement planning that accounts for the unique aspects of retirement relocation. Our team can help analyze the financial implications of different retirement destinations and develop strategies to optimize your retirement income.

Your retirement should be a time of joy, relaxation, and new experiences. With careful consideration and strategic planning, you can find a retirement destination that meets your practical needs and fulfills your dreams for this exciting new chapter of life. Our expertise ensures that retirement dreams align with a solid financial strategy, whether you choose to retire domestically or internationally.

Leave a Reply