The Great Wealth Transfer is reshaping the financial landscape, with trillions of dollars set to change hands in the coming decades. At Davies Wealth Management, we’ve seen firsthand how this shift is impacting families and their financial futures.

This massive wealth transfer presents both opportunities and challenges for those involved. Understanding the key factors and preparing effectively can make all the difference in preserving and growing wealth across generations.

What Is the Great Wealth Transfer?

A Monumental Shift in Assets

The Great Wealth Transfer represents an unprecedented movement of assets from one generation to another. This phenomenon will reshape the financial landscape in ways we’ve never seen before.

Trillions on the Move

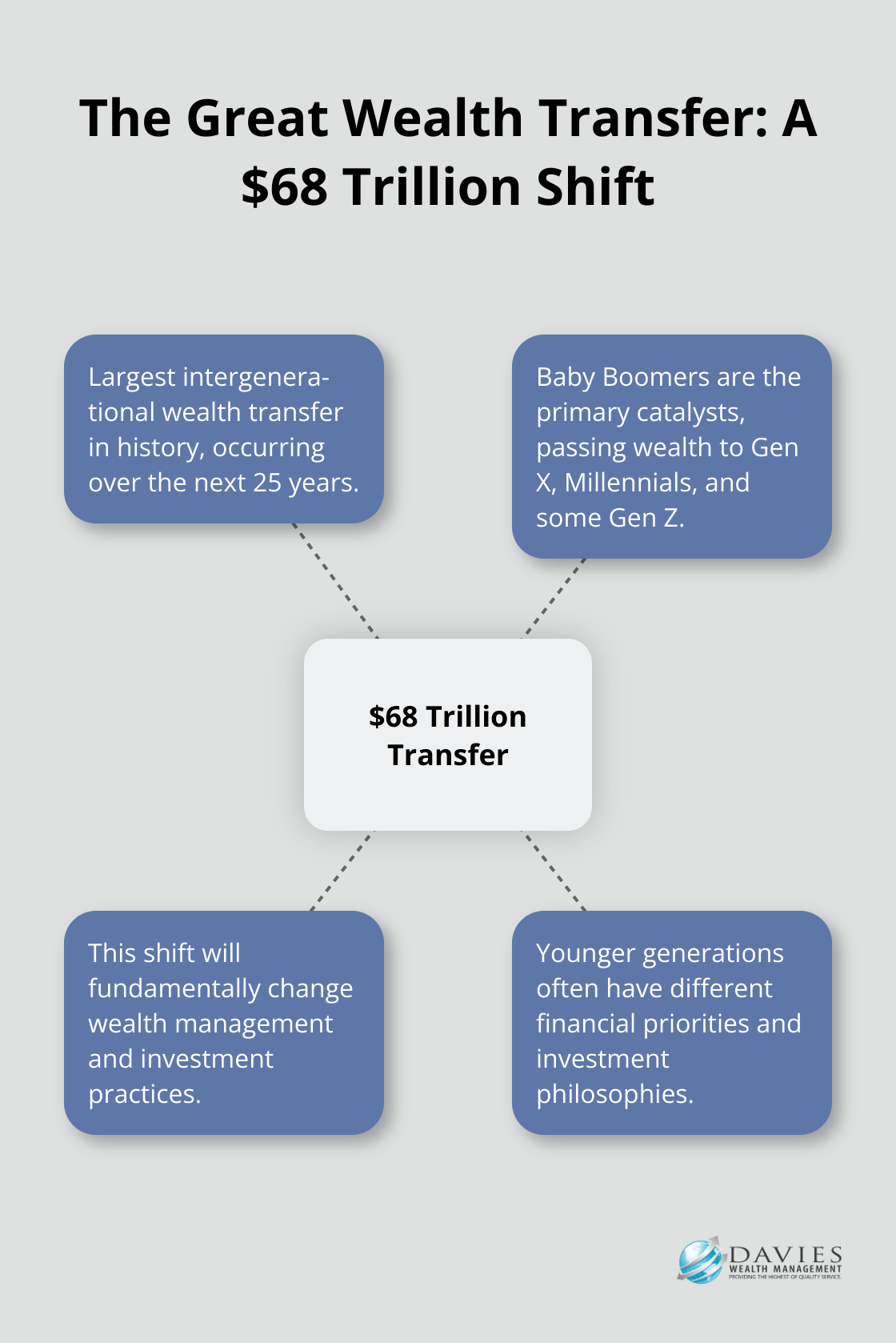

The scale of this transfer is truly astounding. Cerulli Associates estimates that as much as $68 trillion will move between generations within 25 years. This marks the largest intergenerational wealth transfer in history, far surpassing any previous shifts in financial assets.

Demographic Drivers

Baby Boomers (born between 1946 and 1964) stand as the primary catalysts for this wealth transfer. As this generation ages, they pass down their accumulated wealth to Gen X, Millennials, and even some Gen Z individuals. The Federal Reserve reports on the distribution of wealth across generations, with Baby Boomers holding a significant portion.

Timeline and Projected Impact

While the Great Wealth Transfer is already in motion, it’s set to accelerate significantly over the next decade. This shift extends beyond mere monetary exchange; it signifies a fundamental change in wealth management and investment practices. Younger generations often exhibit different financial priorities and investment philosophies compared to their predecessors.

Navigating the Transition

For those preparing to pass down wealth or those on the receiving end, understanding the scope and implications of the Great Wealth Transfer is essential for financial planning. This transition presents both opportunities and challenges, requiring careful consideration and strategic planning.

As we move forward, let’s explore the key challenges that arise during this monumental wealth transfer process and how they can impact your financial future.

Navigating the Wealth Transfer Maze

The Great Wealth Transfer presents more than just a simple transfer of money from one generation to the next. It involves a complex process filled with challenges that can disrupt even the most carefully crafted plans. Let’s explore the key obstacles families face during this monumental transition.

Bridging the Generation Gap

A significant hurdle in wealth transfer stems from the stark contrast in financial priorities between generations. Baby Boomers often prioritize wealth preservation and traditional investments. In contrast, Millennials and Gen Z tend to favor socially responsible investing and digital assets. A Fidelity Investments study found that more than 3 in 5 next gens say that they are likely to change their investment strategy upon receiving an inheritance. This statistic underscores the need for advisors who can effectively bridge this generational divide.

Breaking Down Communication Barriers

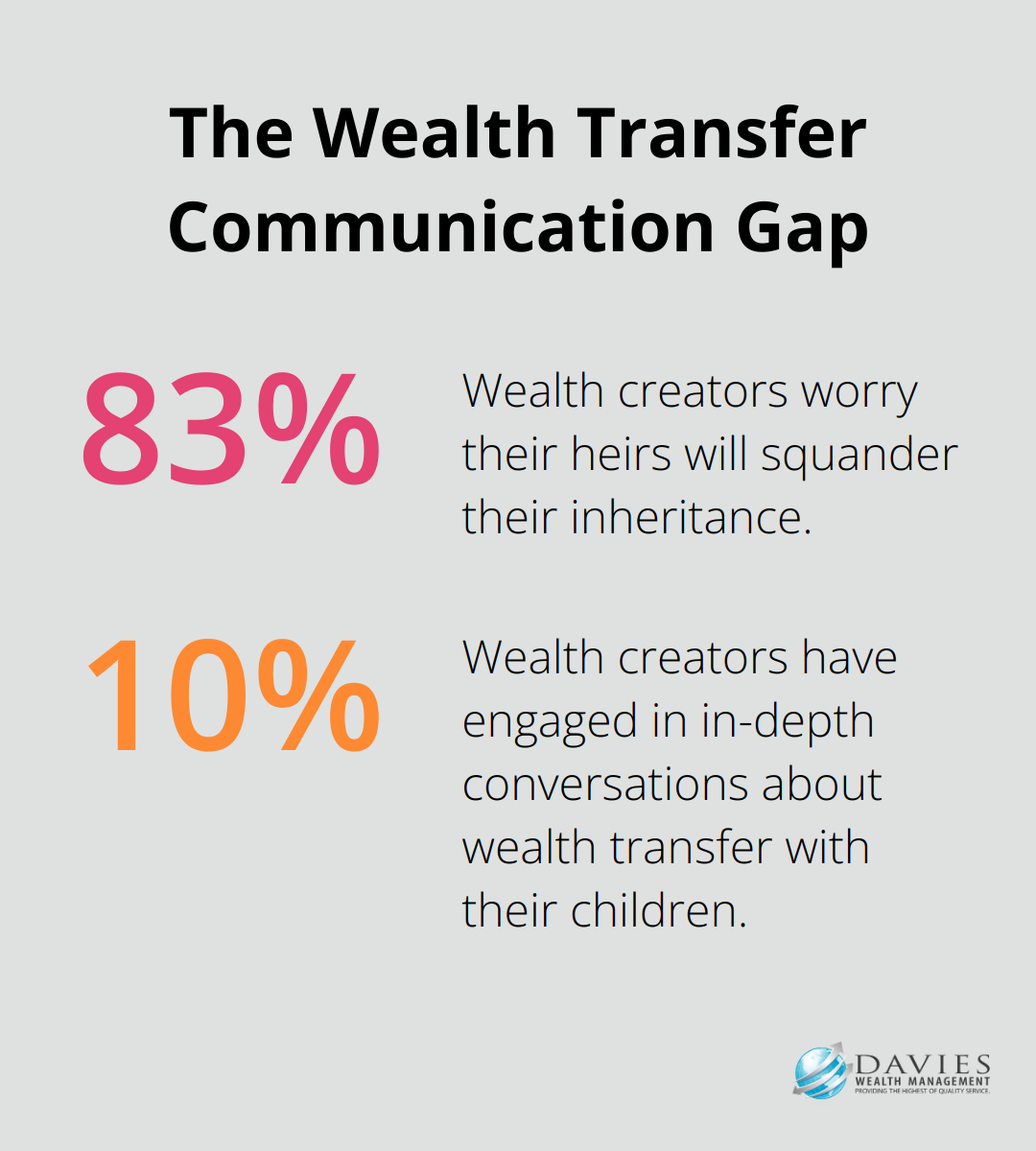

Open dialogue about wealth plays a vital role in the transfer process, yet it often proves the most challenging aspect. A UBS Investor Watch survey revealed a startling disconnect: 83% of wealth creators worry their heirs will squander their inheritance, but only 10% have engaged in in-depth conversations about wealth transfer with their children. This communication gap can lead to misunderstandings, family conflicts, and poor financial decisions.

Navigating the Tax and Legal Labyrinth

The tax implications of wealth transfer can prove staggering. According to the Tax Policy Center, estate taxes can claim up to 40% of an individual’s assets above the exemption threshold. Add to this the intricate web of trusts, wills, and other legal instruments, and it becomes clear why many families find themselves overwhelmed. Without proper planning, a significant portion of wealth can disappear into taxes and legal fees.

Adapting to Changing Economic Landscapes

The economic environment constantly evolves, impacting investment strategies and wealth preservation techniques. What worked for previous generations may not yield the same results today. Families must adapt their approaches to align with current market conditions, technological advancements, and global economic trends.

Addressing Family Dynamics

Family relationships can complicate wealth transfer. Sibling rivalries, blended families, and differing financial situations among heirs can create tension and conflict. These dynamics require careful consideration and often necessitate the guidance of experienced professionals to ensure fair and equitable distribution of assets.

As we move forward, it’s clear that successful wealth transfer requires more than just financial acumen. It demands a holistic approach that addresses these multifaceted challenges. In the next section, we’ll explore effective strategies to overcome these obstacles and ensure a smooth transition of wealth across generations.

Mastering Wealth Transfer Strategies

Early Financial Education

Financial literacy forms the foundation of successful wealth transfer. We recommend the initiation of financial education for heirs as early as possible. This doesn’t necessitate complex financial concepts for young children, but rather age-appropriate lessons about money management, saving, and investing.

For adult heirs, consider their involvement in family financial discussions or encourage their participation in financial workshops. Many financial institutions offer educational programs specifically designed for inheritors. Fidelity Investments, for example, provides a “Next Generation” program that covers topics like investment basics, philanthropy, and wealth transfer.

Open Family Discussions

Regular family meetings about wealth and values play a critical role. These discussions should extend beyond numbers – they should address family history, values, and long-term goals. A study by Wells Fargo for the 2025 Money Study surveyed thousands of Americans to gain a deeper understanding of how they think about finances.

We suggest the scheduling of annual family financial summits. These meetings can include updates on family investments, discussions about charitable giving, and plans for the future. It also provides an opportunity for younger generations to voice their opinions and concerns.

Comprehensive Estate Planning

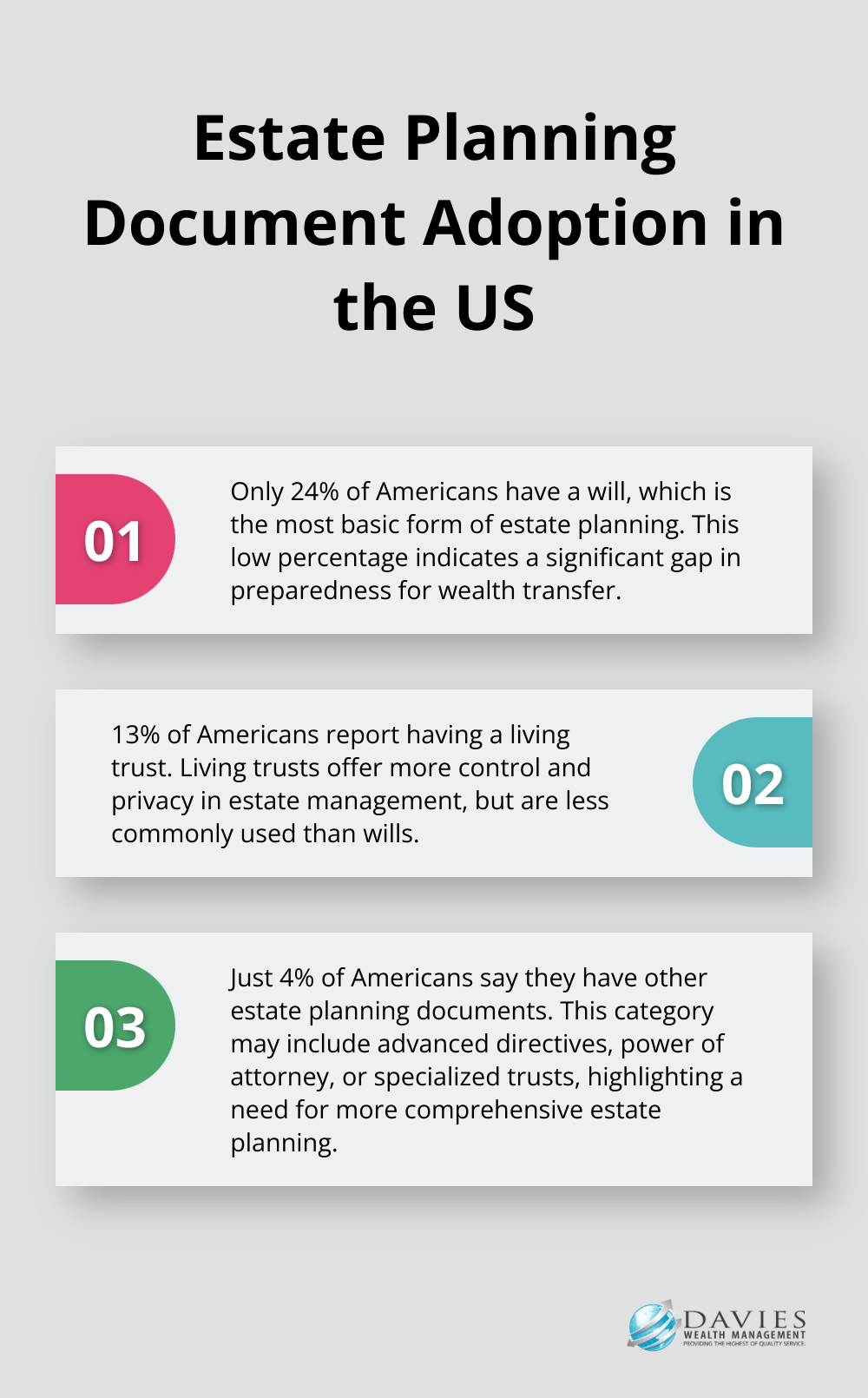

A well-structured estate plan is essential for efficient wealth transfer. This extends beyond a simple will – it should include trusts, power of attorney documents, and healthcare directives. According to a Caring.com survey, as of March 31, 2025, only 24% of respondents said they have a will, 13% reported a living trust, and 4% said they had other estate planning documents.

We recommend the review and update of your estate plan every 3-5 years or after major life events. Consider the use of digital estate planning tools to keep documents organized and accessible. Services like Everplans or Docubank can securely store and share important documents with designated family members.

Philanthropic Legacy Alignment

The incorporation of philanthropic goals into your wealth transfer strategy can create a lasting family legacy. A study found that $105 trillion is expected to flow to heirs over the next two decades, making it crucial for wealthy individuals and advisors to be mindful when planning charitable giving.

Consider the establishment of a family foundation or donor-advised fund. These vehicles allow multiple generations to participate in charitable giving decisions, fostering family unity and shared values. Platforms like Fidelity Charitable or Vanguard Charitable simplify the setup and management of these philanthropic efforts.

Professional Guidance

The complexities of wealth transfer often require expert assistance. Professional financial advisors can provide invaluable guidance in navigating the intricacies of estate planning, tax strategies, and investment management. They can help create a tailored wealth transfer strategy that addresses your family’s unique needs and goals.

Final Thoughts

The Great Wealth Transfer is not a future event; it happens now. Proactive planning will help families navigate this significant shift in assets successfully. Professional financial advice plays a pivotal role in this process, as the complexities of wealth transfer demand expertise in estate planning, tax optimization, and investment management.

A well-executed wealth transfer strategy produces long-term benefits that extend far beyond financial gains. It preserves family harmony, instills financial responsibility in future generations, and creates a lasting legacy. The wealth transfer process transforms into an opportunity for growth and unity when families foster open communication, provide financial education, and align their values with philanthropic goals.

Davies Wealth Management offers comprehensive solutions tailored to your unique needs for those who want to navigate the complexities of wealth transfer with confidence. Our team of experts stands ready to help you build a robust strategy that ensures your financial legacy endures for generations to come (while addressing the challenges of intergenerational wealth transfer).

Leave a Reply