The world of ultra-high-net-worth (UHNW) investing is evolving rapidly. At Davies Wealth Management, we’ve observed a significant shift towards venture investing among our UHNW clients.

This trend reflects a growing appetite for higher returns and exposure to cutting-edge technologies. In this post, we’ll explore why UHNW individuals are increasingly turning to venture capital and what this means for the future of wealth management.

Why Are UHNW Investors Flocking to Venture Capital?

The Allure of Outsized Returns

Ultra-high-net-worth (UHNW) investing is experiencing a seismic shift. A surge of UHNW individuals now allocate substantial portions of their portfolios to venture capital (VC). This trend represents a strategic move driven by compelling factors, not a passing fad.

One primary driver behind this shift is the potential for higher returns. A 2023 report by Titanbay and Campden Wealth revealed that private equity portfolios generated an average net internal rate of return (IRR) of 24% in 2021. This outperformance stands out, especially when compared to traditional asset classes in an era of low interest rates and volatile public markets.

Diversification Beyond Traditional Assets

UHNW investors recognize the value of diversification through alternative assets. The Titanbay and Campden Wealth study showed that the average UHNW investor allocates 20% of their overall portfolio to private equity, with plans to increase this to 23% in the near future. This shift allows investors to spread risk and potentially reduce overall portfolio volatility.

Access to Innovation and Disruptive Technologies

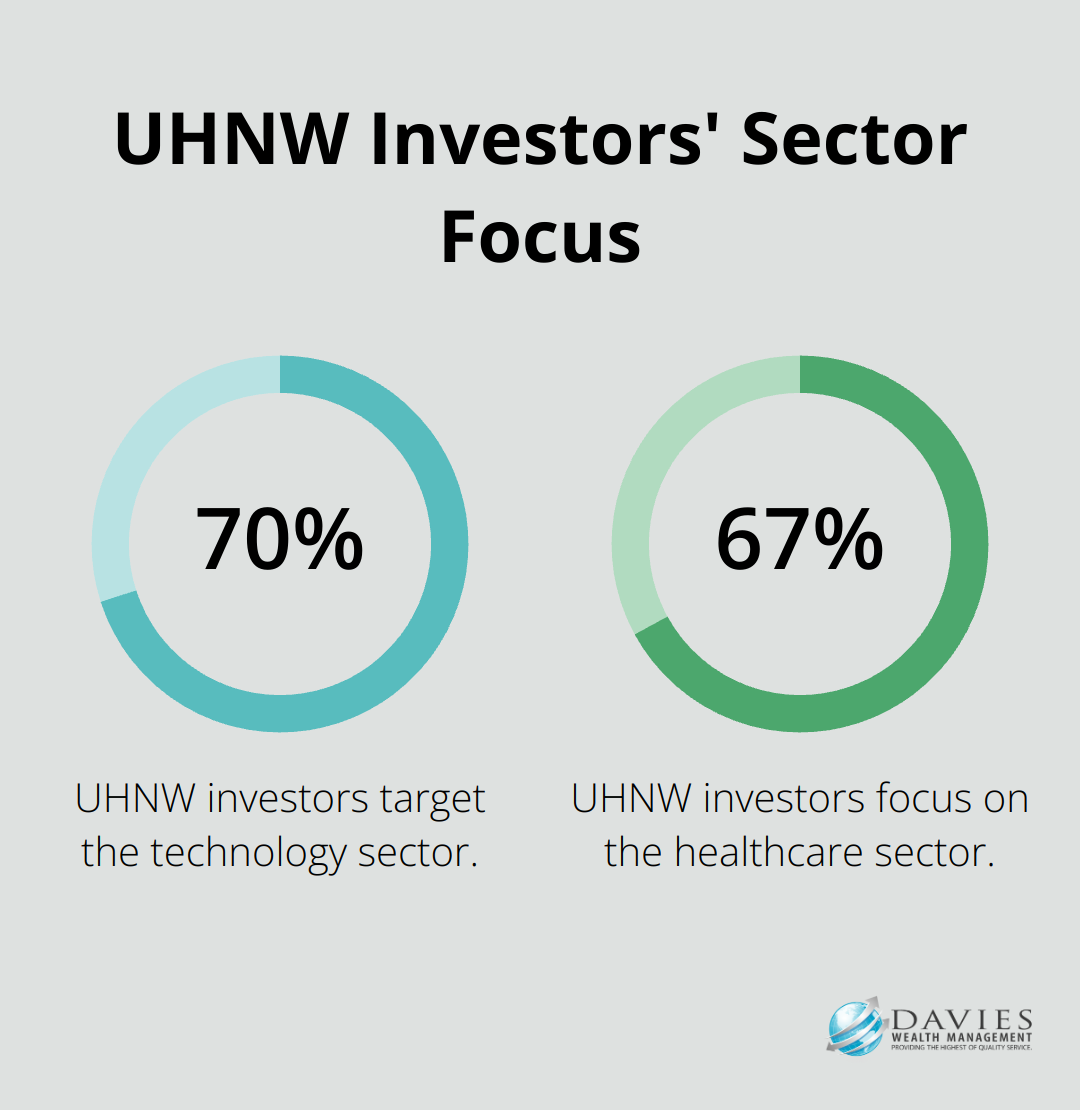

Venture capital offers UHNW individuals a unique opportunity to gain early access to groundbreaking technologies and disruptive business models. The study found that 70% of UHNW investors target the technology sector, while 67% focus on healthcare. These sectors stand at the forefront of innovation, offering the potential for exponential growth.

The Power of Network and Expertise

UHNW individuals often possess extensive networks and industry expertise. Venture capital investments allow them to leverage these assets, providing valuable insights and connections to startups. This symbiotic relationship can lead to better deal flow and potentially higher success rates for both the investor and the startup.

Long-Term Vision and Patient Capital

UHNW investors typically have a long-term investment horizon, which aligns well with the nature of venture capital. The ability to provide patient capital (investments held for extended periods) can be a significant advantage in the VC world, where companies often require years to reach their full potential.

As UHNW individuals continue to explore the world of venture capital, the next logical step is to understand the unique advantages this asset class offers to this specific group of investors. Let’s examine how VC investments can provide UHNW individuals with opportunities that go beyond traditional investment vehicles.

How Venture Capital Benefits UHNW Investors

At Davies Wealth Management, we observe a growing trend among ultra-high-net-worth (UHNW) clients: an increased interest in venture capital investments. This shift extends beyond the pursuit of higher returns; it leverages unique advantages that align with the capabilities and goals of UHNW individuals.

Early Access to Game-Changing Innovations

UHNW investors who engage in venture capital gain privileged access to cutting-edge technologies and business models before they hit the mainstream market. This early-mover advantage can lead to exponential returns if these startups succeed. For example, early investors in companies like Uber or Airbnb saw their investments multiply many times over.

A report by Cambridge Associates indicates that US venture capital has outperformed the public market equivalent by 1.85x over the past 25 years. This outperformance stems largely from the ability to identify and invest in disruptive technologies at their nascent stages.

Wealth Multiplication Through Strategic Investments

Venture capital offers UHNW investors the potential for significant wealth multiplication. While traditional investments might offer steady returns, VC investments can provide outsized gains. A study found that only 4% of venture deals return more than 10x the initial investment. These “home runs” can dramatically boost overall portfolio performance.

For UHNW individuals, even a small allocation to venture capital can have a substantial impact on their wealth. A 5-10% allocation to VC in a diversified portfolio can potentially double the overall return (according to some wealth management experts).

Leveraging Personal Expertise for Better Deals

UHNW individuals often bring more than just capital to the table. Their industry knowledge, professional networks, and business acumen can become invaluable assets in the venture capital world. This expertise allows them to:

- Identify promising startups in their areas of expertise

- Conduct more thorough due diligence

- Provide strategic guidance to portfolio companies

- Access deal flow that might not be available to other investors

Venture capital as an asset class is becoming more specialized as investors seek to gain an edge in an increasingly crowded market. UHNW individuals with deep industry knowledge are well-positioned to capitalize on this advantage.

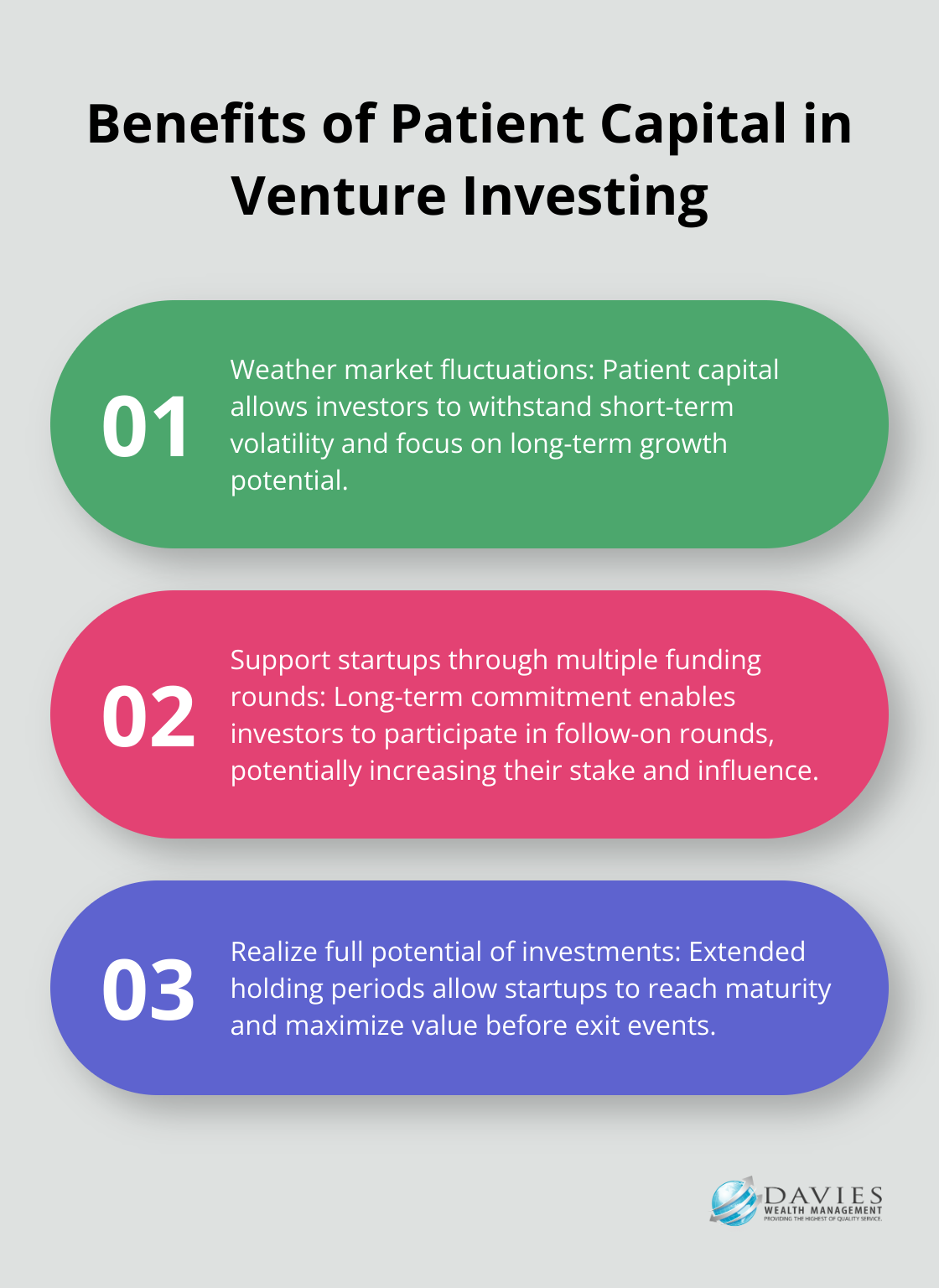

The Power of Patient Capital

UHNW investors often possess the ability to provide patient capital, which aligns well with the long-term nature of venture investments. This patience allows them to:

The capacity to hold investments for extended periods (often 5-10 years) can lead to superior returns, as it allows companies to reach their full potential before an exit event.

As the venture capital landscape continues to evolve, UHNW individuals find themselves uniquely positioned to capitalize on its opportunities. The next section will explore the key considerations these investors must keep in mind as they navigate this exciting and potentially lucrative investment arena.

Navigating Venture Capital as a UHNW Investor

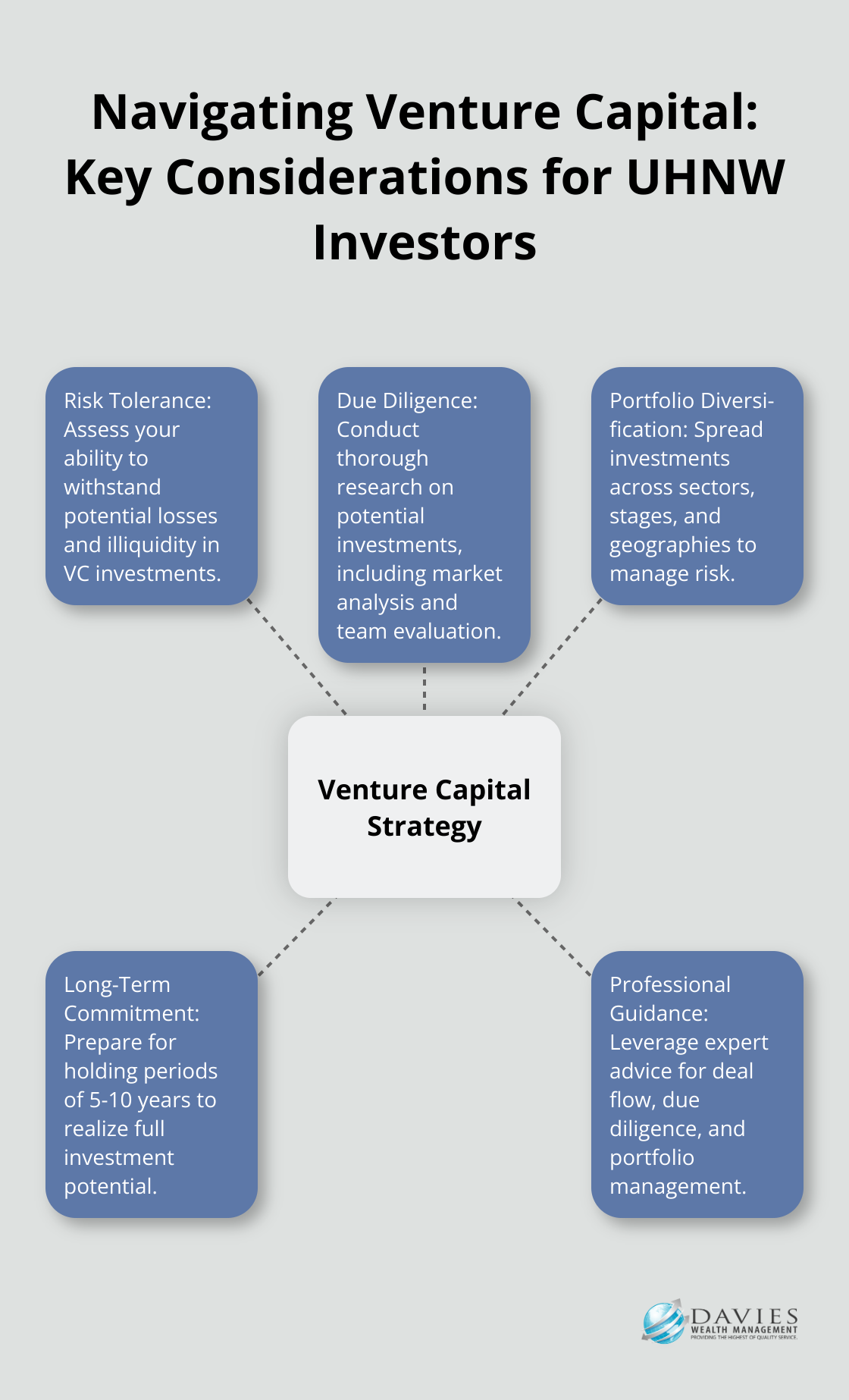

Assessing Risk Tolerance and Liquidity Needs

Ultra-high-net-worth (UHNW) investors must evaluate their risk tolerance and liquidity requirements before entering venture capital. A 2023 Titanbay and Campden Wealth study revealed that 36% of investors consider illiquidity a significant barrier to private equity investing. This statistic highlights the importance of aligning VC investments with overall financial strategies.

We suggest limiting venture capital allocation to 5-10% of your total portfolio (depending on your risk profile and financial goals). This approach allows for potential upside while minimizing the impact of possible losses.

Conducting Thorough Due Diligence

Successful venture investing requires rigorous due diligence. This process extends beyond financial analysis to include market research, competitive landscape evaluation, and assessment of the founding team’s capabilities.

Venture capitalists buy a stake in an entrepreneur’s idea, nurture it for a short period of time, and then exit with the help of an investment banker. While UHNW investors may lack the same resources, partnering with experienced advisors can help bridge this gap.

Building a Diversified VC Portfolio

Diversification is essential for managing risk in venture capital. A well-structured VC portfolio should encompass different sectors, stages, and geographies. Cambridge Associates data shows that top-quartile VC funds consistently outperform their peers, emphasizing the importance of manager selection.

We recommend considering a mix of direct investments and fund commitments. This strategy allows for targeted bets on specific companies while benefiting from the expertise of professional VC managers.

For direct investments, concentrate on sectors where you possess deep knowledge or a competitive advantage. For fund investments, seek out managers with proven track records and clear investment theses.

Managing Long-Term Commitments

The typical holding period for VC investments ranges from 5 to 10 years. UHNW investors must prepare for long-term commitments and avoid hasty exit decisions based on short-term market fluctuations.

Patience is a virtue in venture capital. The extended time horizon allows for companies to reach their full potential before an exit event. This approach often leads to superior returns for investors who can withstand the wait.

Leveraging Professional Expertise

UHNW investors can benefit from professional guidance when navigating the complex world of venture capital. Experienced advisors (such as those at Davies Wealth Management) can provide valuable insights, access to deal flow, and support throughout the investment process.

These professionals can help UHNW investors identify promising opportunities, conduct thorough due diligence, and build a diversified portfolio aligned with their financial goals and risk tolerance.

Final Thoughts

The surge of ultra-high-net-worth individuals into venture capital signifies a major shift in wealth management strategies. This trend acknowledges the unique advantages venture investing offers to those with substantial financial resources and long-term investment horizons. Venture capital provides UHNW investors with unparalleled access to innovative startups and disruptive technologies, offering the potential for outsized returns that can significantly impact overall portfolio performance.

UHNW individuals must carefully consider their risk tolerance, liquidity needs, and the long-term nature of these investments. Thorough due diligence, diversification, and professional guidance are key elements for success in this complex and dynamic field. The potential for wealth creation, coupled with the opportunity to support groundbreaking innovations, aligns well with the goals and capabilities of many UHNW investors.

At Davies Wealth Management, we understand the unique needs and aspirations of UHNW individuals (including professional athletes facing complex financial situations). Our team provides tailored wealth management solutions that incorporate venture capital strategies when appropriate. We ensure our clients navigate this exciting investment landscape with confidence and clarity.

Leave a Reply