Executive wealth management is a complex field, and negotiating compensation packages is a critical skill for top-level leaders. At Davies Wealth Management, we’ve seen firsthand how mastering this art can significantly impact an executive’s financial future.

This guide will equip you with the knowledge and strategies needed to navigate the intricacies of executive compensation negotiation effectively. From understanding various compensation components to preparing for and executing successful negotiations, we’ll cover all the essential aspects you need to know.

What’s in an Executive Compensation Package?

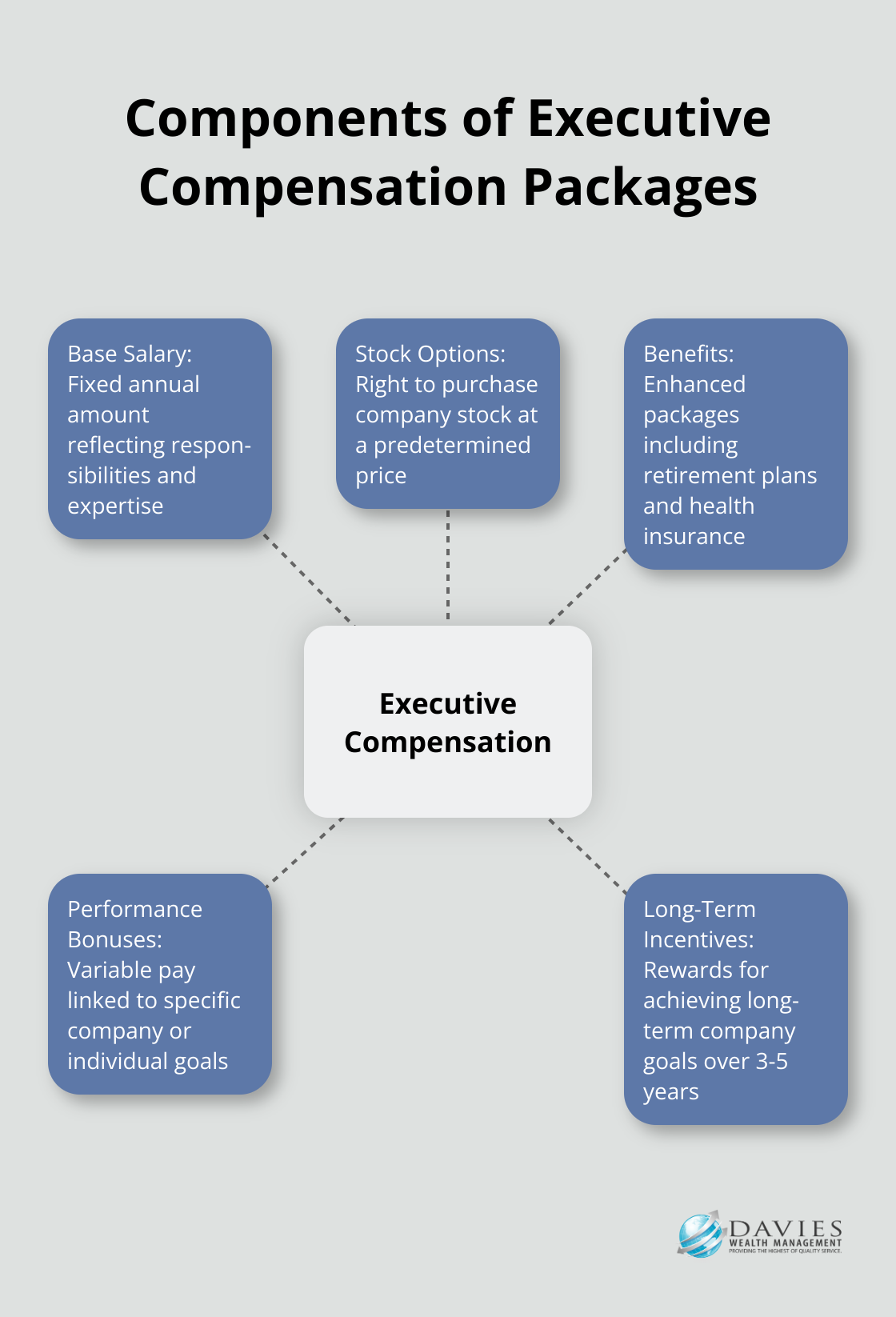

Executive compensation packages are complex and multifaceted, designed to attract, retain, and motivate top-level talent. Understanding these packages can significantly impact an executive’s financial future.

Base Salary and Performance Bonuses

The foundation of any executive compensation package is the base salary. This fixed amount typically exceeds non-executive positions, reflecting increased responsibilities and expertise. In 2023, median total compensation for Equilar 100 CEOs jumped to $23.7 million, marking an 11.4% increase in pay for the same set of companies.

Performance bonuses often link to specific company or individual goals. These can range from 20% to 200% of the base salary, depending on the industry and company size. In the tech sector, workers received an average bonus of $4,806 in 2023, a 3.8 percent drop from 2022.

Equity Compensation

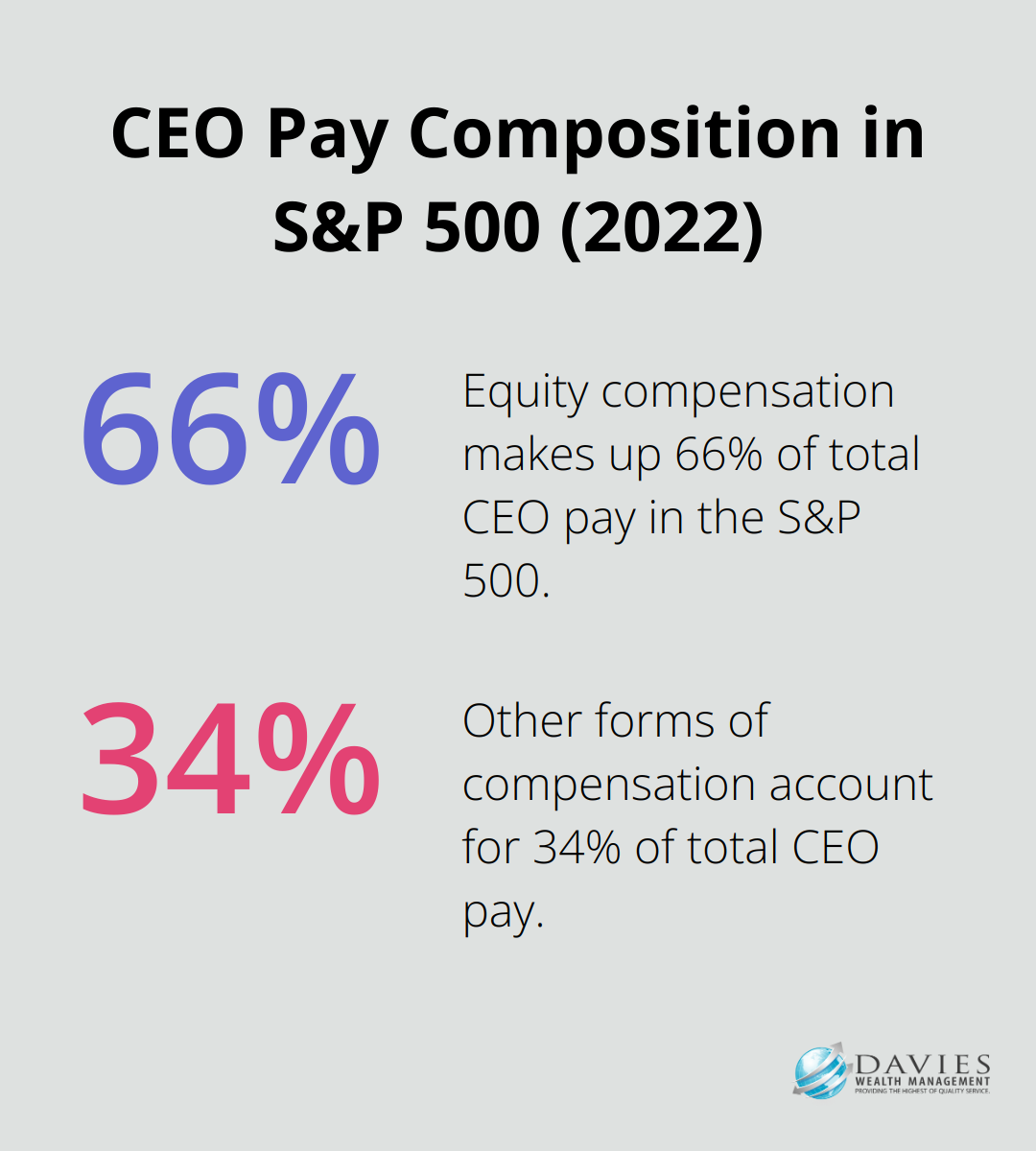

Stock options and restricted stock units (RSUs) form a significant part of executive compensation. These align the executive’s interests with those of shareholders. In 2022, equity compensation constituted about 66% of total CEO pay in the S&P 500 (as reported by the Conference Board).

Stock options give executives the right to purchase company stock at a predetermined price. RSUs, on the other hand, are promises to deliver shares of stock on a future date. Both can serve as powerful wealth-building tools when used strategically.

Long-Term Incentive Plans

Long-Term Incentive Plans (LTIPs) reward executives for achieving long-term company goals. These often span three to five years and can include performance shares, cash awards, or a combination of both.

According to 2024 disclosures, 77.4% of companies in the S&P 500 incorporate ESG performance into executive compensation design. These plans typically constitute a significant portion of an executive’s total compensation package.

Benefits and Perks

Executive benefits often surpass standard employee packages. These can include:

- Enhanced retirement plans: Executives may access supplemental executive retirement plans (SERPs) in addition to 401(k)s.

- Health and wellness benefits: Comprehensive health insurance, executive health screenings, and wellness programs are common.

- Personal services: Many companies offer financial planning services, tax preparation assistance, and even personal use of company aircraft.

- Severance packages: These can include continued salary, benefits, and accelerated vesting of equity awards.

For professional athletes transitioning into executive roles, the shift from performance-based contracts to these multifaceted compensation packages can present unique challenges. Specialized financial advice can help bridge this gap effectively.

Understanding your executive compensation package is essential for making informed decisions about your financial future. It’s not just about the numbers, but how each component fits into your overall wealth management strategy. As we move forward, we’ll explore how to prepare for negotiating these complex packages effectively.

How to Prepare for Executive Compensation Negotiation

Research Industry Standards and Company Performance

Start your preparation by investigating compensation trends in your industry. Websites like Glassdoor, PayScale, and Salary.com offer valuable insights into executive pay scales. However, don’t limit yourself to these resources. Reach out to your professional network, consult with executive recruiters, and review annual reports of similar companies to gain a more comprehensive understanding.

Executive compensation trends show that in 2023, CEO pay at S&P 500 companies increased 6% over the previous year-to an average of $17.7 million in total compensation. This figure varies widely across industries and company sizes. In the tech sector, total CEO compensation can be significantly higher (with some packages exceeding $100 million).

Next, analyze your company’s financial performance. Review annual reports, earnings calls transcripts, and analyst reports. Understanding your company’s financial health and future prospects will help you set realistic expectations and identify potential negotiation leverage points.

Quantify Your Value and Contributions

Document your achievements with precision. Focus on quantifiable results that directly impacted the company’s bottom line. Did you lead a project that increased revenue by 15%? Did you implement a cost-saving measure that reduced expenses by $2 million annually? These concrete figures will serve as powerful negotiation tools.

Create a comprehensive “value report” detailing your contributions. Include not just financial metrics, but also improvements in team performance, successful crisis management, and strategic initiatives you’ve spearheaded. This report will act as a tangible reminder of your worth to the organization.

Performance metrics are data and calculations that businesses use to track activities, behaviors and capabilities within an organization.

Define Your Priorities and Non-Negotiables

Before entering negotiations, clearly outline what matters most to you. Is it a higher base salary, more equity, or perhaps better work-life balance? Rank these priorities and identify your non-negotiables.

Understanding the components of executive compensation, such as annual base salary, stock options, and benefits, is essential to negotiating the package effectively.

Compile Supporting Documentation

Gather all relevant documents to support your case. This includes:

- Your current employment contract

- Performance reviews and commendations

- Industry salary surveys

- Company financial reports

- Your “value report”

Organize these documents in a clear, easily accessible format. You might not need to present all of this information during the negotiation, but having it readily available can boost your confidence and provide quick reference points if needed.

Thorough preparation not only strengthens your negotiating position but also demonstrates your professionalism and commitment to the role. (This groundwork will prove invaluable as you move forward to craft a compelling case for your desired compensation package.) With your preparation complete, it’s time to focus on the strategies that will help you effectively present your case and navigate the negotiation process.

How to Execute Effective Negotiation Strategies

Perfect Your Timing

Timing plays a pivotal role in negotiation success. The optimal moment to discuss compensation often follows a significant achievement or during a period of company growth. For example, after you lead a successful project that increases revenue by 20%, you create an ideal opportunity to initiate the conversation.

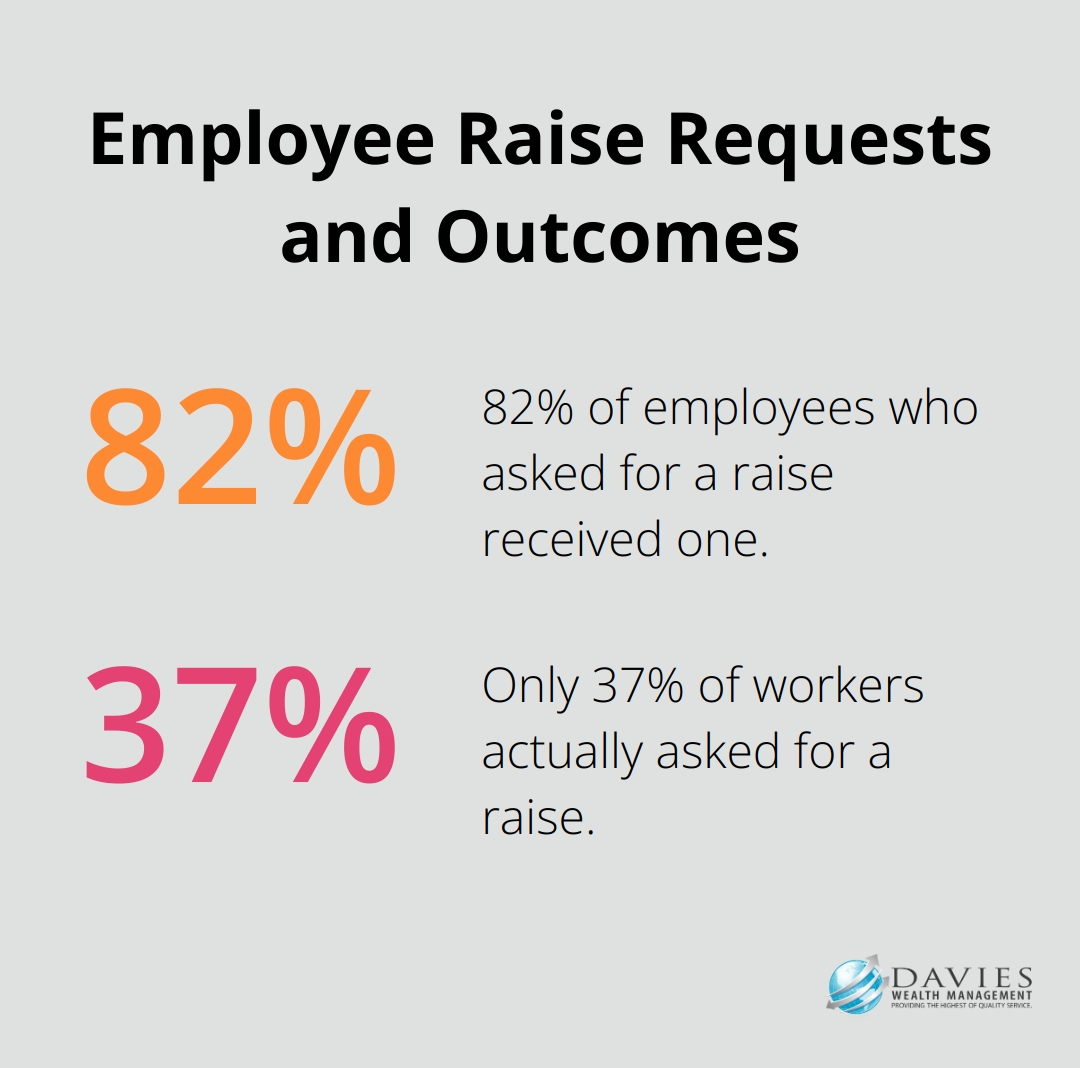

A recent LendingTree survey revealed that 82% of employees who asked for a raise received one. However, only 37% of workers actually made the request. This statistic underscores the importance of proactivity in salary discussions.

Present Your Case with Confidence

When you enter the negotiation, you must come prepared with data. Present your “value report,” highlighting your quantifiable achievements. For instance, state, “Under my leadership, our team reduced operational costs by 15% while increasing productivity by 22%.”

Use industry benchmarks to support your case. If the average compensation for your role in your industry is $X, and you bring above-average results, make that clear. The 2024 Executive Compensation Report by Equilar showed that the median total CEO compensation in the S&P 500 was $16.3 million. While your specific role may differ, understanding these benchmarks provides context for your negotiations.

Focus on Total Compensation

Base salary represents an important component, but it’s just one piece of the puzzle. Recent trends suggest that the composition of executive compensation packages is evolving, with a greater emphasis on performance-based elements.

You should consider negotiating for increased equity stakes, performance bonuses, or improved benefits. You might propose a lower base salary increase in exchange for a larger equity grant or a more generous performance bonus structure. This approach often results in a higher total compensation package while aligning your interests more closely with the company’s success.

Handle Objections Strategically

You must prepare for potential objections. If the company cites budget constraints, you should be ready to propose creative solutions. You might suggest a phased increase, where your compensation rises in stages as you meet certain performance milestones.

If faced with a firm “no,” don’t view it as the end of the negotiation. Instead, ask about the criteria for a future increase. This sets the stage for ongoing dialogue and gives you clear targets to work towards.

Leverage Alternative Offers Wisely

If you have received offers from other companies, you can use these as leverage (but with caution). Present alternative offers as a demonstration of your market value rather than a threat. You might say, “While I’m committed to our company’s vision, I’ve received an offer that values my contributions at X. I’d like to discuss how we can bridge this gap.”

Negotiation represents a process, not a one-time event. It’s about building a mutually beneficial agreement that recognizes your value while aligning with the company’s goals. These strategies will equip you to navigate the complexities of executive compensation negotiation effectively. Sophisticated investment strategies can also play a role in optimizing your overall financial picture, including aspects of risk management, taxes, and estate planning.

Final Thoughts

Mastering executive compensation negotiation will significantly impact your career trajectory and financial future. You must understand your value proposition and articulate it clearly to create a compelling case for your desired compensation. Timing your negotiation strategically, focusing on total compensation, and handling objections with grace are essential elements of a successful negotiation.

Professional guidance often proves invaluable when navigating the complexities of executive wealth management. At Davies Wealth Management, we specialize in helping executives optimize their compensation packages and overall financial strategies. Our expertise in executive wealth management can provide insights and support throughout your negotiation process and beyond.

Successful compensation negotiations set the tone for your perceived value within the organization and contribute to long-term financial security. You must approach negotiations with confidence, preparation, and a clear understanding of your worth to position yourself for sustained success in your executive career. Each negotiation presents an opportunity to refine your skills and enhance your value proposition (stay informed about industry trends and continue to quantify your achievements).

Leave a Reply