As we approach 2025, pension drawdown strategies are evolving rapidly. Economic shifts, regulatory changes, and market volatility are reshaping the retirement landscape.

At Davies Wealth Management, we understand the importance of optimizing your pension drawdown strategy to secure your financial future. This blog post will explore the latest trends, strategies, and risk management techniques to help you make informed decisions about your retirement income.

What’s New in Pension Drawdown for 2025?

The pension landscape continues to evolve as we approach 2025, with significant changes in regulations and economic trends impacting drawdown strategies. These developments require careful consideration for anyone planning their retirement income.

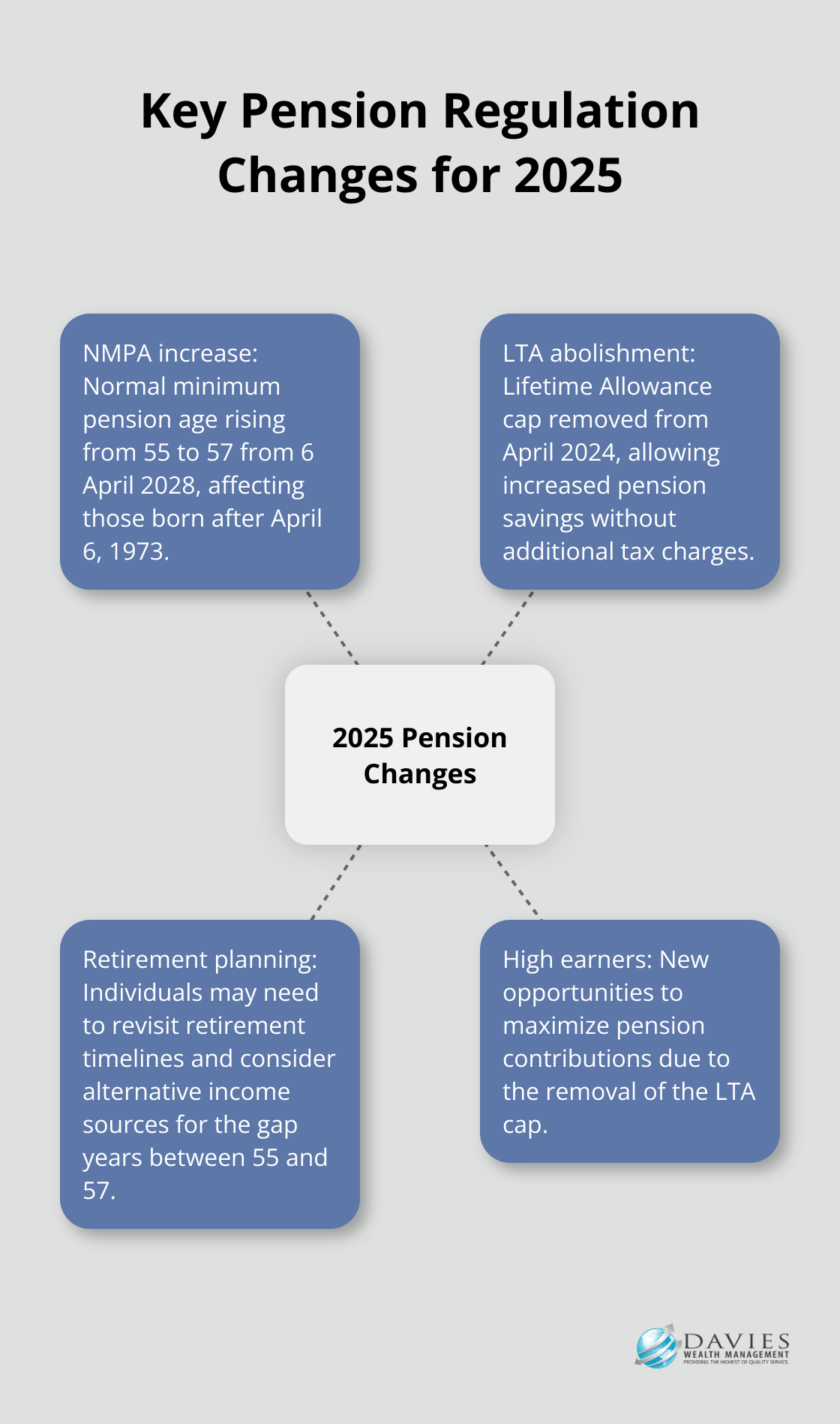

Regulatory Updates

The UK government has introduced several key changes to pension regulations for 2025. The most notable is the increase in the normal minimum pension age (NMPA) from 55 to 57. This change, which will take effect from 6 April 2028, means individuals will need to wait an additional two years before accessing their pension savings, potentially affecting retirement plans for those born after April 6, 1973.

Another significant change is the adjustment to the Lifetime Allowance (LTA). The LTA will be abolished entirely from April 2024. This removal of the LTA cap allows individuals to save more into their pensions without incurring additional tax charges.

Economic Influences on Pension Strategies

The economic landscape also shapes pension drawdown strategies. Inflation rates have been volatile, with the UK experiencing higher than usual inflation in recent years. This has led to an increased focus on inflation-proofing retirement income.

Interest rates have also seen significant fluctuations. The Bank of England base rate, which influences annuity rates and bond yields, has risen from historic lows. This has implications for both drawdown strategies and the potential income from annuities.

Adapting Your Drawdown Strategy

These changes necessitate a reassessment and potential adaptation of pension drawdown strategies. The removal of the LTA cap, for instance, opens up new opportunities for high earners to maximize their pension contributions.

For those affected by the NMPA increase, it may be necessary to revisit retirement timelines and consider alternative sources of income for the gap years between 55 and 57.

The current economic climate also calls for a more dynamic approach to drawdown. With higher inflation, it’s important to ensure your pension pot can generate returns that outpace rising prices. This might involve adjusting your investment portfolio or considering partial annuitization to secure a base level of inflation-linked income.

Specialized Strategies for Professional Athletes

Professional athletes face unique challenges when it comes to pension planning. Their careers are often short-lived, with high earnings concentrated in a few years. This requires a specialized approach to pension drawdown that accounts for these unique circumstances.

For athletes, it’s particularly important to maximize pension contributions during high-earning years and to develop a flexible drawdown strategy that can adapt to changing income levels post-retirement. This might involve a combination of drawdown options and alternative investment strategies to ensure long-term financial security.

As we transition to discussing specific strategies for optimizing your pension drawdown, it’s clear that the changing landscape requires a nuanced and personalized approach. The next section will explore various drawdown options and how to tailor them to your individual circumstances.

How to Maximize Your Pension Drawdown

Tailoring Your Drawdown Approach

Pension drawdown strategies should fit your unique financial situation. At Davies Wealth Management, we recognize that each client’s needs differ. Flexible drawdown allows you to adjust your income as needed, which proves beneficial if you have multiple income sources or variable expenses. You can take up to 25% of your pension tax-free, as a lump sum or in portions. This option can be useful for years with planned major expenses (e.g., travel or home improvements).

Fixed drawdown, conversely, provides a steady, predictable income stream. This option aids in budgeting and offers peace of mind, especially for those with consistent expenses. However, it lacks adaptability to changing circumstances.

Many clients benefit from a hybrid approach. For example, you could use fixed drawdown for essential expenses and a flexible approach for discretionary spending. This strategy provides both stability and flexibility.

Maximizing Tax Efficiency

Tax-efficient withdrawal methods can significantly increase your net income. The key lies in effective utilization of your tax-free allowances. For the 2025/26 tax year, the personal allowance is projected at £12,570. Careful management of your withdrawals can minimize the amount that falls into higher tax brackets.

A combination of taxable and tax-free sources can prove effective. For instance, you could withdraw up to your personal allowance from your taxable pension, then supplement with tax-free cash from an ISA. This approach helps maintain a higher income while keeping your tax bill low.

High-net-worth individuals, including many professional athletes, must consider the impact of the tapered annual allowance. For the 2025/26 tax year, the allowance may fall to £30,000, allowing for significantly higher pension contributions compared to previous years. Strategic planning can mitigate its effects on pension contributions and overall tax position.

Balancing Income and Growth

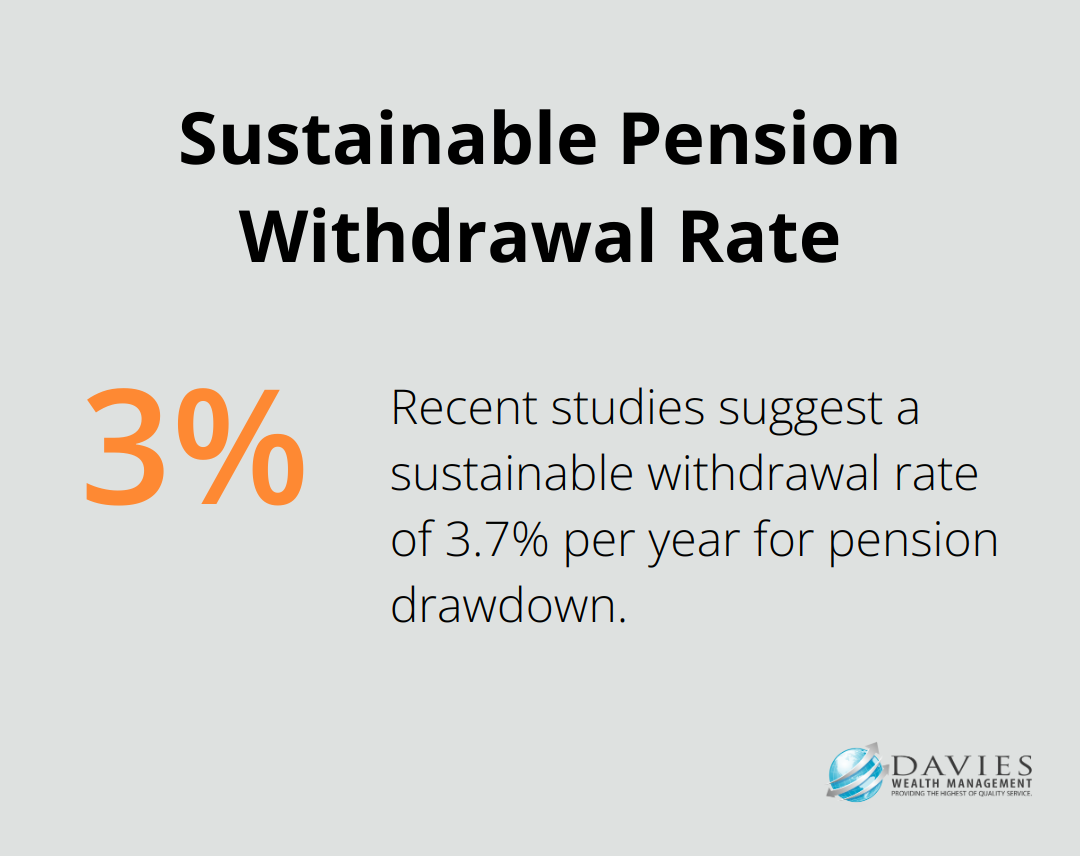

The right balance between income needs and investment growth is critical for long-term financial security. While large early withdrawals seem tempting, they can deplete your pension pot too quickly. Recent studies suggest a sustainable withdrawal rate of around 3.7% per year, reflecting longer lifespans and subdued market returns.

A multi-asset investment strategy can help maintain this balance. This approach aims to provide a steady income stream while allowing for potential growth. You might allocate a portion of your portfolio to dividend-paying stocks for income, while keeping some in growth-oriented investments to combat inflation.

Regular portfolio rebalancing helps maintain your desired asset allocation. This practice ensures that your investment strategy remains aligned with your income needs and risk tolerance as market conditions change.

Specialized Strategies for Professional Athletes

Professional athletes face unique challenges in pension planning due to short careers and high, concentrated earnings. A specialized approach to pension drawdown must account for these circumstances.

Athletes should maximize pension contributions during high-earning years and develop flexible drawdown strategies that adapt to changing post-retirement income levels. This might involve a combination of drawdown options and alternative investment strategies to ensure long-term financial security.

As we move forward, it’s important to understand how to manage risks associated with pension drawdown. The next section will explore strategies to protect your retirement income against market volatility and inflation.

Navigating Risks in Pension Drawdown

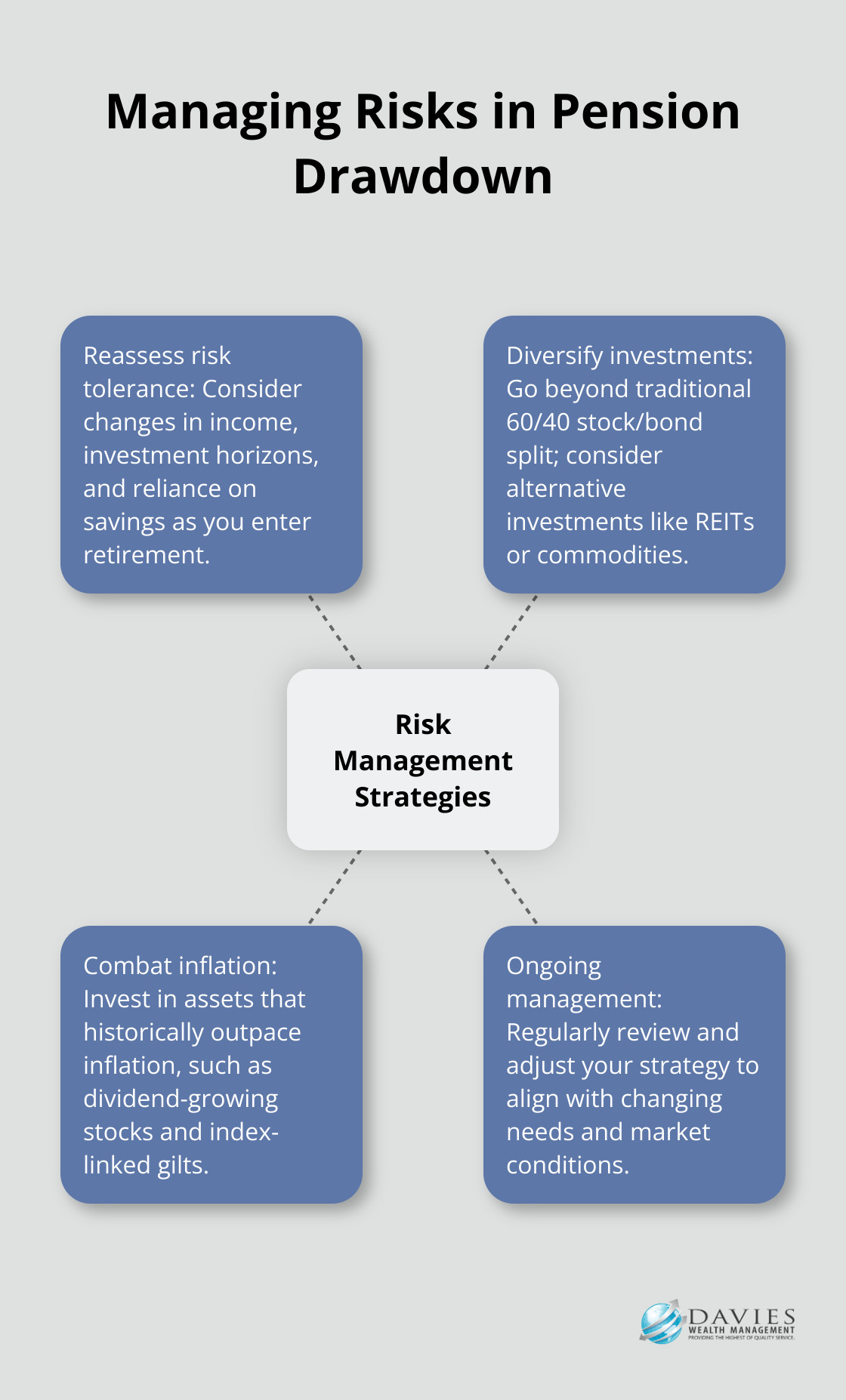

Reassessing Risk Tolerance in Retirement

Your risk tolerance changes as you enter retirement. Reduced income, shorter investment horizons, and increased reliance on savings contribute to this shift. A study by the Institute for Fiscal Studies explored how people draw on their private pension wealth in retirement and the risks they face.

We use advanced risk assessment tools to help clients understand their true risk tolerance. These tools consider factors such as health, family history, and lifestyle to provide a more accurate picture of potential longevity and financial needs.

Diversification: Your Shield Against Market Volatility

Diversification remains a key risk management strategy in retirement. However, the traditional 60/40 stock/bond split may no longer suffice. The recent low interest rate environment has challenged the effectiveness of bonds as portfolio stabilizers.

A more nuanced approach can prove beneficial. Adding alternative investments like real estate investment trusts (REITs) or commodities can provide additional diversification benefits. Vanguard provides model portfolio allocation strategies to help build diversified portfolios that match risk tolerance and investment goals.

For professional athletes (who often have concentrated wealth from short careers), diversification is particularly important. We recommend spreading investments across various asset classes and geographical regions to mitigate risk.

Inflation: The Silent Threat to Your Retirement Income

Inflation poses a significant risk to retirement savings, eroding purchasing power over time. The Bank of England has set a target for the 12-month increase in the Consumer Prices Index of 2%. This 2% inflation target is symmetric.

To combat inflation, consider investments that have historically outpaced inflation rates. Stocks (particularly dividend-growing stocks) can provide both income and growth potential. Index-linked gilts, while offering lower yields, provide a direct hedge against inflation.

A combination of strategies can protect against inflation. This might include a mix of inflation-linked bonds, real estate investments, and stocks with strong pricing power in inflationary environments.

Ongoing Risk Management

Risk management in pension drawdown is not a one-time event but an ongoing process. Regular reviews and adjustments ensure your strategy remains aligned with your changing needs and market conditions.

Professional guidance can prove invaluable in optimizing your pension drawdown approach. Financial advisors can help you navigate complex regulations, assess your risk tolerance accurately, and develop a tailored strategy that aligns with your goals and circumstances.

Final Thoughts

Pension drawdown strategies for 2025 require careful consideration of regulatory changes, economic influences, and personal circumstances. Flexibility remains essential, whether you choose flexible drawdown, fixed drawdown, or a hybrid approach. Tax efficiency should be prioritized, with careful management of withdrawals to maximize your personal allowance and minimize tax liabilities.

Risk management in pension drawdown is an ongoing process. Reassessing risk tolerance, diversifying portfolios, and protecting against inflation are critical components of a robust strategy. Regular reviews and adjustments ensure your approach aligns with changing needs and market conditions.

At Davies Wealth Management, we create tailored pension drawdown strategies that address the complex needs of our clients (including professional athletes). Our team of experts can help you navigate pension regulations, optimize your tax position, and develop a comprehensive strategy aligned with your financial goals. For personalized advice and ongoing support to ensure your financial security throughout retirement, visit Davies Wealth Management.

Leave a Reply